Business Opportunities for German Investors in China

Germany-China relations

Germany-China relations

Germany and China established diplomatic relations almost 50 years ago and, since then, have become partners, both economically and politically. China was Germany’s most important trading partner in 2019 for the fourth consecutive year, with a volume of trade worth €206 billion (about US$249.5 billion).

In the second quarter of 2020, China surpassed the US to become Germany’s largest export market for the first time, and, according to the German Federal Statistical Office from April to June, the total value of German exports to China was close to €23 billion (about US$27.25 billion). In October 2020, exports to China increased by 0.3 percent to €8.7 billion (about US$10.5 billion) compared with October 2019, while goods to the value of €10 billion (about US$12 billion) were imported from China (declining 3.3 percent).

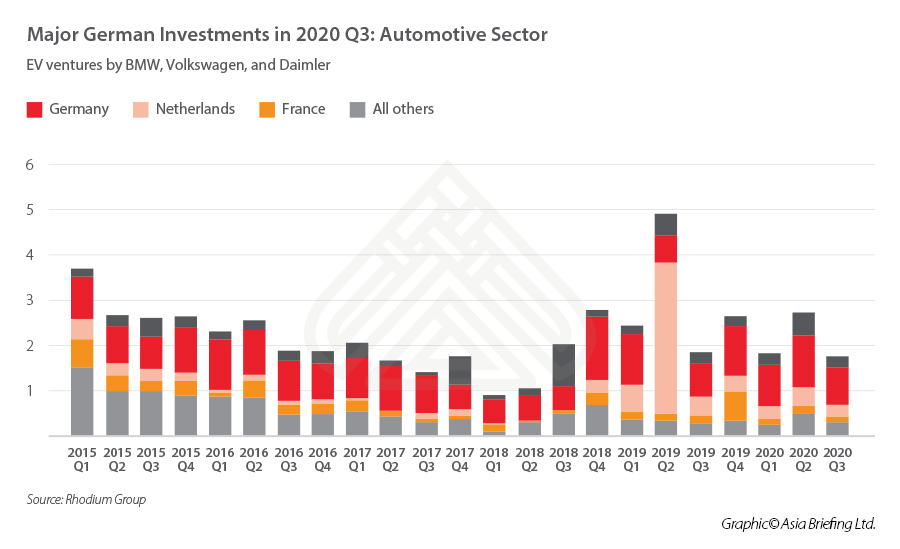

The importance of China’s market for Germany is also confirmed by the direct investments that position Germany as China’s main EU investor during the third quarter of 2020. The international cooperation between these two countries has also increased in recent years, including now in dealing with global challenges like COVID-19 and climate change.

In this article, we briefly touch upon key aspects of bilateral investment ties, and opportunities for German companies in China.

