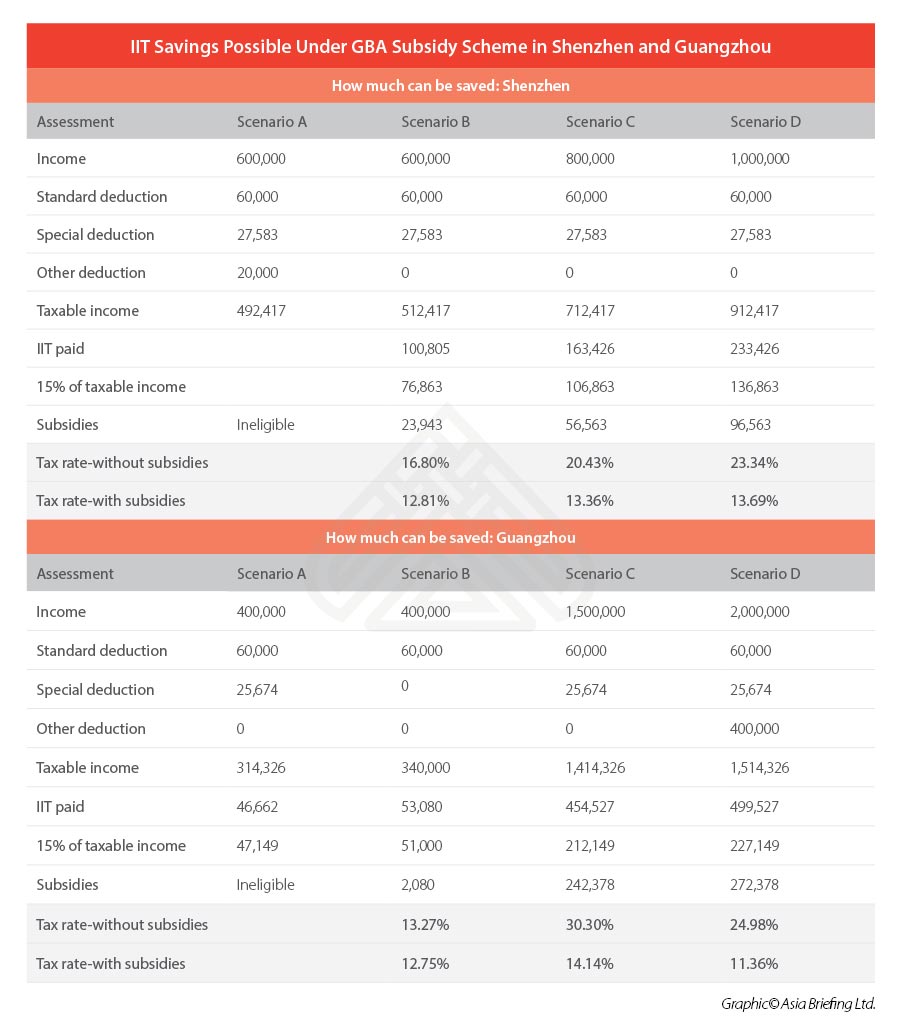

IIT Subsidies in the Greater Bay Area: How Much Can be Saved

By Karen Huang, Associate, PAY, Dezan Shira & Associates

China has rolled out income tax incentives to lure outstanding overseas talents to work in the Guangdong-HongKong-Macao Bay Area (GBA).

In March 2019, China’s Ministry of Finance (MOF) and State Taxation Administration (STA) jointly released the Circular about the Preferential Individual Income Tax (IIT) Policies in the Greater Bay Area (Cai Shui [2019] No.31).

Nine cities have started accepting applications. You can read our published article IIT Subsidies in China’s Greater Bay Area: You Can File Your Applications Now to check your qualification.

You will find how much can be saved and opportunities for individual taxpayers in the GBA in this article.

How much can be saved from the GBA IIT policy?

Calculation of subsidy amount

Generally, to calculate the amount of subsidy, the formula is:

The subsidy amount = the amount of IIT paid in nine cities in 2019 – taxable income × 15%

Specifically, the subsidies will be calculated based on the following taxable individual income items, respectively, and will then be distributed in combination next year:

- Comprehensive Income, including:

– Income from wages and salaries;

– Income from labor compensation;

– Remuneration income; and

– Income from royalties; - Operating income; and

- Subsidized income from selected talent programs or talent projects.

You will find different scenarios in the following paragraphs. Assuming talents were working in Shenzhen or Guangzhou in 2019, how much can be saved?

