China Further Expands the Encouraged Catalogue to Boost Foreign Investment

We highlight new opportunities in China’s “2022 Catalogue of Encouraged Industries for Foreign Investment”, which contains 1,474 items. These align with China’s plans to attract foreign investments into high-tech manufacturing, production-oriented service industries, as well as regional advanced industries in the central, western, and northeastern regions. Opportunities also exist in industries linked to green, healthcare, elder care, sports, and vocational education sectors besides rural revitalization.

What’s new?

On October 28, 2022, the National Development and Reform Commission (NDRC) and the Ministry of Commerce (MOFCOM) released the Catalogue of Encouraged Industries for Foreign Investment (2022 Version)(hereafter the “2022 FI Encouraged Catalogue), which will come info force on January 1, 2023.

Once enacted, the 2022 FI Encouraged Catalogue will replace its 2020 version.

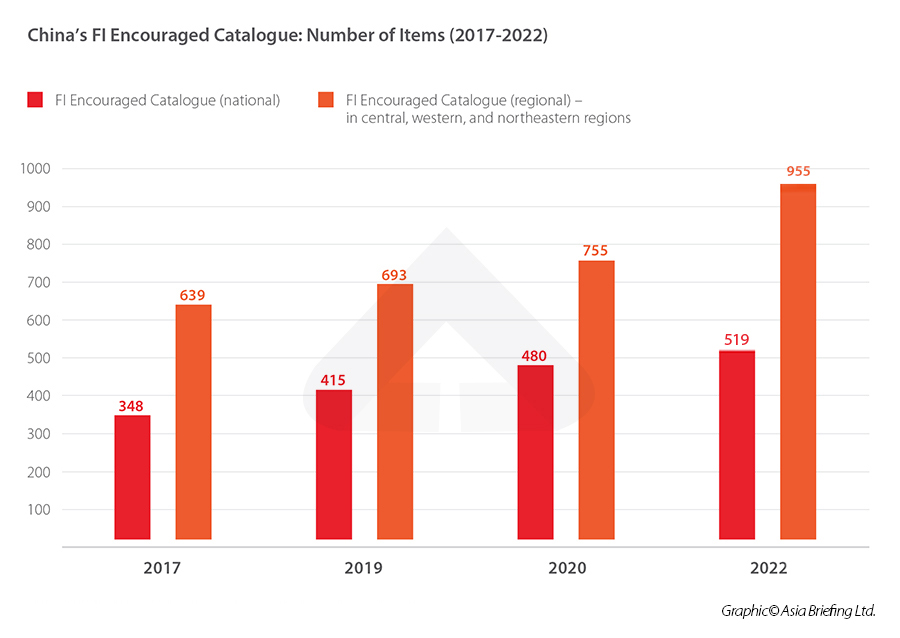

Similar to the previous version, the 2022 FI Encouraged Catalogue includes two sub-catalogues – one covers the entire country (“national catalogue”) and one covers the central, western, and northeastern regions (“regional catalogue”). Together, the 2022 FI encouraged catalogue identifies industries where foreign direct investment (FDI) will be welcome and treated with favorable policies in China.

The newly released 2022 FI Encouraged Catalogue contains a total of 1,474 items (519 in the national catalogue and 955 in the regional catalogue), increased by 19 percent from 1,235 items (480 in the national catalogue and 755 in the regional catalogue) in the 2020 version.

The lengthening of the catalogue demonstrates China’s firm standing on economic opening-up and the fact that more investment fields will favor foreign investors.

To break this down: the 2022 FI Encouraged Catalogue has added 239 items and modified 167 items (mainly expanding the area covered by the original entry). In the national catalogue, 39 new items have been added and 85 items modified, while 200 new items have been added and 82 items modified in the regional catalogue.

According to the official interpretation, the revision of the 2022 FI Encouraged Catalogue will serve three main purposes:

- Boost foreign investment in manufacturing to upgrade China’s industrial and supply chains.