German investments in China: Key points

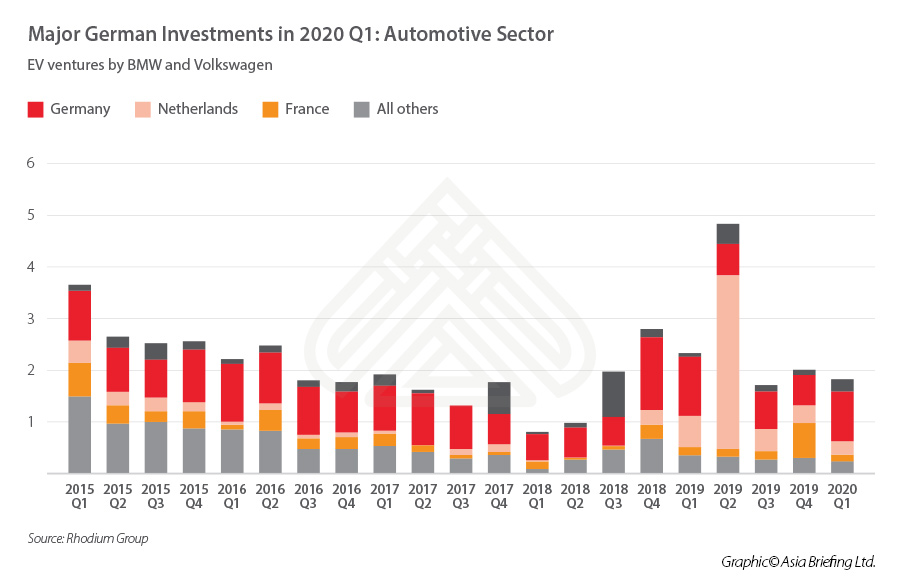

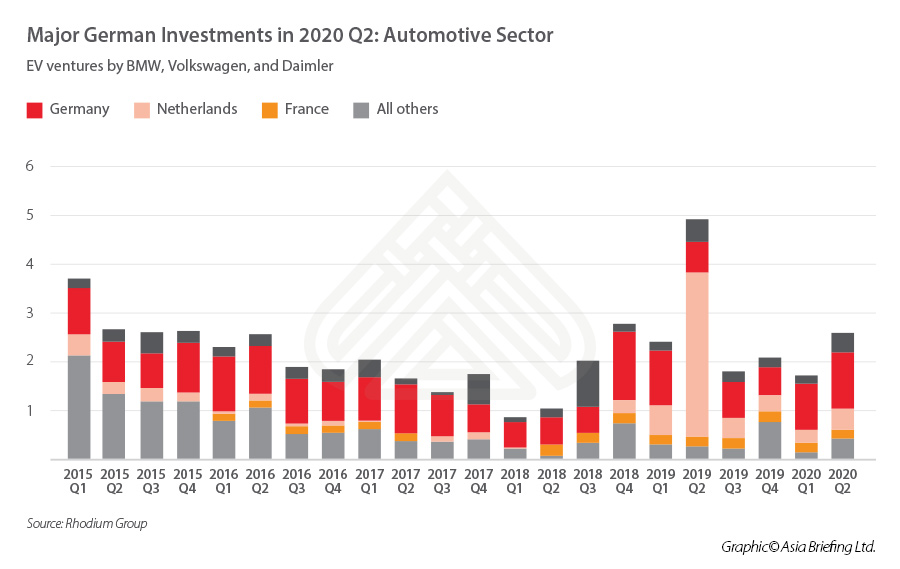

There are about 5,000 German companies established in China. Germany is also China’s main EU investor, with investments amounting to US$3.68 billion in 2019 (a 139 percent increase compared to the previous year) and rising to US$840 million during the third quarter of 2020, according to Rhodium Group’s data.

According to the Business Confidence Survey 2019/2020, most German businesses are concentrated in the automotive and machinery/industrial equipment industries, followed by business services, consumer products, healthcare products, financial services, IT/telecommunications, electronics, chemicals, logistic, transportation and distribution, construction and civil engineering, plastic/metal products industries.

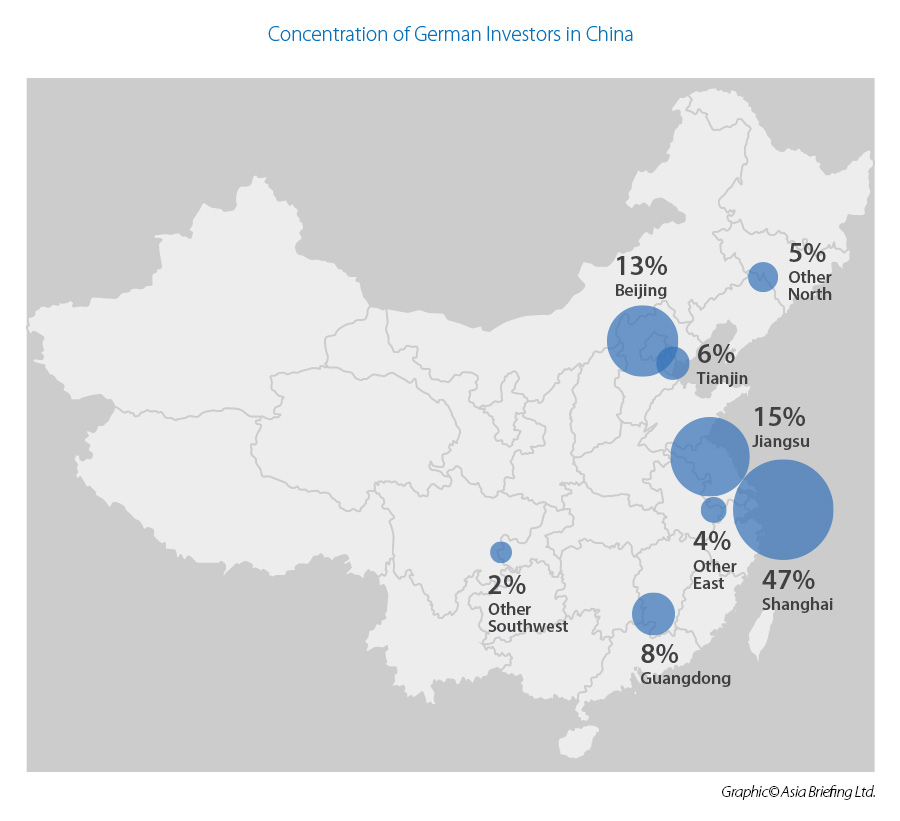

Most of these companies are wholly foreign-owned enterprises (WFOE) but there are also joint ventures and representative offices established in the main cities, such as Shanghai or Beijing, or along China’s coastal areas, such as the Yangtze Delta (East), Bohai Economic Rim (North), and Pearl River Delta (South), while just a few companies are based in the interior part of the country.

