Manufacturing Regions in China Struggle to Meet Growth Targets

Major cities in two of China’s strongest manufacturing regions struggled to hit their growth targets in 2018, as the country felt the impacts of a decelerating economy and trade tensions with the US.

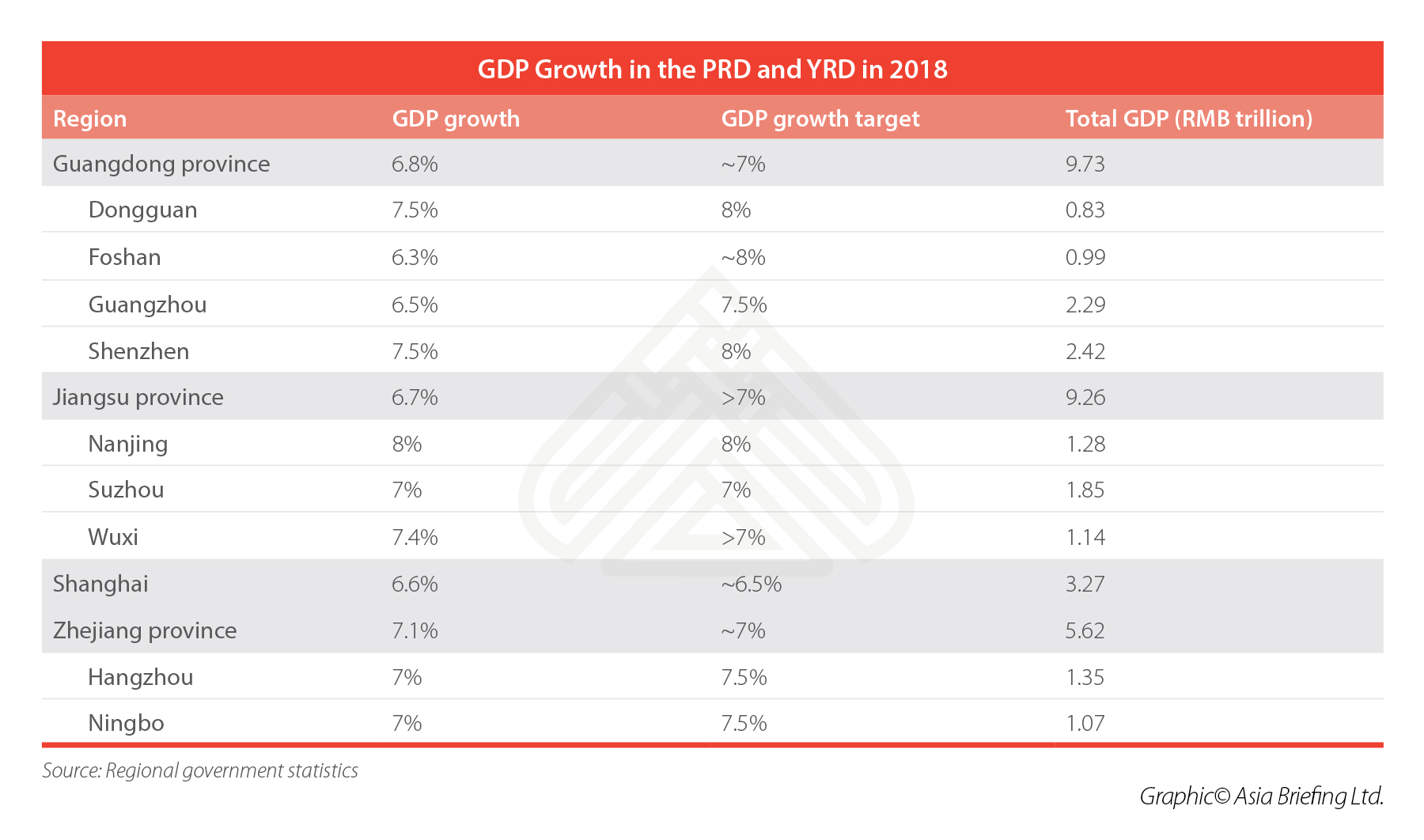

Guangdong province in the south and Jiangsu province in the east – two of China’s most important regions for light manufacturing – both failed to hit their GDP growth targets for the year. Zhejiang, another economically vital eastern province, managed to hit its target, but some of its key cities still missed theirs.