- Promote the integrated development of the service and manufacturing sectors.

- Encourage foreign investment in China’s central, western, and northeastern regions.

The additions to the regional catalogue account for 84 percent of all new entries. This can also be viewed as part of China’s efforts to promote common prosperity, a key task emphasized during the recent 20th Party Congress that aims to reduce wealth inequality and balance the level of social and economic development across different regions of the country.

Key changes in the 2022 FI Encouraged Catalogue

Nationwide, the catalogue has added or expanded items on manufacturing of components and parts and equipment. To be more specific:

- In the field of end products manufacturing, items such as aviation ground equipment, glow discharge mass spectrometer, transmission electron microscope, and industrial water-saving equipment have been added or modified.

- In the field of components and parts manufacturing, the new or modified items include shield machine bearings, key parts related to autonomous driving, high performance light metals, etc.

- In the field of raw materials manufacturing, new items added or modified include high-purity electronic chemicals, high-performance coatings, and organic polymer materials.

In the service industries, foreign companies are encouraged to invest in production-oriented services, with items such as professional design, technical services, and development, newly added to the national catalogue. To be more specific:

- In the field of technical services, new items added include advanced system integration technology and service of low carbon, environmental protection, green energy saving and water saving, development and application of environmentally friendly technology, design and research and development of offshore wind power equipment and marine new energy equipment.

- In the field of business services, items such as retired wind turbine blades and waste photovoltaic modules recycling and processing, clean operation of traditional energy, engineering construction and technical services, language services, etc., are newly added or modified.

The regional catalogue has added or expanded relevant items catering to the specific advantages of China’s central, western, and northeastern regions, such as labor force availability, distinctive resources, and need for investment. For example:

- To give full play of human resource advantages in inland China, labor-intensive processing trade related industries was added as encouraged items in Jiangxi, Anhui, Henan, Guizhou, Gansu, Ningxia, Guangxi, etc.

- To take advantage of the strong traditional manufacturing basis, encouraged items such as equipment manufacturing have been added in Chongqing, Sichuan, Hubei, Hunan, Shaanxi, etc.

- Items related to agricultural and livestock products processing have been added to the regional catalogue in Heilongjiang, Jilin, and Liaoning, etc., due to their rich agriculture resources.

- To improve the level of export-oriented economic development in the border areas, items such as commercial logistics and tourism and leisure businesses have been added to the regional catalogue in Tibet, Xinjiang, Yunnan, etc.

- To promote green transformation in resource-based areas, relevant industries have been added as encouraged items in Shanxi, Inner Mongolia, etc.

Taking a closer look, the revision to the encouraged catalogue is also in line with China’s priorities on further improving the country’s healthcare system, sports industry, elder care, rural revitalization, vocational education, and the transition to a green, low-carbon, and circular economy.

We briefly highlight some of the investment opportunities in the promoted industries below. Businesses should seek professional support to understand the full extent of the opportunities available and potential access to incentives that may streamline costs and offer market benefits.

Healthcare sector

The 2022 FI Encouraged Catalogue adds multiple new items for the healthcare sector. Some areas where foreign investment is encouraged are:

- Production and research and development of therapeutic medical and health textiles, artificial skin, absorbable sutures, hernia repair materials, new dialysis membrane materials, catheters for interventional therapy, and high-end functional biomedical dressings.

- Development and production of drugs for rare diseases and special drugs for children.

- Consumables related to pharmaceutical manufacturing industry: separation and purification media, solid phase synthesis media, chiral resolution media, consumables for drug impurities control and detection, etc.

- Manufacturing of dental implant system for implant repair in patients with bone loss.

- Manufacturing of closed negative pressure drainage and protect wound materials, bacterial cellulose film, and polyurethane foam dressing and other polymer material dressing manufacturing.

- Hearing aid and cochlear implant manufacturing.

