Annual Audit in China: Why it’s Important and How to Get Started

A financial audit is an objective examination and evaluation of the financial statements of an organization to make sure that the financial records are a fair and accurate representation of the claimed transactions.

Almost all companies receive a yearly audit of their financial statements – which includes an examination of the income statement, balance sheet, and cash flow statement, among others – as the first step of the annual compliance.

While tedious, this process is a good opportunity for companies to conduct an internal financial health check to optimize tax efficiency, financial structure and processes, as well as internal control mechanisms for fraud prevention.

Why are annual audits important to businesses?

When foreign invested enterprises (FIEs) initially began setting up in China, many were not familiar with China’s idiosyncratic accounting standards and tax rules. Incorrect accounting treatments or tax filings thus became widespread, and especially common among small-and medium-sized FIEs.

Annual audits thus provided a good opportunity for FIEs to find mistakes within their reporting of day-to-day operations and improve their financial reports in accordance with Chinese accounting standards and ensure that their accounting data was presented appropriately. This, in turn, informed better business decision making, based on accurate representation of their financial and tax situation.

To this day, annual audits continue to serve as a perfect opportunity for FIE’s to double-check their tax obligations, identify unnecessary tax payments that can be refunded, and improve their accounting system. Though the annual audit report is generally not required to be submitted in current practice, it is by law a necessary requirement for all FIEs.

Beyond this, there are various other reasons for FIEs to undergo an audit annually. In some cases, an audit may be a necessary step or will enable the firm to be better equipped to complete a certain business transaction. In other situations, constant changes in the external environment deem an audit a prudent business decision. We discuss the most common considerations below.

Prerequisite for profit repatriation

Generally speaking, FIEs can only repatriate profit once a year after the annual audit and tax compliance process has been completed. During this process, tax authorities will use annual audit reports to ensure that a business is compliant with local law and regulations and will probe into whether the corporate income tax (CIT) had been paid on the profit to be distributed. At the same time, tax authorities will confirm the maximum profit amount that can be repatriated based on the net profit indicated in the financial reports.

Required by overseas HQ for group consolidation purpose

If an overseas headquarter is required by law to complete an audit, the domestic subsidiary will also be required to provide an audit report where the asset or revenue of a domestic company within a company group reaches the reporting threshold stipulated by the overseas regulations.

Required in customs and tax investigation

In cases where the tax authority or the customs authority initiates an investigation due to irregular records or where a whistleblower reports the matter to the authorities, the company investigated may be required to submit an audit report of a certain period in a short turnaround (subject to case-by-case analysis, but usually around 10 days). This is especially true in lower tier cities where tax bureaus or customs rely heavily on audit reports to learn about the financial state of a business and its potential liabilities.

At such a time, if the company does not submit an updated audit report, it can delay the overall process or result in additional costs as the report needs to be produced within short notice. This can lead to a stressful, mistake-prone environment – and offers companies less chance to correct discrepancies in their financial statements.

Prepare for changes to the accounting standards

Starting January 1, 2021, several new accounting standards will apply to all entities that have adopted the Chinese Accounting Standards for Business Enterprise (CAS). The changes will mainly pertain to accounting treatment of revenue and leases. By undergoing an audit, companies can better understand their current finances and accounting structure, and the discrepancies between the old and new, to facilitate necessary adjustments in a timely manner next year. For more information about these new accounting standards, see Chinese Accounting Standards for Business Enterprises: Prepare for Changes in 2021.

An audit can get you better prepared for the COVID-19 business climate

As China emerges stronger and more resilient from the ongoing COVID-19 pandemic, profit repatriation from China has become more common among FIEs, deemed necessary against the backdrop of supply chain disruptions, and remote employees distributed sparsely around the world. As a result of this, an audit report, certified by an independent qualified Certified Public Accountant (CPA) firm, can complement the headquarters in managing and monitoring the financial situation of the FIEs.

Moreover, only companies that stay vigilant and actively strive to reduce their mistakes will be able to survive and thrive in the new environment, and audits serve as a good way to spot the internal flaws and make amendments at the appropriate time. Companies can use the annual audit to enhance their internal control and risk management system.

