China’s Latest Corporate Income Tax Update for Six Items: Q&A

China’s tax body recently clarified the corporate income tax assessment applicable on six items, including expenses associated with COVID-19 charitable donations, convertible bonds, and cross-border hybrid investments. Enterprises should note that the new policy will close some prevailing corporate income tax loopholes.

On June 25, 2021, the State Taxation Administration (STA) released the Announcement about Policies for Collecting Corporate Income Tax (STA Announcement [2021] No.17). The Announcement, applicable for tax settlement and payment in the 2021 tax year and future years, clarified the following corporate income tax (CIT) treatment on six items in China:

- Pre-tax deduction of expenses associated with COVID-19 charitable donations;

- Tax treatment for the conversion of convertible bonds into equity investments;

- Tax treatment for cross-border hybrid investments;

- Tax treatment for assets after the change from “levying upon assessment” to “levying upon audit of accounts”;

- Tax treatment for enterprise’s collection of cultural relics and artworks assets; and

- The point of time to recognize the income after receiving government payments.

This article explains the CIT treatment for the six items for the reference of enterprises.

1. How to deduct expenses associated with COVID-19 charitable donations?

During the pandemic, some enterprises made donations towards COVID-19 relief. To encourage such acts and help businesses make it through the year, the government rolled out support measures (MOF SAT Announcement [2020] No.9), which allow cash and materials donated by enterprises to combat COVID-19 to be fully deducted before calculating corporate income tax (CIT).

However, when corporate taxpayers make non-monetary asset donations, some of them incur transport fares, insurance fares, handling charges, labor costs, and other related costs.

For these costs, the STA Announcement [2021] No.17 clarifies that:

- If the expense is included in the amount recorded in the donation voucher issued by the state organs or public welfare social organizations, it can be deducted before CIT as public welfare donation expenditure.

- If aforesaid expense is not included in the said amount, it can be deducted before CIT as related corporate expenditure.

To be noted, for general charitable donations, the deduction limit is within 12 percent of the enterprise’s gross annual profit, and the excess part can be carried over to the following three years. In principle, the same expense cannot be repetitively deducted.

2. What is the tax treatment for conversion of convertible bonds into equity investments?

A convertible bond is a fixed-income corporate debt security that yields interest payments but can be converted into a predetermined number of common stocks or equity shares.

The conversion from bond to stocks can be done at certain times during the bond’s life and is usually at the discretion of the bondholder. A vanilla convertible bond provides the investor with the choice to hold the bond until maturity or convert it to stocks.

The STA Announcement [2021] No.17 clarifies the CIT treatment for conversion of convertible bonds into equity investments:

CIT treatment for holders (purchasing enterprises) of convertible bonds

- If a bondholder obtains interest income at an agreed rate during the holding period, the bondholder should declare and pay CIT according to law.

- If a bondholder converts the bond into stocks together with the accrued interest receivable, even the accrued interest receivable is not recognized as income on the bondholder’s accounting books, it should be recognized as interest income of the current period by tax authorities and be declared for tax purposes. After conversion, the purchase price of the bond, the accrued interest receivable, and related taxes and fees paid together constitute the cost of the equity investment.

CIT treatment for issuers (issuing enterprises) of convertible bonds

- If a bond issuer incurs interest expense of convertible bonds, the cost can be deducted before CIT.

- If the bond issuer converts the bond into stocks together with the unpaid interest payable, the unpaid interest payable should be deemed as having been paid to the investor and should be allowed to be deducted before CIT.

In short, for convertible bond issuers, the interest expense, which is part of the company’s financing cost, is allowed to be deducted before tax.

If the bondholder converts the convertible bonds as well as the accrued interest receivable (which is the unpaid interest payable for bond issuers) into stocks, the interest should be deemed as received by the investor and thus for bond issuers, it is allowed for pre-tax deduction.

3. What is the tax treatment for cross-border hybrid investments?

Hybrid investment refers to investments that have dual characteristics – of equity and debt.