Nationally, China’s GDP grew by 6.6 percent, hitting the target of “around 6.5 percent”, but still the slowest growth since 1990. Overall, 17 of mainland China’s 31 regions failed to hit their growth targets for 2018.

What does this data say about the prospects for China’s traditional economic powerhouses – the Pearl River Delta (PRD) and the Yangtze River Delta (YRD) – in 2019?

Economic slowdown in China: Looking at the PRD and YRD

Guangdong was one of the first regions in China to open up to foreign investment, and since became the nucleus for the country’s manufacturing sector.

The province’s four biggest municipal economies – Shenzhen, Guangzhou, Foshan, and Dongguan – are all based in the PRD region, close to the border with Hong Kong.

Similarly, the YRD in eastern China has historically been among China’s most international regions and a magnet for foreign investment.

The YRD revolves around Shanghai, China’s financial capital; other key cities include Suzhou, Wuxi, and Nanjing in Jiangsu province, and Hangzhou and Ningbo in Zhejiang province.

Of the cities listed above, all four in Guangdong missed their 2018 GDP growth targets, as did the two in Zhejiang. Shanghai and the three cities in Jiangsu met their goals, but Wuxi was the only one to do so with ease.

At the provincial level, Guangdong grew by 6.8 percent, narrowly missing its target (depending on how one defines “around seven percent”), while Jiangsu registered 6.7 percent growth, missing its target of “greater than seven percent”. Zhejiang, however, managed to hit its goal of “around seven percent”, growing by 7.1 percent.

Although many of these cities failed to reach their targets, in several cases their growth still exceeded provincial and national averages.

Although many of these cities failed to reach their targets, in several cases their growth still exceeded provincial and national averages.

For example, Shenzhen’s 7.5 percent growth missed its target by 0.5 percentage points, but still exceeded Guangdong’s provincial target of “around seven percent” and the national target of “around 6.5 percent”.

Shenzhen is also growing from a particularly large base, as it is one of China’s wealthiest cities and, according to its mayor, now among Asia’s five largest city economies.

Nevertheless, it is notable that so many regions missed their targets, as it clearly suggests that China’s economy is under-performing relative to expectations. And this is without considering the accuracy of the official statistics – something many observers are skeptical of.

Many economists argue that China’s actual GDP growth is significantly lower than what is reported – perhaps even less than half the official numbers. This issue may have been borne out in the port city of Tianjin, which grew by just 3.6 percent 2018 after municipal officials admitted that 2016 growth figures had been exaggerated.

After reporting 2018 statistics, most regions lowered their targets for the coming year. Guangdong’s target is down from “around seven percent” to 6-6.5 percent; Jiangsu’s from “greater than seven percent” to “greater than 6.5 percent”; and Zhejiang’s from “around seven percent” to “around 6.5 percent”.

Manufacturing regions struggle to hit their growth targets

Several factors converged to make the PRD and YRD struggle to hit their targets.

Lucy Lu, Assistant Manager of Business Intelligence at Dezan Shira & Associates, said that the nature of the PRD and YRD’s economies made them more vulnerable to the economic risks that arose in 2018. “Both the Pearl River Delta region and the Yangtze River Delta region have similar economic models,” Lu said. “Export-oriented manufacturing, which is an important pillar of these economies, was under pressure in 2018. Because of the tariff dispute with the US, export-driven business had to be shifted to the domestic market.”

Lower growth, though, is not only explained by trade tensions, according to Lu. “Manufacturing businesses rely heavily on financial funding and cash flow. However, in 2018, all banks tightened their lending in response to the central government’s financial de-risking campaign.”

Lu continued: “The squeeze on bank lending directly led to the breakdown of cashflow, and as a result many manufacturers were forced to suspend production last spring.”

