China Policy Change on Expatriates’ Tax-Exempt Benefits: Case Study and FAQs

Update: The government has extended the preferential IIT policy on foreigners’ fringe benefits to the end of 2023. Previously, from 2022, foreigners working in China were to lose some tax-free fringe benefits (for example, housing rental, children’s education costs, and language training costs). This would have resulted in larger tax liability for some higher-earning foreign workers. See Announcement No. 43 of 2021 of the Ministry of Finance and the State Administration of Taxation here.

Starting 2022, China will roll back tax exemption on some fringe benefits for some foreigners (including housing rental, children’s education costs, and language training costs), which is expected to result in larger tax liability for those earning higher incomes. This article with case studies and Q&As helps you understand how serious the tax burden could hike up in 2022 and how to prepare for the policy change.

According to the Notice on the Preferential Policy Convergence Problem (Cai Shui [2018] No.164), from January 1, 2022, foreign tax residents shall cease to enjoy tax exemption policies for fringe benefits* such as housing expense, language training expense, and children’s education fee and shall claim additional itemized deductions pursuant to the provisions.

The current policy and upcoming change

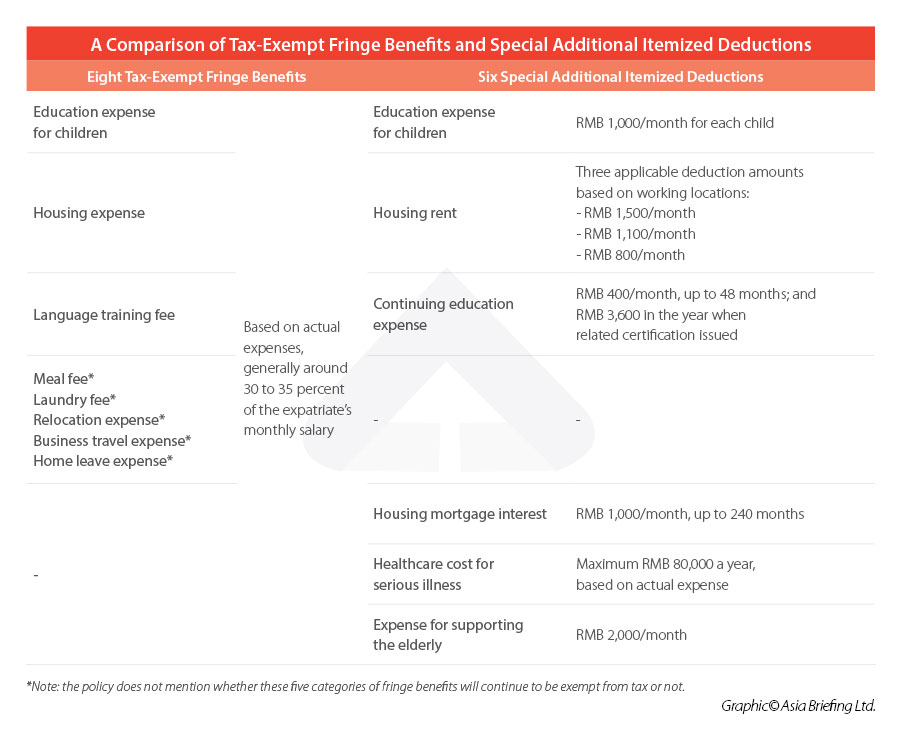

By far, foreigners working in China are able to enjoy the exemption of individual income tax (IIT) on the following eight categories of fringe benefits:

- Housing expense

- Education expense for children

- Language training expense

- Meal fee

- Laundry fee

- Relocation expense

- Business travel expense

- Home leave expense

However, starting from January 1, 2022, foreign tax residents will no longer be entitled to IIT exemption on the first three kinds of fringe benefits – namely, housing expense, education expense for children, and language training expense. As to the remaining five categories of benefits (meal fee, laundry fee, relocation expense, business travel expense, and home leave expense), the existing policy is not clear about whether they will continue to be tax-exempt.

Instead, from 2022, foreigners who are resident taxpayers in China will be able to enjoy the following six additional itemized deductions when they pay IIT on their comprehensive income, which are:

- Children’s education expenses

- Continuing education expenses

- Housing mortgage interest

- Housing rent

- Healthcare costs for serious illness

- Expenses for supporting the elderly

The difference between the expat fringe benefits and additional itemized deductions

As shown in the table above, the three expiring expats’ tax-exempt fringe benefits overlap with some additional itemized deductions.

