Tax Residency in China under New IIT Law: Impact on Foreigners

(For the latest coverage on this topic, see our article here.)

How tax residency in China gets determined is among key changes introduced in the recently passed individual income tax (IIT) law. The new law is set to reform IIT in the country, including the tax treatment of foreigners.

Beginning January 1, 2019, an individual who resides in China for 183-days or more will be considered a tax resident and be liable to PRC IIT on their global income.

The amendments are set to have substantial impact on foreigners living in China as it imposes a more stringent test with a lower threshold period as to when a foreigner will be regarded as a tax resident.

China’s new tax residency rule aligns with international standards

The 183-day-rule is a tax residency threshold commonly adopted by many countries across the world (such US, UK, Australia, France, and New Zealand) and will see a shift in China’s current tax practices to more internationally recognized practices.

This will also allow China’s domestic tax practices to better accord with Double Taxation Agreements (DTAs) made with other countries.

Details surrounding the practical implementation of this rule are yet to be released.

Of the many questions that remain unanswered are – how will China collect IIT from non-domicile expats? How will foreigners be able to reclaim tax through DTAs? Will the rule hold any implications on an individual’s visa status?

It is anticipated that further bylaws will be released by the State Administration of Taxation later this year. Meanwhile, businesses should continuously monitor for new IIT updates and prepare accordingly.

The new tax brackets and standard deduction amounts will take effect on Monday, October 1, 2018. The remainder of the new personal income tax laws – including the residency rules – will come into force as of January 1, 2019.

Understanding the 183-day residency rule

Under Article 1 of the IIT Amendments, a ‘tax-resident’ is deemed to be:

- A person who has domicile in China, or

- An individual who does not have domicile in China but has resided in the country for (an accumulated) 183 days or more within a tax year (January 1 to December 31).

The new 183-day rule will replace the previous one-year rule, essentially cutting in half the amount of time one has to spend in China to be considered a tax resident.

At the moment, however, it is unclear whether the previous five-year exemption enjoyed by foreigners will still exist under the new IIT law.

That rule stipulated that foreigners could escape tax liability on their global income until they reached the threshold of staying in China for more than five years.

China’s residency rule prior to IIT reform

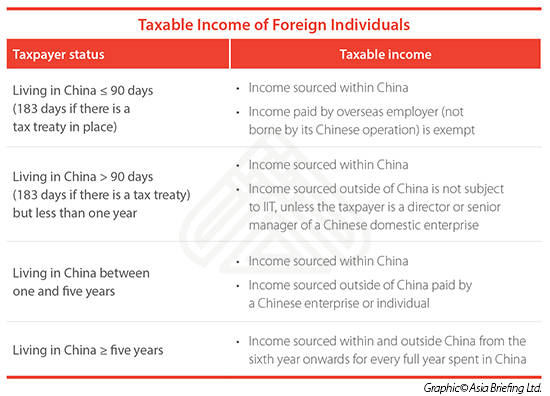

The current calculation for IIT liability is dependent on the source of income, how long one has worked in China, and whether or not income is sourced within or outside of China.

For more information on how ‘time in China’ is calculated, please review our previous article: Paying Foreign Employees in China: Individual Income Tax.

A summary of the different categories of tax liability can be found below.

- One to five years

Currently, foreign individuals who stay in China for more than one year but less than five years – are subject to tax on their income sourced within China and their income sourced outside of China (from a Chinese entity or individual).

A full year is defined as 365 days; however, if an individual is absent in a single period of 30 days or less or an aggregate of 90 days or less then this is deemed as a temporary absence and the individual is still deemed a PRC tax resident for the tax year.

This is referred to as the ‘one-year-rule’.

- Exceeding five years

However, once a foreign individual is domicile in China for more than five years, they will begin to pay taxes on their worldwide income (income sourced within and outside of China – regardless of origin). This is often referred to as the ‘five-year-rule for expatriates.’

The five-year-rule previously contained a well-known loophole whereby foreigners could ‘reset the clock’ and thereby avoid income tax liability by leaving the country for more than 30 consecutive days or an aggregate of over 90 days.

The amendments in effect will make it harder for expatriates to avoid paying tax on their worldwide income tax liability by removing this loophole.

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices in China, Hong Kong, Indonesia, Singapore, Russia, and Vietnam. Please contact info@dezshira.com or visit our website at www.dezshira.com.

- Previous Article China’s New Gaming Regulations: What it Means for Investors

- Next Article An Introduction to Doing Business in China 2018-19 – New Publication from Dezan Shira & Associates