Pre-Establishment Considerations for Setting Up a WFOE in China

Learn about key pre-establishment considerations before setting up a WFOE in China, including the business scope, investment capital, expenses and tax planning, and location search metrics, among others, in this article.

Before setting up a wholly foreign owned enterprise (WFOE) in China, there are several pre-establishment considerations that investors should take into account, to optimize the process and decrease the risk of costly errors.

In particular, making changes to a Chinese entity after establishment – such as to its range of commercial activities or registered address – can be challenging and onerous.

In some cases, closing the entity all together and starting from scratch may be easier, or even mandatory.

For these reasons, it is always better to start out with a clear and informed business plan, rather than attempt to make on-the-fly adjustments later on.

Business scope

The business scope is an enumeration of the commercial activities in which a business is authorized to operate in. It is administered by two state bodies – the Ministry of Commerce (MOFCOM) and the local Administration for Market Regulation (local AMR) – and is printed on its business license along with other registered information such as its name, registered capital, and legal representative.

For foreign businesses, it’s imperative that the company operations must be reflected accurately in the business scope.

Under the current laws and regulations, foreign investors are still restricted or prohibited to engage in certain sectors, as stipulated in the Special Administrative Measures on Access to Foreign Investment (2020 edition) (National Negative List) and the Free Trade Zone Special Administrative Measures on Access to Foreign Investment (2020 edition) (FTZ Negative List).

In addition to the legal risk of disingenuously operating in an unregistered domain, not keeping the company’s commercial operations within the range of activities set out in its registered business scope can also be detrimental to a company’s ability to issue official invoices (fapiao) to its clients.

While a company still can issue fapiao for occasional activities out of the business scope, regular discrepancies may trigger potential tax investigations. It is therefore critical that companies carefully plan their business scope prior to initial incorporation in China, or else risk having to undergo the onerous and time-consuming process of changing this later.

Depending on the business scope, WFOEs can be classified as being a manufacturing company, a service company, a foreign invested commercial enterprise (that is, a trading company), regional headquarters, an R&D center, an investment company, or several others. Often, the capital requirements will differ depending on the type of company that is being incorporated.

Registered capital

Registered capital is the fund all the shareholders contribute or promise to contribute to the company when they apply to the local Administration of Market Regulation (AMR) for incorporation of the company.

The amount of the registered capital depends on a range of factors, which include the region, the sector, the company’s business scope, the planned scale of operations, etc. It will show in the company’s business license, this information is available to the public to show the fund strength or capacity of a company to some extent.

The registered capital does not need to be paid completely up front.

The previous system of paid-up capital has been replaced by a subscribed capital model, under which a schedule of contributions must be declared in the Article of Association and be registered with the local AMR in charge. The government will check whether the investors follow the capital injection plan.

There is no minimum registered capital requirement for corporate establishment except few industries, such as banking, financing, insurance, etc.

Despite this, in practice, the governing authorities will ensure that a company’s registered capital is sufficient to support its business operations for at least one year, including its rent, labor costs, and office expenses.

The amount of “sufficient” capital varies depending on various factors, such as the region of incorporation and the industry. A basic consulting wholly foreign owned enterprise (WFOE) will typically require a minimum commitment of between RMB 200,000 to RMB 500,000. Manufacturing WFOEs, on the other hand, will require more.

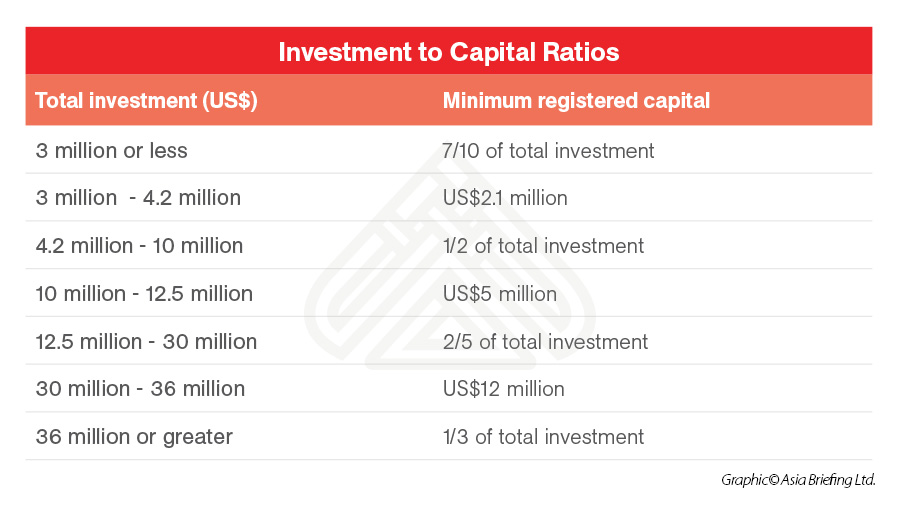

Moreover, the registered capital can affect the amount of offshore debt the WFOE can borrow from other investors or foreign banks, if the WFOE chooses to follow the ratio between registered capital and total investment as shown in the following chart. The upper limit of the offshore debt is the gap between the total investment and the registered capital.

