China’s New Measures to Optimize Credit Management on Tax Payment

Starting November 1, 2020, China’s State Taxation Administration (STA) will implement the Announcement about Issues Related to Credit Management on Tax Payment (STA Announcement [2020] No.15). The announcement, which was published on September 18, includes a total of four measures to optimize China’s credit evaluation system for taxpayers:

- Adding non-independent accounting branches into taxpayers’ credit evaluation system, on a voluntary basis;

- Adding a mechanism to review credit evaluation indicators;

- Adjusting the application rules for taxpayer credit evaluation; and

- Relaxing the measure of keeping D rating for two years.

Since China introduced corporate credit system, including the system for monitoring taxpayer creditworthiness in 2014 and started to function it this year, taxpayer’s credit ratings are becoming increasingly important for foreign-invested companies doing businesses in China.

This article explains what changes have been introduced to the taxpayer credit management policy and how they will impact taxpayers in China.

Adding non-independent accounting branches into taxpayers’ credit evaluation system

In principal, a branch registered in China may take the form of either an independent accounting branch (“独立核算分公司”) or a non-independent accounting branch (“非独立核算分公司”).

Non-independent accounting branches refer to branches established by corporate taxpayers, whose registration information has been confirmed with the tax authorities and whose accounting method is non-independent accounting – all the accounting of the branch company needs to be consolidated into the accounting of its head office.

Previously, such non-independent accounting branches were not allowed to participate in the taxpayer creditworthiness evaluation system for independent taxpayers.

Now, such branches can voluntarily join the credit evaluation on tax payment, by submitting the Application Form for Supplementary Assessment of Tax Credit to the relevant tax bureau.

With a tax creditworthiness rating, it would be more convenient for non-independent accounting branches to handle tax-related matters, expand businesses, and conduct bidding.

Adding a mechanism to review credit evaluation indicators

In addition, the STA Announcement [2020] No.15 added a review mechanism for credit evaluation – any taxpayer that disagrees with the status of the indicator evaluation may apply for a reconsideration with the relevant tax bureau, by filing the Application Form for Taxpayer Creditworthiness Review (Verification) in March of the following year, before the release of the credit evaluation results.

The tax bureau will examine and make adjustment when carrying out the annual evaluation in April and provide the taxpayer with self-checking service for review status along with the evaluation findings.

Adjusting the application rules for taxpayer credit evaluation

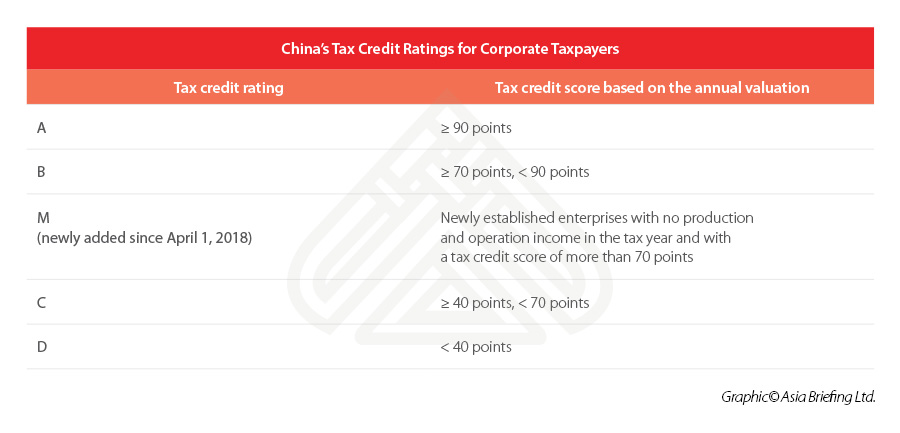

Currently, China has five credit ratings for taxpayers – categorized as A, B, M, C, and D, as shown in the following table. Grade A taxpayer creditworthiness has an annual evaluation benchmark score of 90 points and above; Grade B has a credit score of above 70 but below 90; Grade C has a score of above 40 but below 70; and Grade D has a score of less than 40 or is determined by way of direct grading – direct grading applies to taxpayers who have committed serious dishonesty acts. The category of grade M was newly added since April 1, 2018, which refers to newly established enterprises with no production and operation income in the tax year and with a tax credit score of more than 70 points.

