China 2022 Outlook: The Economy, Covid, Business, and Regulatory Landscape

China’s economic outlook for 2022 is predicted to be relatively bright with GDP growth forecast at over 5 percent – higher than the global average. However, sustained pressure from Covid-19 outbreaks and supply chain bottlenecks will continue to have an impact. To counter the economic pressures, China will place particular importance on economic stability and recovery, adopting fiscal and monetary policies to spur growth in strategic portions of the economy. China is also expected to continue its ‘zero-Covid’ strategy in 2022, with quarantine-free travel to the country unlikely. Despite the relative economic slowdown and closed borders, international trade is reaching record highs, and foreign companies maintain an optimistic outlook.

2021 was a momentous year in China, with landmark regulations marking pivotal changes to key industries and areas of society. At the same time, continued economic pressure stemming from sporadic Covid-19 outbreaks, the supply chain crisis, high commodity prices, and natural disasters, took its toll on the economy in the latter half of 2021.

Many of these issues are expected to continue well into 2022, and the government is already oiling the economic gears to help the country weather the next few months of downward pressure and guide development in the right direction.

Below we take a look at what to expect for China’s economy and market access, Covid-19 travel restrictions, further regulations in the digital space, and the trade and business landscape of 2022. We also look at the reasoning behind government decisions on these issues to predict what to expect in the coming year.

For a better grasp of the developments of the past year that will inform the coming year’s policies, you can also read our China 2021 year in review.