Registered capital contributions can be made in cash, as a lump sum, or in installments. However, locally obtained RMB cannot be injected as registered capital – it must be contributed from outside China by the overseas investor. The company’s payment schedule for contributions must be specified in its Articles of Association, and once paid, the amount cannot be freely wired out again.

Expense and tax planning

When setting up a company in China, one inevitably incurs costs prior to the company being formally incorporated. The question then arises what part of these costs may be deducted from the company’s tax bill. This becomes especially relevant if the investment is a large project, such as setting up a factory and purchasing machinery, where the costs incurred prior to incorporation can be substantial.

A WFOE, being an independent legal entity registered in China, is taxed on its income, and may therefore deduct expenses from Chinese tax.

As pre-incorporation expenses by definition have been incurred prior to the WFOE formally existing, only some of these expenses can be taken on by the WFOE. Of all the expenses made before formal incorporation, only the so-called pre-operation costs (开办费) may be allocated to the WFOE and deducted. The key point in defining pre-operation costs is the time when they occurred.

In practice, the starting point of this period is seen as either the establishment date on the business license, or the day on which the investor gets the company name confirmation from the AIC.

This is usually one month before the establishment date on the business license. The ending point of the pre-operation cost period is when the company issues its first invoice, or generates its first revenue.

Most of the costs incurred during this period, such as wages, training, printing, transport fees, registration fees, and purchases of items not considered fixed assets, may be deducted if relevant valid tax invoices can be provided. Up to 60 percent of advertising and business-related entertainment expenses (business dinners, gifts, baijiu, etc.) may be allocated to the WFOE during this period.

It is often hard to predict what the establishment date of the company will be. This largely depends on how the incorporation process is conducted. However, the better the investor manages the incorporation from its side, the more clarity one can hope to get.

Before the company is incorporated, the foreign investor may open a temporary bank account in China. The investor may wire foreign currency into this account and spend these funds on pre-operation and other expenses. After the company has been established, it needs to open a capital account. The funds from the temporary account can then be wired to this account.

In practice, the only cost incurred prior to the pre-operation cost period is office rent. Allocation to the WFOE is accepted, as an office lease is a required step of the incorporation process.

Enterprises, especially manufacturing companies, which often have a long pre-operation period, should take careful consideration of when their pre-operation period ends. These companies in particular need to make sure costs incurred can be carried forward as a loss over the next five years.

Besides income tax, WFOEs should pay extra attention to value-added tax(VAT) for tax planning under China’s reformed VAT system.

In order to obtain tax planning benefits, and gain an advantage through permission to issue special VAT invoices and obtain VAT deductions, WFOEs usually register as general taxpayers.

During the pre-operation period, a WFOE may still be in the process of tax registration without having obtained general taxpayer status, even while some input tax cost was incurred.

However, if the company does not derive any income from business activities and does not make simple computation of VAT, input tax may be kept as credit when general taxpayer is eventually confirmed.

Location

Choosing a location is one of the first decisions that companies must make when entering a new market. Location and a strategic site selection plan can have a major impact on the success of the business, affecting production, operation, and sales.

Therefore, companies must take steps to ensure they have the right information before committing their time and money.

