China’s Health Foods Market: What Makes it Attractive for Foreign Investors

In China’s thriving food and beverage market, health foods are witnessing remarkable growth, presenting enticing opportunities for both local and foreign companies. Indeed, Chinese consumers’ increasing adoption of healthy lifestyles and preference for organic foods is reshaping purchasing behavior, creating both prospects and challenges for foreign investors. However, it’s crucial to note regional variations and China’s own national standards, which foreign firms must adhere to in order to avoid legal risks. F&B companies are also advised to pursue an omnichannel strategy when selling to the Chinese market.

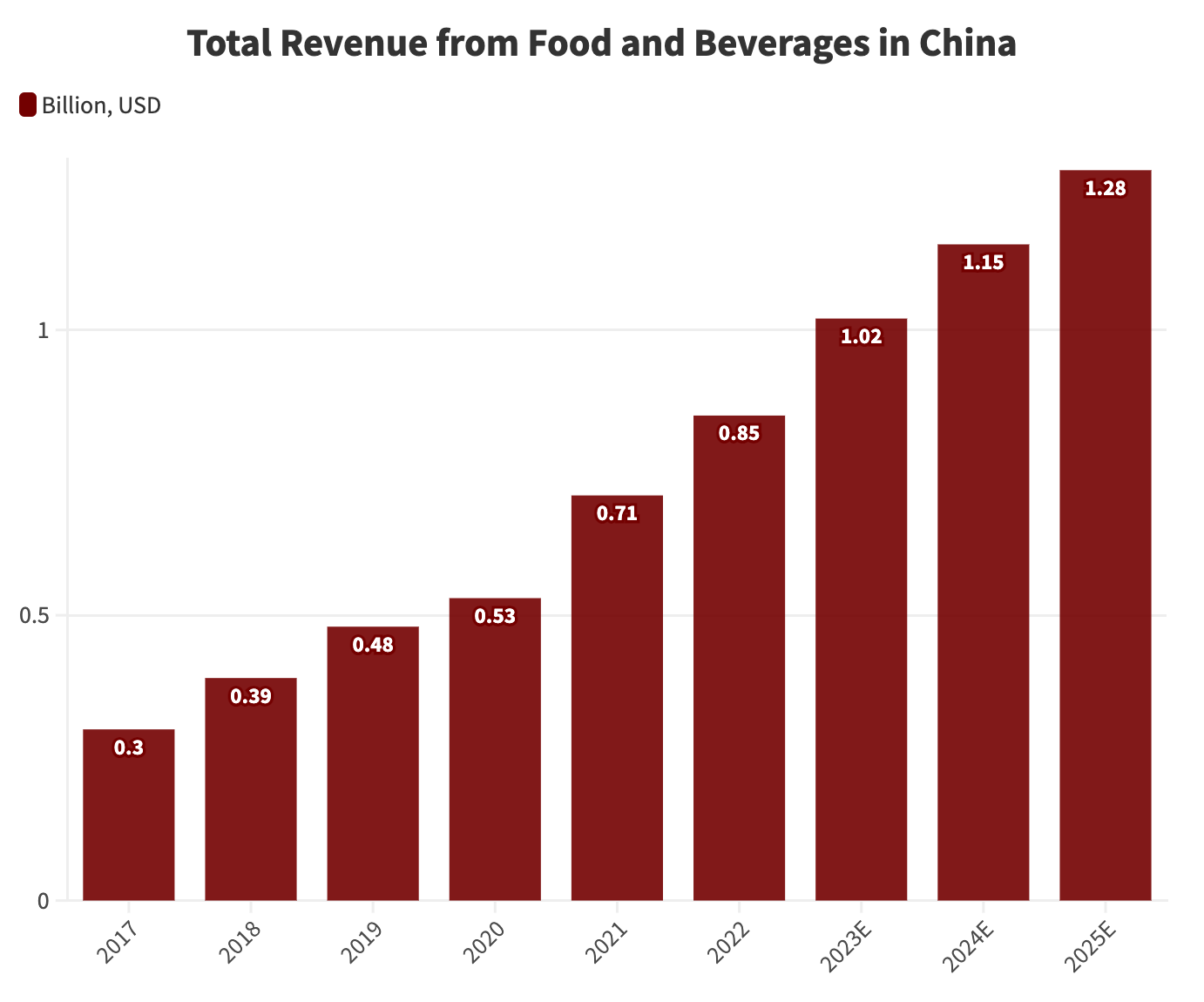

For many international investors, the fast-growing food and beverage (F&B) industry in China is an attractive destination. The market’s value has surged from US$300 million in 2017 to US$850 million in 2022, and it is projected to surpass US$1 billion in 2023.

