China Expands Encouraged Catalogue, Improves Foreign Investor Access

On December 28, 2020, the National Development and Reform Commission (NDRC) and the Ministry of Commerce (MOFCOM) rolled out the Catalogue of Industries for Encouraging Foreign Investment (2020 Version) (hereafter “2020 FI encouraged catalogue”), to be implemented from January 27, 2021, replacing its 2019 version.

The catalogue includes two sub-catalogues – one covers the entire country (“national catalogue”) and a second document covers the central, western, and northeastern regions (“regional catalogue”). Together, the 2020 FI encouraged catalogue identifies industries where foreign direct investment (FDI) will be welcome and treated with favorable policies in China. (You can check out the full catalogue in Chinese here, the full national catalogue in English here, and the full regional catalogue in English here).

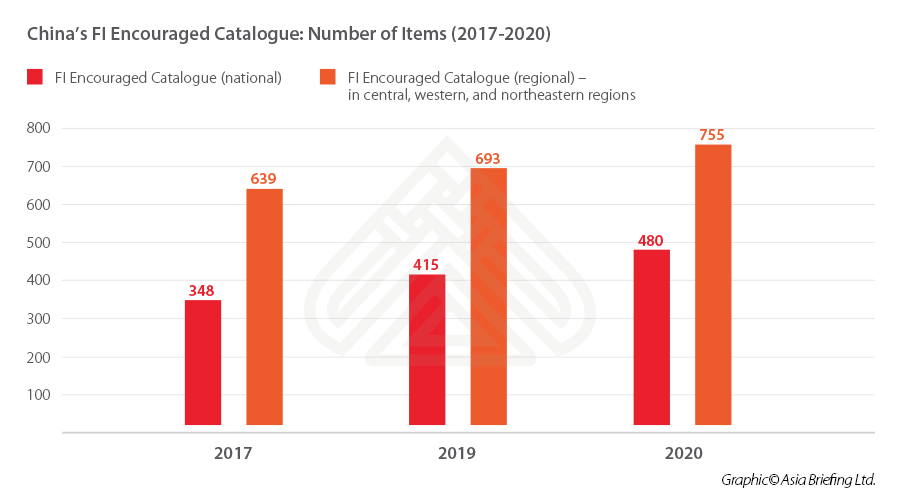

The newly released 2020 FI encouraged catalogue contains a total of 1,235 items, increased by 10 percent from 1,108 items in the previous version, with 127 items added (65 new items in the national list and 62 new items in the regional list) and 88 items modified.

The lengthening of the catalogue signifies that more investment fields will favor foreign investors.

Key changes in the 2020 FI encouraged catalogue

The revision of the 2020 FI encouraged catalogue is intended to lure foreign investment in three main areas:

- Advanced manufacturing industries;

- Production-oriented service industries; and

- Reginal advanced industries in the central, western, and northeastern regions.

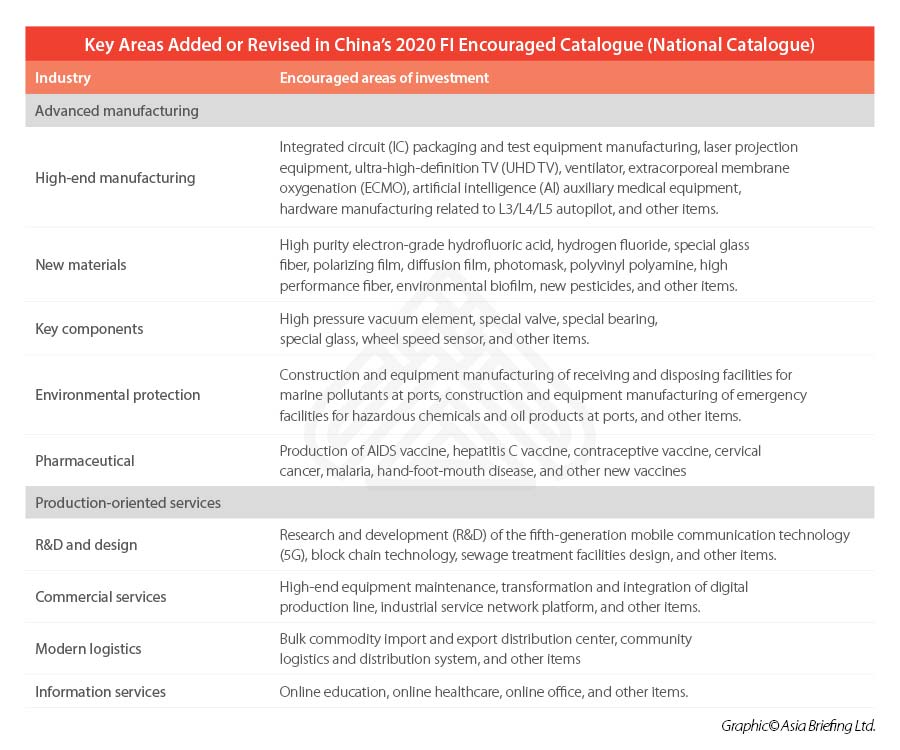

Nationwide, the catalogue encourages foreign investors to engage in advanced manufacturing, with a purpose to enhance the resilience of China’s industrial and supply chains under an uncertain international environment.

