What to Expect from China’s 2023 Two Sessions and Government Work Report

The 2023 Two Sessions is expected to oversee changes to China’s institutional structures, legislation, and policy environment, which will have a profound impact on the economy and businesses in the coming year and beyond. As China emerges from the COVID-19 pandemic, the government is also likely to launch a pro-growth economic agenda, which could translate to preferential industry policies and increasing market access. We discuss the possible outcomes of the Two Sessions meetings and their potential impact on China’s business and investment landscape.

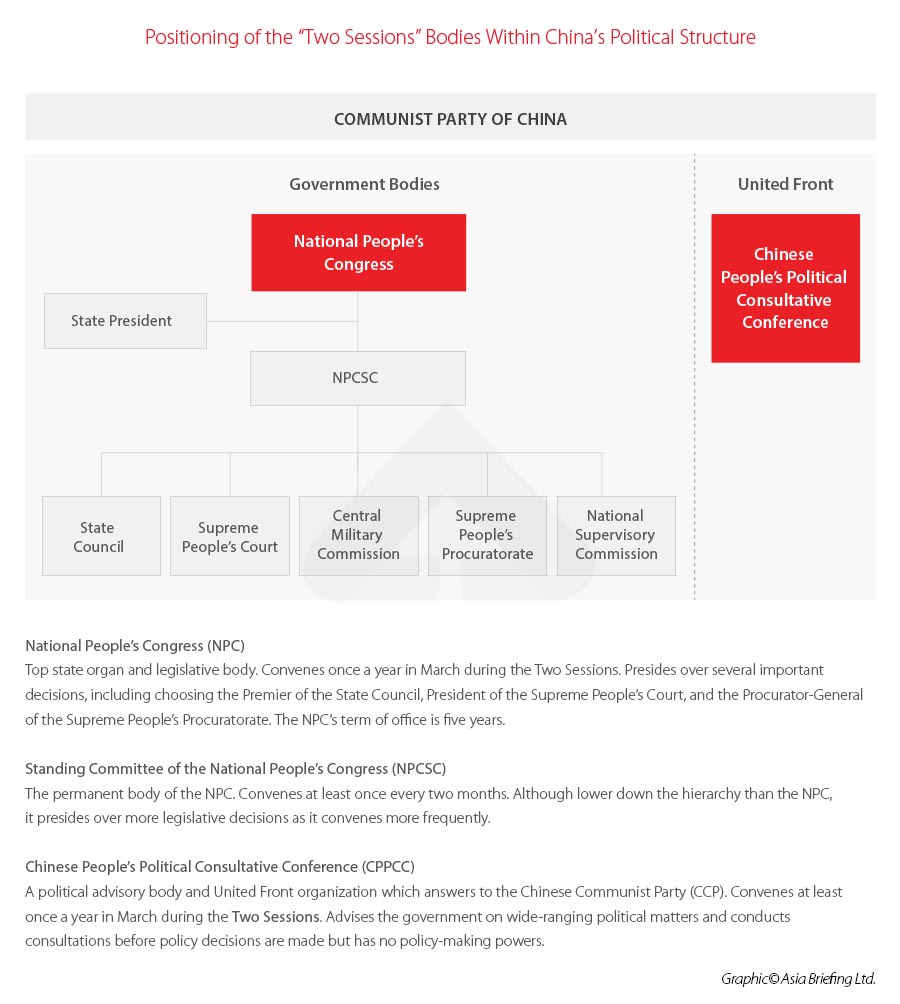

China’s most important annual governmental meetings are slated to start on Saturday, March 4, in the Great Hall of the People in Beijing. The “Two Sessions” meetings, which refer to the annual meetings of the National People’s Congress (NPC) and the Chinese People’s Political Consultative Conference (CPPCC), will preside over the main economic agenda for 2023, as well as significant governmental restructuring. 2023 will mark the first year of re-opening after the COVID-19 pandemic, and the government has already set its sights on full economic recovery and high growth as the year’s top priority.

Although the lifting of COVID-19 restrictions in late 2022 has already boosted economic activity – the official manufacturing PMI reached the highest level in nearly 11 years in February – there remains a range of challenges, including sluggish domestic demand, persistent problems in the housing market, and unequal development across the country.

The economic and legislative decisions made at the Two Sessions are of high importance to business leaders and foreign investors in China; they serve as a valuable window into China’s politics and reveal Beijing’s priorities and policy direction for the coming year.

