China vs. Vietnam as the Future Workshop of the World

By Shelly Zhao

May 20 – As a “China alternative” in overall production efficiency and quality, there is no doubt that Vietnam is up-and-coming, but industry and market development play a key role in the decision to move to Vietnam. For industries such as clothing and toy manufacturing – for which low-cost production is a chief concern – the labor market would be more responsive to any wage rate increases, thus requiring cutting down on factor inputs such as land and labor. For large multinationals it may make sense to set up production bases in Vietnam to complement expansion into the Vietnamese market.

Some analysts see China’s continued wage increases as significantly impacting the global labor market and affecting foreign companies’ production decisions in China. Others predict a more muted scenario, where there will be some impact but that China will retain much of its competitive advantage.

According to a report by Caixin, Chinese real wage increases have not fundamentally changed the labor market cost structure. In fact, it points out, “real wages, after accounting for inflation and labor productivity gains, are lower now than they were in 2001.”

China remains a strong international competitor, and the wage increases are “not likely to alter that key conclusion,” writes Stephen S. Roach for China Daily. This agrees with recent evidence that in response to labor protests in China, companies may be inclined to compromise on demands for higher pay rather than shift countries (Honda and Foxconn Technology are two examples).

A shift of production from China to Vietnam, it seems, is not likely to be a panacea for the wage increase and other labor issues in China. For foreign companies with years of presence in China, shifting production to Vietnam would mean opportunity cost considerations in areas such as infrastructure and workforce quality. Moving to Vietnam must factor into a company’s longer-term strategy and will require familiarization with Vietnam’s regulatory and legal systems. So the main question is whether the savings in production costs would offset any potential challenges to be encountered in Vietnam.

For other companies that are less elastic in response to wage changes or require high-skilled labor, it may be more pragmatic to stick with the production base with which they are familiar. Rising wages are one element of production, and China’s prowess in infrastructure and skilled labor may be enough to keep the foreign companies there for the short and medium-term. For China, labor costs aside, favorable factors still include a wide supply network, high efficiency, and experience with production and manufacturing. In fact, a 2010 article in the Economist suggests that the “next China” of low-cost production may very well be moving away from coastal areas into inland provinces, rather than automatically abroad to Vietnam. So, to some it appears that the best “China alternative” may still be China – just look inland. This is something we covered extensively in our March edition of China Briefing Magazine titled “Operational Costs of Business in China’s Inland Cities.”

Challenges in moving to Vietnam

Certain factors – which also apply to other developing economies in Southeast Asia – put Vietnam as a “China Alternative” in the short run into question. These potentially worrisome factors include the unskilled nature of its workers, lack of robust infrastructure and developed supply chain, and economic uncertainties. These elements create an uncertain investment climate and can make foreign companies’ operations in Vietnam less smooth than they may have hoped.

Unskilled labor

Vietnam faces challenges in productivity and quality, where China still has the comparative advantage. The quality of labor is important for a foreign country’s production in the country, since ease of management and possible re-training will affect production efficiency. Though wage increases have made Chinese workers less competitive, they still retain higher skills and productivity, which could sustain their labor demand.

The aforementioned Economist article that doubted whether Vietnam would really become the “next China” focused on the fact that the country is also not immune to challenges such as labor instability and labor quality.

Infrastructure and supply chain

Vietnam’s infrastructure can be a hindrance to investment, affecting the transport and smooth running of operations. Last year, Vietnamese Prime Minister Nguyen Tan Dung acknowledged the infrastructure challenges: “The Vietnamese government is well aware of difficulties in the investment climate, first of all infrastructure like roads, ports and energy.”

Though the Vietnamese government has pushed for infrastructure improvements, relatively speaking, China appears to have the upper hand in this area.

Gianfranco Lanci, the chief executive of computer company Acer, has noted that Vietnam remains behind China when it comes to operations and cited this as a major factor in his choosing not to shift production to Vietnam.

“There is no substitute for China’s supply chain. Other countries (such as Vietnam) are quite a way behind,” Lanci said.

Economic uncertainties

Since Vietnam is still in transition to accommodate more market forces, there are many development challenges such as confusing and non-transparent procedures (regulatory and financial) and slow issues of investment licenses. Some of the other economic issues include high inflation and its budget deficit that could add to further economic uncertainty.

So while some see rising costs across China as a sign that the country’s days as the “factory of the world” are numbered, it would be wrong to completely dismiss all the advantages that come from an experienced manufacturing market. It may no longer be the cheapest manufacturing destination in Asia, but China still offers solid infrastructure, strong supply networks and skilled labor all at a reasonable price.

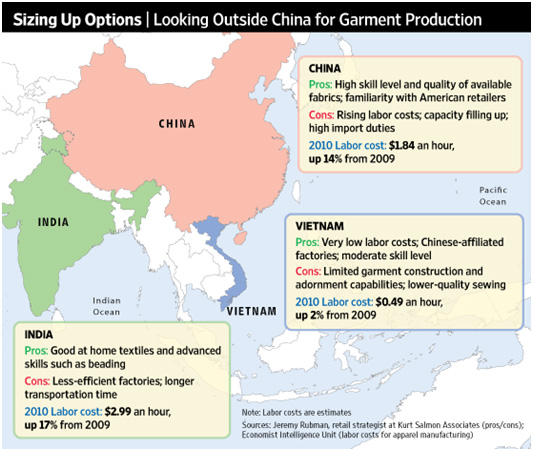

Below is a terrific graphic from The Wall Street Journal looking at the key pros and cons of China and Vietnam as garment manufacturing destinations (with India thrown in for good measure).

Dezan Shira & Associates is a boutique professional services firm providing foreign direct investment business advisory, tax, accounting, payroll and due diligence services for multinational clients in China, Hong Kong, Vietnam and India. Established in 1992 with seventeen offices in four jurisdictions. For advice on market entry or relocation within or outside any of these regions please email info@dezshira.com, visit www.dezshira.com, or download the firm’s brochure here.

Related Reading

The China Alternative

The China Alternative

Our complete series on other manufacturing destinations in Asia that are now starting to compete with China in terms of labor costs, infrastructure and operational capacity.

China’s Neighbors

China’s Neighbors

This unique book is an introductory study of all 14 of China’s neighbor countries: Afghanistan, Bhutan, India, Kazakhstan, Kyrgyzstan, Laos, Myanmar, Mongolia, Nepal, North Korea, Pakistan, Russia, Tajikistan and Vietnam.

Operational Costs of Business in China’s Inland Cities

Operational Costs of Business in China’s Inland Cities

It is widely held that land and labor costs in inland provinces offer quite significant cost savings over major east coast and southern cities. In this issue, we take a quick look at the numbers behind these beliefs.

![]() Vietnam Briefing

Vietnam Briefing

Vietnam Briefing Magazine is released four times a year. Annual subscriptions can be acquired by clicking here.

China Briefing’s Doing Business in China title is the definitive business guide to one of the fastest growing economies in the world.

Establishing Business in Vietnam

Establishing Business in Vietnam

In this issue of Vietnam Briefing, we focus on establishing a business in Vietnam, from the corporate and personal income tax regime, to the various registration procedures investors must go through to establish a legal entity in the country.

The Sichuan Question – Chengdu or Chongqing?

Coastal China, Inland China, India or Vietnam for Your Sourcing Business?

- Previous Article The China Alternative – Kazakhstan

- Next Article Safety Concerns to Slow Down Beijing-Shanghai High-speed Rail