China’s economic outlook for 2022

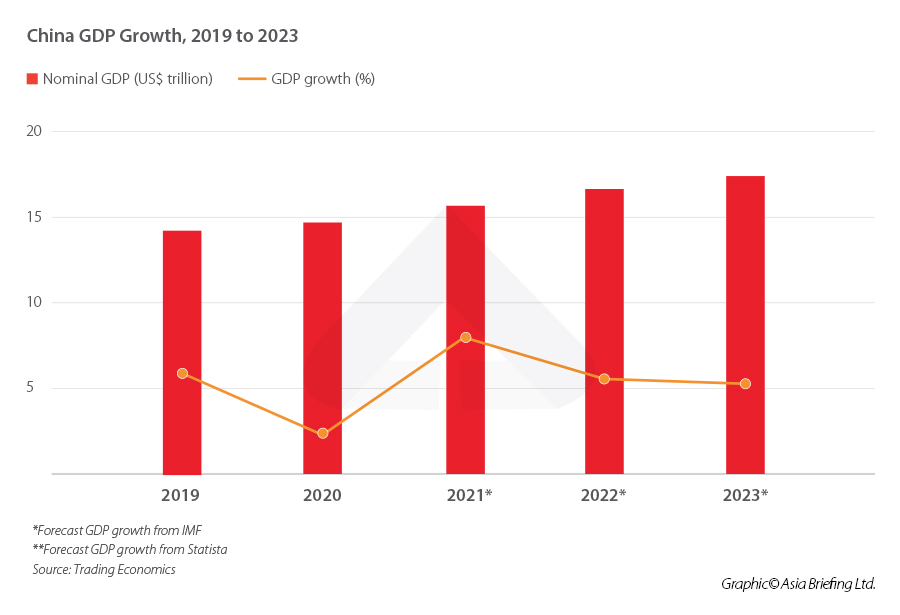

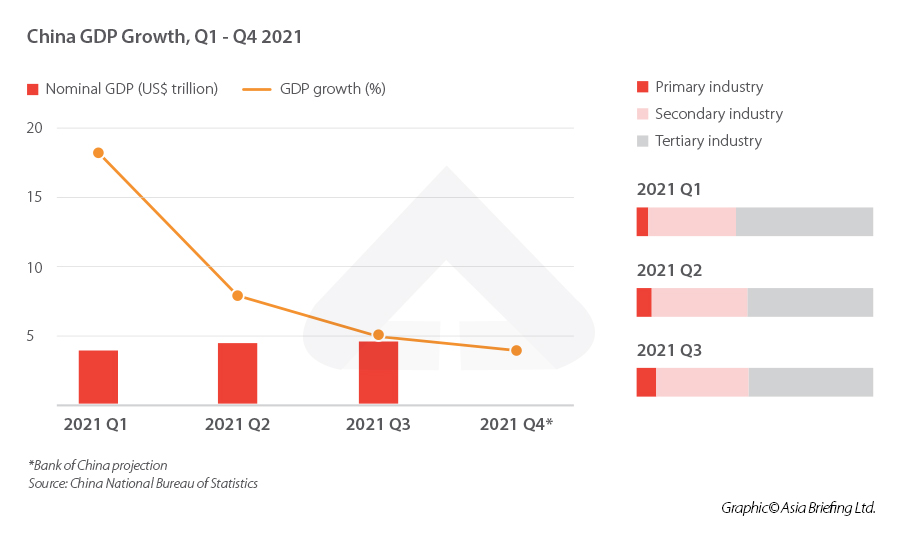

China’s GDP growth shot up at the beginning of 2021, reaching a blistering 18.3 percent in the first quarter. The projected year average GDP growth of around 8 percent will be considerably stronger than the 2.3 percent recorded in 2022, indicating that China’s economy has in many ways bounced back from the pandemic.

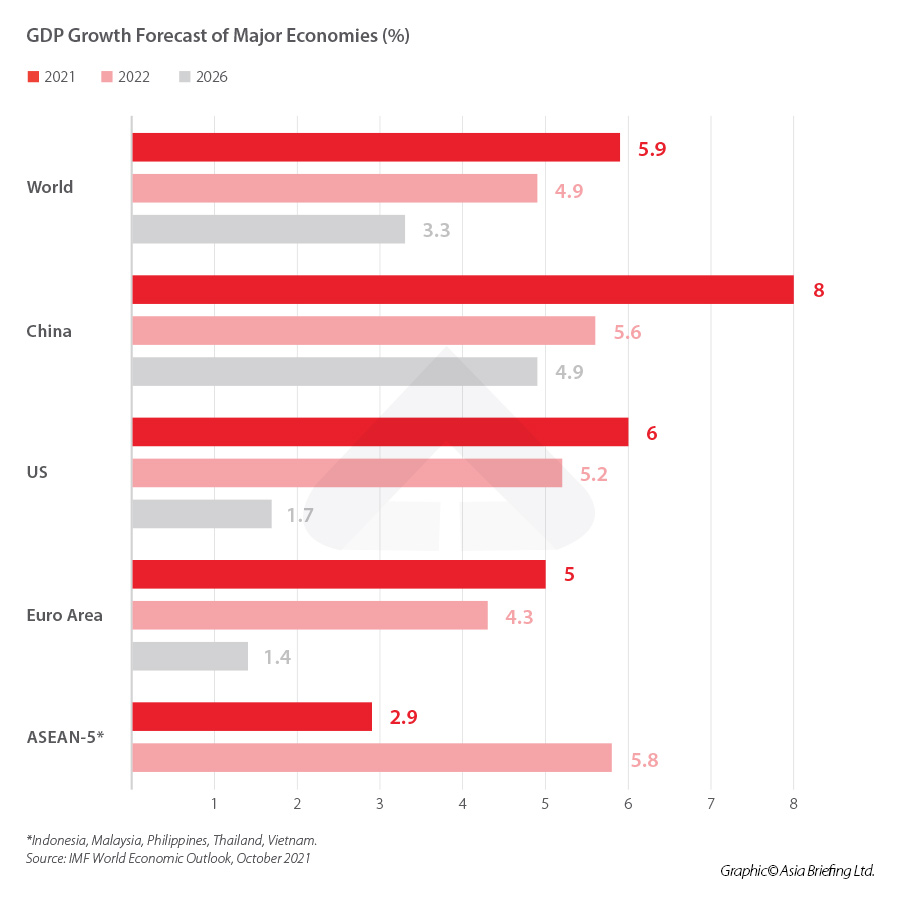

However, looking ahead, China’s economic growth in 2022 is expected to slow from its 2021 rate. Forecasts from the International Monetary Fund (IMF) and the World Bank, which predicted a 5.6 percent and 5.4 percent year-over-year growth, respectively, align with the 5.3 percent prediction made by the Chinese Academy of Sciences in its annual Blue Book on the Chinese Economy.

As can be seen in the below chart, China’s GDP growth slowed significantly in the latter half of 2021, a trend that is expected to persist into the beginning of 2022. This slowdown has been attributed to a combination of factors. Natural disasters over the summer and early fall grounded some major cities to a standstill, while sporadic Covid-19 outbreaks triggered restrictions on movement and, in some instances, led to factory closures while generally impacting consumer confidence.