Various factors have contributed to the industry’s expansion during this period. The COVID-19 pandemic has prompted shifts in people’s behaviors and values, leading to a heightened emphasis on health and well-being. Furthermore, the rising affluent population now possesses increased purchasing power, enabling them to spend more on premium food and beverage offerings.

As a result of these combined factors, China’s F&B market has emerged as the second-largest worldwide.

Unfortunately, with less than 11 percent of its land currently arable, China faces a steep challenge when it comes to sustainably ensuring food supply for its population. Further, up to 40 percent of China’s rivers and 20 percent of its land are polluted, resulting in the limited ability to produce homegrown food products.

Accordingly, China has no choice but to import huge amounts of food products to satisfy the needs of its immense population. In 2022, China’s food imports accounted for 8.5 percent of the total. Besides soybeans, which represented about 40 percent of the total value of F&B imports to China, meat products, wines, spirits, fish products, confectionery and chocolates, bottled water, dairy products, and sugar are the most commonly imported products.

Consumer trends in the F&B industry: the soaring popularity of Health foods

Based on the National Food Safety Standard – Health Foods, health food can be categorized into two types: those claiming specific health functions or acting as nutritional supplements. The former category includes food suitable for specific groups to regulate body function without treating diseases and should not pose any health hazards. Nutritional supplements consist of products with vitamins and minerals as major ingredients, available as single or multi-ingredient supplements.

Several factors, both social and economic, contribute to the rise of the health foods segment in China.

As a result of increasing life expectancy, China is experiencing a shifting population pyramid. United Nations data reveals that in 2022, the proportion of people aged over 60 in China reached 280.04 million, up from 267.36 million people (or 18.9 percent of the total population) from the previous year. China’s ‘new’ older generation has undergone a noticeable transformation in recent years and now possesses both the awareness and the means necessary to increase their consumption of healthy food products.

Meanwhile, increasing levels of education and an internet-savvy Chinese middle class are additional factors of growth.

Consuming organic and healthy food products is now considered a status symbol in Chinese society and has in a short time created and expanded the country’s lifestyle products market. Scoring 12 points above the global average, China is today known to be one of the most health-conscious nations worldwide.

73 percent of Chinese consumers are ready to pay extra for food deemed healthier and 58 percent of the Chinese middle class (aged 20-49 years) are willing to pay more for ethical brands.

In 2021, China held the second-largest health food market globally, accounting for 17.8 percent of total global sales. Data shows that sales of health food in mainland China increased by 8.2 percent in 2021, reaching RMB 270.8 billion (US$37.69 billion). By the end of 2023, the market is predicted to expand further to RMB 328.3 billion (US$45.81 billion) by the year 2023.

Accordingly, the sales of imported health foods, such as food supplements and premium dairy products, are booming while low-nutrition food products are gradually losing popularity.

This shift in consumer behavior has led companies to respond by integrating healthier or dietetic ingredients into their products. This pattern is observable in a wide range of beverages, spanning from soft drinks to coffee.

Tapping into the health foods segment

Yet, to be successful in the Chinese market, foreign players need to understand local consumer behavior.

This includes having a grasp of the objectives and demands of Chinese consumers, regional differences in consumption patterns, and the internal dynamics of the overall market structure.

Brands that adopt a uniform strategy across China risk ignoring prominent differences in their regional markets.

For instance, better-developed cities with higher disposable incomes and a more international lifestyle, such as the first-tier cities along China’s east coast, have a higher appetite for foreign products than western and inland provinces.

At the same time, brands that target less saturated markets could benefit from the rapid growth projected in many of China’s tier-2 cities.

Foreign players thus have two options when doing business in China – one, partnering with local operators, and, two, investing in market research to determine local preferences and offer customized products that suit local demand.

