China BITs: How to Use Investment Agreements

China’s Ministry of Commerce released a new guide to help companies and investors understand and use bilateral investment treaties (BITs). China BITs guarantee equitable treatment for investors and their investments in the host country, improving trust between the two parties and fostering an investor-friendly environment.

On June 28, 2021, China’s Ministry of Commerce (MOFCOM) released a Reference Guide for Enterprises to Use Investment Agreements (‘the Guide’) to help investors navigate the terms and conditions of China’s BITs, how to use them for arbitration in the event of dispute settlement.

In this article, we outline the contents of the Guide and provide additional context on what protections investors can and cannot receive under a BIT between their own country and China.

What are BITs and why do they matter?

The Guide defines a BIT as an agreement signed between two countries or regions that sets out terms and regulations for private investors in the partner country.

An important function of BITs is providing protection and guarantees for both individuals and companies in the host country. These are provisioned in addition to protections already guaranteed under a host country’s domestic laws. The BITs often also include mechanisms for foreign investors to raise and settle disputes in a neutral court should the host country fail on its obligations to protect their rights. Some BITs also stipulate regulations for market access.

In short, a BIT seeks to promote and facilitate bilateral foreign investment by protecting foreign investors from unfair treatment in the host country. This helps ensure they can enjoy the same rights as domestic investors for the scope of investments detailed in the contract.

Free trade agreements (FTAs) and other international investment agreements (IIAs), such as treaties of friendship, commerce, and navigation, as well as framework and partnership agreements, often also contain relevant chapters on the terms and conditions of private foreign investment. China may therefore provide protections for investors from a particular country even if there isn’t an active BIT covering them.

According to the United Nations Conference on Trade and Development (UNCTAD), China has 107 BITs in force as of 2021. It also has active IIAs and FTAs with a further 17 countries and regions.

What protections are provided by China BITs and who is covered?

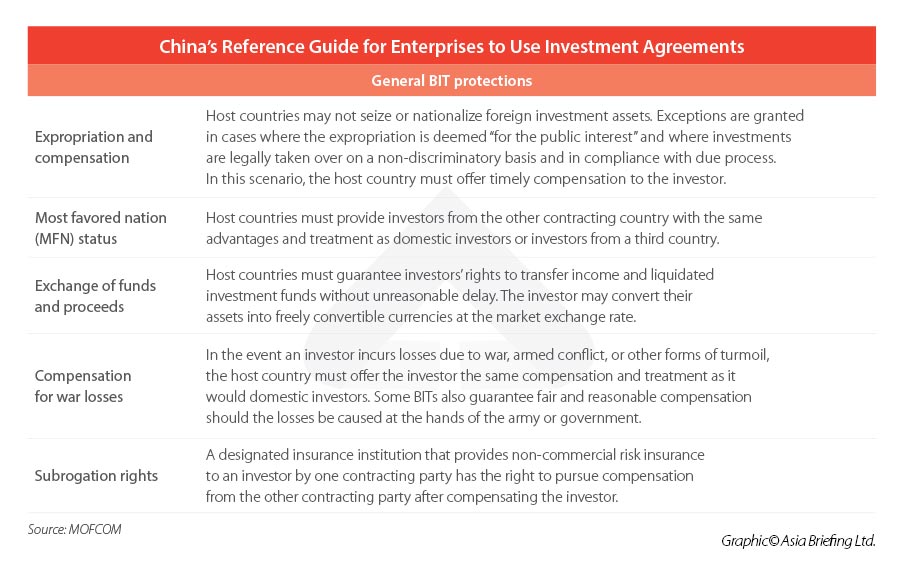

BITs guarantee investors and companies from one contracting country the same treatment by the host country as that awarded to domestic investors or investors from a third country. These protections include, but are not limited to provisions on expropriation and compensation, rights to exchange funds and proceeds, compensation for war losses, and subrogation rights.

The specific protections and guarantees provided vary between contracts, and therefore may not contain all of the provisions detailed above. Investors are advised to consult the BIT documents signed with their country to evaluate which protections they are guaranteed. A full list of the active China BIT documents can be found on the UNCTAD website.

What kind of investments are protected by China BITs?

The scope of investments protected under a BIT will vary depending on the specific agreement signed between the contracting countries. They generally cover movable and immovable property, equity, monetary claims, intellectual property, and franchise and contract rights.