Although each successive outbreak has been contained, the frequency with which they arise does not appear to be slowing. The most recent outbreak, which started spreading in late October, has affected cities in several provinces, including Heilongjiang, Inner Mongolia, and Zhejiang. The resulting lockdowns and travel restrictions have in turn impacted the November 2021 economic indicators. China also reported its first case of the new Omicron variant, which is predicted to be more transmissible than previous variants.

Despite the very low absolute number of Covid-19 cases in China, the sporadic outbreaks nonetheless continue to take their toll. Retail sales, for example, saw slower-than-expected growth in November, with areas such as catering being particularly hard hit. Manufacturing output has also been impacted. In addition to Covid-19-related shutdowns, high commodity prices and shortages of crucial components, such as microchips, have compounded to impact upstream industries.

Although some industries are out of the woods in terms of supply crunches, stubbornly high commodity prices and persistent congestion in the global supply chain are likely to continue to affect output well into 2022. For example, recent closures of cobalt mines in Zhejiang province due to Covid-19 outbreaks are expected to further inflate prices of the material. A crucial component in the production of car batteries, the effect is expected to be felt particularly strongly by the electric vehicle (EV) industry, with the pressure of high costs ultimately being offloaded to consumers.

Many of these problems are expected to continue in 2022. Although China has been successful in containing all of the Covid-19 outbreaks in 2021, it is highly likely that more will appear, especially if the more contagious Omicron variant takes hold. The country’s strict zero Covid policy in turn means that more lockdowns are highly likely. With pockets of Covid outbreaks therefore to be expected, and the important 20th National People’s Congress to be held in Beijing in November, we suspect that travel into and out of China (and Hong Kong) will remain restricted for much of the year. Strict lockdowns and quarantine can be anticipated to be enforced throughout much of 2022 until the NPC sessions are completed by the year end. Businesses and foreign investors will need to prepare for 2022 being a long haul.

The uncertain nature combined with the relative regularity of the outbreaks will likely continue to impact consumer confidence, affect productivity, and inflate prices of key commodities. However, Covid-19 is likely not the only cause of the economic slowdown; domestic policy decisions have also had a part to play. Environmental policies targeting coal output and consumption are largely to blame for the power crunch that led to power outages in parts of China, impacting both housing and factories.

Yet, when compared to the economic outlook of the rest of the world, China is still in a relatively strong position. Its success in containing the Covid-19 pandemic and stimulating productivity has allowed a relatively normal pace of work and life in the country, and its forecast GDP growth for 2022 is expected to slightly exceed the world average, according to the IMF’s October 2021 World Economic Outlook.

Economic policy in 2022

China set out its overarching economic policies for 2022 in the annual Central Economic Work Conference (CEWC), held from December 8 to 10, 2021. The conference stressed the importance of ‘stability’ above all else, and that it would implement “a proactive fiscal policy and a prudent monetary policy.”

According to the official readout of the conference, a “proactive fiscal policy” means providing more targeted and sustainable fiscal incentives and support, in particular for micro, small, and medium-sized enterprises (MSMEs) and individuals.

A “prudent monetary policy”, meanwhile, will mean maintaining a ‘reasonable’ level of liquidity but without ‘flooding’ the market. Banks will be encouraged to increase support for the most important industries and businesses, such as MSMEs, companies engaged in green development, technological innovation, and those serving the ‘real economy’.

These principles are in many ways a continuation of the economic policy adopted in 2021 – the government has been adhering to the “prudent, flexible monetary policy” since at least late 2020, and has repeated this mantra on many occasions since.

Among other actions, the CEWC reiterated the need to continue with the Covid-era policies of the ‘six guarantees’ (sometimes called the ‘six priorities’). First proposed by the politburo in April of 2020, the ‘six guarantees’ represent the six fundamental aspects of the economy and society that must receive priority attention and protection in economic policy to ensure economic recovery post-Covid.