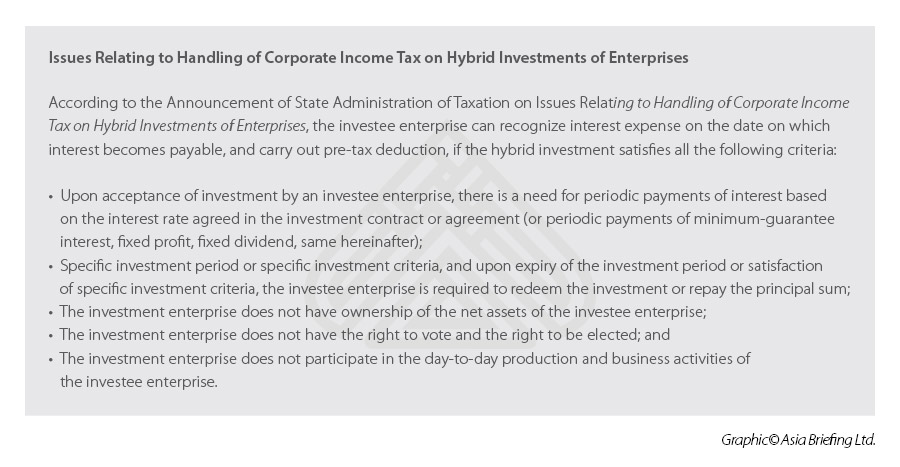

According to the STA Announcement on Issues Relating to Handling of CIT on Hybrid Investments of Enterprises (STA Announcement [2013] No.41), if a hybrid investment meets certain conditions, it can be treated as debt investment (instead of equity investment); thus, the investee enterprise can recognize interest expense and carry out pre-tax deduction.

In a bid to fill tax loopholes omitted in the SAT Announcement [2013] No.41, which was implemented from 2013, the SAT Announcement [2021] No.17 added two restrictive conditions. The added conditions will prohibit hybrid investment from being seen as debt investment under certain situations.

According to the No.17 Announcement, if a hybrid investment meets both of following two conditions, the interest paid by the domestic investee enterprise to the overseas investment enterprise should be regarded as dividend (that is, to be regarded as equity investment instead of debt investment), and cannot be deducted before CIT:

- Foreign investment enterprise and domestic investee enterprises are related parties; and

- The country (region) where the foreign investment enterprise is located recognizes the investment income as equity investment income and does not levy CIT on it.

4. What is the tax treatment for assets after the change from “levying upon assessment” to “levying upon audit of accounts”?

In China, there are two methods to collect corporate income tax:

- Levying CIT based on audit of accounts; or

- Levying CIT based on assessment.

Most corporate taxpayers are subject to CIT based on the audit of accounts. However, for taxpayers, such as those who are exempt from keeping accounts or those whose accounts are confusing, tax authorities will assess the percentage of their taxable income.

In some cases, taxpayers may eventually transfer from being levied CIT upon assessment to being levied CIT upon audit of accounts.

After the transformation, how to confirm the value of the company’s assets is important as it will affect the owner’s equity as well as depreciation and amortization expenses, which in turn will affect the profit and loss of the enterprise and its taxable income.

To avoid tax evasion, the STA Announcement [2021] No.17 clarifies how to confirm the value of assets for tax collection purpose.

How to confirm the value of the asset

According to the Announcement No.17, if an enterprise can provide an invoice for asset purchase, the tax should be calculated on the basis of the amount stated in the invoice.

In case an asset purchase invoice cannot be provided, the amount recorded in the asset purchase contract (agreement), proof of fund payment, and accounting materials and other documents may be used as the basis for tax collection.

How to deal with the depreciation and amortization of the asset

For an asset that was put into use during the period of levying upon assessment, after the enterprise transfers to levying upon audit of accounts, based on the depreciation and amortization years stipulated in the tax law, after deducting the use years of the asset, the amount of depreciation and amortization of the asset shall continue to be calculated and deducted before tax for the remaining year.

5. What is the tax treatment for enterprise collection of cultural relics and artworks assets?

Based on the STA Announcement [2021] No.17, cultural relics and works of art purchased by the enterprise and used for collection, display, and preservation and appreciation should be treated as investment assets for tax purposes.

Therefore, during the holding period of cultural relics and artworks assets, accrued depreciation and amortization is not allowed for pre-tax deduction.

6. When to recognize the income after receiving government payments?

Recognizing the income on the accrual basis

Pursuant to the STA Announcement [2021] No.17, where an enterprise sells goods or provides labor services at market prices and is paid in whole or in part by the financial department of the government, in accordance with a certain proportion of the quantity or amount of the goods sold or labor services provided by the enterprise, the income should be recognized under the principle of accrual basis.

Recognizing the income on the actual basis

Except for the aforesaid circumstances, for all kinds of government financial funds obtained by enterprises, such as financial subsidies, subsidies, tax rebates, and compensation, income should be recognized on cash basis – at the time on which the income is actually obtained.

China Briefing will keep you updated on the most recent tax news. Our parent company, Dezan Shira & Associates, has an experienced team of tax accountants, lawyers, and ex-tax officials who can help your business on a wide spectrum of tax service areas across all major industries. For more information and assistance, please email us at China@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China City Spotlight: Investing in Foshan, Guangdong Province

- Next Article GBA’s Shenzhen Qianhai Extends 15% CIT for Qualified Enterprises Until End of 2025