For example, the China-Nigeria BIT defines investments as:

- “Movable and immovable property as well as any property rights, such as mortgages, liens, and pledges;

- Shares, debentures, stock, and any other kind of participation in companies;

- Claims to money or to any other performance having [sic] an economic value associated with an investment;

- Intellectual property (IP) rights, in particular copyrights, patents, trade-marks, trade-names, technical process, know-how, and good-will [sic]; and

- Business concessions conferred by law or under contract permitted by law, including concessions to search for, cultivate, extract or exploit natural resources.”

In the above example, no mention is made of investments that are excluded from protection. However, some BITs include provisions on excluded investments, such as in the China-Canada BIT:

“‘Investment’ does not mean:

- claims to money that arise solely from

- (i) commercial contracts for the sale of goods or services, or

- (ii) the extension of credit in connection with a commercial transaction, such as trade financing, other than a loan covered by subparagraph (d) [a loan to an enterprise:

- (i) where the enterprise is an affiliate of the investor, or

- (ii) where the original maturity of the loan is at least three years]”

BITs may define investments very broadly or very narrowly. Investors are advised to check the scope of investments protected under the BIT signed between their country of citizenship or business domicile before investing in the partner country.

The Guide points out that some BITs mention that only investments that comply with the host country’s laws are protected. This has previously been brought up in some arbitration tribunals.

Who is covered by a China BIT?

In general, any natural person or company from one of the two contracting countries is covered by a BIT. BITs normally include clauses defining who qualifies as an ‘investor’ and thereby who has the legal right to initiate arbitration. In most cases, the investor must be a citizen of one contracting country, but some BITs also extend rights to permanent residents.

The provisions for which enterprises are covered may also differ, with some BITs simply defining it as “corporations, firms, and associations incorporated or constituted under the law in force in the territory of the Contracting Party”. Other BITs clarify specific types of legal entities and cover both for-profit and nonprofit organizations, as well as their subsidiaries.

Investors are advised to read the applicable BIT and, where necessary, seek legal counsel to ensure that their company is guaranteed protections and litigation rights under the agreement.

How can investors use the dispute settlement clauses?

If an investor or company has reason to claim that a host country has failed on its obligations to protect their investments or violated their rights, they can do one of two things: negotiate directly with the host country government or submit the dispute to a neutral international arbitration tribunal.

If an investor chooses to submit a dispute to an international tribunal, they must first ensure that the claims meet the conditions for international arbitration outlined in the relevant BIT. This means establishing that their investments are protected by the BIT, that the investor is eligible to initiate an international arbitration, and that the host country has indeed failed on its obligations under the BIT to protect the rights of the investor.

Some BITs stipulate investors must first seek to resolve disputes through the host country’s judicial system. Only when a dispute cannot be settled directly with the host country’s government can an investor initiate an international tribunal.

For example, the BIT signed between China and Nigeria stipulates disputes “shall, as far as possible, be settled amicably through negotiations between the parties to the dispute”. Only if the dispute is not settled within six months can the claimant submit the dispute to a court under the jurisdiction of either contracting party or choose to set up an ad hoc tribunal (but not both).

Some BITs have provisions for time limits for international dispute litigation, and investors must therefore ensure the initiation is carried out within the stipulated time limit.

Settling disputes at international arbitration tribunals

To aid dispute settlement between an investor and a host country, known as investor-state dispute settlements (ISDS), BITs normally outline provisions for dispute settlement mechanisms through a neutral international arbitration tribunal.

Disputes can normally be submitted to one of two international tribunals:

- The International Center for Settlement of Investment Disputes (ICSID). An institution of the World Bank, the ICSID settles disputes under the 1965 Washington Convention, ratified by 155 countries, including China. This is the most commonly used ISDS mechanism. The requirements of the Washington Convention must be satisfied in order to initiate arbitration with the ICSID.

- An ad hoc tribunal set up under the Arbitration Rules of the United Nations Commission on International Trade Law (UNCITRAL) for ISDS arbitrations.

It is important to note that not all BITs mention both of these ISDS mechanisms. Investors are advised to check the relevant BIT documents for details on which tribunals are permitted under the contract.

Besides, the selection of different arbitration rules leads to differences in time limits, rules of proof, transparency, arbitration fees, and execution of awards.

Execution of awards

If an investor wins an arbitration, the host country will generally take the initiative to implement the arbitral award. If the arbitration is carried out by the ICSID, the host country is obliged under the Washington Convention to provide the investor with monetary awards from the arbitration.