The ‘six guarantees’ are:

- Guaranteeing employment

- Guaranteeing basic livelihood

- Guaranteeing market entities

- Guaranteeing energy and food security

- Guaranteeing the stability of supply chains

- Guaranteeing the operations of grassroots organizations and structures

We mention these six principles because they give a strong indication of which issues are a bottom line for the Chinese government and which kinds of economic policies will be prioritized in the coming year. It also helps to put the most pressing issues facing the Chinese economy into clear focus, as many of the above principles were precisely the ones that were tested in the latter half of 2021 – most notably supply chain disruption and power crunches – and will continue to be priority issues in 2022.

Economic policies will therefore revolve around ensuring these six areas of the government, economy, and society.

We have already seen the roll-out of fiscal and monetary policies that align with the above strategies. On December 15, the State Council announced a series of measures specifically to help MSMEs mitigate against the downward economic pressure.

From 2022 onwards, the government will:

- Extend loan support policies for small and micro-sized enterprises until June 2023. These policies include further deferring loan repayments and extending support for principal and interest payment, and enabling the People’s Bank of China (PBOC) to provide funds to local corporate banks to issue inclusive credit loans (at a 1 percent incremental balance) to small and micro-sized enterprises, as well as individual industrial and commercial businesses.

- Include microcredit loans in the relending support plan for agricultural and small businesses. In addition, the RMB 400 billion relending quota that was originally for supporting small and microcredit loans can begin to be issued on a rolling basis, and this quota can be increased when necessary.

In addition to the above fiscal support, the measures also point out the need to ease administrative procedures for MSMEs, primarily by:

- Establishing a national integrated financing credit service platform to provide microfinancing to MSMEs. This will seek to speed up registration for market entities while facilitating administrative punishments, judicial judgments and enforcement, as well as facilitating the sharing of information such as tax and social insurance payments, which can help banks better service MSMEs.

- The fourth is to improve the regulations on performance appraisal and due diligence exemption of microcredit loans issued by financial institutions, support financial institutions to issue special financial bonds for MSMEs, and expand the scale of government financing guarantee business for small and micro enterprises and reduce guarantee costs.

Environmental policy in 2022

China made major strides in both environmental policy and implementation of environmental regulations in 2021, from ceasing coal production overseas to releasing the foundational policy documents for reaching carbon reduction targets.

The most notable perhaps was the release of two long-awaited policy documents in the lead up the COP26 climate summit in Glasgow in October 2021: the Working Guidance for Carbon Dioxide Peaking and Carbon Neutrality in Full and Faithful Implementation of the New Development Philosophy (the “Working Guidance”) and the Action Plan for Reaching Carbon Dioxide Peak Before 2030 (the “Action Plan”). The two documents represent the basis of China’s “1+N” framework for reaching its carbon targets of peak carbon by 2030 and net-zero by 2060.

While the Working Guidance acts as the foundational pillar for China’s overall carbon emissions strategy (representing the “1” of the “1+N” framework), the Action Plan is just the first of a series of more granular and applicable policy documents (representing the first of the “N” documents). For this reason, more such policy documents and guidelines are expected to be released targeting specific areas of industry and society in the near future, with the possibility of more being released in 2022.

Although many around the world will be hoping that China will take drastic measures to cut carbon emissions in 2022 – and especially cuts to coal consumption – recent events and actions indicate that the government will not be taking a zealous approach, and may even ease up on some of the more stringent environmental regulations of 2021.

Back in June 2021, the Politburo warned against ‘campaign-style’ carbon reduction measures – that is, doing too much too quickly, resulting in unsustainable measures that could potentially damage supply chains and the business environment. These warnings turned out to be somewhat prophetic as measures to curb the production of coal led to power shortages in the fall, which in addition to leaving millions of homes without power, also forced factory closures and led to rising coal prices. These issues touch upon the government’s bottom line of ensuring people’s basic livelihoods and economic stability, and it is therefore keen on preventing it from happening again.

Going forward, the Chinese government will therefore seek a more ‘orderly’ means of tackling carbon emissions, while staying clear of its bottom line of economic stability and recovery.

Market reform and opening

To get a better idea of how the government envisions the development of FDI, we can look to the 14th Five-Year Plan (FYP) for Utilizing Foreign Capital, released in October 2021. The 14th FYP sets targets for the development of FDI for the period until 2025 and set the target for FDI growth to an accumulated US$700 million by the end of this period.

