The Annual Compliance Process for China FIEs

By Shirley Zhang

Feb. 15 – Many Western parent companies today are a bit disturbed by the perfunctory nature with which annual compliance procedures are carried out, and with good reason. Chinese audit reports roll into group audit reports, and thus it is imperative to have confidence in these figures. Furthermore, annual compliance procedures, when conducted with care, can tell stories about what’s going on behind the scenes in a company’s operations.

Meeting the numerous annual compliance requirements in China can be quite a long process. In this article, we discuss annual compliance requirements for China foreign-invested entities (FIEs), including wholly-foreign owned enterprises (WFOEs), joint ventures (JVs) and foreign-invested commercial enterprises (FICEs), as well as the less demanding requirements for representative offices (ROs), with notes on regional differences and tips from experienced accountants and auditors.

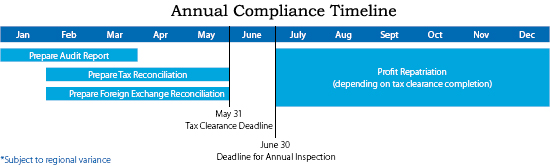

For WFOEs, JVs, and FICEs, annual compliance involves producing a statutory annual audit report, a corporate income tax (CIT) reconciliation report, an audit report for foreign currency reconciliation, as well as passing an annual inspection and fulfilling any other region-specific requirements. For ROs, annual compliance procedures are simpler; generally preparing a statutory audit report and a tax reconciliation report.

Statutory Annual Audit Report

The annual audit of financial reports is mandated by Company Law, with entity-specific laws like WFOE law requiring this audit to be conducted by a Certified Public Accountant (CPA) firm in China. The objective of a statutory audit is to ensure that companies meet Chinese financial and accounting standards, including proper use of China GAAP. Audit report requirements vary by region. For instance, in Shanghai, companies are requested to include a Taxable Income Adjustment Sheet in the audit report, which is not a necessary supplement in Hangzhou, Beijing, and Shenzhen.

For many foreign-invested firms in China today, annual statutory audit requirements mean inviting a “cost-effective” local CPA firm over for a day to give the books a cursory glance, a big red stamp, and the freedom to keep their wheels turning for another year.

“But there’s still a significant gap between Western expectations and the audit services often delivered in China,” explains Richard Cant, director at Dezan Shira and Associates’ Shanghai office. “Many foreign investors want to know what’s really going on in their Chinese subsidiaries and they’re ready to upgrade to an in-depth audit done according to Western best practices; someone to design, supervise and assist with audit execution, handling liaison with the head office to help bridge the expectation gap in audit services.”

Usually, CPA firms start preparing an annual audit report in January, right after closing last year’s account. The audit procedure takes about 2 months, and the audit report should be completed before the end of April in order to meet the May 31 tax filing deadline.

CIT Reconciliation Report

Although the State Administration of Taxation (SAT) oversees all kinds of tax paid by corporations, only corporate income tax (CIT) requires annual reconciliation. CIT is prepaid on a monthly or quarterly basis subject to the assessment of taxation authorities, and an annual CIT reconciliation allows the Tax Bureau to investigate companies’ actual tax-related operations, and determine whether the company needs to pay supplementary tax, or apply for a tax reimbursement.

Every year around March, depending on the area, the local Tax Bureau will issue annual guidance on CIT reconciliation. The Annual CIT Reconciliation Report is examined by the Tax Bureau to see if all tax liabilities have been fulfilled under tax law. Adjustments in financial statements caused by the discrepancies between Tax Law and accounting standards are also required to be included in the Annual CIT Reconciliation Report.

Foreign-invested enterprises (FIEs) that make a lot of transactions with related parties are required to prepare an Annual Affiliated Transaction Report on transfer pricing issues as a supplementary document to the Annual CIT Reconciliation Report.

Moreover, FIEs in certain regions need to engage a Certified Tax Agent firm in China to prepare another separate CIT audit report. In Beijing, this requirement applies to firms that meet the following conditions:

- Yearly sales revenues exceed RMB30 million;

- Carrying over last year’s losses to deduct this year’s income; or

- Yearly losses exceed RMB100,000.

Usually the CPA firm that prepares the statutory financial audit report also has Certified Tax Agents (CTAs) to prepare the Audit Report for CIT. In the case that the CPA firm does not have CTA qualifications, companies have to hire another CTA firm to do the report. Usually, the CTA firm will request an annual (financial) audit report as reference for CIT reconciliation.

The deadline for submitting the CIT Reconciliation Report to the Tax Bureau is May 31 every year, but the investigation of the tax compliance could last to the end of the year, and companies should be prepared to provide supporting documents upon demand from the Tax Bureau.

“In one case, there was a significant delay in tax clearance, in which the tax officer chose to examine all tax returns back to 2006,” explains Sisi Xu, senior manager of Dezan Shira & Associates’ Shenzhen office. “The company had to apply for an extension for annual inspection and it was not until the beginning of July that tax clearance was finally settled. Ultimately, there were almost no mistakes in their tax filings, so the fine was only around RMB100, but the whole procedure was a bit frustrating for the company.”

Audit Report for Foreign Exchange Reconciliation

All foreign exchange transactions in and out of China are strictly controlled by the State Administration of Foreign Exchange (SAFE), the bureau under the People’s Bank of China that drafts rules and regulations governing foreign exchange and market activities and supervises and inspects foreign exchange transactions.