What do annual audits involve?

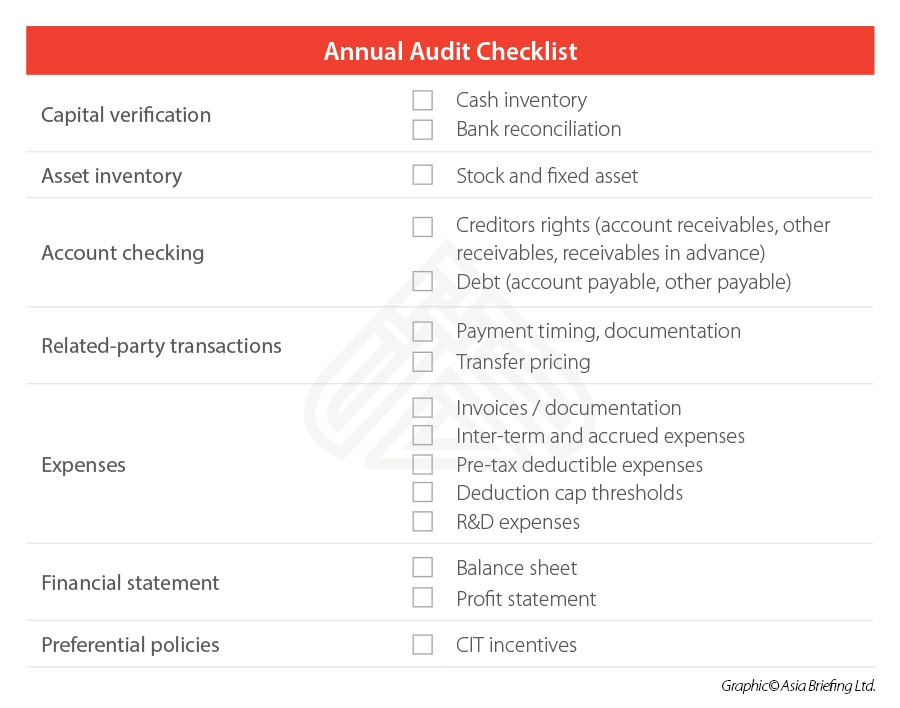

While the requirements for the audit report may vary by region, the auditor will typically do a systematic review of the following:

1. Capital verification

The auditors will examine the cash inventory, checking to see whether this matches the accounting records and whether the cash ratio holding aligns with the stated total capital amount. The bank reconciliation process will also be a primary focus at this stage, and auditors will investigate two aspects. Firstly, whether relevant records on the accounting books are consistent with bank records (that is, checking the balance, deposit in transit, borrowings etc.) and secondly, whether there are any inactive accounts.

2. Asset inventory and evaluation

Next, the auditors will investigate the goods in stock and the fixed assets to determine whether this lines up with the records of the accounting books. An examination will take place to determine whether the documentation and the tax verification report are complete for the disposal of the scrapped products/assets, idling products/assets, and defective products. Auditors will also recalculate the impairment of the assets as needed.

3. Account checking

The auditors will check the account to verify the transactions recorded. For creditor’s rights, this will concentrate on:

- Accounts receivable (AR) – verifying the amount; assessing the risk of bad debts by analyzing the aging of the AR and the debtor’s financial situation;

- Other receivables – collecting them in a timely manner to avoid unnecessary loss and tax risks; and

- Receivables in advance – carrying income forward according to regulations and checking whether the profit needs to be adjusted.

For debt, the following aspect will be examined:

- Accounts payable – verifying the amount; checking whether the bookkeeping and the estimated amount are correct and reasonable; and

- Other payables – whether there are long-term unpaid balance or potential tax risks.

4. Related-party transaction evaluation

The auditor will also check the related-party transactions to evaluate whether these payments have been made in time, whether the supporting documents are complete, and whether there are any unreconciled balance pending for clean-up. Similarly, the auditor will assess whether the transfer pricing is in line with the arm’s length principle to avoid potential tax adjustments and penalties.

