China’s ‘Fapiao’ Invoice System Explained

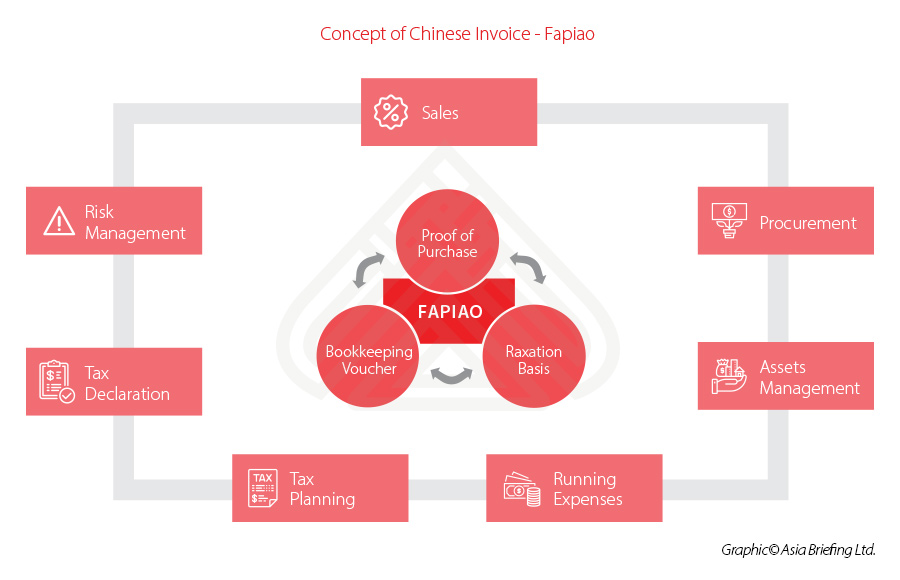

A fapiao is a legal receipt that serves as proof of purchase for goods and services. The larger fapiao invoice system, however, is an essential component of China’s tax law, and compliance for businesses.

The country’s tax authorities require businesses to use fapiao to compel companies to pay tax in advance on their future sales. In this way, China’s fapiao invoice system serves as a paper warranty against tax evasion, unlike other countries where invoices serve as a tax receipt.

The State Administration of Tax (SAT) prints, distributes, and administers fapiao. These authorities then require all businesses to purchase relevant fapiao, according to their business scope.

Foreign businesspeople and companies should take the time to understand the fapiao system: individuals need fapiao to reclaim business expenses, while companies must record all business transactions on a fapiao.

A solid understanding of the system is therefore a critical requirement.

Types of Fapiao

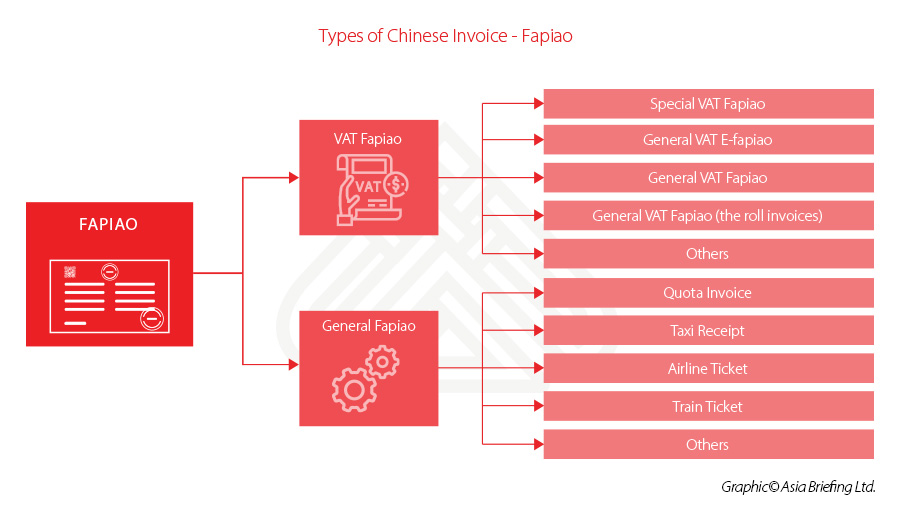

There are two major categories of fapiao – general fapiao and special value-added tax (VAT) fapiao. The main difference between the two is that the latter can be used for tax deduction purposes, while the former cannot.