Eligibility for IIT subsidies in Shenzhen and Guangzhou

Shenzhen rolled out an application guidance requiring foreigners to earn more than RMB 500,000 (US$71,530) taxable income. This is not applicable to the following types of talents:

- Permanent residents of Hong Kong or Macao;

- Mainland residents who have settled down in Hong Kong or Macao and had cancelled their mainland hukou/household registration;

- Hong Kong residents who came to Hong Kong through the Hong Kong entry scheme for talents, professionals, and entrepreneurs;

- Residents of Taiwan; and

- Overseas students and overseas Chinese who have obtained the right of long-term residence abroad.

Meanwhile, Guangzhou requires talents to earn more than RMB 300,000 (US$42,918) taxable income.

Below we present two tables – discussing four scenarios and how much income savings can be achieved under the IIT subsidy scheme.

Assumptions for IIT calculation examples

The scenarios presented above assumes the following facts about the applicants:

- That they are eligible to this policy and are all foreigners.

- That they have lived in mainland China for no less than 183 days in 2019. *

- That they have received a bonus in 2019 and they have chosen to combine their bonus with basic salary to calculate IIT.

- That they have paid their IIT by themselves.

- That they did not earn other income in 2019 and only received income from wages and salaries.

- That they enjoyed and declared local social insurance in 2019 – except for Scenario B in Guangzhou. **

- In Scenario D – Guangzhou table, it is assumed that the applicant declared the amount of RMB 400,000 (US$57,224) deduction from housing allowance, children education fee, and language class fee in 2019.

* The method of IIT calculation is quite different between tax residents and non-tax residents. A foreign individual will be considered as a China tax resident if the individual lives in mainland China for no less than 183 days during a tax year. As a China tax resident, the taxable income amount of consolidated income shall be the balance after deduction of RMB 60,000 (US$8,584), as well as special deductions, special additional deductions, and other deductions determined pursuant to the law, from the income amount of each tax year.

** The amount of social insurance received by the individual can be deducted when calculating the IIT for China tax residents. The amount of social insurance is different from city to city, but there is an upper imit. The amount showed in the calculation above is based on high-income employees. In Scenario A – Shenzhen table, it is assumed that the applicant declared rent deduction of RMB 20,000 (US$2,861) in 2019.

Calculation observations and analysis

From the above brief calculation, it shows that the tax rate is much lower under this policy. The tax rate will not exceed 15 percent for most of the cases under this policy.

Generally speaking, Chinese IIT rate is high when compared to many countries and regions. The cap of the IIT rate is at 45 percent in China.

In practice, some Chinese employers choose to bear IIT by themselves in case of losing net income when hiring overseas talents.

If employers help overseas talents with getting subsidies, they will be able to reduce the cost of hiring overseas talents. Employers will have more opportunities to negotiate how they will allocate IIT between the employees and themselves.

Further, the examples above demonstrate that there are significant variances in the amount that an applicant can save, highlighting the following key points:

- The taxable income is affected by the deduction amount.

When comparing Scenario A with Scenario B in Shenzhen, applicants in Scenario B made rent deductions whereas Scenario A had no deductions. Scenario B applicant in Shenzhen gets RMB 23,943 (US$3,426) where Scenario A applicant gets nothing even though they earned equal gross salary.

This difference can be verified by comparing Scenario A with Scenario B in Guangzhou. In Scenario A in Guangzhou, there is no need to apply for subsidies as 15% of taxable income in this instance is higher than what had originally been paid in 2019 and therefore the applicant will not be eligible for the subsidy here.

- A reasonable salary breakdown and IIT planning is helpful to save tax.

Comparing Scenario C with Scenario D in Guangzhou, applicant under Scenario D broke down the gross salary into basic salary and allowance. Thus, Scenario D will benefit from a lower tax rate than Scenario C in Guangzhou even though Scenario D earned more.

Where Dezan Shira & Associates can help

For further assistance with calculating your foreign employee’s IIT, how to apply for a subsidy, or practical advice about deriving solutions on human resource arrangement in GBA, please email us at China@dezshira.com.

We can provide the following services for business operating in the GBA in China:

- Advisory services

We can help you analyze whether these policies apply to you and answer further inquires.

- Identify qualification

We can help to identify qualification.

- Application support

We can help you prepare required documents and contact local departments. We are familiar with all kinds of applications and can assist you with avoiding obstacles when applying for subsidies.

- Payroll breakdown and IIT planning

We can assess how to combine different eligible beneficial policies to maximize net income, and determine how to allocate allowance, bonus, basic salary, etc. when you are entitled to IIT subsidies in the Greater Bay Area. For example, during the period from January 1, 2019 to December 31, 2021, a foreign individual may choose to claim special additional deductions for individual income tax, or choose to enjoy tax exemption policies for subsidies and allowances, such as housing allowance, language class fees, children education fee etc. We can assess how to allocate allowance, bonus, basic salary, etc. when you are entitled to IIT subsidies in the Greater Bay Area.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Company Chops in China: What Are They and How to Use Them

- Next Article How the Tax System is Organized in China