China’s Biopharma Industry: Market Prospects, Investment Paths

Biopharma, short for biopharmaceuticals, are medical products produced using biotechnology (or biotech). Typical biopharma products include pharmaceuticals generated from living organisms, vaccines, gene therapy, etc.

An important subsector of biotech, China’s biopharma industry has much attention home and abroad, especially after Chinese companies developed multiple COVID-19 vaccines now in wide circulation. Market capitalization of Chinese biopharma companies grew to over US$200 billion in 2020 from US$1 billion in 2016.

With China’s rapidly aging population and a growing affluent middle-class, the country’s biopharma industry presents challenging but compelling opportunities to investors.

In this article, we discuss the market size, growth drivers, and global competition facing China’s biopharma industry and suggest potential investment paths.

How big is China’s biopharma market?

Biopharmaceuticals in China is a lucrative business, with significant domestic demand due to an aging population and expanding household budgets for quality products and services as people’s living standards improve.

China’s healthcare market is predicted to expand from around US$900 billion (RMB 6.47 trillion) in 2019 to US$2.3 trillion (RMB 16.53 trillion) in 2030, and its market size is second to only the US. China’s total expenditure on healthcare as a component of its GDP increased to 5.35 percent in 2019 from 4.23 percent in 2010.

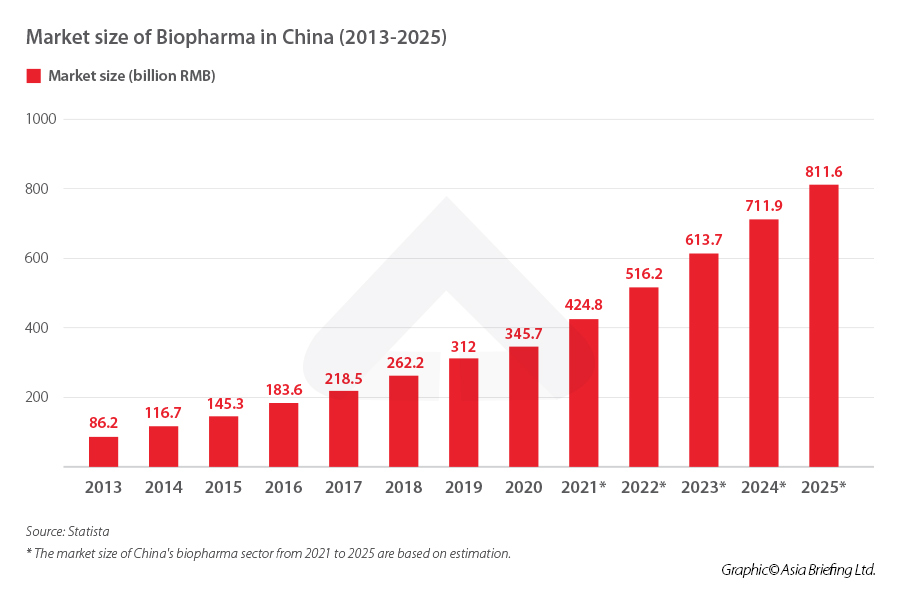

Specifically to the biopharma industry, the market size will likely grow from RMB 345.7 billion (US$47.60 billion) in 2020 to RMB 811.6 billion (US$111.76 billion) in 2025, an 135 percent increase in five years. Similarly, market capitalization of Chinese biopharma companies grew from US$1 billion in 2016 to over US$200 billion in 2020. From 2010 to 2020, 141 new drug and biotech companies were launched in China, doubling from the previous decade.

What are the growth drivers for China’s biopharma industry?

The broader biotech sector is a main focus of the Chinese government’s “Made in China 2025” strategy. The country needs a steady biopharmaceutical industry to address its healthcare needs and to build an internationally competitive and innovative pharmaceutical industry as part of wider economic restructuring. Under the same momentum, on January 30, 2022, nine agencies jointly issued the “14th Five-year Plan for the Development of the Pharmaceuticals Industry” as a guiding document that clarifies the goals and directions for China’s pharmaceutical industry development in the next five years.

In recent decades, China’s biopharmaceutical industry has undergone a momentous shift, evolving from a generics-focused space to a thriving innovative hub. Promoting the industrialization and application of novel drugs and high-end medical devices and techniques is a major developing area under the industry’s plan. At the same time, the country’s wider pharmaceutical regulations were revised and brought in line with global standards. Authorities have streamlined the complexity of new therapy approval and reduced the cost of domestic drug development, making the Chinese market more attractive to domestic and foreign investors alike.