Below are the full FDI targets set out in the 14th FYP.

| Predicted Quantitative Indicators for the Use of Foreign Capital During 14th FYP Period | |||

| Indicator | 2020 | 2025 | Accumulated total |

| Actual absorption of foreign direct investment (US$ 100 million) | 1,444 | – | 7000 |

| Proportion of foreign capital in high-tech industries (%) | 26.6 | 30 | – |

| Proportion of foreign capital in free trade zones and ports (%) | 17.9 | ~19 | – |

| Source: 14th Five-Year Plan for Utilizing Foreign Capital, Ministry of Commerce | |||

In addition to the above targets, the FYP outlines a three-pronged approach for ‘promoting high-level opening to the outside world’. The three proposed measures are:

- Reducing the number of items on the ‘Foreign Investment Negative List’.

- Relaxing barriers to entry for key fields.

- Continuing to reduce market access restrictions, including reducing the number of items on the ‘Market Access Negative List’.

The Foreign Investment (FI) Negative List mentioned in the first measure is a list of prohibited or restricted industries for foreign investment. The list has gradually been shortened over the years, with the National Development and Reform Commission (NDRC) and the Ministry of Commerce (MOFCOM) recently revealing the 2021 edition, which reduced the number of restricted fields to just 31, down from 33 in 2020.

The 14th FYP plan proposes amending the list to expand access to manufacturing, services, and agriculture, and relax equity ratio restrictions for foreign investment to allow foreign holdings or sole proprietorship in more areas.

To further relax barriers to entry in key fields, the FYP specifically mentions the fields of telecommunications, internet, education, culture, and healthcare, and further opening up China’s capital markets and providing easier access to industries. It also proposes relaxing foreign investment laws and expanding the permitted scope of business in industries such as transportation, as well as relaxing personnel qualifications and other requirements.

Finally, the ‘Market Access (MA) Negative List’ is a list of banned or restricted industries for market players. It differs from the FI Negative List in that it standardizes market entry rules for all players (domestic or foreign), including state-owned firms, private companies, joint-ownership firms, and foreign firms. As with the FI Negative List, the MA Negative List has also become gradually shorter year by year and was shortened from 123 items in 2020 to 117 in 2021.

In addition to shortening the MA Negative List, the FYP proposes further reducing requirements to obtain permission to access industries, such as warehousing and postal services, information transmission, software and IT services, leasing and business services, scientific research and technical services, culture, sports, and entertainment.

Although not mentioned in the FYP, the NDRC and MOFCOM also recently released the 2021 edition of the negative list for foreign investment access in free trade zones, which was shortened to just 27 items, down from 30 in 2020.

Will China ease Covid-19 travel restrictions in 2022?

When discussing China in 2022, some of the most pressing questions on the minds of businesspeople are whether the country will allow quarantine-free entry, reinstate tourist and business visas, and relax its zero-Covid policy.

The short answer, unfortunately, is not likely.

China’s zero-Covid policy has proven, thus far, to be extremely effective at preventing the spread of the virus through the population, even with the arrival of the more infectious Delta variant. As of December 23, the total number of confirmed cases in China was just 4,245.

Although the prevention measures would be considered drastic in other parts of the world, they largely have the support of the wider Chinese population. This is helped by the fact that, due to the highly targeted nature of the lockdowns and travel restrictions, only a very small proportion of the population is affected at one time – usually only those living in the district or housing community in which a case was detected – thereby allowing the majority of the population to live life as normal.

In addition, the recent spread of the Omicron variant has given even more credence to China’s prevention strategy and has only led it to double down on its current policies. This is compounded by the fact that China’s domestic booster vaccines (which have been used to administer 2.695 billion doses as of December 20, 2021), appear to be weaker against the new Omicron variant than previous strains. China recorded its first Omicron case in December 2021, although the variant has thus far not spread further in the population.

The latest outbreak and concerns over the spread of the new variant have led the government to discourage people from traveling during Chinese New Year – the single most active travel period in China – for the third year in a row. Measures to deter people from traveling have also been put in place, such as prohibiting online travel agencies from selling tour tickets.

Apart from genuine concern for the health and well-being of the population and stability of the healthcare system, China also has political and economic reasons for remaining unwavering in its zero-Covid stance.

During the first wave of Covid-19 in Wuhan in early 2020, the government found itself the subject of a rare bout of criticism from the general population as case numbers and the death toll rose. The government has since worked hard to regain the confidence of the people, and one way to do this is to ensure the basic livelihoods of the people – by providing fiscal stimulus and support, but above all else, by ensuring that Covid is not permitted to spread as it did in early 2020.

