China FDI and Foreign Trade Recovers After COVID – May 2022 Data

China FDI and trade data from May 2022 indicate a slight recovery from a considerable slowdown in previous months due to the impact of COVID-19 restrictions. The higher growth rates are a positive sign, but an uncertain outlook and weak demand may weigh on growth through the rest of the year. We break down the May data and discuss the measures China is taking to stabilize foreign trade and investment.

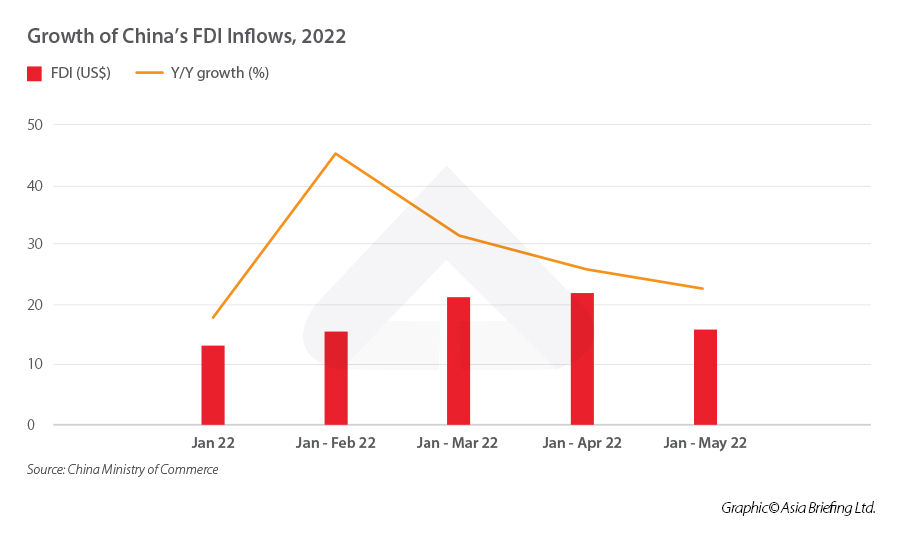

China’s Ministry of Commerce (MOFCOM) has released the foreign direct investment (FDI) for the period from January to May 2022, showing a slight dip in growth from the previous month but maintaining an overall strong growth trajectory.

The latest FDI data reflects the impact of the recent COVID-19 outbreaks across China and the related lockdowns on restrictions on movement that have been implemented in several cities across the country this year, most notably Shanghai and Beijing.

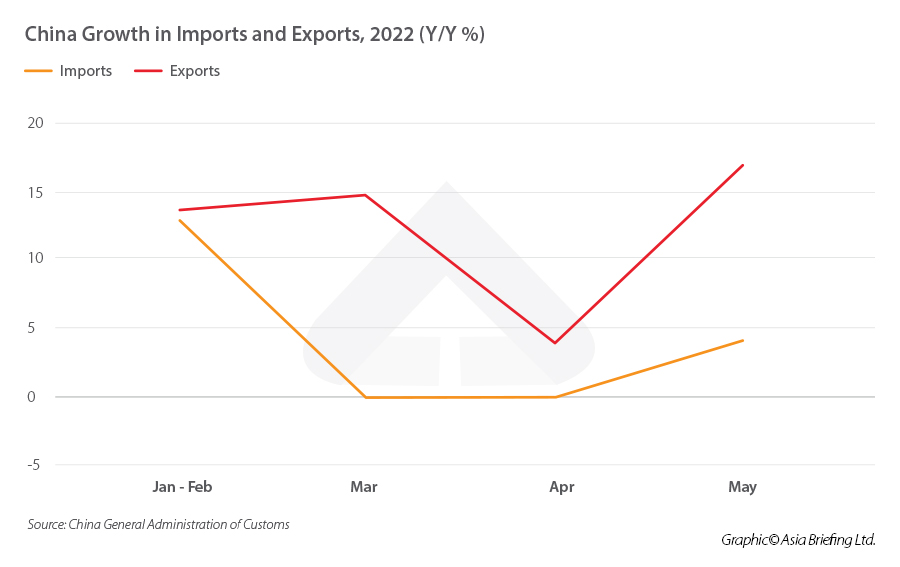

Meanwhile, trade data for May released by China’s General Administration of Customs show a recovery of imports and exports after the lifting of strict COVID-19 lockdowns in parts of the country.