A combination of these strategies will enable foreign businesses to effectively assess the opportunities and risks available across China’s different regional markets and adapt to match consumer needs.

New retail strategies and diversifying sales channels

A prominent trend in the Chinese F&B market is the importance of its online retail channels. However, simply translating the F&B company’s existing website into Chinese is often not enough to attract local consumers to buy online. International brands must tailor their websites to the interests of Chinese customers; additionally, they must also have a clear social media strategy in play.

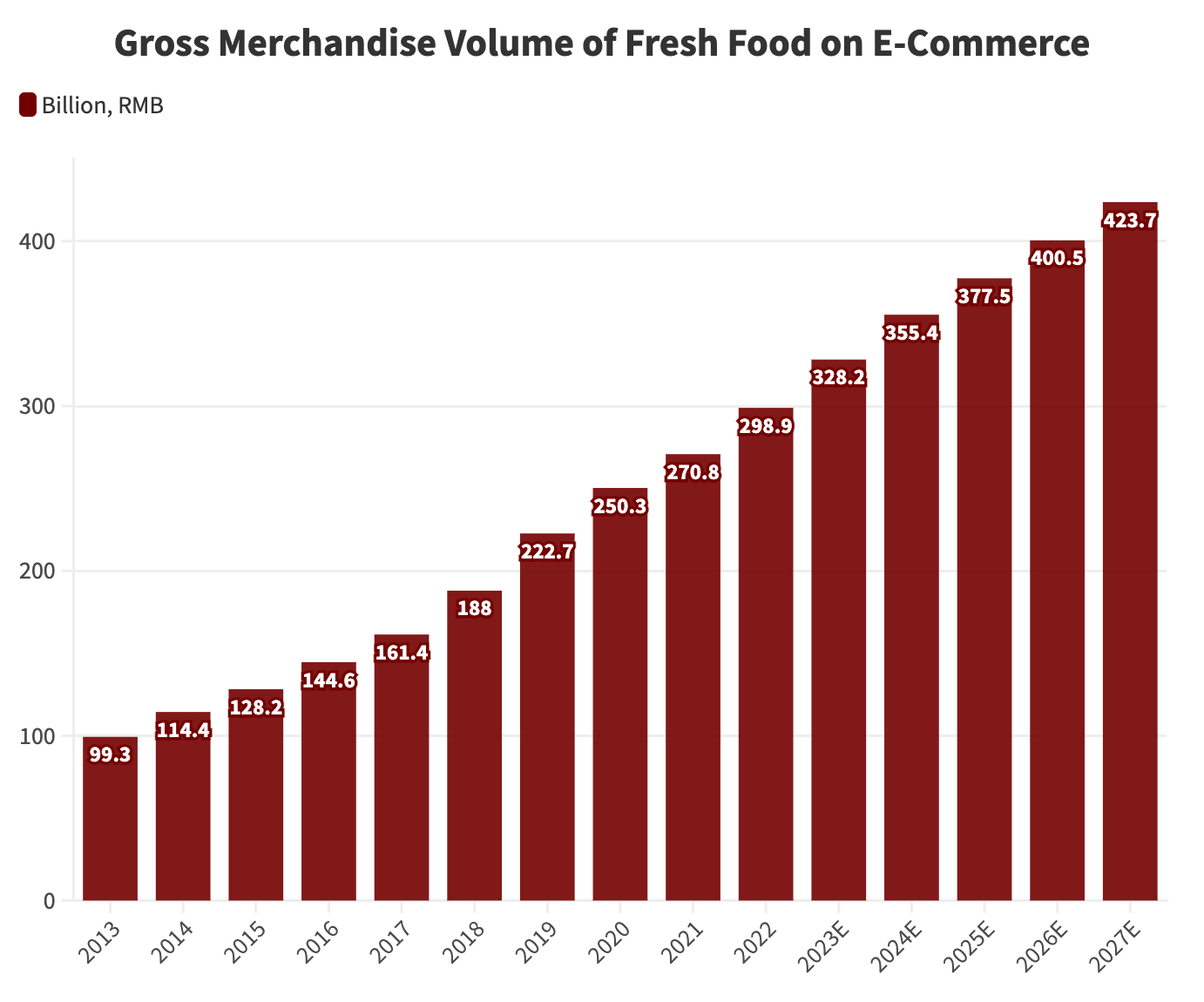

In 2022, the gross merchandise volume (GMV) of fresh food e-commerce reached RMB 560.14 billion (US$78.17 billion). While sales through e-commerce platforms directly owned by the company and through third-party platforms, such as Tmall.com and JD.com, is becoming more popular, successful suppliers of health products employ multiple channels to ensure their product visibility and sales in the Chinese market.

