Companies with Equity-Based Compensation Plans are Subject to More Reporting Obligations in China

China has tightened the tax administration of income derived from equity-based compensation plans. Companies that implement equity-based compensation plans are now required to submit a reporting form on the status of the equity incentives, as well as other documents, to the tax authorities in charge. If an overseas company grants equity-based incentives to staff in the territory of China, the domestic employer will need to comply with the filing requirements and withhold the individual income tax on income from equity incentives.

On October 12, 2021, the State Tax Administration (STA) released the Notice to Further Deepen the “Fang Guan Fu” Reforms to Cultivate and Stimulate the Vitality of Market Entities (hereafter Notice [2021] No.69) aimed at deepening tax reform. As part of the reform, the notice further strengthens the administration of individual income tax (IIT) on the income derived from equity-based incentives.

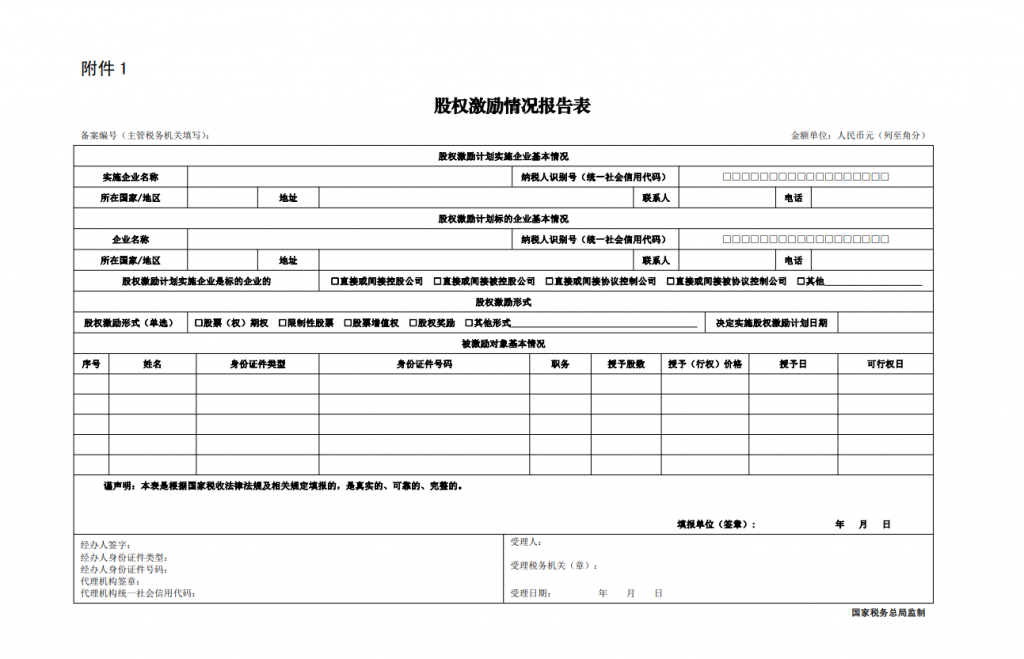

Companies that implement equity-based compensation plans (such as stock appreciation rights, stock options, and restricted stocks) will have to submit the Reporting Form on the Status of Equity-Based Incentives (shown below), as well as some other relevant documents, to the tax authority in charge within the first 15 days of the month following the decision to implement such a plan.

In addition, if the equity-based compensation plan being implemented hasn’t been closed this year, the company is obliged to submit the Reporting Form as well as relevant materials to the tax authority in charge by the end of 2021.

If a domestic company rewards its employees with equity of an overseas company, the domestic company must also follow the above filing requirements. The domestic entity is also responsible for withholding the IIT on the income that the employees derive from the equity-based compensation plan (the income will be taxed as the employee’s wages and salary).

In the Reporting Form on the Status of Equity-Based Incentives, companies will need to fill out the information concerning the companies, the types of equity-based incentives, list of staff who receive the equity-based incentives, including granted shares, awarded/strike prices, and so on.

What are the major changes and potential impacts?

Previously, China only required listed companies that implement a stock option plan to file the plan and relevant materials with the tax authorities, according to the Notice on Issues relating to the Levy of IIT on Personal Income from Stock Options (Cai Shui [2005] No.35).

Unlisted companies that grant equity-based incentives to employees are only required to complete filing formalities with the tax authorities if they want to enjoy a deferred tax policy, according to the Notice on Improving IIT Policies Relating to Equity-Based Incentives and Provisional of Technology in Exchange for Shareholding (Cai Shui [2016] No.101).

Now, based on the requirements of the new notice, technically, all companies with equity-based compensation plans, listed or unlisted, need to file with the tax authorities.

Businesses should be aware that under the new rules, it may be easier for tax authorities to find out that some overseas-listed companies – as well as some companies with offshore structures (including those with Variable Interest Entity structures) – have implemented equity-based compensation plans but have not paid IIT as required.

In addition, the notice definitively confirms that all listed companies will be responsible for withholding and paying the IIT, regardless of whether equity-based incentives are granted directly or indirectly (such as through asset management plans, trust plans, or offshore trusts) to their employees.

Who should submit the reporting form?

All companies that implement equity-based compensation plans are required to submit the Reporting Form as well as other materials to the tax authorities in charge. If the company implementing equity-based compensation plans is not in the territory of China, the domestic employer of the recipient of equity-based incentives must take responsibility for filling in and submitting the form.

What do equity-based incentives usually include?

Employee Stock Options (ESOs): ESOs refer to a type of equity compensation granted by companies to their employees and executives. Rather than granting shares of stock directly, the company gives derivative options on the stock instead. These options come in the form of regular call options and give the employee the right to buy the company’s stock at a specified price for a finite period of time. Unless a stock option is transferable at the time of grant and has a price on the public market, an employee is taxed when exercising an option.

Stock Appreciation Rights (SARs): SARs are a type of employee compensation linked to the company’s stock price during a predetermined period. SARs are profitable for employees when the company’s stock price rises, which makes them similar to employee stock options (ESOs). However, employees do not have to pay the exercise price with SARs. Instead, they receive the cash payment based on the appreciation of the stock. When an employee exercises the stock appreciation right, the company will pay the employee in cash equal to the difference between the grant price and market price of the stock. Employees are taxed when they receive payment with respect to a SAR.

Restricted stock units (RSUs): RSUs are issued to employees through a vesting plan and distribution schedule after they achieve required performance milestones or upon remaining with their employer for a particular length of time. An employee is taxed when the restrictions on shares of restricted stock lapse or are relieved, which generally is the time when those shares are fully vested to the individual.

At present, companies may still need to submit the hard copy of the reporting form and materials to the tax authority in charge. However, it will be possible to submit these reporting forms via the Natural Person Tax Information Management System (ITS) in the future.

For more information and assistance on your company’s equity-based compensation plans, you’re welcome to contact us at China@dezshira.com

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Trading Opportunities Available Under the RCEP

- Next Article Q&A: How to Understand the Implementation of the PIPL in China?