In this article, we look at the latest FDI data and discuss how China plans to stabilize foreign trade and investment in the aftermath of COVID-19 restrictions.

FDI in May 2022

The actual use of foreign capital in the period from January to May reached RMB 564.2 billion, a year-on-year increase of 17.3 percent. In dollar terms, it reached US$87.8 billion, up 22.6 percent year-on-year.

According to the notice posted on the central government website, the slight slowdown in growth in May compared to April is due to the impact of COVID-19 containment measures imposed in multiple areas of the country, but this impact is likely to be short-term.

MOFCOM did not release data on the proportion of FDI by source country, but showed significant growth in FDI from South Korea, the US, and Germany:

- 52.8 percent growth in FDI inflow from South Korea

- 27.1 percent growth in FDI inflow from the US

- 21.4 percent growth in FDI inflow from Germany

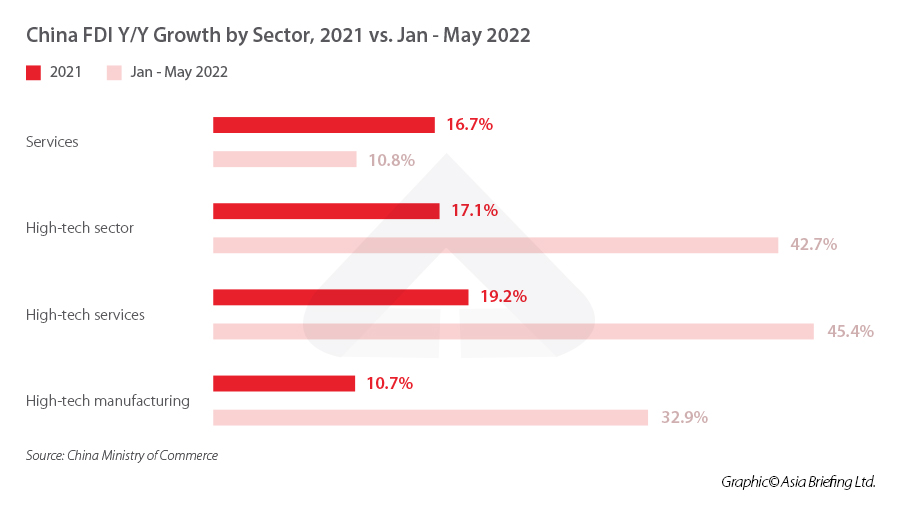

In addition, the data showed a considerable growth rate of FDI inflow into high-tech sectors. The FDI growth rate in the overall high-tech industry, high-tech manufacturing, and high-tech services all outpaced the average annual growth rate in 2021. FDI growth in the services sector was slower than the 2021 average of 16.7 percent, growing 10.8 percent in May to reach RMB 42.3 billion (US$6.3 billion).

The strong FDI growth rates in high-tech sectors are closely related to policies for high-tech enterprises in various regions, according to Zhu Keli, executive director of the China Information Association and president of the New Economic Research Institute.

Trade data in May 2022

China’s foreign trade is showing signs of recovery. In May, imports-exports grew 11.1 percent year-on-year to reach US$537.7 billion. Exports beat expectations to grow 16.1 percent year-on-year, reaching US$308.2 billion, up from a considerable slowdown of 3.9 percent in April. Meanwhile, imports reached US$229.5 billion, up 4.1 percent, recovering from zero growth in April.

Trade with China’s main trading partners, such as ASEAN and the EU, also continued to see positive growth.

ASEAN remained China’s largest trading partner, accounting for 14.8 percent of trade, growing 10.2 percent year-on-year, up from 7.2 percent in the period from January to April. The EU, China’s second-largest trading partner, accounted for 13.7 percent of trade and grew 8.8 percent year-on-year, up from 6.8 percent in the period from January to April.

Trade with the US, China’s third-largest trading partner, grew 12.2 percent in the period from January to May, up from 10.9 percent in the period from January to April.

