Alternatives to China: Where is the Manufacturing Capacity?

Op/Ed by Chris Devonshire-Ellis

With China now recovering from the COVID-19 outbreak, it has spread to other countries in what is now termed a pandemic by the WHO. What was, a month ago, a call for relocating China manufacturing elsewhere is now becoming complicated as HQ bean counters look for where other alternatives lie.

But to shift production isn’t so simple – China remains an attractive consumer market, and demand there is now once again picking up. Uniqlo, the Japanese retailer, have just reopened all their Chinese stores except those still under lockdown in Hubei Province. Apple has reopened all its China stores – just as it closed down all non-China retail outlets.

Calls to relocate from China now seem immensely premature – imagine having followed that advice and applied to close your China operations? Your China business license would by now have been terminated leaving your manufacturing with nowhere to move to. Seriously, taking note of such advice can be immensely damaging to your business.

But this doesn’t mean that sticking 100 percent with China is necessarily the only way to go, and in fact it isn’t. Spreading risk is one way to cover bases and is in fact one of the reasons our practice, which until 2006 was purely based in China, became operational in Singapore, India, and Vietnam by the end of 2007. At that time, certain other blogs were suggesting that Vietnam Ain’t No Big Thing.

Which I think is an adequate illustration as to why international investors should listen to firms with their feet really and truly on the ground and have their business radars in place.

Spreading risk away from China then is a good strategy. But it also carries with it a distinctive bonus, at least in Asia. The ASEAN region includes Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam and has its own middle-class consumer base of about 135 million. That’s equivalent to adding another 30 percent to the existing China middle class market. But what’s really impressive are the growth figures: over 380 million people are under the age of 35 in ASEAN (58 percent of the population), being roughly 20 percent larger than the entire US population.

ASEAN also has the world’s third largest labor force, trailing only China and India. ASEAN’s middle-class meanwhile is expected to more than double in size from 135 million (24 percent of ASEAN’s population) to 334 million (51 percent of the population) by 2030. It is becoming the place to be – and can act as both a China risk spread and a market development strategy at the same time.

Back in 2006 when Dezan Shira & Associates were establishing a presence in Vietnam, I recall competitors telling stories about how crazy dumb that was, as the manufacturing capacity wasn’t up to China standards. But we’d done our homework: Vietnam was cheaper, and although the production capacity was about 70 percent of that in South China at the time, we knew that infrastructure developments already taking place in the country would soon close that gap. And we were right. Our three Vietnam offices are now some of our firm’s busiest.

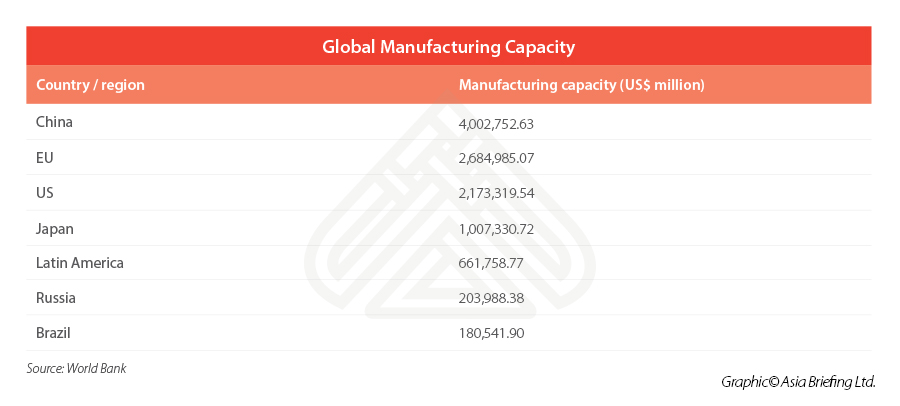

However, the same logic still applies – where is the manufacturing capacity? The tables below show how it looks as things stand right now.

The statistics are interesting as the second, third and fourth largest in terms of capacity – the EU, US, and Japan – are also among the most expensive to manufacture in. Chinese capacity is close to double that of the US. However, when one considers Asia, there is more Asian manufacturing capacity outside China than there is within it. Countries like India, Indonesia, Thailand, Malaysia, and the Philippines all have strong capacity to manufacture. Vietnam, which has gained so much traction and attention over the years, is actually revealed to have less capacity than some of its neighbors. In fact, in Asia overall, there is five times the total manufacturing capacity than is available in the US and four times more than in the EU.

But there are disparate opinions. As one American blog mentioned last week, Puerto Rico could be an alternative destination for US manufacturers should they wish to leave China. That is, if you’re looking to invest in a place with less than 0.1 percent of China’s total capacity. Again, this from a greed of Seattle lawyers who think China is over, Vietnam isn’t a big deal, and relocating from China to Puerto Rico is a sound alternative. Which brings us quickly back to Asia as being the real deal.

There are also trade and tax incentives: ASEAN has free trade agreements with China, India, Japan, South Korea, Australia, and New Zealand. This means it is possible to establish a manufacturing presence in one of the ASEAN countries – we would typically suggest, in order, Vietnam, Indonesia, Thailand, Philippines, and Malaysia in basic terms of getting things done – and then export back to the US or EU. The FTAs mean that it is also possible to export, with low or zero duties, to markets in China, India, Japan, South Korea, and Australasia.

The recent US-China Trade War also saw ASEAN countries introduce a series of policies designed to attract foreign investment into the region. These can be read about in the article Trade War Incentive Schemes in ASEAN.

Finally, there is also the manufacturing cost aspect. Our firm has a Business Intelligence Unit that can identify key operational costs and make comparisons throughout Asia. Please contact them at asia@dezshira.com. Concerning wages, we covered minimum wages across the ASEAN region in the piece Minimum Wages In ASEAN: How Are They Calculated?

Further information regarding details of operating a business in ASEAN can be found below in the Related Reading section. These magazines are available as complimentary downloads.

Related Reading

Relocating Your Business from China to ASEAN

Relocating Your Business from China to ASEAN

We introduce the different incentives issued by ASEAN countries to attract investments from the spillover of the trade war. We also analyze productivity levels in ASEAN and focus on special economic zones (SEZs) in ASEAN. Export and Import Procedures in ASEAN: Best Practices

Export and Import Procedures in ASEAN: Best Practices

We outline the export procedures in each ASEAN member state. Next, we focus on import procedures in each ASEAN country. Finally, we discuss the importance of meeting the region’s Rules of Origin (RoO) criteria for exporters and importers looking to take advantage of the individual ASEAN member states’ FTAs as well as the bloc’s regional FTAs. Manufacturing and Trading in India

Manufacturing and Trading in India

We discuss the advantages India offers as an alternative destination for manufacturing businesses in China. Further, we highlight the advantages of operating in India’s special economic zones and discuss the factors a company must consider before choosing an ideal SEZ location. Finally, we look at the relevant steps and procedures for establishing an import-export company in India.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, and Thailand in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article 3 Reasons Foreign Investors Should Stick with China amid the Coronavirus

- Next Article COVID-19 – What to Do If Your China SME Becomes Insolvent