The emphasis on innovation and standardization has profound implications for patients and industry peers. China’s National Reimbursement Drug List (NRDL) has, for example, expanded access to innovative drugs through the country’s basic medical insurance coverage. The 2020 NRDL list, effective from 2021, expanded to include 2,800 drugs and resulted in an average price cut of 51 percent. The same year, the list increased the number of drugs once again to cover 2,860 drugs, and analysts anticipated a price cut of up to 61.7 percent among new drugs. Such facilitated approval and price reduction will drive more interest to the industry.

The biopharma industry is also boosted by the application of advanced technology. Many pharmaceutical companies have built partnerships with technology firms to develop new drugs through artificial intelligence (AI) during the research, discovery, and testing stages. It is reported that financing for AI-assisted drug discovery in China exceeded RMB 8 billion (US$1.26 billion) in 2021. Application of AI will be more critical to the industry’s development in the future.

China’s biopharma innovations are also gaining worldwide regulatory recognition. For instance, the US Food and Drug Administration (FDA)’s designations for China-originated therapies have proliferated in the past two years. While China’s biopharma industry sees rapid development in breakthrough innovations, its research capacity still lacks behind major powers, such as the US, Japan, and EU countries.

To further develop its biopharmaceutical and biomedical industries, the Chinese government has established seven biomedical city clusters, spanning from Jing-Jin-Ji Area, the Yangtze River Delta, and Greater Bay Area to places in central and western China. These regions host industrial zones that incubate key research entities and companies that facilitates technical development.

Chinese biopharmaceutical companies in the global market

Chinese biopharmaceutical companies are exploring options to go global and secure the full value of their innovations. Biotech start-ups, across the globe, rely on Chinese companies’ services in drug discovery and preclinical trials for development and commercialization, with extensive operations in Asia, Europe, and North America.

Major companies include Wuxi Biologics, with around half of its sales last year coming from North America; BeiGene, a commercial-stage biotech with a major physical presence in the United States and Europe; Jiangsu Hengrui Pharmaceuticals, which opened R&D facilities and drug subsidiaries in those more developed medical markets. Similarly, these Chinese companies also obtained international investment. For example, US-based biotech company Amgen acquired a 20.5 percent stake in BeiGene in 2019, which was up by approximately US$1.5 billion two years later. In 2020, Pfizer invested US$200 million in CStone, headquartered in Suzhou, and gained access to CStone’s late-stage oncology drug (CS1001, PD-L1 antibody) in mainland China. These demonstrate the interconnections between Chinese companies and the world.

Challenges: Competition between China and the US in biopharma

Nonetheless, despite the commercial potential, many speculate that the biotech sector could become a new battleground between the world’s two superpowers—China and the US—similar to what is happening in semiconductors.

In February this year, the U.S. government added two subsidiaries of Wuxi Biologics to its “unverified list.” While this does not prevent American companies from doing business with the firm, it adds procedures and paperwork. In September, the US President Biden signed an executive order to boost domestic manufacturing in the US biotech industry. The order mentioned risks posed by foreign competitors in the biotechnology supply chain. Following the order, shares of Chinese biotech companies tumbled, especially those with large revenue exposure to the US.

Though the executive order did not come up with specific sanctions as it has done with the restrictions imposed on semiconductors, it is a first step as it asks US departments to make reports and come up with plans for alternatives. In addition to protecting US technology and supply chain competitiveness, similar to the actions on semiconductors, the executive order on biotech also explicitly mentioned the importance of safeguarding biological data for security concerns. It is possible that the biopharmaceutical industry could potentially follow a similar path.

As evidenced in investment flows, pharmaceutical companies are closely linked with the biotech sector. Reshoring the supply chain will take years and is likely to increase operational costs for companies, which could impede the development of new drugs and therapies. While concerns over supply chain resilience and safety may increase in the long-term, the immediate impact on Chinese biotech companies should be minimal.

Potential investment paths for foreign investors

Active government and policy support, growing domestic R&D capacity, and the scale of public healthcare demands have galvanized a new era of biopharmaceutical innovation in China. China’s emergence as a potential new source of innovation and R&D opens more doors to the global biopharmaceutical industry. Strategic partnerships with Chinese companies can provide access to local markets and commercialization opportunities. Possible involvement for foreign investors includes the following:

- Sourcing assets from China for local and global markets

- Partnering or launching local investment funds

- Establishing incubators to foster early-stage innovation

- Opening technology platforms to Chinese innovators

- Investing in R&D for commercialization

These strategies will enable foreign players to capture a share of China’s rapidly growing biopharma industry. They will likely gather momentum as Chinese players continue to evolve and augment the global biopharmaceutical marketplace. At the same time, anticipating the increasing competition between China and the US in biotechnology, investors in this space should prepare for risk exposure to geopolitical entanglements.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article How to Start a School in Hong Kong

- Next Article L’intelligenza artificiale in Cina: Normativa, opportunità, e sfide per gli investitori