In addition, trade with countries along the “Belt and Road” – central Asian countries – grew 16.8 percent year-on-year to reach RMB 5.11 trillion (US$760.2 billion) in the first five months of the year.

The growth of trade in May indicates that the country is back on track to recovery following the impact of pandemic-related lockdowns that caused the slump in April. A major driver of the growth may therefore be the ports and logistics chains playing catch-up with orders placed in earlier months.

It is also uncertain whether this momentum will carry on through the rest of the year. Demand for Chinese exports in overseas markets has cooled as many countries return to normalcy after the COVID-19 lockdowns and consumers spend more on services and less on goods.

In addition, high inflation in many developed countries is making overseas consumers less likely to spend on Chinese imports.

The slow import growth also indicates weak domestic demand. Uncertainty stemming from a slowing economy and sporadic COVID-19 outbreaks has led to a dip in consumption as consumers to tighten their purse strings.

Measures for stabilizing foreign trade and investment in 2022

China’s policymakers have indicated that stabilizing foreign trade and investment will be an important task to boost economic growth in 2022.

China has already rolled out numerous stimulus measures in 2022 to boost the economy in the face of strict COVD-19 lockdowns, with a large portion of the support going to small businesses and companies in hard-hit industries.

On May 31, 2022, China’s State Council released a set of 33 measures, titled Policy Measure Package to Stabilize the Economy (“the policy package”). In addition to a broad range of COVID-19 relief and support measures for businesses, the policy package also proposes a number of measures for promoting major foreign investment projects and attracting more foreign investment.

For instance, the policy package calls for speeding up the revision of the Catalogue of Industries Encouraged for Foreign Investment. The draft 2022 edition of the catalogue increased the number of encouraged industries by 16 percent, signalling new opportunities for foreign investors. The deadline for public comment on the draft catalogue ended June 10.

The policy package also seeks to attract more foreign investment to high-tech fields, such as advanced manufacturing, technological innovation, and tech R&D, while also encouraging investment in less developed areas of the country, such as central, western, and northeastern regions.

At a routine State Council meeting on June 8, Premier Li Keqiang addressed some of the issues foreign-invested companies and companies engaged in foreign trade. He stated that it was necessary to further open up China’s markets as stabilizing foreign trade and investment “is closely related to the overall economic and employment situation”.

To this end, he called for increasing support in addition to implementing the existing support measures. To stabilize foreign trade, he called for:

- Providing tax rebates within three days for companies with good export tax rebate credit

- Expanding the import of high-quality products

- Increasing the efficiency of port loading, unloading, transshipment, and customs clearance

- Fully leveraging free trade agreements such as the Regional Comprehensive Economic Partnership (RCEP)

To attract more foreign investment, Li Keqiang proposed:

- Introducing stronger support policies for the transfer of processing trade to other regions (such as less-developed inland, central, and western regions).

- Expanding the Catalogue of Industries Encouraged for Foreign Investment in manufacturing in the central and western regions.

- Improve the normalized communication mechanism with foreign-funded enterprises, understand their difficulties in a timely manner, and support reasonable needs.

Key takeaways

FDI in China remains relatively strong despite the current challenges in the China market, and further support policies may incentivize more foreign investors to enter and expand into key markets within China. The release of the 2022 Catalogue of Industries Encouraged for Foreign Investment, which is expected to be finalized later this year, will also open up new opportunities for investment and may have a positive effect on future FDI numbers.

However, it remains unclear how these measures will weigh against consistent COVID-19 containment measures that may spook some foreign investors and companies, and in turn slow FDI inflow into China throughout the rest of the year.

With regard to foreign trade, stabilizing logistics chains and getting ports back to full capacity may continue to have a positive impact on trade numbers in the coming months. Facilitating and expediting customs procedures and setting up green channels for certain goods could also help to bump up trade in certain sectors, and support for traders could provide some much-needed short-term relief.

On the other hand, the decline in demand in both overseas and domestic markets may be harder to mitigate and will rely in part on the global macroeconomic outlook as well as the COVID-19 situation at home.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com. Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Investing in Shanghai: Industry, Economics, and Policy

- Next Article China’s Cloud Computing Market: Developments and Opportunities for Foreign Players