Investing in Beijing: Industry, Economics, and Policy

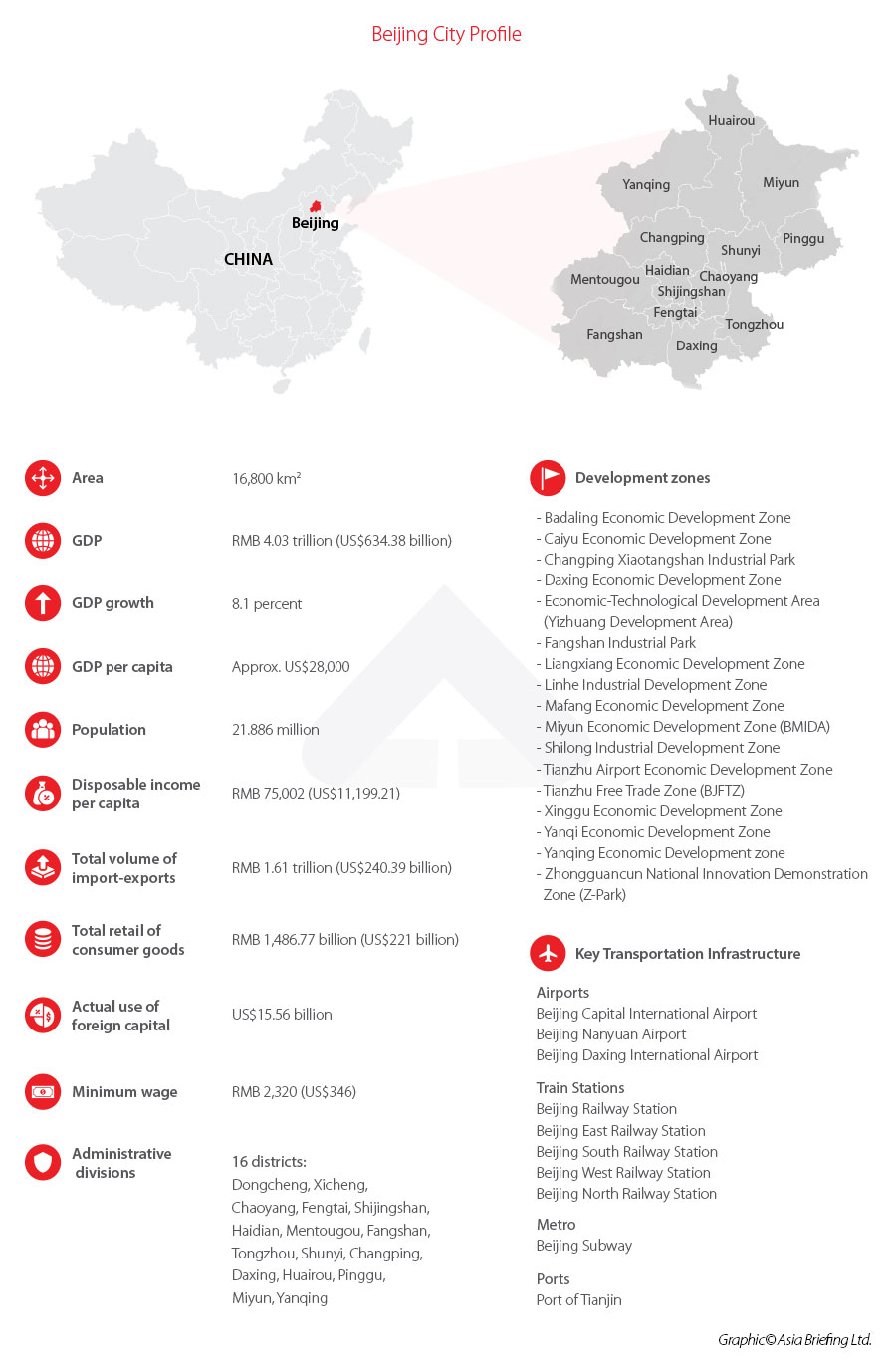

Beijing, formerly known as Peking, is the capital of the People’s Republic of China, and the country’s political and cultural center.

Situated in northern China, Beijing is a directly-controlled municipality surrounded by Hebei Province to the north, east, and south, and Tianjin municipality to the southeast.

These three regions together form the Beijing-Tianjin-Hebei metropolitan region, also known as Jing-Jin-Ji, one of the three prioritized mega city clusters in China.

As the second-largest first-tier city in terms of GDP, Beijing is home to the headquarters of most of China’s largest state-owned companies and houses the largest number of Fortune Global 500 companies in the country.