- Postpartum maternal and child services in maternity centers

- Rehabilitation institute for autistic children.

Sports sector

Inspired by the success of the Beijing Winter Olympic Games, the 2022 FI Encouraged Catalogue encourages foreign investment into China’s snow and ice industry, with “research and development and production of snow and ice heavy equipment and light equipment for ski resort, passenger ropeway, snow machine, snow press, and other special equipment” being added to the encouraged catalogue.

The 2022 FI Encouraged Catalogue also added “construction, operation, and management of fitness facilities such as outdoor sports camps” and “development, popularization, and promotion of intelligent sports products and services” as encouraged items for foreign investment.

Elder care sector

To facilitate the development of the elder care sector, the 2022 FI Encouraged Catalogue encourages foreign investment in “research, development, and manufacturing of smart healthcare products for the elderly”, which include geriatric products and auxiliary products manufacturing, geriatric medical equipment and rehabilitation AIDS manufacturing, elderly intelligent and wearable equipment manufacturing.

Moreover, foreign investment is also encouraged for elder care related services, including services for renovation and barrier-free transformation of home, livable environment, and public facilities for the elderly, eldercare related professional education, training services designed for elder care, and education provided to the elderly.

Rural revitalization

The 2022 FI Encouraged Catalogue adds multiple items that are designed to improve the agriculture, living environment, logistic, commerce, and industrial structure of the rural area. Among others, the below items are introduced in the encouraged catalogue:

- Efficient water-saving irrigation, farmland soil improvement and ecological management, comprehensive utilization of farmland reserve resources – such as saline-alkali land, and green farmland construction, technology development, and application.

- Rural environmental remediation, rural sewage and garbage treatment, water ecological environment treatment, and restoration related engineering construction, technology development, and application.

- Construction of cold chain logistics facilities for storage and preservation of agricultural products.

- Smart agriculture (integrated application of software technology and equipment, digital transformation of agricultural production, operation, and management).

- Rural e-commerce and new type of rural services, including agricultural productive services adapted to large-scale, standardized, and mechanized agricultural production, as well as rural life services.

- Rural tourism, leisure sightseeing, agricultural experience, outdoor expansion, ecological health, and labor education and practice base construction.

Vocational education

To echo China’s plan to strengthen the country’s vocational education system, in addition to the Vocational Education Law that came into force recently on May 1, 2022, the 2022 FI Encouraged Catalogue adds “non-academic language training institutions” and “non-academic art training institutions”.

To be noted, this does not include language and art training services for primary and secondary school students and preschool children between the ages of 3 and 6, which are still subject to stringent supervision amid China’s effort to reduce burden for students and parents.

China’s transition to a green, low-carbon and circular economy

On top of the nearly 100 items that are relevant to China’s green transition in the 2020 FI Encouraged Catalogue, the 2022 FI Encouraged Catalogue introduces more, such as:

- Development and production of new technology and products for wood structure and wood building materials, as well as recycling of used wood.

- Production of ultra-high folding optical resin material, co-extrusion backplane for environmental recyclable solar modules and plastic materials for backplane, auto start and stop lead battery diaphragm, energy storage lead battery diaphragm.

- Green hydrogen fuel preparation technology (chemical by-product hydrogen production, biological hydrogen production, water electrolysis hydrogen production from renewable energy, etc.)

- Industrial water-saving technology, technology development, and application and related equipment manufacturing.

- Development and production of environment friendly surface treatment technology product.

- Deep processing of high-performance light metal and copper alloy materials used in energy-saving and environmental protection area.

- Low-carbon upgrade of petrochemical chemical raw materials.

- Clean production technology development and service, traditional energy clean operation, engineering construction and technical service, and clean production evaluation, certification, and audit.

- Advanced system integration technologies and services of low carbon, environmental protection, green, energy saving, and water saving.

- Development and application of environmentally friendly technologies.