Below we look at some of the most likely outcomes of the Two Sessions and discuss how they could impact businesses.

EVENT – Is China “Really” Coming Back? How Successful Brands are Navigating Uncertainty in China and Southeast Asia

With China’s surprise reopening, the Chinese market is on the minds and in the news feeds of many global brand executives. But as e-commerce growth slows and the country’s path to economic recovery remains uncertain, many are wondering… is China “really” coming back? As you prepare for an uncertain year ahead, it is more important than ever to make well-informed business decisions to support your growth strategies for China and Southeast Asia. Join us at one of our upcoming in-person events in Europe, where we team up with Kung Fu Data to uncover e-commerce industry insights, explore how to protect your intellectual property in Asia when selling online, and discuss the latest developments taking place in the region to bring you the inside scoop on brand performance and consumer behavior. This event is FREE of charge. This event is part of our Reforesting Asia 2022 Eco Initiative.

What are the Two Sessions?

The Two Sessions, known as Lianghui 两会 in Chinese, is the name given to the back-to-back annual meetings of two of China’s major political bodies – the Chinese People’s Political Consultative Conference (CPPCC) and the National People’s Congress (NPC). The CPPCC is a consultative body that includes over 2,000 members from various segments of Chinese society, ranging from business entrepreneurs to movie stars. The NPC is China’s top legislative body. The Two Sessions are particularly significant as they are the only fixed annual meetings of these two political bodies.

The 2023 Two Sessions will start on Saturday, March 4, and are expected to last for around two weeks. The session on Sunday, March 5 will the first of the 14th NPC since being elected for the five-year term from 2023 to 2027. On the first day of the meeting of the 14th NPC, the Chinese Premier (currently Li Keqiang, but who will soon be replaced by Li Qiang) will present the annual Government Work Report (GWR), which will contain the country’s economic and social development blueprint for the year.

2023 GDP growth target

One of the most important announcements that will be made during the Two Sessions is the annual GDP growth target. In 2022, the GDP growth target was set at “around 5.5 percent”. However, China’s GDP growth rate missed the target, growing 3 percent year-on-year, due mainly to the large outbreaks of COVID-19 experienced over the year. In recent months, provincial and municipal governments have announced local GDP growth targets for 2023, giving an indication of the overall sentiment in the country. In general, the provinces and municipalities have set very ambitious growth targets for 2023:

- At the higher end, the provinces of Hainan, Tibet, Xinjiang, and Jiangxi have set targets of between 7 and 9.5 percent

- At the lowest end, Beijing, Tianjin, Shanghai, and Guangdong have set targets of between 4 and 5.5 percent.

The average of all the regional growth targets is around 5.9 percent.

Although some of these targets may seem very ambitious, it is important to note that the single largest factor for decelerated growth in 2022 – COVID-19 restrictions – has been removed. In addition, low base effects from the slow GDP growth recorded in 2022 will mean that high growth rates in 2023 will be highly likely. For these reasons, we expect that the government will feel confident in setting a growth target similar to that of 2022.

The GDP growth target will have a major effect on the policy agendas of local governments. A more ambitious growth target will mean more effort will be put into short-term growth, which could come in the form of more infrastructure investment, incentive policies, and consumption vouchers, whereas a lower target will allow for governments to formulate longer-term development plans and address more systemic issues.

Government restructuring

The 14th NPC is expected to approve some structural changes to the government. This is a regular occurrence in China, with each new NPC making some tweaks at the beginning of its session every five years. The changes are not always big, but may nonetheless have a significant impact on how policy is formulated and implemented over the next five years. The structural changes made in 2018, when the 13th NPC convened for the first time, were much more widespread than usual, and saw the creation of new ministries and branches of government, including the National Supervisory Commission, an anti-corruption agency.

The new structural reforms have already been drafted and deliberated by the government on at least two occasions this year: during the Politburo meeting on February 21, as reported by Xinhua, and during the second plenary session of the 20th Central Committee of the CPC, which took place from February 26 to 28. According to the readout of the second plenary session, the session “agreed to submit some of the contents of the Party and State Institution Reform Plan to the first session of the NPC for review. The plan is therefore expected to be approved and released during the course of the Two Sessions, but no details have yet been made public.