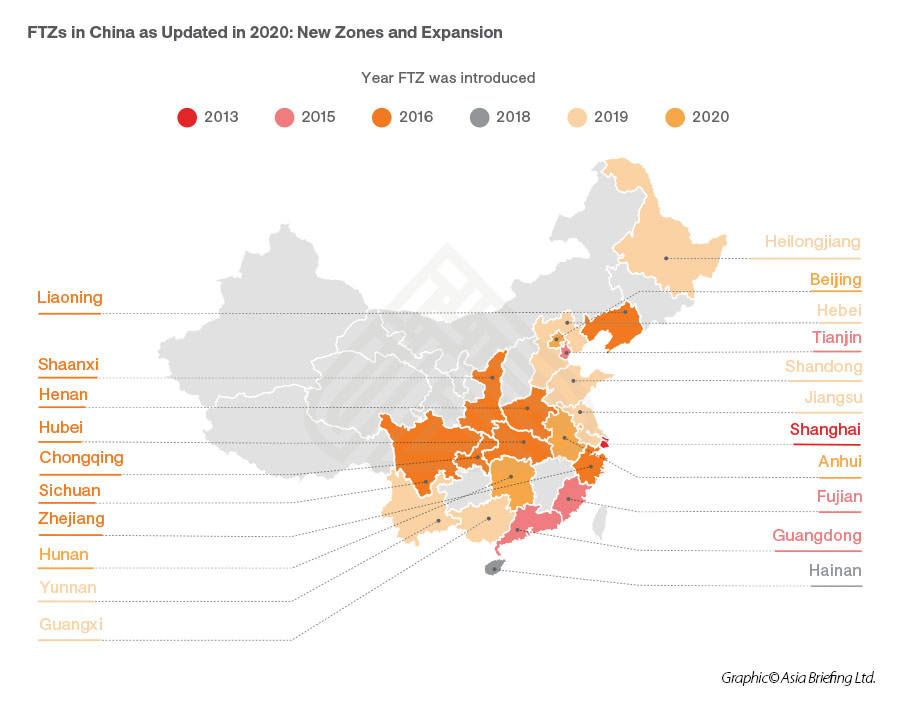

Some locations offer more preferential policies to foreign investment based on the local economic priorities, such as the pilot free trade zones (FTZs).

By far, China has established 21 FTZs, which constitutes part of China’s efforts to transform into a more innovative, service, and consumption-driven economy and the creation of sustainable and high-end manufacturing capacity to attract international businesses.

However, investors are not suggested to make decisions solely based on preferential policies.

Rather, there are multiple considerations that companies must grapple with when choosing a location, including but not limited to real estate, infrastructure, supplier and customer market, cost, operating environment, legal and regulatory environment, and human resources.

Below, we share some tips on location selection:

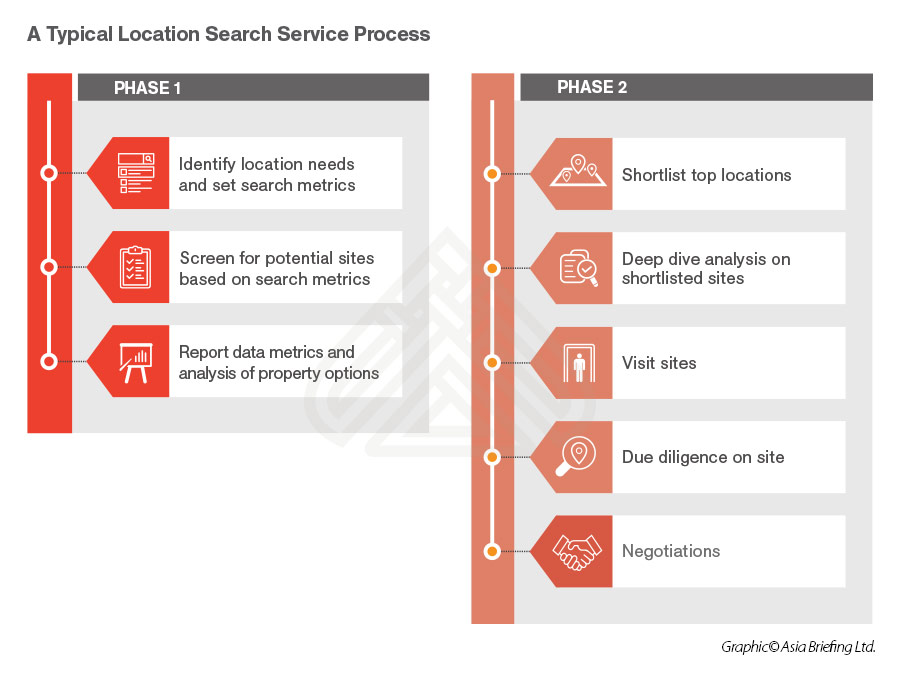

Establish search metrics

The most important factor in site selection is the specific needs of the enterprise, which can be refined into the enterprise’s business priorities and goals. Generally, businesses usually consider the below metrics during location selection:

- Cost metrics – real estate (such as rental or purchasing cost or site and building amenities), utilities (water, gas, or power), labor costs (including social insurance);

- Supply Chain – number of upstream and downstream enterprises, number of competitors;

- Connectivity – major infrastructure, transportation options, ease of access to customers and suppliers;

- Work force – availability of skilled workers, labor productivity;

- Legal environment – industry permit or certifications, special requirements on targeted industries; and,

- Incentives – tax, financial supports, visa.