These include direct sales channels supported by interactive events, conference marketing, and traditional marketing campaigns through television and social media as well as the establishment of their own online platforms.

Through the online-to-offline (O2O) model, Chinese consumers are encouraged to try the products in the physical stores and place orders online, thus combining the offline experience, which is more tactile, and the online purchasing process, which is convenient.

Leveraging social media, livestream, and KOLs

Social media plays a vital role in marketing strategies for the whole F&B industry in China. It serves as a significant platform for product promotion and sales. Users frequently share their product reviews online, influencing other consumers’ opinions and purchase decisions. Businesses leverage social media by collaborating with key opinion leaders (KOLs) and virtual influencers, who have large and devoted followings, thus effectively increasing product awareness.

For example, social media platforms, such as WeChat and Douyin, have brought about a transformative change for Chinese local farmers. Organic farmers, for example, would now regularly share photos and videos of their life and production process, bridging the gap between consumers and the farm, and becoming online sensations.

By March 2020, during the peak of the COVID lockdowns, approximately 60,000 farmers had registered to use Alibaba’s Taobao Live, a livestreaming feature. The Ministry of Agriculture and Rural Affairs has championed live streaming as an innovative means to broaden the sales avenues for fresh and healthy foods in the country. Since its launch, this initiative has contributed to a positive upward trend in agricultural product sales, with experts estimating sales reaching up to RMB 15 billion (US$2.09 billion) in 2020 alone.

A taste for premium, high-quality products

The rising middle class and affluent consumers have led to an increase in spending on premium products, with a preference for fewer, but higher-quality goods.

One area witnessing significant growth within this trend is the premium seafood market. Reports indicate that the demand for luxury seafood products has risen steadily, and imported seafood remains particularly sought after. In 2022, the import value of seafood in China reached US$19.13 billion, surging 35 percent from the previous year.

Likewise, the premium alcohol segment has seen considerable success in China. Despite baijiu remaining a dominant spirit, high-end alcoholic brands are attracting wealthier consumers. In 2021, China imported approximately US$2.7 billion worth of hard liquors, with premium offerings contributing significantly to this figure.v

Preparing to meet China’s regulatory standards

Foreign F&B products entering China meet a multi-layered regulatory system as soon as they reach the country.

Foreign firms that want to sell health food products in China need to pay special attention to its legal and regulatory provisions. At present, the country does not recognize international standards for organic food products, while it has its own set of national standards.

Health food registration and filing

To legally sell health products in China, businesses need to apply for imported health foods registration and filing through the State Administration for Market Regulation (SAMR). Both the SAMR and the Center for Food Evaluation are responsible for the technical review of the application.

When registering a health food product, the documents to be submitted to the SAMR include:

- Application form

- R&D report

- Product formula materials

- Production process

- Product safety and function evaluation materials (test reports)

- Sample of Chinese label

- Certifying documents related to the qualification of the applicant and product production sales information in the country (region) of origin

- Health food-associated standards in the country (region) of origin, as well as the original label

- 3 samples with minimum sales packaging

Registration types for imported food products

China’s regulations have undergone rapid change in recent years, requiring foreign investors to adopt a methodical approach when preparing for the licensing needed to import their products into China.

From October 2015, it has become mandatory for exporters to register each shipment of food products online with the Administration of Quality Supervision, Inspection and Quarantine (AQSIQ) for tracking purposes.

Additionally, with the aim of enhancing oversight of imported food facilities, China’s General Administration of Customs (GACC) introduced the Administrative Provisions on Registration of Overseas Manufacturers of Imported Food, referred to as “Decree 248,” on April 21, 2021. This regulation became effective from January 1, 2022, imposing that all imported food items destined for China, with final production concluded on or after that date, must display GACC-issued registration numbers on both their inner and outer packaging.