5. Expenses checking

The auditor will also check to see if a company’s relevant invoices and other documentation have been obtained for the recorded expenses. The auditor will assist businesses in ensuring that any inter-term expenses are recorded in the account before the end of December and any accrued expenses are properly recorded in the books.

In terms of pre-tax deductible expenses, deduction caps, and R&D expenses – supporting documents will be verified, and assessed as to whether the thresholds are met, and the deductions made are accurate to undergo a final check.

6. Financial statement analysis

Financial statements are not only important in determining tax liabilities but are also key to helping firms understand their own financial situation. Auditors generally focus on the balance sheet and the profit statement analysis to reveal the capital structure, the profit, cost and expenses, as well as losses, etc.

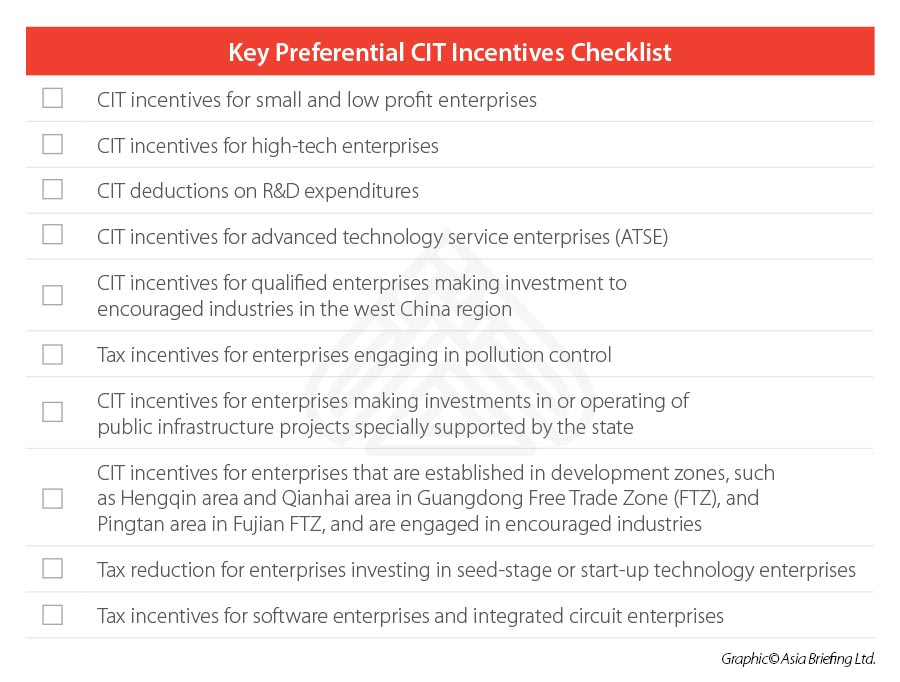

7. Preferential tax evaluation

Under the current law, enterprises can make a self-assessment as to whether they are qualified to enjoy the CIT incentives and retain relevant documents for potential future inspection from the tax bureaus. This simplifies the process for enjoying CIT incentives, but it also increases the tax risks where there has been a misjudgment. So, auditors generally will help to evaluate relevant qualifications in the annual audit.