While expats will no longer enjoy tax exemption on education expenses for children, housing expenses, and language training fee, correspondingly, they may be able to enjoy pre-tax deductions on education expense for children (RMB 1,000/month for each child), housing rent (RMB 800 to RMB 1,500/month, depending on the city), and continuing education expense (RMB 400/month for degree continuing education, up to 48 months for the same degree, or RMB3,600 for a qualification certificate for skilled personnel and technicians).

The biggest difference between the two policies is that expatriates’ tax-exempt fringe benefits can be fully deducted based on the actual cost of each expenditure, provided it is a “reasonable” amount (the “reasonable amount” is judged based on the local living standard, consumption level, market price, etc.) and accompanied by a corresponding invoice or other proof of payment. In practice, a proportion below around 30 to 35 percent of the expat’s monthly salary is regarded as “reasonable” by Chinese tax authorities.

However, most additional itemized deductions (except for healthcare costs which is deducted based on actual expense with a cap at RMB 80,000 a year) are deducted based on a standard basis – namely on a fixed amount.

For instance, the additional itemized deduction standard for children’s education fee is RMB 1,000 a child per month – this can be a much smaller amount than the foreigner’s actual expenses for children’s education (for example, in China’s first-tier cities like Beijing and Shanghai, the average annual education fee of an international school for a kid is about RMB 200,000 to RMB 300,000).

Thus, for many expatriates who have a higher income and level of expense, the tax-exempt fringe benefits are considered more beneficial than the pre-tax additional itemized deductions.

Case studies

Case 1

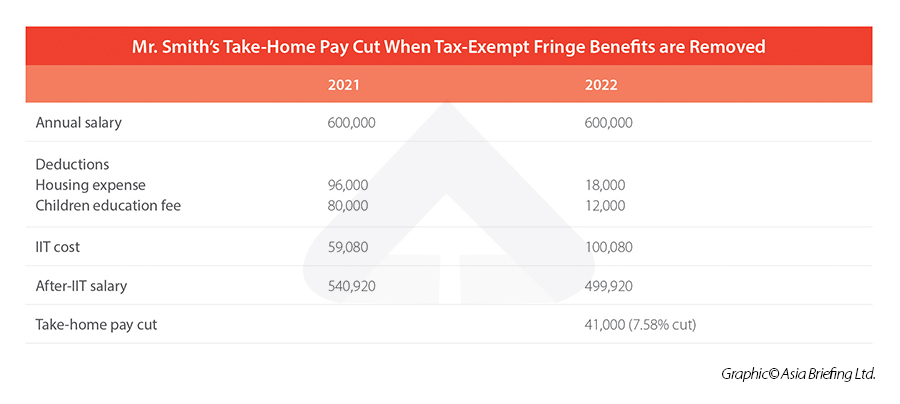

Mr. Smith is a sales manager at a pharmaceutical company in Shanghai. He rents an apartment for RMB 8,000 a month and pays an international school fee of RMB 80,000 a year for his kid. In 2021, he was able to take full deductions for both expenses before tax.

However, starting from 2022, as the tax exemption policy on foreign tax residents’ fringe benefits is abolished, Mr. Smith, who is a tax resident in China, has to choose to deduct a fixed amount of his rent and children’s education expenses before paying IIT.

Assuming Mr. Smith is not subject to any other pre-tax deductions, he should be upset to see that he will bear an extra IIT of about RMB 41,000/year from 2022, which means a 7.58 percent cut to his net salary (see calculation above).