Since the VAT fapiao is used for tax deduction purposes, it will contain a lot more detailed information including the trader’s tax code, address, telephone number, and bank account information.

Additionally, the purchase amount on a VAT fapiao is usually explicitly broken down into its taxable and non-taxable components, while the amount shown on the general fapiao is usually a tax-inclusive figure.

Given the different types of fapiao, companies should check with an accountant to confirm which type of fapiao they need before making any fapiao purchases with the tax authority.

General VAT fapiao

General VAT fapiao are used as evidence of payment where special VAT fapiao do not apply. There are two formats of general VAT fapiao – the normal general VAT invoices and the roll invoices.

Although taxpayers can choose either type at their own will, the latter are mainly used in the life services industry. The most common taxpayers for general VAT fapiao are generally:

- Business tax taxpayers;

- VAT small-scale taxpayers; and,

- VAT general taxpayers who are not allowed to issue special VAT invoices (such as general commercial taxpayers who retail cigarettes, alcohol, food, clothing, shoes and hats, makeup, and other consumer goods).

Enterprises or individuals who are not able to issue special VAT fapiao should issue general fapiao when selling commodities, providing taxable services, or conducting other operating activities.

Special VAT fapiao

Special VAT fapiao are issued by general taxpayers to customers when selling commodities or providing taxable services. Special VAT fapiao cannot be issued for sales of tax-free commodities.

A special VAT Invoice comprises of the following three basic copies:

- Bookkeeping copy – a bookkeeping voucher for the issuer;

- Deduction copy – a tax deduction voucher for the customer who made the purchase; and,

- Invoice copy – a bookkeeping voucher for the customer.

The number of fapiao that may be printed, and the capital value of each individual fapiao, are subject to quotas. The company’s local tax bureau determines the quotas based on the taxpayer’s actual manufacturing and/or business operation status.

The local tax bureau determines the status after the taxpayer submits a maximum invoice amount application. For invoice applications that amount to over RMB 100,000 (US$14,458), authorities conduct a site inspection for the applicant.

Once the tax bureau has approved the quotas for the special VAT invoice, a taxpayer can print invoices using the tax bureau’s printers, which are specially designed and integrated into the tax system. To receive training to use special fapiao printers, one or more company staff are required to visit the local tax bureau.

If a company exceeds the quota approved by the tax bureau, the company can either apply for a temporary value increase, or obtain additional fapiao. Often the latter is easier for businesses.

Fapiao liability in China

The severity of mishandling a company’s fapiao system should not be underestimated – if a company fails to produce a fapiao when requested to by a customer, this constitutes an illegal act, as all business transactions are required by law to be recorded on a fapiao.

For individual consumers, fapiao act as proof of expenditure in cases where they need to reclaim business expenses. It is a customer’s responsibility to obtain fapiao from a service provider, as they are not always automatically offered.

To streamline the fapiao issuing process, the popular social media app WeChat has launched a new function allowing users to input relevant corporate tax information and present it to service providers in the form of a scannable QR code.

If a business owner is unable or unwilling to provide a fapiao, customers have to right to report the company to the local tax bureau.

To minimize liabilities, and ensure compliance, many businesspeople consult with professional advisers to understand best fapiao practices for their company and industry.

Editor’s note: This article was originally published on August 13, 2013, and has been updated to include the latest regulatory changes.

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Dalian, Beijing, Shanghai, Guangzhou, Shenzhen, and Hong Kong. Readers may write to china@dezshira.com for more support on doing business in China.

- Previous Article Investing in Zhejiang Province: A Quick Guide for Foreign Investors

- Next Article Nuova guida pubblicata da China Briefing: Human Resources and Payroll in China 2019-2020