The city also boasts of the top two higher education institutions in China – Peking University and Tsinghua University.

Economic profile

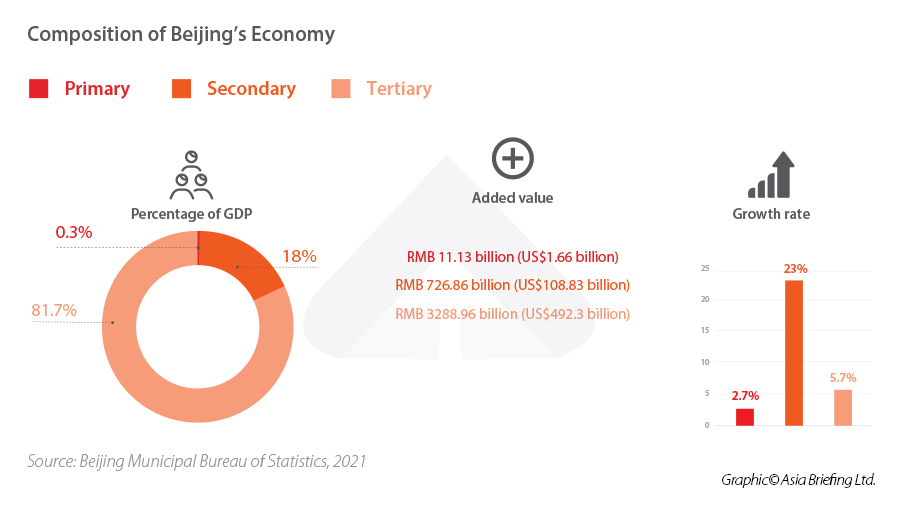

The city is largely a post-industrial economy and has the biggest tertiary industry as a proportion of GDP among all Chinese cities. In 2021, Beijing’s tertiary industry, or service sector, accounted for over 80 percent of the city’s GDP, while the secondary industry, or manufacturing sector, accounted for most of the remaining 23 percent.

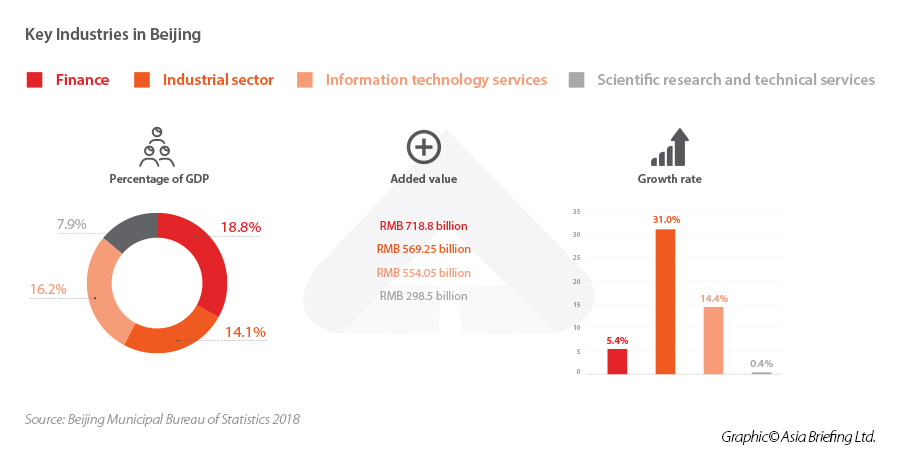

Sector-wise, Beijing has highly-developed financial, service, R&D, cultural, and education industries.

Specifically, the added value of Beijing’s modern service industry – which includes financial, technology, information services, and other advanced services – contributed to around 60 percent of its GDP in 2021. Income derived from the cultural industries, meanwhile, reportedly reached RMB 1 trillion (US$15 billion) in the same year.

Foreign trade and investments

A key component of China’s fundamental national strategy of opening up to the outside world is luring international investment. Foreign-invested businesses have made distinctive and significant contributions to the steady and quick economic growth of China and Beijing is no exemption. Since 2019, the Beijing Municipal Commerce Bureau has been publishing a ‘Beijing Foreign Investment Development Report’ on annual basis for the benefit of international investors.

With a compound annual GDP growth rate of six percent between 2016 and 2020, Beijing has built an economic structure featuring high-grade, precision, and advanced industries, reaching a combined GDP of RMB 3.6 trillion (US$537.3 billion), close to the average level registered by developed countries. Utilization of foreign investment between 2016 and 2020 was US$82.98 billion, more than 12 percent of the total for the country. Beijing thus serves as a key portal for China’s commercial and economic engagement with the world.

