China Finance and Investment Outlook

China’s finance sector closely linked to urbanization, new energy, and market culture

By Jane Shi

Apr. 14 – It is no secret that the Chinese government plays a large hand in the country’s economic developments, currency flows, and financial investment platforms. From calling for more FDI in high value-added industries to giving access to foreign investment in only B-level shares of Chinese companies, the environment on the mainland for foreign capital investors is simultaneously encouraging and restrictive.

As China has juggled multi-faceted and often aggressive development schemes in the last few decades, the financing behind various projects has come from relatively minimal – in terms of percentage – and calculated allowances of shares to foreign investors by the government. Even recent numbers show less than 2 percent of foreign ownership of domestic financial assets in public projects and Chinese firms.

Yet as China promises major improvements to infrastructure, energy sources, and an overhaul of its industrial focus to high-tech and higher skilled services, the opportunities for an expanded financial sector in which foreign individuals and institutional investors can gain more pieces of the “China pie” are rising.

After last month’s approval of the 12th Five Year Plan by China’s National People’s Congress, nicknamed the “Greenest FYP in China’s history,” and the circular on renewable energy architecture that followed shortly afterwards, new channels of investment will begin to open as China builds financing for its sustainable and renewable energy projects. China has announced it intends to lower energy intensity by 16 percent over the next five years, as well as cut CO2 emission by 17 percent and reduce industrial waste by 8 percent to 10 percent.

The continued growth potential in Chinese raw materials processing and higher value-added goods manufacturing has no doubt also fed into the need for China to expand its energy production options. From more direct sourcing of domestic raw materials for electronic components and luxury goods factories, for example, owned by both Chinese and foreign companies, to greater demand of utilities services in urban areas as the population of cities grow, the capital investments market in terms of these three segments is likely to grow exponentially.

Their expansions go “hand in hand,” says Stephen Couch, senior financial consultant at deVere Group Shanghai, an international financial consultancy that specializes in expatriate and foreign investor affairs.

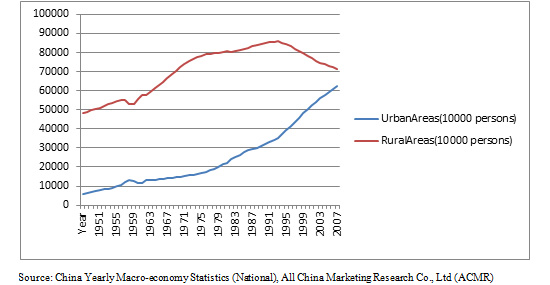

Couch also says that as a majority of China’s population settles in urban areas with rising per capita disposable incomes, the demand for more infrastructure, housing, utilities services such as gas, electricity, and water, and consumption of branded, designer, luxury, automobile, and big ticket appliance goods will continue to escalate. In 2010, 47 percent of the Chinese population lived in urban areas, with the annual rate of urbanization between 2010 and 2015 estimated to be 2.3 percent. The figure below shows the population of rural to urban residents in China from 1949 to 2009, with an obvious direction of crossover within just these couple of years.

The anticipation of nationwide access to Chinese-designed 4G mobile network technology in the near future creates yet another area of great financing and investment opportunities for domestic and international companies as consumer demand for 4G-equipped mobile phones, telecommunication networks equipment, software technology, and service management will more than likely boom. China Mobile has already launched trial networks in six cities, with participation from ZTE Corp, Huawei, Nokia Siemens, and Ericsson.

The anticipation of nationwide access to Chinese-designed 4G mobile network technology in the near future creates yet another area of great financing and investment opportunities for domestic and international companies as consumer demand for 4G-equipped mobile phones, telecommunication networks equipment, software technology, and service management will more than likely boom. China Mobile has already launched trial networks in six cities, with participation from ZTE Corp, Huawei, Nokia Siemens, and Ericsson.

It should be noted, however, that even with seemingly vast number of sectors for finance investment in China, the forms of doing so are limited by both government regulations and market culture. Until recently, Chinese policymakers have kept a tight grip on foreign activity in the finance and banking industries. Even now, with some positive regulatory changes and systemic developments, the market is still relatively “young” and filled with “gray” areas of practice and compliance, says Couch.

Shares and stock trading make up the majority of capital investments in the Chinese market, as domestic investors and companies alike are not as open to the volatility risk that comes with a market filled with diverse financial instruments such as is seen in Western markets. Stock options in China are currently of three major types:

- A-shares: traded in Chinese yuan; limited to investment by Chinese nationals and foreign institutional investors granted special access through the Qualified Foreign Institutional Investor regulatory system

- B-shares: traded in U.S. dollars on the Shanghai Stock Exchange and Hong Kong dollars on the Shenzhen Stock Exchange; open to trade by foreign investors; starting 2001 also open to trade by Chinese nationals

- H-shares: traded in Hong Kong dollars; limited to trade on the Hong Kong Stock Exchange any by entities with registered presence in Hong Kong, both foreign and Chinese

Funds and bonds do exist in the market, but their presence is few and far between relative to institutional shares. But with the anticipated increase in major government-backed development projects, there may be growth in municipal bonds trading at B-level.

“China should accelerate its economic transformation by utilizing fast-growing foreign investment to develop its high-tech, service and advanced-agricultural industries, all of which are crucial to its long-term economic development,” said Huo Jianguo, director of Chinese Academy of International Trade and Economic Cooperation, the official research institute of the Ministry of Commerce.

As China’s finance sector has grown from a large portion of stocks released by formerly state-owned enterprises, many of which are still majority-owned by the Chinese government, it is likely that China will continue to regulate the impact of foreign investment in Chinese company stocks with scrutiny – especially those related to the infrastructure, energy, and development sectors. That said, the regulatory environment on practices in the general market are less developed and in some aspects more relaxed than in Western markets.

As China moves forward, the main financial centers will likely remain in Shanghai, Shenzhen, and Hong Kong. Transparency and expansion of instruments are areas in which the sector still lacks full development, but as the investing environment grows more favorable for foreign involvement and consultancy firms based in the three cities spread to satellite zones in second-tier economic cities such as Wuhan and Suzhou, the market will undoubtedly become a dynamic source of power for China’s development through the next five years and beyond.

- Previous Article China Briefing Releases New Transfer Pricing Guide

- Next Article China Reports First Quarterly Trade Deficit in Seven Years