The outcomes of international arbitrations conducted under UNCITRAL are enforced by the rules laid out in the 1958 New York Arbitration Convention, which has been signed by 168 countries, including China.

Preparing for litigation

Many BITs contain clauses stipulating the conditions and steps for submitting disputes and initiating arbitration. In addition, institutions such as the ICSID have specific processes and requirements for filing arbitration requests.

International arbitration is a complicated legal process, and both parties hire lawyers to provide counsel and litigate on their behalf. For ICSID tribunals, each party is required to appoint one arbitrator each. A third presiding arbitrator, normally from a third country with diplomatic ties to both countries involved in the arbitration, is then appointed by agreement of both disputing parties. In cases where the disputing parties cannot agree upon the third arbitrator within a certain timeframe, the Secretary General of the ICSID will appoint the arbitrator on their behalf.

Some BITs also stipulate specific requirements for the expertise of the arbitrators, which may differ depending on the nature or industry from which the dispute arises.

Both parties will be required to gather and submit evidence to the arbitration tribunal and participate in hearings. Legal processes are lengthy and it may take several years for a dispute to be settled.

Disparities between BITs

It bears mentioning that China began signing BITs over three decades ago, the first one with Sweden in 1982. Many of these treaties are still in force and have not been amended since (although the Sweden-China BIT was amended in 2004 to include provisions permitting the use of international arbitration tribunals). In addition, the provisions of each BIT are negotiated individually by the two contracting countries.

For this reason, the contents of BITs vary greatly from contract to contract, with some enjoying a broader scope of protected investments, more clearly defined conditions for arbitration, and a wider choice of ISDS mechanisms. Some of China’s BITs, on the other hand, have narrow definitions of scenarios in which an international tribunal can be initiated for ISDS, such as exclusively in the case of expropriation.

It is important for investors to be aware of the disparities between BITs and have a clear understanding of the contents of the BIT, both before entering the China market and during operations, paying particular attention to which settlement mechanisms are available to them.

What if a country has no China BIT?

Although China has established investment ties with large swathes of the world, there are still many countries and regions that remain uncovered. The US, for instance, has not signed any bilateral agreements protecting investor rights with China, despite several attempts to negotiate such a treaty over the past few years. In some cases, in particular where there is no other agreement outlining protections for investors or international arbitration mechanisms in place, this means investors may be subject to stricter investment conditions and narrower market access in the host country.

An investor or company that wishes to raise a dispute against a host country where no active BIT is in force will have to negotiate directly with the host country under the local laws and regulations.

In some cases, companies can seek help from their own government to raise a dispute to the World Trade Organization (WTO), provided both countries involved are WTO member states and the rights in question are protected by a WTO agreement. Claims of IP infringement have previously been made against China by the US government on behalf of US companies.

In the absence of government involvement, the investor has little recourse to seek international arbitration. Investors do, therefore, take on certain risks when choosing to enter the China market, and are advised to conduct due diligence before making any investment decisions, which includes checking whether there are investment protections in place under other agreements.

On the other hand, China has taken several steps to improve conditions for foreign investors and companies in recent years, which, at least on paper, serve to offer fairer treatment even in the absence of a BIT. Measures include the new Foreign Investment Law, which includes provisions on strengthening China’s IP laws. Relevant to US companies specifically, phase one of the US-China Economic and Trade Agreement also included renewed commitments to IP rights and fair and reciprocal trade.

How can investors get the most out of China BITs?

BITs can be a powerful tool for investors to safeguard their rights and investments in China and give them recourse to raise and settle disputes in a neutral court. However, some BITs are better than others, and due to certain limitations in provisions, they should not be seen as a catch-all for any legal dispute that may arise.

It is therefore crucial for investors to assess and prepare for non-commercial risks before choosing to invest in China, and to check whether there are any BITs or other investment agreements in force with their home country or business domicile. If there are agreements in place, investors should familiarize themselves with the provisions for protected investments and the mechanisms for arbitration.

Dezan Shira & Associates’ business intelligence professionals have the expertise and experience to help foreign investors and enterprises navigate the complex regulatory requirements of doing business in China. Investors looking for more information and guidance on what legal protections are provided under BITs, or other investment agreements with China, can contact China@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article GBA IIT Subsidy in Shenzhen: Updated Application Rules and Deadline

- Next Article Belt and Road Weekly Investor Intelligence, #42