By the end of 2020, Beijing had registered over 45,000 foreign-invested businesses from more than 165 nations and regions. For 10 years running, Beijing has held the top spot worldwide for the number of Fortune 500 headquarters, with more than 55 of these companies choosing China’s capital city to establish their office.

In particular, Beijing’s high-tech sectors had used US$9.66 billion of foreign investment, accounting for 68.5 percent of all the FDI in the municipality. The city has also welcomed 736 newly founded high-tech foreign-invested firms.

Investment and consumption

- Total investment in fixed assets: RMB 54.45 trillion yuan (US $8.56 trillion); and

- Total retail sales of consumer goods: RMB 1,486.77 billion (US$221.88 billion).

Import and export

- Total value of imports and exports: RMB 3.04 trillion (US$326.7 billion);

- Total value of imports: RMB 2.43 trillion (US$362.64 billion); and

- Total value of exports: RMB 805.84 billion (US$120.26 billion).

Industry development

Digital economy

According to official figures, the added value of Beijing’s digital economy in the first quarter of 2022 was 387.36 billion yuan ($57.9 billion), up 7.2 percent year over year, and represented 41.2 percent of the city’s GDP.

The city authorities have unveiled an action plan for the growth of its digital economy to boost the industry’s vitality. According to the Beijing Municipal Bureau of Economy and Information Technology, the plan proposes steps including enhancing the ability to offer digital technology and fostering the ecosystem for its creation. It focuses on innovations in vital technologies across a range of industries, including high-end semiconductors, artificial intelligence, critical software, blockchain, privacy computing, and operating systems for urban environments.

For example, in 2021 Beijing added 13,000 5G base stations to achieve basic gigabit broadband coverage in the city and precise coverage in the 5G signal free trade zone.

According to the strategy, Beijing will become a destination for domestic and international open-source projects and organizations, and efforts to open and exchange data will be stepped up.

High-tech

Beijing has rapidly developed into a technological superpower. Supported by an excellent higher education system and research credentials, as well as active government backing, the city has become a world leader in artificial intelligence (AI) and sophisticated manufacturing.

Beijing frequently appears in the top tier of rankings for innovation ecosystems. It boasts of a mature start-up ecosystem and is a tech unicorn breeding ground (numbering 63 in early 2019). However, China’s capital has lagged behind other cities in activities such as the marketization of technological innovations and the improvement of creative cultural industries, indicating that it still has potential for growth.

For instance, according to a study by The Economist Intelligence Unit, the absolute number of deals closed in 2015–17 for venture capital (VC) funding of emerging tech firms was significantly lower than in other Chinese cities. However, the total value of such transactions was still much higher.

A closer examination indicates that Beijing’s strengths in emerging technology are more significant in the complementary industries of advanced manufacturing and AI. The ambitious ‘Made in China 2025’ strategy, for example, has set these sectors as targets for fast growth, backed by the Beijing regional administration in several ways.

There are currently well over a thousand AI-focused businesses in Beijing. Zhongguancun Science Park, located the city’s northwest district of Haidian, is the center of most of these technological innovation activities, both in terms of start-up growth and corporate research and development. Some of the city’s most well-known tech accelerators and incubators are based in this area, including Innovation Works, Legend Star, Tsinghua University Science Park, and Microsoft Accelerator.

Moreover, to help China become the world’s leading AI power in the near future, the regional Beijing administration has invested US$2.1 billion in building an AI innovation park in Zhonggcuancun. The center will be able to house up to 400 AI start-ups once constructed. The project will be finalized by 2024.

Cultural industry

Culture, sports, and entertainment are all drivers of growth in Beijing. In 2021, Beijing’s cultural industries ‘above designated size’ (规模以上文化产业 guīmó yǐshàng wénhuà chǎnyè) – a term used by the Chinese government to denote industrial enterprises with annual revenue of RMB 20 million (US$ 2.98) and above – earned a total of RMB 1756.3 billion (US$ 262 million), with an year-on-year increase of 17.5 percent.

The revenue from core cultural fields accounted for more than 90 percent of the total earnings of Beijing enterprises. Among them, a) cultural entertainment and leisure services and b) content creation and production increased by 38.5 percent and 30.8 percent, respectively, year-on-year.

Policies and trends

A significant turning point in Beijing’s growth history is represented by the 13th Five-Year Plan era. Beijing has steadfastly carried out the criteria of high-quality growth throughout the past five years, recognized the strategic orientation of the capital city as the “four centers,” insisted on cultivating new prospects, and persistently broken new ground. (The four centers refer to the capital’s strategic position as the national political center, cultural center, center for international exchanges, and center for national innovation.)