Tips on getting the most out of the annual audit and compliance process

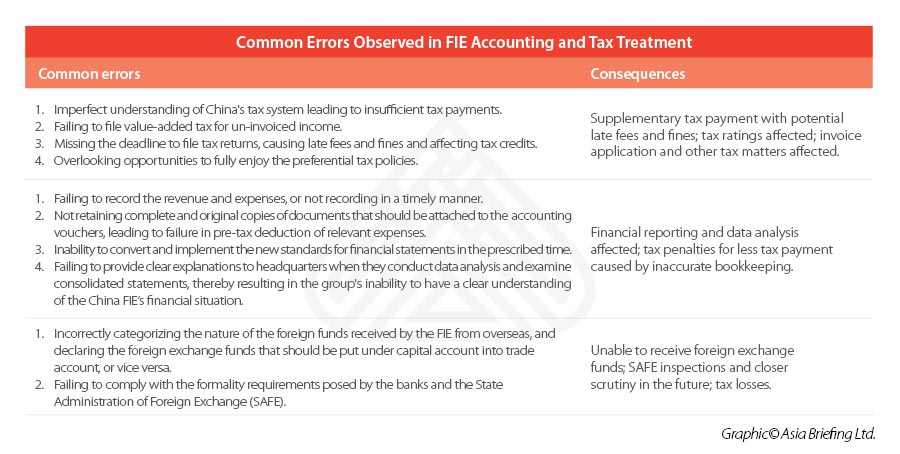

In our experience, the most common mistakes that FIEs make when managing their accounting and tax processes stem from three main causes: incorrect tax treatment, a failure in bookkeeping, or mishandling of foreign exchange activity. The issues are varied and can range from misinterpreting the tax system in the context of cross-border transactions, failing to record revenue in a timely manner, or mis-categorizing the nature of foreign funds received by the FIE from overseas.

Oftentimes untimely and costly, these mistakes may disrupt the flow of normal business operations. To avoid this, we spotlight a few important considerations to enable you to gain the most out of your annual audit and compliance process.

Tip 1: Start the annual audit at the right time

The right time to start an annual audit will depend on the size of your company and the complexity of your business structure. Generally speaking, larger companies will begin a preliminary audit starting from November or December to spot the potential issues and leave some time to make self-corrections.

A formal audit will then begin later after the New Year and will form the basis of the clean audit report. A preliminary audit is recommended for several reasons. Firstly, it saves time. A company that has completed a preliminary audit of their finances can finish their final audit by simply analyzing the data from the last one to two months. They can therefore avoid the ‘rush period’ in late January and February, when businesses are scrambling to get their audit reports finished and will therefore have ample time to implement changes in terms of how finances are run, or internal control is managed, as needed.

Smaller companies usually opt to do an audit after the New Year due to a more limited budget. However, the annual audit should still be completed in advance – latest by April – considering the annual CIT reconciliation deadline on May 31.

Tip 2: Use annual audit to improve internal control and risk management

Companies should implement an effective system of internal control to complement their annual auditing reporting. Internal control (IC) ensures the proper deployment and allocation of a company’s tangible and intangible assets, smooth business operations, the reliability of financial records and reporting, compliance with laws and regulations, and most importantly, prevents fraud risks.

To improve a company’s internal control, it is important that any given IC system is well-designed from the outset, reviewed periodically, and optimized where necessary to fit the needs of the business. Unlike listed companies, which are required by law to conduct separate internal control audits and evaluation regularly, internal control review is generally not mandatory for smaller companies. On the other hand, however, smaller companies are easier to be caught by fraud risks and other irregularities. For such companies, internal control review is usually integrated into the annual audit process.

Tip 3: Review your transfer pricing activity

It is quite common for FIEs in China to conduct the bulk of their transactions with affiliated companies overseas. For example, they may import from their foreign parent company and either sell the products domestically, or export products purchased from China to their overseas affiliates. These transactions can raise issues in transfer pricing and bring the foreign company into non-compliance with the Chinese tax bureau. The annual audit is a good chance to review such related-party transactions to assess whether they are in line with the arm’s length principle and to avoid being challenged at the CIT reconciliation stage or be subject to a transfer pricing investigation by the tax bureau.

Moreover, according to relevant laws and regulations, enterprises reaching specific thresholds must prepare the master file within 12 months from the fiscal year end of the group’s ultimate holding company and prepare the local file and special file before June 30 of the year that follows the related-party transaction.

Further, contemporaneous documentation may need to be provided to tax authorities within 30 days upon request. By reviewing the related-party transactions in the annual audit process, companies will know whether they have reached such thresholds and be better prepared to comply with the requirements.

This article first featured in our China Briefing magazine issue ‘Annual Audit and Compliance in China: Prepare for 2021‘. The magazine is available as a free download on the Asia Briefing Publication Store.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article China-New Zealand FTA Upgrade: Reduced Costs and Compliance for NZ Exporters

- Next Article China’s Industrial Standards for the Internet of Things: What the Draft Guidelines Say