Based on the data provided by the German FDI Centre, most German companies in China are engaged in manufacturing activities.

In 2018, German companies opened more testing centers than in the entire period from 2013 to 2017; the number of R&D center projects in 2018 was the highest recorded over the five-year period.

However, according to the Business Confidence Survey 2019/2020, manufacturing operations are still the most prevalent type of German enterprise in China.

According to the World Investment Report 2020, in 2019, FDI inflows into developing Asia declined by five percent to US$474 billion, but despite the decline, it remained the largest FDI recipient region, hosting more than 30 percent of global FDI flows.

The decline was driven primarily by a 34 percent fall in Hong Kong, but China, with reported inflows reaching an all-time high, continued to be the second largest FDI recipient after the US.

What are the main business opportunities for German companies in China?

Since the last decade, China’s market has opened more widely than ever before to foreign investors, either through the implementation of several legislative reforms that allow and encourage investments in various industries without restrictions, but also through initiatives like the Belt and Road Initiative (BRI), that undeniably create many opportunities for cooperation with China.

FIL 2020, Negative Lists, Encouraged Catalogue

Notably, last year, China enforced the new Foreign Investment Law (“FIL”) – effective from January 1, 2020 – and amended the Negative Lists (the one applicable at the national level and another one referred to Free Trade Zones) – effective from July 23, 2020, thus reducing the restrictions on foreign investments and liberalizing sectors previously limited to domestic companies or joint ventures.

With the implementation of the FIL and its implementing regulations, China intends to demonstrate that from now on, the Chinese market will be ruled by the principles of fair competition, transparency, and efficiency, thus marking the transition to a new era, where foreign enterprises are treated equally compared to domestic companies and their rights and interest are much more protected. This change in treatment of foreign enterprises is also a key component of the Comprehensive Agreement on Investments agreed to in principle in late December last year by the European Union and China.

Considering the activities carried out by most German companies in China – mainly focused in the automotive, machinery/industrial equipment, and business services – it is noteworthy to mention that the Negative Lists further liberalized the services sector (with specific reference to financial, transportation, and infrastructure sectors), and in the manufacturing sector – foreign investors equity ratio’s restrictions have been relaxed substantially, particularly in the commercial automotive vehicle manufacturing industry.

Starting from 2020, foreign investors can set up WFOEs to manufacture commercial automotive vehicles. Foreign investor equity ratio restriction for passenger automotive vehicle manufacturing as well as the restriction that a foreign investor may establish two or less equity joint venture enterprises in China to manufacture the same types of vehicles shall be removed in year 2022.)

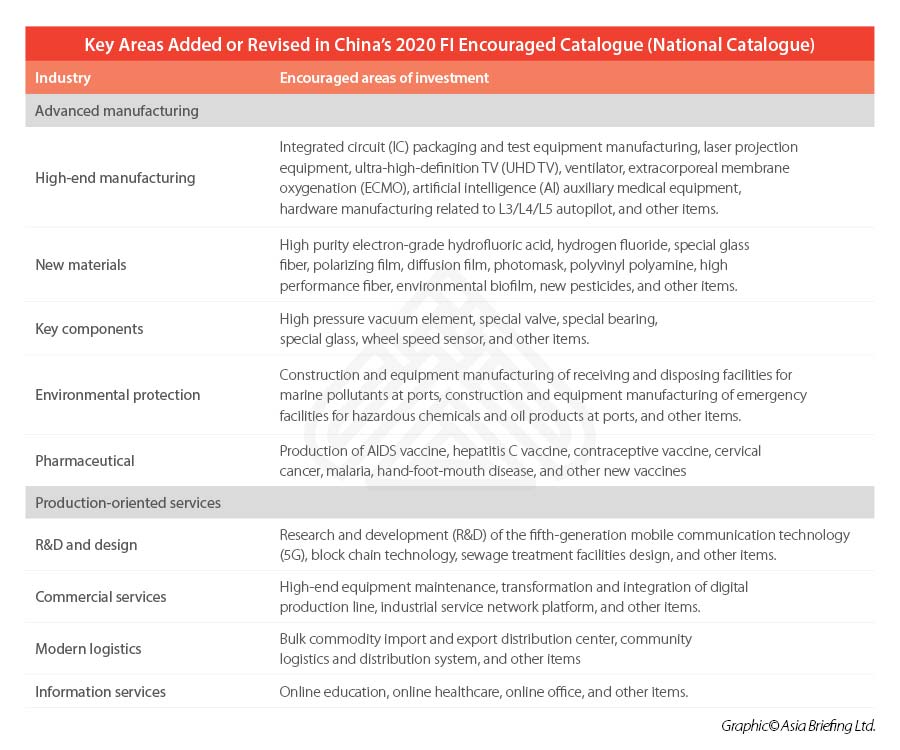

On December 28, 2020, China rolled out the Catalogue of Industries for Encouraging Foreign Investment (2020 Version) (hereafter “2020 FI Encouraged Catalogue”), to be implemented from January 27, 2021. The 2020 FI Encouraged Catalogue includes two sub-catalogues – one covers the entire country (“national catalogue”) and a second document covers the central, western, and northeastern regions (“regional catalogue”).