One possible piece of information we have on the proposed plans comes from the Wall Street Journal, which quoted unnamed sources saying that the government was planning on resurrecting the Central Financial Work Commission (CFWC) as part of an overhaul of the financial system. The CFWC was a financial supervisory body that was set up in 1998 in the wake of the Asian Financial Crisis, but was later dissolved in 2003. According to the Wall Street Journal report, the reinstatement of this body will “largely serve a comparable function of consolidating all financial regulatory matters under a single authority”.

In addition to institutional reforms, the Two Sessions are also expected to confirm the appointments of several high-level positions, including the premiership (to which Li Qiang has already been confirmed), the vice premiers, and the heads of major governmental bodies, including the National Development and Reform Commission (NDRC), the Ministry of Finance (MOF), and the central bank (PBOC). The appointment of these officials will give a good indication of where the country’s policies and development trajectory will go, as the officials will have a significant influence on policy decisions in their respective fields.

Policies impacting foreign businesses and investment

Since China’s reopening at the end of 2022, government officials have been promoting the role of foreign investment in China’s economic recovery. The CEWC, for instance, highlighted the need to increase foreign trade and investment cooperation to stimulate growth and proposed expanding market access as one of the means to increase foreign investment in China.

Several Chinese officials have also embraced pro-foreign business rhetoric, calling for improving the business environment to make it more attractive to foreign investors. On January 17, Vice Premier Liu He gave a speech at the World Economic Forum in Davos, in which he stated that China will continue to promote market opening, and also called for attracting foreign investment. It is therefore likely that the Two Sessions will take a pro-business stance, reduce restrictions on market entry, and promote policies to attract foreign investment. The appointment of Li Qiang as premier also gives credence to this line of thinking, as he is generally seen as being in favor of foreign business and investment.

Legislative changes and policy priorities

With economic growth and recovery at the forefront of the agenda for 2023, we expect that many of the legislative changes and policies announced during the Two Sessions will focus in large part on areas such as advancing industry development, production, and consumption.

This may mean that other long-term structural changes and policies that were previously outlined as priorities, such as the Common Prosperity, may be placed on the back burner in 2023 (though certainly not scrapped). We may instead see more policies aimed at propping up various industries, in particular strategic industries that the government has an interest in growing, such as healthcare, strategic tech sectors, such as semiconductors, green technology, and agriculture to improve food security and self-sufficiency, among others.

With regard to industry policy, we may see further easing of the so-called “tech crackdown”, which saw tightening regulatory oversight of internet and tech companies in late 2020. Over the course of 2022, the government made several moves indicating that it would ramp up support for the technology sector.

In January 2022, government ministries released the Opinions on Promoting Standardized, Healthy, and Sustainable Development of Platform Economy, which endorsed the technological advancements and international expansion of tech companies. Later, in May of the same year, Vice Premier Liu He explicitly reassured tech companies that the government would support them in going public on domestic and overseas stock exchanges.

Although the Two Sessions may not deliver specific regulations or policy directives, it is possible that the language regarding the tech industry will be increasingly supportive and encouraging, which could in turn translate into concrete policies in the future.

One major legislative change that we can expect to be finalized during the Two Sessions is the passing of the amended version of China’s Legislation Law. The draft amendments to the law were released for public comment in December and January, after having been reviewed by the 13th NPC.

The amended Legislation Law will further devolve certain legislative powers to provincial and municipal governments, giving them more authority to draft regulations on matters such as urban and rural construction and management, environmental protection, and historical and cultural protection. However, certain details on the scope of powers and fields were not yet clear, but may be addressed in the final version of the law that is passed.

Giving more discretion to local governments to formulate and implement rules could enable a more flexible regulatory environment, but inconsistencies across China could also complicate compliance procedures, in particular for large companies with operations across multiple jurisdictions.

An agenda for growth

Whatever the details of the GWR or the policies that are announced during the Two Sessions, the outcome of the meetings is almost certainly going to be a pro-growth agenda. This could mean promises of more support for industry, possibly through further tax incentives, more market access, and measures to boost consumption.

From a business perspective, the Two Sessions will also provide insight into the industries that are a priority for the government and help to answer key questions on how it intends to regulate and oversee the development of various sectors and businesses.

Business leaders and foreign investors are therefore advised to keep a close eye on the announcements that will emerge over the next two weeks. In particular, it is important to be aware of any major legislative or regulatory changes that could impact compliance, while looking out for potential opportunities and benefits.

About Us China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com. Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article How China Intends to Reduce the Cost of Government Tender Bidding Transactions

- Next Article Belt And Road Weekly Investor Intelligence #123