On the other hand, the economic impact of the Covid-19 pandemic on China was devastating – as it was in most of the world – and yet the country has succeeded in mostly bouncing back without reopening to foreign travel. One of the major contributors to the post-Covid recovery was domestic consumption, which has been greatly boosted by low Covid numbers allowing a return to normal work and productivity.

In short, the economic impact of keeping borders closed is far lower than the impact of Covid-19 spreading through the population.

So is there no chance of eased restrictions in 2022?

Many have speculated that China will begin to ease restrictions after some of the major events in 2022 are over, namely, the Beijing Winter Olympics in February and the 20th Party Congress in Q4 2022. As discussed above, there are many other issues of concern for the government with regards to reopening quarantine-free international travel. The restrictions are therefore likely to continue after these events are over.

There are, of course, some situations that could help convince authorities to ease some restrictions. One is the roll-out of a highly effective vaccine. China is developing its own mRNA vaccine, which is expected to hit the market next year. In addition to a domestic vaccine, the mRNA vaccine developed by Germany’s BioNTech and Fosun Pharma is now under administrative review, while the Shanghai-based biopharma firm Everest Medicine has signed a license agreement with the Canadian biotech company Providence Therapeutics to produce and sell its potential mRNA COVID-19 vaccine in China. Everest Medicine hopes to complete the China factory by the end of the year.

In addition to an effective vaccine, an effective drug to treat Covid-19 could also mark a significant step toward reopening. On December 8, 2021, China’s top medicine regulator, the National Medical Products Administration (NMPA) approved a neutralizing antibody combination therapy against Covid-19, which can be used for adults and adolescents with mild to moderate symptoms who are at risk of developing more severe symptoms. Clinical trials show a significant reduction in hospitalization and death, and the drug has already been used on patients in China.

As it currently stands, however, China is not ready to fully reopen quarantine-free travel, and restrictions are expected to persist. The next best thing may be opening travel corridors with specific countries or regions that have high vaccination rates and low numbers of Covid cases, such as Singapore. There have been discussions of a Hong Kong-Singapore quarantine-free travel bubble since November 2020, but each round has subsequently been tabled after outbreaks in one of the two jurisdictions.

Despite the uncertain outlook for China’s international travel in 2022, it may not be all doom and gloom for foreign businesses in the country, as will be discussed below. To stay up to date with China’s Covid-19 cases and prevention measures, follow our Covid-19 tracker.

Further regulating digital industries

2021 was a momentous year for regulatory shifts in China. A wide range of industries was hit by unexpected regulations, from the education sector to internet platforms to the gaming industry.

Among the more significant laws that were passed in 2021 was the Personal Information Protection Law (PIPL). Going into effect on November 1, 2021, the law regulates how internet platforms can handle users’ personal information throughout the data’s entire lifecycle, from collection to storage to processing and disposal. In addition to the PIPL, a number of auxiliary regulations for the digital sphere were released, such as rules governing algorithms, the handling of data by ‘critical information infrastructure (CII) operators’, and rules for exporting data out of China, to name a few.

Going into 2022, it is likely we will see more regulations be released to further strengthen China’s growing regulatory regime for digital industries. To understand what sector or area of the law the government is likely to target next, it helps to understand the motives behind these regulatory moves.

There are, broadly, three major motives behind the ‘crackdowns’ – antitrust, national security, and common prosperity.

Several regulations have been released targeting anticompetitive behavior in the tech industry in particular. These include requiring companies to allow hyperlinks from rival platforms on their own platforms, cracking down on fake online reviews and price discrimination, and increasing penalties for antitrust violations, such as failing to disclose mergers.

China also recently established a new anti-monopoly bureau, meaning that the department will have more investigative powers going forward and more resources to implement regulations and punish market players for failing to comply.

Many of the data regulations released in 2021 that stipulate requirements for the handling of sensitive data, personal information, or ‘important’ information, fall under the category of national security considerations. The government has become increasingly concerned about the security of vast amounts of data collected from Chinese users and organizations, and especially data that could be considered ‘sensitive’ to China’s national interests. The ride-hailing app Didi Chuxing famously found itself in the cross-hairs of this situation.