Case 2

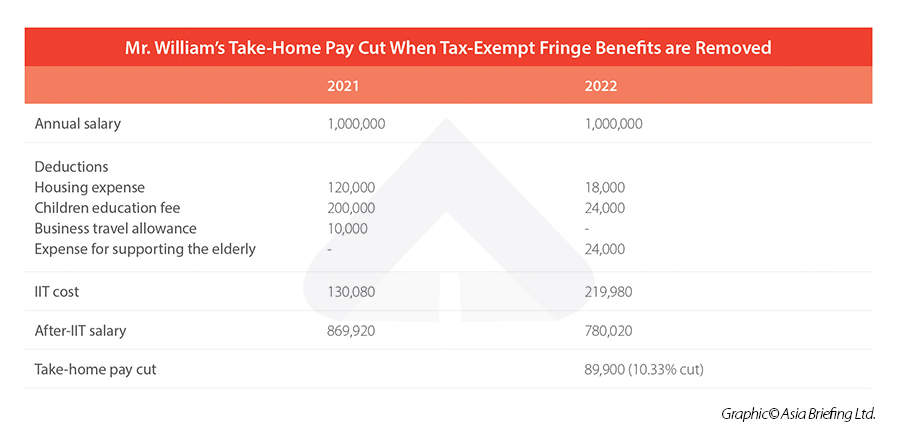

Mr. William is a senior executive of a tech company in Beijing. He rents an apartment for RMB 10,000 a month, pays international school tuition of RMB 200,000 a year for his two kids, and receives a business travel allowance of RMB 10,000 every year. In 2021, Mr. William was able to fully deduct the three fringe benefits from his taxable income.

However, starting from 2022, with the cancellation of foreign tax residents’ tax-free fringe benefits, Mr. William, who is a China tax resident and whose parents are both in their 60s, choose to deduct a fixed amount of his rent, children’s education expenses, and expenses for supporting the elderly before tax.

Assuming business travel expenses are not tax-exempt next year (though the policy is pending) and Mr. William is not subject to any other deductions, he should be astonished to find that he would pay an additional RMB 89,900 in income tax in 2022. That would mean a 10.33 percent cut in his net salary (see calculations above).

Frequently asked questions on the IIT policy change

Q: Will it affect staff stability?

A: Very likely. Some employees may find it hard to accept if they have to bear a lot of extra tax burden themselves. If the company does not take any action and does not show concern for the interests of employees, some foreign employees may consider leaving China, moving to companies that offer higher wages, or relocating to other regions of China, like the Guangdong-Hong Kong-Macao Greater Bay Area (GBA) and Hainan Free Trade Port (FTP), where they as foreign talents may be able to enjoy IIT incentives.

Q: When should companies start the preparation?

A: As soon as possible. Based on our experience, many firms have already begun making necessary preparations for the (possible) changes triggered by the tax regulations, including:

- Keeping track of the IIT policy change on expatriates’ tax-exempt fringe benefits.

- Re-examining the employment contract/assignment letter with foreign employees.

- Preparing for possible salary package restructure under different scenarios.

- Seeking tax professional’s advisory for possible tax planning for expats.

- Providing training for foreign employees, offering guidance so they understand the policy change, and explaining how to make use of the additional itemized deductions.

- Some companies have started considering assigning their foreign employees to the cities/areas where IIT subsidies or IIT preferential IIT policy are offered to high-end and urgently needed foreign talents, such as the GBA, Hainan FTP, etc.

- Some firms may consider hiring local Chinese talents if the net-take-home salary finally becomes less attractive to foreign employees from the employment cost perspective.

- Multinational corporates headquartered overseas may be more cautious when planning the dispatch of foreign personnel to China, given the possibly higher personnel costs.

Q: Should companies increase salary packages for their foreign employees?

It all depends on the salary term and IIT bearing method (which are usually specified in expats’ employment contract/assignment letter) as well as the HR strategy of the company.

If net salary term is adopted, the employer will surely be the one to bear the foreign employees’ IIT, and as a result, the labor cost of the company will inevitably increase. If gross salary term is used, then foreign employees will be the ones to absorb the higher tax burden. In this case, if the employer wants to retain the talents, it may consider increasing salary packages to make sure the net-take-home income of the employee will not change.

Q: What to note in the course of amending employment contracts?

Employers should bear in mind that any amendment to the employment contracts should be subject to mutual consent of both the employer and the employee and should be in a written form.

Given the pandemic, some employers may turn to electronic contracts. It should be noted, however, the selection of an appropriate electronic contract management platform (that is recognized by the government) is crucial.

In addition, when amending the contract, employers should pay special attention to wage terms, the legal procedures, and preserve evidence in case a dispute arises.

With a large professional team of tax, HR, and legal experts located throughout China, Dezan Shira & Associates has been providing professional human resources, payroll, tax, legal advisory services, and China individual income tax briefing for our clients. For more information and assistance on salary structure adjustment, labor contract modification, and staff re-allocation, you are welcome to consult our experts and email us at China@dezshira.com.

*Note: Please note that in this article, the “fringe benefits” refers to “benefits-in-kind” (BIK) – BIK is additional compensation, not included in the salary and wages, but paid on reimbursement and non-cash basis.

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China Green Cards: Guangzhou Mulls New Scheme for High-Level Talent

- Next Article Shanghai Extends Maternity Leave and Grants Childcare Leave