Together, the 2020 FI Encouraged Catalogue identifies industries where FDI will be welcome and treated with favorable policies in China. (You can check out the full catalogue in Chinese here, the full national catalogue in English here, and the full regional catalogue in English here).

Hence, with these measures, China has opened-up its market even further, sending a clear message of encouragement to foreign companies to attract new investments and to facilitate the business of companies already present on the territory.

Under this perspective, Germany might be one of the main beneficiaries of China’s positive message, being a EU country with more expertise in some of the prominent sectors (high-tech, infrastructure, modernized agriculture, and others) that China is focusing on in its next era of development.

Made in China 2025

In 2015, the government’s Ministry of Industry and Information Technology released Made in China (MIC) 2025, an industrial masterplan inspired by the Germany 4.0 strategy, that intended to transform China into a production hub for high-tech products within the next few decades. The goal of MIC 2025 is to render China self-sufficient by substituting foreign technology with innovation developed on the mainland, thus enabling Chinese companies to be more competitive in global markets. This plan inevitably created tensions with other countries, especially in the US. However, foreign investors – especially German – may benefit from the MIC 2025, considering the huge amount of business opportunities that will be created in upstream and downstream industries.

To achieve the goal of high-tech self-sufficiency, the Chinese government has pushed for leadership in sectors like information technology, computerized machines, robots, energy-saving vehicles, medical devices, and high-tech equipment for aerospace technology, maritime, and rail transportation.

In this context, German companies have a broad range of action, considering their high levels of expertise in most of these sectors, and can take advantage of the preferential policies to encourage investment into and develop these areas.

In this regard, even though domestic companies acquire new technologies, thus becoming more competitive in various areas, the know-how of foreign companies is still very much needed – for instance, in sectors such as robotics, electric vehicles, and environmental technologies.

Moreover, as reported by the German FDI Centre and the China International Investment Promotion Agency in Germany, many opportunities may be found with reference to the transmission and energy storage technology. Most of China’s new energy equipment is located in remote areas of the country and a huge amount of energy is not used due to insufficient transmission. The photovoltaic sector is also expected to expand in China’s underdeveloped provinces.

Belt and Road Initiative

This initiative, often described as a 21st century Silk Road, holds many opportunities for Germany and other EU countries, including but not limited to industries, such as infrastructure, logistics, and business services.

The BRI’s potential in terms of business prospects and international cooperation has not been fully displayed yet, but some opportunities are already evident.

For instance, during the pandemic, the China-Europe freight trains have become a major channel for cargo transportation and movement of anti-virus supplies between China and Germany, thus proving that the BRI already has an important role at the international level.

Nevertheless, according to the Business Confidence Survey 2019/2020, only 29 percent of German companies surveyed perceive the BRI as a significant opportunity. Interestingly, these are enterprises engaging in business services, machinery/industrial equipment, and IT/telecommunication industry, while others, from the sectors of automotive and healthcare products, deem the initiative as irrelevant to their business.

It shall be noted though, that further opportunities – particularly for companies from the healthcare sector and those engaging in technology related activities – may rise thanks to the recently announced Digital Silk Road and the Health Silk Road, that will also open-up broader space for China-Germany cooperation.

China-Germany cooperation

China’s economy is rebounding from the COVID-19 pandemic more rapidly than others, thereby attracting greater than anticipated investments from several countries, including from the EU.

As stated earlier, Germany is not only the main EU investor in China, but it is also China’s main European trading partner, besides being an essential interlocutor in the dialogue between China and the EU.

The political dialogue and cooperation between these two countries also has relevance at the international level, especially considering the US-China trade war. Indeed, until US-China ties remain strained, the EU will likely play an outsized role in the Chinese market and be prominent beneficiaries of further market opening.

German companies, with their high expertise in key areas, may find profitable opportunities in terms of industrial investments and prospects for cooperation with domestic companies in China. German investors would also need to evaluate where to locate their presence – either in the main Chinese cities with sophisticated infrastructure in place or in remote areas of the country where the need for new technologies, infrastructures, environmental technology, bioscience and healthcare, and other services will be pushed by the government through encouraged investment policies and tax breaks.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Signing a Property Lease Agreement in China: Key Points to Manage

- Next Article An Introduction to Doing Business in China 2021 – New Publication from Dezan Shira & Associates