Beijing Tightens Social Insurance Filing Services by Third-Party HR Agency

- Beijing has released a new regulation restricting third-party HR agencies from filing social insurance in Beijing for employees of non-Beijing resident companies.

- Companies that have employees based in Beijing but do not have a registered entity or branch in the capital and entrust a third-party agency to file social security for their Beijing-based staff need to find alternative solutions as soon as possible before the end of the grace period granted by the government – in late September.

- Companies must take the regulation seriously to avoid incompliance and the adverse consequences so caused, such as being blacklisted, fined by the government, or being sued by affected employees, etc.

Effective from July 5, 2020, all labor dispatch companies and HR service companies (hereafter referred to as ‘HR agencies’) registered in Beijing are required to report part of the employees’ labor contract information when registering new employees with the Beijing Social Security Bureau for the administration of social insurance, according to the Notice Concerning Several Issues on Participation of Labor Dispatch companies and HR Service Companies in Social Insurance Scheme issued by the Beijing Social Security Fund Management Center on June 30, 2020.

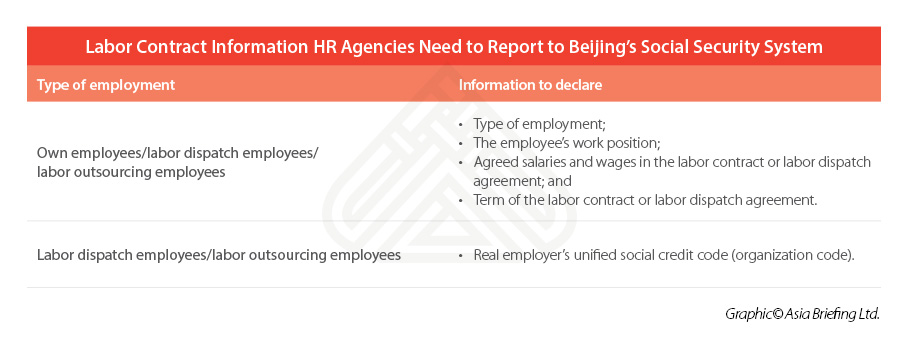

The notice requires Beijing HR agencies to state the labor contract information (see the following table) into the online service portal, when opening insurance accounts or transferring the social insurance relationship for three types of employees – HR agencies’ own employees, labor dispatch employees, and labor outsourcing employees.

If the employee is not an employee of the HR agency, but instead a labor dispatch employee or a labor outsourcing employee hired by other companies, the Beijing HR agency will have to declare the real employer’s unified social credit code (organization code) in the online social insurance system.

If the real employer’s unified social credit code does not match any registered entity in Beijing, the system will not be able to process the request.

This implies that Beijing HR agencies will no longer be allowed to file social insurance in Beijing for employees who are hired by companies registered in other cities – which is a common practice in many cities of China but not 100 percent compliant.

Who will be affected by the policy?

The new regulation will not only impact the Beijing HR service market but also companies that do not have an entity or branch in Beijing but do have employees in the city and entrust a third-party agency to withhold and pay social security for their Beijing-based staff.

To comply with the new rule, Beijing intermediary HR agents will have to terminate some of their existing social insurance filing services and stop offering new social insurance filing services to employees who signed labor contracts with companies outside the city.

Some HR agencies like Beijing Foreign Enterprises Service Corporation (FESCO) have received a government notice to disclose employment information to the government and determine illegal services before September 30, 2020.

Thus, companies adopting this cross-city third-party social insurance filing arrangement will have to find alternative solutions as soon as possible to avoid social insurance incompliance.

It should be noted that failing to rectify any incompliance may cause disruption to social insurance filings for affected employees and leave the companies exposed to high levels of risks.

“Companies could be blacklisted or fined if their social insurance incompliance was discovered in a government spot-check, or if anyone reported the irregularities to the government authority,” said Fanny Zhang, Business Advisory Services Manager at Dezan Shira and Associates’ Beijing office.

Moreover, “the company could also face legal proceedings initiated by affected employees and have to pay severance and compensation to employees where employees quit the job due to company’s incompliance on social insurance contribution,” Fanny added.

What are the solutions available?

There are solutions available to firms affected by this new notice, including:

- Entity structuring solutions; and

- Employment structuring solutions.

Companies can choose to register a branch office or subsidiary in Beijing and have the Beijing-based employees sign labor contracts with the branch or subsidiary. Then the branch or subsidiary can be responsible for the filing of the employee’s social security. To handle employees’ social insurance contributions, the Beijing branch or subsidiary will have to open the bank account, social insurance account, and housing provident fund account after business registration.

The Beijing branch and subsidiary can also entrust an intermediary HR agency to withhold and pay employees’ social insurance on behalf of the Beijing branch and subsidiary after obtaining the business license and opening social insurance and housing provident fund accounts in Beijing.

If the companies are not willing to set up entities in Beijing, they may also consider employment restructuring options, such as rearranging their employees’ places of work or social security registration, or “offshore hiring”, which refers to a local entity that is registered in Beijing signing a labor contact with the employees, becoming the social insurance withholding subject for the employees, and then dispatching the employees to the non-Beijing resident company.

Each of these options have pros and cons with various implications in terms of risks and costs, depending on the actual circumstances. Setting up a Beijing branch office or subsidiary is the most compliant solution at the present stage, while the management cost is relatively high for the employer.

Employment restructuring options are cheaper and more flexible, but enterprises must consider the wishes of employees and choose reliable and cooperative companies and scrupulously formulate the labor contracts and cooperation agreements to avoid disputes of interests among parties. “In addition, please bear in mind that such employment structuring option could only serve as a makeshift solution, which cannot rectify the incompliance permanently,” Fanny reminded.

Businesses are advised to seek local counsel to understand the impacts of the new regulation on the company and find a solution that ensures compliance and best fits the company’s needs. For more information or local assistance, please feel free to contact us at China@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article China Reopens Borders, Visa Channels to 36 European Countries

- Next Article China Reinstates Import Tax Reduction and Exemption for 20 Commodities