- Recycling and processing of retired wind turbine blades and discarded photovoltaic modules.

- Comprehensive utilization of Yellow River sediment.

- Construction and operation of clean coal power generation projects using circulating fluidized bed, pressurized fluidized bed, integrated coal gasification combined cycle power generation and low calorific value coal power generation projects using coal gangue, medium coal, slime and other coal.

What are the favorable policies to facilitate FDI in encouraged industries?

So far, the following favorable treatment is in place for foreign-invested enterprises (FIEs) engaged in doing business in the listed industries published in the encouraged catalogue:

- Tariff exemptions on imported equipment – for encouraged foreign-invested projects, the import of self-use equipment within the total amount of investment can be exempted from customs duties, excepted for those listed in the Catalogue of Major Technical Equipment and Products Not Exempt from Import Duty and Catalogue of Imported Commodities Not Exempt from Import Duty for Foreign Investment.

- Access to preferential land prices and looser regulation of land use – land can be preferentially supplied for encouraged foreign-funded projects with intensive land use. The land transfer reserve price can be determined at 70 percent of the national minimum price for the transfer of industrial land.

- Lowered corporate income tax (CIT) – for FIEs in encouraged industries in the western regions and Hainan province that meet the requirements, the CIT rate can be reduced to 15 percent.

How to read China’s recent efforts on improving foreign investor access

China’s strict curbs implemented to prevent and control the COVID-19 pandemic, especially lockdowns and restrictions on movements has seriously hampered the national economic growth in 2022, together with an uncertain international environment caused by the Russian-Ukraine conflict, geopolitical confrontation among the superpowers, shrinking overseas demand, and the recession concern in major economies.

According to preliminary estimates of the National Statistic Bureau, the gross domestic product (GDP) in the first three quarters of 2022 reached RMB 87,026.9 billion, up by 3.0 percent year on year at constant price. Although the third quarter’s GDP growth rate jumped to 3.9 percent year on year from the 0.5 percent in Q2 2022, the initial growth target of 5.5 percent by the end of the year still seems too far to achieve.

All these factors have taken their toll on business confidence. In a recent survey conducted by the American Chamber of Commerce in Shanghai, 19 percent of the 307 respondents decreased investment in China this year, rising from 10 percent in 2021, though more than half said they remained optimistic about the five-year business outlook.

Given that FIEs account for about a quarter of China’s industrial output, a fifth of its tax revenue, and about 40 percent of its total imports and exports – stabilizing foreign investment and optimizing the distribution of foreign capital is a top priority for the government and policymakers. This is reaffirmed in the 20th Party Congress Report delivered by President Xi Jinping on the first day of the week-long 20th Party Congress on October 16, 2022.

The shortening of the FI negative lists as well as the lengthening of the FI encouraged catalogue marks further liberalization of the Chinese market for foreign investors, as promised by the country’s government.

On the other hand, however, analysts hold the view that further relaxations to improve market access alone is not enough to boost foreign investment. China will need to substantially loosen COVID-related restrictions and implement more concrete stimulus measures, among others, to restore business confidence in China.

On October 25, 2022, three days before the release of the 2022 FI Encouraged Catalogue, the NDRC released the Several Policy Measures to Stabilize Foreign Investment Stocks and Spur Foreign Investment Quality and Quantity with a Focus on the Manufacturing Sector, which details 15 measures to stabilize and attract foreign investment. In addition to tax breaks, financial supports, land facilitation, and measures to improve fairness and business environment, it also pledges to relax travel restrictions for inbound travelers include executives, foreign talents, and their families, smooth COVID-19 related logistics bottlenecks that have seriously disrupted the operation of foreign businesses, and support FIEs to list on domestic share trading market.

Investors are suggested to keep a close eye on China’s policy developments that impact the foreign investment environment.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Belt And Road Weekly Investor Intelligence #105

- Next Article “Global Bankers Are Very Pro-China” – UBS Investment Bank