The annual evaluation benchmark scores adopt the demerit method – taxpayers’ scores will be deducted when they failed to meet evaluation indicators.

According to the Administrative Measures on Taxpayer Creditworthiness (Trial Implementation) (STA Announcement [2014] No.40), there are “recurring indicators” (“经常性指标”) and “non-recurring indicators” (“非经常性指标”) – recurring indicator refers to indicator information frequently generated by taxpayers during the year of evaluation, such as tax-related declaration information, tax payment information, invoices and tax control equipment information, registration and accounts books information; non-recurring indicator means indicator information not frequently generated by taxpayers, such as the tax bureau’s record of tax assessment, tax audit, anti-tax avoidance investigation, or tax inspection information.

Previously, where the recurring indicator and non-recurring indicator information of the taxpayer in the year of evaluation are complete, the starting score is 100; where there are missing non-recurring indicators of the taxpayer, the starting score is 90.

However, according to the new announcement, as long as there is non-recurring indicator information in the past three evaluation years (instead of within one evaluation year), the starting score of the taxpayer can be 100; where there is no non-recurring indicator information in the past three evaluation years, the starting score is 90.

This adjustment, which would significantly increase the number of enterprises to be evaluated as grade A or B taxpayers, will be implemented starting this year. The evaluation results made in previous years will not be retroactively modified.

Relaxing the measure of keeping D rating for two years

Previously, according to the STA Announcement [2014] No.40, where a taxpayer is graded D for two years, it will get no chance to be graded A in the third year.

However, the STA Announcement [2020] No.15 regulates that if a taxpayer is rated as grade D on the basis of the evaluation indicator score, which is blow 40, 11 points can be additionally deducted at the time of evaluation, instead of maintaining its evaluation as grade D in the next year.

For any taxpayer rated D directly due to serious breach of trust (Article 12 of the STA Announcement [2014] No.40), the evaluation of grade D for this taxpayer should remain for two years and the taxpayer should not be evaluated as grade A in the third year.

Tax authorities will adjust the taxpayer creditworthiness grade for year 2019 by November 30, 2020 pursuant to the announcement, but the taxpayer creditworthiness grade before year 2019 will not be adjusted retrospectively.

China’s efforts on perfecting its tax credit management system

China has been putting serious effort into perfecting its corporate credit system, including the credit system on tax payment, to improve the efficiency of tax and credit governance:

- On October 1, 2014, China announced the Administrative Measures on Taxpayer Creditworthiness (Trial Implementation) (STA Announcement [2014] No.40).

- On February 1, 2018, it published the Announcement on Matters Relating to Evaluation of Tax Creditworthiness (STA Announcement [2018] No.8), adding the category of grade M taxpayers.

- On November 7, 2019, the STA released the Announcement on Matters Related to Tax Credit Restoration (SAT Announcement [2019] No.37), which allowed eligible taxpayers to restore their tax credit to proactively fix their tax incompliance records.

- This year’s STA Announcement [2020] No.15 is a further step by the government to relax its measures on the credit management of taxpayers and encourage taxpayers to accumulate credit assets.

Tax credit rating has become a very important credit asset for enterprises in China. The higher the credit rating, the more convenience the taxpayers can enjoy when conducting bidding, applying for loans, or obtaining business qualifications.

According to the STA, the results of tax credit evaluation in 2020 show an increasing awareness, willingness, and ability of taxpayers to pay tax in good faith. The number of grade A enterprises rose sharply, up 37 percent from the previous year. The number of grade B and M enterprises has been rising steadily, accounting for about 85 percent of all evaluated enterprises. The number of grade C and D enterprises continued to decrease, dropping by more than two percentage points compared with last year, and maintaining a decline for two consecutive years.

For further information or assistance in your tax credit management, please contact us at china@dezshira.com or tax@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Was erwarten die EU-Investoren von China?

- Next Article Imposte e tasse sull’Import-Export in Cina