At the same time manufacturers dealt with higher costs and tighter lending, they also faced increasing competition from emerging investment hotspots elsewhere in Asia. Daisy Zang, Manager of Asian Outbound Investment at Dezan Shira & Associates, observed, “Southeast Asian countries pose serious competition in terms of manufacturing capacity. And this was already increasingly the case before China was confronted with new macro-economic risks in 2018.”

Zang listed countries like Vietnam, Cambodia, the Philippines, and India as popular alternatives for investment. “A lot of investment in these countries is coming from China itself,” Zang said. “China has become the third largest foreign investor in Vietnam, attracted by lower land and labor costs and being sheltered from the trade war.”

While the economies of the PRD and YRD have many similarities, they also have important differences – some of which may explain why the YRD was more successful in reaching its growth targets. Alberto Vettoretti, Managing Partner of Dezan Shira & Associates, said, “Due to the fact that Guangdong still boasts so many manufacturers and exporters, external shocks are felt there more than in other locations.”

Vettoretti elaborated: “The province is at a crossroads, as Guangdong does not attract the tech and service companies it wishes to have, given the abundance of alternatives in Asia and the fact that many would rather locate in Jiangsu and Zhejiang, and still has a lot of ‘old’ businesses that are struggling to make ends meet.”

What does lower growth mean for businesses in China?

GDP growth can paint a broad picture of the health of an economy, but Lu and Vettoretti both emphasized that it is far from the most important indicator for businesses on the ground. “It is now a general trend of economic development in China – the growth is slowing down but the quality and value of the growth is upgraded,” Lu said.

With China’s economy in transition, Vettoretti said that GDP growth is no longer the most important indicator to judge performance. “China knows it has to change its economic model – even more so in Guangdong province – so slower growth is acceptable,” he said. “They know that they can no longer rely on low-value, polluting industries, and the transition process started a long time ago. Some traditional sectors are still thriving by adopting technology, going lean, and roboticizing.”

Much of the damage from the slowdown is being felt in specific sectors, Vettoretti noted, while others continue to grow at a strong rate. Medical, new materials, education, automotive suppliers, AI, and Asia-bound tech are some of the industries that Vettoretti sees succeeding on the back of strong local and regional demand.

Still, he cautioned that even where sales are healthy, “margins across industries are trending down.” Lu said that this trend can be seen using indicators outside of official growth statistics. “In 2018, more than 10 listed companies in Guangdong reported financial losses of over RMB 1 billion,” she said.

In response to slowing growth, Vettoretti said regional governments across China are introducing an array of policies to lower costs for businesses, such as energy cost subsidies, social security cost reductions, and industry-specific incentives. And in the longer term, the PRD and YRD’s ambitious regional integration plans could spring new life into the economies of both areas.

Despite government support, however, Vettoretti cautioned that ultimately businesses must adapt to be successful in the long-run amid China’s changing economic landscape. “Businesses need to become leaner and cut unnecessary costs, and restructure where they need to. As margins are shrinking, many businesses are embracing a China+1 strategy to both lower costs and risk exposure.”

The PRD and YRD’s struggles to hit their growth targets simultaneously show where China’s economy is struggling and where it is evolving. As two of China’s most developed regions, the PRD and YRD are faced with the difficult task of shedding the traditional parts of their economies that have become untenable. Yet, the maturity and complexity of these economies may also make them the best-positioned regional economies in China to transition to the next stage of economic development – one driven by services, technology, and efficiency.

Although GDP growth in and of itself may not be the most accurate statistic to describe opportunities for foreign investment, slower growth is a reality of China’s economy in transition. “Guangdong has always been amongst the first provinces to face the brunt of economic difficulties given the nature of the region,” Vettoretti observed. “But it has also been the first at engineering new ways around this.”

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Dalian, Beijing, Shanghai, Guangzhou, Shenzhen, and Hong Kong. Readers may write china@dezshira.com for more support on doing business in China.

- Previous Article China’s Middle Class in 5 Simple Questions

- Next Article China’s Machinery Industry: Structural Reforms Bring New Incentives, Tax Breaks