Analyzing your shortlist

Enterprises need to conduct an in-depth analysis of their search findings and chose the most suitable options based on the business priorities and goals set at the beginning.

At this stage, some quantitative tools, such as a table to weigh all the metrics based on the significance, can be helpful when the decision maker is flooded by the data gathered and has difficulty to make any evaluations.

Enterprises are also advised to seek professional services for at least this step, to take advantage of the insight of independent advisors.

Due diligence for property options

After collating information based on the search metrics, a business will likely get several potential options.

The final step is to conduct a due diligence check on the shortlisted properties or preferred destination. This is particularly important for businesses entering a new region.

For example, an industrial park might have wonderful promotion brochures for marketing, but the infrastructure or the facilities are nothing like those printed on paper. The property option might not have the proper landowner certifications. In worst-case scenarios, the incentives promised by the authority-in-charge might not be in compliance with the national policies.

Given these risks, a due diligence check in advance is not a simple procedural step but serves as necessary and important measures to save investors from potential troubles.

Transfer pricing

Transfer pricing concerns the price charged for intercompany transactions of associated enterprises in different tax jurisdictions. China adheres to the ‘arm’s length principle’, meaning that related party transactions must be treated the same as transactions between unrelated parties.

With a relatively low threshold for applying transfer pricing rules, WFOEs should be aware of their tax filing obligations, particularly those with overseas parent companies.

Obligations mainly consist of two parts: (a) ensuring that related party transactions are appropriately disclosed in the tax return; and (b) preparing and maintaining detailed transfer pricing documentation, if required.

As an active participant in the base erosion and profit shifting (BEPS) project, China has enhanced its transfer pricing regulations.

For example, in 2016, a three-tiered documentation framework was introduced by the State Taxation Administration (STA). WFOEs, under the scheme of tax assessment by accounts examination, need to submit the ‘Enterprises Annual Reporting Forms for Related Party Transactions of the People’s Republic of China’, in Chinese, by May 31 of the following year. In some cases, a nationality report will be required when submitting the report on related party transactions. WFOEs should additionally prepare and maintain contemporaneous transfer pricing documentation in compliance with China’s transfer pricing regulations, which shall be kept for 10 years for future reference.

Reviewing transfer pricing related requirements, as well as preparing proper internal management in the pre-establishment period, is therefore essential for WFOEs.

Holding company issue

Foreign investors may use an intermediary holding structure, otherwise known as a holding company, to serve as the formal investor shareholder of its China subsidiary. There are two key advantages to using a holding company, namely tax benefits and a simpler process to follow in case of restructuring or divestiture.

Tax benefits

Investors may benefit from preferential tax treatment by locating a holding company in a region that has favorable tax treaties with China.

Traditionally, Hong Kong has served as a preferred jurisdiction, but many other countries now offer similar advantages.

However, qualification for such tax benefits has become stricter, as China’s authorities have started closing loopholes.

Restructuring or divestiture

In addition to possible tax benefits, a holding company also offers a simplified procedure for WFOEs looking to change their shareholders.

Formally changing the shareholders of a WFOE registered in China requires tax clearance, including a potential valuation of the WFOE, followed by updating registration information with all relevant Chinese authorities.

It is also possible that the Chinese authorities will object, forcing investors to spend more time, effort and money towards the change.

Key takeaways

Pre-establishment considerations are increasingly important in China.

Making correct and strategic choices from the onset can position a company for long-term success in China, while businesses that fail to do so risk incurring additional costs and wasting valuable time.

Investors must carry out prior research to ascertain the applicable authorities and approval procedures for their business venture.

From the business scope to tax planning, every step requires strong attention to detail, and familiarity with Chinese law.

This is particularly important as China continues to reform its business environment to attract investment, as evidenced by the frequent amendments to the negative lists.

Investors should also be aware that entering the competitive Chinese market requires time and patience. Some regulations and procedures may be vague and complicated and are often available only in Mandarin. In these cases, procuring the services of experienced and qualified professionals can go a long way.

This article was originally published in May 2017. It was updated on April 7, 2021 to reflect new regulatory developments and requirements.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China HR Considerations and Management Strategies During Company Restructuring Period

- Next Article Investing in Xinjiang: Economy, Industry, Trade, and Investment Profile