In general, GACC registration is necessary for both imported food items and foreign exporters of such products. This registration process is documented within the China Single Window digital platform, commonly referred to as CIFER. The specific registration form to complete is contingent upon the kind of food one intends to export to China. This distinction is grounded in the regulations that classify foods into two categories: those that require recommendation and those that necessitate registration.

Foods that require a recommendation from their local authority include:

- Meat and casings

- Aquatic products

- Dairy

- Cubilose and Cubilose-Products

- Bee Products

- Eggs and Egg Products

- Edible Fats and Oils

- Stuffed pasta

- Edible grains

- Industrial grains and malt

- Fresh and dehydrated vegetables

- Dried beans

- Spices

- Nuts and seeds

- Dried fruit

- Raw Coffee beans and Cocoa beans

- Foods for special dietary use

- Health-Products

Foods that can be registered directly include:

- Processed vegetable products

- Grain products

- Tea

- Nut products

- Alcoholic drinks

- Soft drinks

- Cookies and Bread

- Sugar

- Sweets and Chocolate

- Seasonings

- Roasted Coffee and Cocoa beans

- Processed fruit products

- Others

China’s import regulations vary according to the type of food product and may not be consistently applied and enforced by different ports, bureaus, and individual officers.

However, if at any time, Chinese authorities realize a gap in compliance or irregularity in food quality standards, the importer’s license may be revoked, and the companies may be barred from future trade with China.

Food Safety Law

China’s Food Safety Law (FSL) was introduced in 2009 and subsequently modified in 2015, 2018, and 2021. The most recent update became effective on April 29, 2021. In total, there are 154 provisions within the law. Its primary objective is to guarantee the safety of food and protect the overall well-being and survival of the general populace.

This comprehensive legislation encompasses the establishment of a licensing system to regulate food-related activities, ensuring that individuals engaged in food production, sales, and catering services acquire proper permits.

The FSL also emphasizes the proper storage and handling of food, mandating compliance with food safety regulations, regular inventory checks, and the swift removal of expired or deteriorated items. An integral component of the law is the implementation of a robust food recall system, requiring food producers to take immediate action if their products are deemed unsafe—including recalling items from the market and notifying relevant stakeholders. Furthermore, the legislation places a significant emphasis on the safety of imported and exported food, assigning oversight responsibilities to the SAMR. This highlights the law’s dedication to safeguarding public health by ensuring that imported products meet China’s rigorous food safety standards and labeling requirements.

Challenges and opportunities for foreign investors

The Chinese F&B industry holds vast opportunities for foreign investors. However, navigating this market comes with challenges due to a complex regulatory landscape, stringent food regulations, and the competitive strategies employed by local players. To succeed, potential investors are advised to thoroughly understand Chinese consumer behavior by engaging with them directly on the ground. This approach can provide valuable insights and help overcome sociocultural barriers and other factors.

Another significant challenge is combating counterfeit products. Although progress has been made, China’s counterfeit F&B industry still thrives. Such products often contain substandard or even harmful ingredients, posing serious risks to consumers. Chinese consumers are particularly cautious when purchasing food products, and any negative experiences with poor quality or health issues can irreparably damage a brand’s reputation.

To mitigate these risks, foreign businesses should take proactive measures to safeguard their brand identity and trademark, preventing their products from being imitated and challenged in the Chinese marketplace.

As Chinese consumers become more urban, wealthy, and exposed to foreign cultures and lifestyles, the demand for foreign F&B products will develop correspondingly.

Nowhere is this observed more visibly than in the rise of the organic and health foods segments.

Moreover, due to frequent domestic food scandals resulting from pollution, fraud, and corruption—consumers of all classes and backgrounds in China view foreign food and beverage products as the safer and healthier option.

It is expected that foreign food imports will be promoted by the government through favorable regulations and import procedures.

This offers immense and long-term growth potential for foreign investors looking to do business in China.

(This article was first published on April 4, 2019, and last updated on August 16, 2023.)

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China’s Average Wages – Trends and Implications for Businesses

- Next Article China Economic Roundup – July 2023