Each year, SAFE requires an audit report for foreign exchange reconciliation to demonstrate the legality of a company’s foreign currency inflows and outflows. This report should be audited by an authorized Chinese CPA firm. Theoretically, the preparation of the Audit Report for Foreign Exchange Reconciliation can be started at the same time as the statutory audit report. However, practically, the time for SAFE to issue the annual guidelines on Annual Foreign Exchange Reconciliation may vary by region, usually around March or April each year. The deadline for submitting all the required documents is June 30.

If an FIE misses annual foreign exchange reconciliation for two consecutive years, its License of Foreign Exchange Registration will be no longer valid, and its Foreign Exchange Registration would be revoked, which means the FIE will not be able to receive or disburse foreign exchanges through banks.

Annual Inspection

All enterprises in China are required to go through the annual inspections (or “cooperative annual examinations”) of multiple government departments. These inspections are designed to ensure that FIEs conduct business in compliance with each department’s requirements.

Each year from January to the end of June, the annual inspection is jointly or separately conducted by the following government departments:

- Local office of the Ministry of Commerce (MoC)

- Finance Bureau

- Administration of Industry and Commerce (AIC)

- Tax Bureau

- Customs

- State Administration of Foreign Exchange

- Statistics Bureau

In certain parts of China, the annual inspection is just a formality, with the first 90 percent of annual compliance work involving annual reporting package preparation and the last 10 percent involving submission at a one-stop service location where all relevant government departments check and approve. In other parts of China, submission processes are more complicated and this one-stop service does not exist.

The inspection procedures and requirements can also vary from region to region. For example, in addition to attending the cooperative examination, Shanghai-located FIEs and FIE branches also go through separate annual examinations conducted by the AIC between March 1 and June 30. They file a declaration for inspection with the Shanghai AIC or the state AIC, and submit documents in accordance with related provisions.

Wholly foreign-owned enterprises with branches should pay special attention to ensuring that their branches also undergo annual inspection.

“Previously, miscommunication with the parent WFOE led to a branch overlooking their annual inspection obligation. The penalty for this was in the range of RMB10,000-RMB20,000,” explains Xu.

Industry-Specific License Renewals

While almost all annual compliance obligations for FIEs are tax and accounting-related, depending on the industry, there may be additional required annual inspections/renewals/examinations for special licenses, such as:

- Food Circulation License (irregular examinations may be conducted by relevant authorities)

- Human Resource License (for HR service companies, normally in November and December following a prior notice from HR Bureau in October or November in that year)

- Medical Device Operation License (irregular examinations may be conducted by relevant authorities)

- Industrial Food Manufacturing License (normally in October or November or upon local authorities’ prior notice)

The timing for the aforementioned annual inspections/renewals/examinations may also vary from district to district within the same city. In many cases, these special licenses will have sections dedicated to annual inspection approvals, and operating without such approvals could lead to penalties or having the license revoked.

The procedures and deadlines for such annual inspections/special license renewals are determined by the relevant government bureaus. Therefore, it is highly recommended that FIES in possession of special licenses/certificates seek assistance regarding specific annual inspections/renewals/examinations.

Social Insurance Finalization

Annual human resources administration obligations in China are generally limited to calculating the average salary for the previous year and declaring this amount to the Social Insurance Bureau and Housing Fund Bureau in order to adjust the company’s social insurance payment base. The Social Insurance Bureau will issue a notice specifying the deadline for such calculation submissions, usually in February or March, and the newly calculated social insurance payment base is effective on April 1. In addition, for companies selected by the Social Insurance Bureau, there will also be a social insurance annual audit conducted by a Bureau-appointed CPA firm.

Annual Compliance for ROs

While ROs are exempt from cooperative annual inspection, starting from 2011, ROs are also required to submit an annual report between March 1 and June 30 every year providing information on the legal status and standing information of the headquarters overseas, ongoing business activities of the RO, and an audited expense report. The RO annual report is significantly more simple than the report for WFOEs.

Unlike WFOEs, annual compliance requirements for ROs only include a statutory audit report (usually around five pages) and a tax reconciliation report. The statutory audit report should also be conducted and signed by an authorized Chinese CPA firm, and submitted to the AIC by June 30 every year. The tax reconciliation report is required to be submitted to the Tax Bureau by May 31. Regional variances may exist.

Penalties of RMB10,000 to RMB30,000 are applicable if the RO fails to provide such reports on time, and an RMB20,000 to RMB200,000 penalty if the report includes false information. Fraud may also lead to license revocation.

Portions of this article came from the January/February 2013 issue of China Briefing Magazine titled, “Annual Compliance, License Renewals & Audit Procedures.” In this issue of China Briefing Magazine, we discuss annual compliance requirements for China foreign-invested entities and detail the full audit processes for representative offices, wholly foreign owned enterprises, and joint ventures in China. We also discuss IIT liability for expatriates in China, IIT rates and calculation methods, permissible tax deductions, and how working for a permanent establishment can change tax liabilities.

Portions of this article came from the January/February 2013 issue of China Briefing Magazine titled, “Annual Compliance, License Renewals & Audit Procedures.” In this issue of China Briefing Magazine, we discuss annual compliance requirements for China foreign-invested entities and detail the full audit processes for representative offices, wholly foreign owned enterprises, and joint ventures in China. We also discuss IIT liability for expatriates in China, IIT rates and calculation methods, permissible tax deductions, and how working for a permanent establishment can change tax liabilities.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across China by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

An Introduction to Doing Business in China

An Introduction to Doing Business in China

Asia Briefing, in cooperation with its parent firm Dezan Shira & Associates, has just released this 40-page report introducing everything that a foreign investor should be familiar with when establishing and operating a business in China.

- Previous Article China to Cancel Preferential IIT Policy for Foreigners

- Next Article Leading Edge Alliance Named Second-Largest International Association