Internal Control and Anti-Corruption Regulations in China

By Eunice Ku

Jul. 23 – As the investigations into corruption at foreign investors in China’s pharmaceutical industry continue to rumble on – no doubt to ensnare other individuals and players in the industry – we can note that internal control and audit efforts in China are often criticized for only meeting compliance requirements, with little or no benefits to the business – form over substance. This is not, however, because the country lacks a related regulatory framework.

While relatively young in comparison to guidelines and organizations recognized internationally, China has an evolving regulatory framework for internal control and audit.

Internal Control

The Basic Standard

China SOX, China’s version of the Sarbanes-Oxley Act of 2002 (the U.S. federal law that details requirements promulgated to improve risk management and prevent financial scandals such as Enron and Worldcom), was issued in 2008, with supporting guidelines issued in 2010.

The Basic Standard for Enterprise Internal Control (Caikuai [2008] No. 7, “Basic Standard”) mirrors its American counterpart in many ways as it aims to enhance the quality of financial reporting by listed companies.

The supporting guidelines started applying to companies that are concurrently listed in the domestic and overseas markets from January 1, 2011 onwards, and to companies listed on the main board of the Shanghai Stock Exchange and the Shenzhen Stock Exchange from January 1, 2012 onwards.

Companies listed on the small and medium-sized enterprise board and the Growth Enterprise Market will be required to adopt these guidelines “when appropriate.” Non-listed large and medium-sized enterprises are merely encouraged to adopt the guidelines.

Supporting Guidelines

To implement the Basic Standard, in April 2010, the five Chinese governmental departments issued the Supporting Guidelines for Internal Control of Enterprises (Caikuai [2010] No.11, “Supplementing Guidelines”).

The Supplementing Guidelines consist of three guidelines:

- Application Guidelines

- Evaluation Guidelines

- Audit Guidelines

The Supplementing Guidelines require listed companies and non-listed large and medium-sized enterprises governed by the Basic Standards and the Supplementing Guidelines to disclose an annual self-evaluation report on the effectiveness of their internal control as well as engage an accounting firm to issue an auditor’s reports on the effectiveness of their internal control in financial reporting.

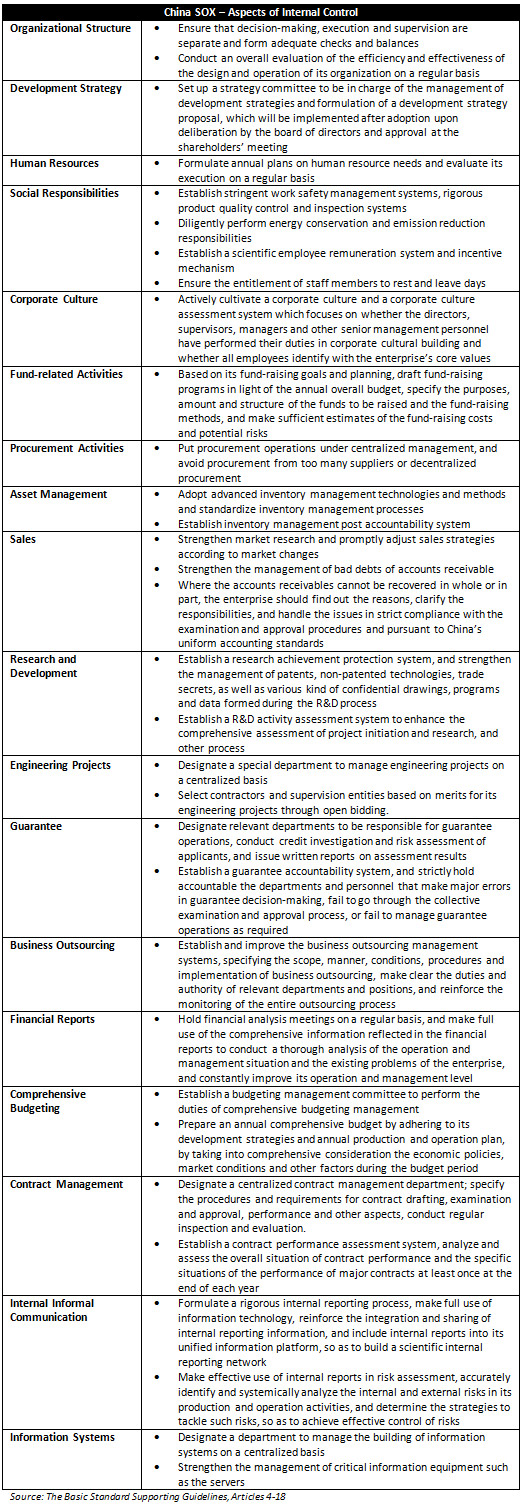

The Application Guidelines include 18 aspects for enterprises to focus on in establishing internal controls, along with definitions and examples (please see table below), while the Evaluation Guidelines provide an outline for enterprises to perform comprehensive assessments on the design and operation of their internal controls. These guidelines are generally in line with international materials.

Finally, while the audit section of the Supplementing Guidelines outlines basic requirements for performing internal control audits for enterprises, China has a number of other laws and regulations on this topic.

Internal Audit

China joined the Institute of Internal Auditors (IIA) in 1987 and established The Chinese Institute of Internal Auditors the same year. Since then, the country has gradually established the basic framework of a standard internal audit system by promulgating basic guidelines for internal audit, codes of practice for internal audit practitioners, and specific rules and directories for internal audit practices, including implementing the Internal Audit Regulations in 2003.

One key difference in China’s internal audit framework, compared to its international counterpart, is a more narrow, financial audit-focused definition of internal audit.

IIA defines internal auditing as:

“An independent, objective assurance and consulting activity designed to add value and improve an organization’s operations…(that) helps an organization accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes.”

China’s Internal Audit Regulations, on the other hand, define internal auditing as:

“An activity that consists of independent supervision and evaluation of the authenticity, validity and benefit of the fiscal and financial income and expenses and economic activities of an enterprise and its affiliated organizations, in order to enhance and strengthen its economic management and realization of economic goals.”

While internal auditors are expected to examine and evaluate risk management and the soundness and effectiveness of the internal control system, IIA’s definition of internal audit is clearly broader than that provided under China’s regulations; while the former is concerned with improving risk management, control, and governance processes.

Conclusion

With the Chinese government facing political pressure over many cases of fraud and corruption domestically, foreign investors are easy targets for government agencies to hit and examine in order to take the heat off China’s own domestic issues with the same problem. It can only be expected that pressures on foreign companies will increase. Therefore, getting your China operations into compliance as much as possible, and to examining exactly what the internal processes and protocols are should be at the top of every MNC’s agenda in China right now. Paying attention to the relevant regulatory structures (both in China and internationally) and imposing them upon your business model should be a matter of priority for foreign companies operating in China today.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across China by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

Internal Control and Audit

Internal Control and Audit

This issue of China Briefing Magazine is devoted to understanding effective internal control systems in the Chinese context and the role of audits in detecting and preventing fraud.

The China Tax Guide: Tax, Accounting and Audit (Sixth Edition)

The China Tax Guide: Tax, Accounting and Audit (Sixth Edition)

This edition of the China Tax Guide, updated for 2013, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in China, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in China in order to effectively manage and strategically plan their China operations.

- Previous Article China Clarifies Tax Collection Issues Under Nationwide Tax Reform

- Next Article The Duties and Liabilities of Key Personnel in a Foreign Company in China