Beijing Overall Urban Planning (2016-2035)

In September 2017, the Central Committee of the Communist Party of China and the State Council jointly presented the Beijing Urban Master Plan (2016-2035), to set out the city’s development plan until 2035. According to the plan, Beijing will look to leverage its position as a “national center of politics, culture, international exchanges, and scientific and technological innovation” as a basis for its development and become a “world-class harmonious and livable city” by 2035.

According to Beijing city authorities, this will require dispersing “non-capital functions” from the city to solve urban problems like an overcrowded downtown and widespread air pollution. For this purpose, authorities set up “three red lines” to restrict this city’s overpopulation, ecological pollution, and excessive urban development in stages by 2035.

Xiongan New Area

National-level authorities are looking to shift many of Beijing’s “non-capital functions” to the Xiongan New Area, a development hub for the Beijing-Tianjin-Hebei economic triangle. The Xiongan New Area is considered a pet project of Chinese President Xi Jinping, who wants the city to become emblematic of China’s next stage of economic development.

In Xiong’an New Area, more than 200 projects are expected to take off in 2022 alone, with a total investment likely to reach RMB 700 billion ($110 billion). A significant number of projects for the new region were launched in February of the same year.

These include three industrial park projects intended to serve China’s three major telecom operators, namely China Telecom, China Mobile, and China Unicom, as well as the first batch of projects functional to China’s centrally administered state-owned enterprises (SOEs). These examples can all be considered as part of the greater plan to shift Beijing’s functions not necessarily to its role as the capital of Xiongan New Area.

“Two Zones”

In his keynote speech at the 2020 China International Fair for Trade in Services, (CIFTIS), president Xi Jinping openly supported Beijing Municipality’s efforts to create a national integrated demonstration zone for greater openness in the services sector and a pilot free trade zone that emphasized scientific and technological innovation, opening-up of the services sector, and the digital economy.

On September 24, the Beijing Pilot Free Trade Zone was formally established, and on September 28, the International Business Service Area of the Beijing Pilot Free Trade Zone was formally opened – comprehensively referred to as the “Two Zones” policy.

The “Two Zones” policy implementation made sufficient progress thanks to the backing of higher-ups and our combined efforts. Since the creation of the Beijing Pilot Free Trade Zone in 2020, reportedly 14,790 new domestic-funded enterprises have been created in the Beijing district of Chaoyang, making up 16.67 percent of the total number of enterprises in the city. In addition, 563 new foreign-funded enterprises were also set up. The municipality closed US$4.626 billion in contractual foreign capital and US$1.34 billion in FDI, maintaining a growth-oriented momentum – even throughout the pandemic.

Why invest in Beijing: Key considerations

All in all, Beijing is a good destination and starting point to investing in China, given that it is the country’s first comprehensive pilot city for further service sector openness. Beijing was given over 400 reform tasks and granted permission to test out more lenient market access policies, more convenient trade regulation policies, and more thorough talent attraction policies as part of the State Council’s program for further opening the city’s service sector in 2015, 2017, and 2019, respectively.

Beijing was also given these new policies to pilot in its service sector. In addition to other top companies from throughout the world, Moody’s, Standard & Poor’s, Fitch, MASTER, VISA, Experian, Apple, and Tesla have offices in Beijing.

A pilot free trade zone that spans Beijing and Hebei was officially launched in August 2019 with the opening of the China (Hebei) Pilot Free Trade Zone Daxing Airport Area. Beijing makes up 9.97 square kilometers of the 19.97 square kilometers that make up the Daxing Airport Area. It aspires to operate as a hub for global interactions, a pioneer in aviation innovation, and a showcase for coordinated growth between Beijing, Tianjin, and Hebei. Therefore, the growth of aviation logistics, aviation technology, and financial leasing will be the main priority of the Daxing Airport Area.

Beijing also hosts the China International Fair for Trade in Services (CIFTIS). Five successful CIFTIS events have been held since 2012 with great success. The fair’s anticipated revenue has reached US$529.33 billion and has attracted participation from about 300 international organizations and foreign trade associations from 184 countries and regions. The China International Import Expo and the China Import and Export Fair joined the CIFTIS in 2020 as additional forums for China’s growth of its opening up.

This article was originally published in March 2019. It was last updated on June 30, 2022.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com. Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article How to Read China’s Latest Inflation Data and its Economic Implications

- Next Article Investing in Shenzhen: Industry, Economics, and Policy