2021 therefore saw more laws and regulations to beef up the protection of domestic data – in particular, ‘sensitive’ data that is of national interest – and strengthen rules about the processing and export of this data. In this regard, we expect there to be more regulations and guidelines released to help companies comply with the current regulations, as well as further clarifications as many of the current regulations include vague definitions (such as the definition of who constitutes a CII operator and what exactly is classed as ‘important’ information).

In addition, it is possible we will see more regulatory documents targeting specific industries, or amendments to clarify existing laws. For example, in September 2021, China released trial regulations for the management of vehicle data, requiring that vehicle makers operating in China store their data within China and undergo security assessments before exporting data out of the country. Although these requirements had previously been stipulated in other legislation, it had, until this point, been left largely up to interpretation whether auto companies fell under the purview of these laws.

Finally, the regulations that banned for-profit tutoring in core education can be classified as falling under the push for ‘common prosperity’. First proposed by President Xi Jinping in August 2021, common prosperity is a principle to tackle inequality by redistributing wealth and providing more equality of opportunity. The crackdown on the private tutoring sector was therefore an attempt to even the playing field in China’s highly competitive education system, and prevent wealthier families from getting an unfair upper hand by sending their children to expensive extra-curricular classes.

From this, we can extrapolate that more policies to level the playing field, as well as more crackdowns on industries and companies that are found to violate labor rights or otherwise exploit workers or customers. Expect also more policies and incentives to promote ‘rural revitalization’, such as promoting agricultural e-commerce and rural infrastructure development to help close the rural-urban wealth gap, as well as incentives to provide better services and care for the elderly and vulnerable in society.

Trade and business landscape in 2022

Despite the challenges presenting China’s economy, there are also reasons to remain positive about business in 2022.

First of all, the relatively stable economic situation that has benefitted consumption and productivity among domestic companies is also a boon for foreign companies.

A survey by the American Chamber of Commerce (AmCham) in Shanghai released in September showed that a majority of American companies are still bullish on China and optimistic about its market growth potential, with Pharmaceuticals, medical devices, and life sciences companies, as well as automotive, non-consumer electronics, and industrial manufacturers, being among the fields receiving the highest level of confidence.

The majority of companies see sales, marketing, and development as a number one investment priority (which implies a race to reach Chinese consumers).

Notably, about 70 percent of respondents have increased their investment in digital technologies since Covid-19. In several industries, over 80 percent of companies are increasing investment in this area, including agriculture and food, healthcare and hospital services, and logistics, transportation, warehousing, and distribution.

Secondly, despite the relative economic slowdown, China’s economy is still set to grow at a rate faster than the global average in 2022. China’s international trade has also seemingly been unaffected by the pandemic. Exports have remained consistently high in 2021 and reached a record US$325.53 billion in November 2021, while imports reached US$253.8 billion, up 31.7 percent from the previous year.

These trade numbers are expected to continue into 2022, especially as China tariff reductions to ASEAN – China’s biggest trading partner – take effect from January 1, 2022.

A challenging but promising year ahead

As has been discussed, many of the issues that China faced in the latter half of 2021 are expected to continue into 2022, with rising Covid-19 numbers in particular likely to hurt profits at the beginning of the year. At the same time, more targeted and focused development in key areas of the economy represents more opportunities for growth, especially where those areas help prop up China’s bottom line of economic stability and people’s livelihoods.

As Chinese policymakers focus more on the quality of the country’s development trajectory, looking ahead to 2022, the government is expected to ensure the alignment of private capital (including foreign capital) with key development goals, the resilience and security of industrial and supply chains, and monetary and fiscal support for the most important entities and industries to ensure ‘high-quality growth’ and economic stability.

Given the dynamic geopolitical and business climate, understanding China’s policies and development goals is necessary for making timely adjustments to business development strategies and avoiding compliance risks.

Dezan Shira & Associates’ Business Advisory team works alongside in-house tax, audit, HR, and technology teams who are well-equipped to advise foreign investors throughout the lifecycle of their business projects, enabling them to manage risks and maximize their business options. For advice on managing your business growth in China and other parts of Asia, you are welcome to contact us at China@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Итоги 2021 Года в Китае: Обзор Ключевого Года

- Next Article China, Cyprus Builds Strategic Partnership, Promote China-EU Cooperation and BRI