Specific sectors include the manufacturing of certain terminal products – such as integrated circuit (IC) packaging and test equipment, laser projection equipment, ultra-high-definition television (UHD TV), ventilators, ECMO, artificial intelligence (AI) auxiliary medical equipment, key new materials – such as special glass fiber and high-performance fiber, and key components – such as high pressure vacuum element, special valve, special bearing, special glass, and wheel speed sensor.

Service industries-wise, foreign companies are encouraged in production-oriented services, such as 5G telecommunication technology, blockchain technology, and design of sewage treatment facilities, with a focus on boosting the quality of modern services as well as the integrated development of manufacturing and service sectors.

To narrow the gap between China’s wealthiest eastern coastal regions and less-developed regions, the regional catalogue enumerates industries across the country’s provinces, municipalities, and autonomous regions in – the central, west, and northeastern regions – which require for foreign knowhow and investment.

In the latest 2020 version, Heilongjiang and Yunnan have added encouraged items related to agricultural product procession and tourism development; Henan, Shaanxi, and Guangxi added medical equipment, epidemic prevention and protection articles, and active pharmaceutical ingredient (API) production; Hubei, Sichuan, and Chongqing added semiconductor materials and industrial ceramics; and Anhui and Shanxi are welcoming foreign investment in vocational schools.

The catalogue for Hainan, where the whole island is being developed into a free trade port, now includes as many as 50 items – with 10 added items related to trade, shipping, finance, and tourism, such as yacht design and manufacturing, financial leasing services, and R&D, design, and parts manufacturing of new energy vehicles (NEVs).

What are the favorable policies to facilitate FDI in encouraged industries?

So far, the following favorable treatment is in place for foreign-invested enterprises (FIEs) engaged in doing business in the listed industries published in the encouraged catalogue:

- Tariff exemptions on imported equipment – for encouraged foreign-invested projects, the import of self-use equipment within the total amount of investment can be exempted from customs duties;

- Access to preferential land prices and looser regulation of land uses – land can be preferentially supplied for encouraged foreign-funded projects with intensive land use. The land transfer reserve price can be determined at 70 percent of the national minimum price for the transfer of industrial land, which yet shall be no less than that of the local land; and

- Lowered corporate income tax (CIT) – for FIEs in encouraged industries in the central, western, and northeastern regions that meet the requirements, the CIT rate can be reduced to 15 percent.

Why China remains intent on improving foreign investor access

In the Two Sessions meetings in May 2020, after experiencing the worst of the COVID-19 outbreak in China, the Chinese government pledged in its Work Report that China will significantly shorten negative lists for foreign investment, draw up a negative list for cross-border trade in services, grant greater autonomy in reform and opening-up in special economic zones, open new pilot free trade zones and integrated bonded areas in the central and western regions, and foster an enabling market environment in which Chinese and foreign companies can be treated as equals.

In June, the NDRC and MOFCOM jointly released the revised 2020 version of the Negative Lists for Foreign Investment (“FI negative lists”), which further removed some sectors restrictive or prohibited to foreign investment.

In July, the two authorities issued a draft version of the catalogue of industries encouraging foreign investment and sought public opinions from FIEs, foreign business associations, and other parties. Compared with the draft version, the official version of the catalogue has added nine more items.

The shortening of the FI negative lists as well as the lengthening of the FI encouraged catalogue marks further opening-up and friendliness of Chinese markets to foreign investors, as promised by the country’s government.

Despite 2020 being an incredibly challenging year for most economies, China maintained its strong appeal for foreign investment. In great contrast to the estimated 40 percent plunge in global FDI inflows, in the first 11 months of 2020, the actual use of foreign investment in China reached RMB 899.38 billion (US$137.77 billion), up 6.3 percent year on year, according to official data. The high-tech service industries, such as e-commerce services, professional and technical services, R&D and design services, and services for the transformation of scientific and technological achievements, witnessed rapid growth of FDI inflows in China.

Given that FIEs account for about a quarter of China’s industrial output, a fifth of its tax revenue, and about 40 percent of its total imports and exports – stabilizing foreign investment and optimizing the distribution of foreign capital is a top priority for the government and policymakers.

As China’s industrial structure continues to upgrade, foreign investment will continue to be favored in industries related to advanced manufacturing, high and new technologies, energy conservation, and environmental protection.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article A Users Guide to 2020 Annual Audit and Compliance in China, Hong Kong, and ASEAN

- Next Article Shanghai Relaxes Incorporation Documentation Rules