China Infrastructure Investment in 2022 – Can it Stimulate Economic Growth?

China infrastructure investment has historically been a key driver of economic growth. In the face of a slowing economy, the government is now hoping infrastructure development can continue to spur growth as it has in the past, despite a rapid deceleration in investment growth over the past decade and the dual priorities of increasing spending and reducing government debt. As the central government holds tight reins on monetary and fiscal policy, financing will mainly go to sustainable infrastructure projects that can help secure the country’s future, such as digitalization, transport, affordable housing, and public sanitation.

Infrastructure spending has had a huge role to play in China’s meteoric economic rise over the past three decades. From laying hundreds and thousands of miles of railway tracks to building record-breaking skyscrapers, an eagerness to provide jobs and improve the quality of life for the population led to a construction boom that has continued to this day.

Beijing has historically leaned heavily on local governments to invest in infrastructure to shore up growth and ensure employment in their jurisdictions. Now, on the back of slowing growth in the fourth quarter of 2021, the country is once again turning to infrastructure spending to stimulate the economy at the beginning of 2022. The focus of investment, however, will be much narrower than in the past, with less rampant investment in speculative and unsustainable projects.

In this article, we look at China’s latest fiscal policies to promote infrastructure spending and the industries that will likely receive a large proportion of the funding in 2022.

Overview of China’s infrastructure investment

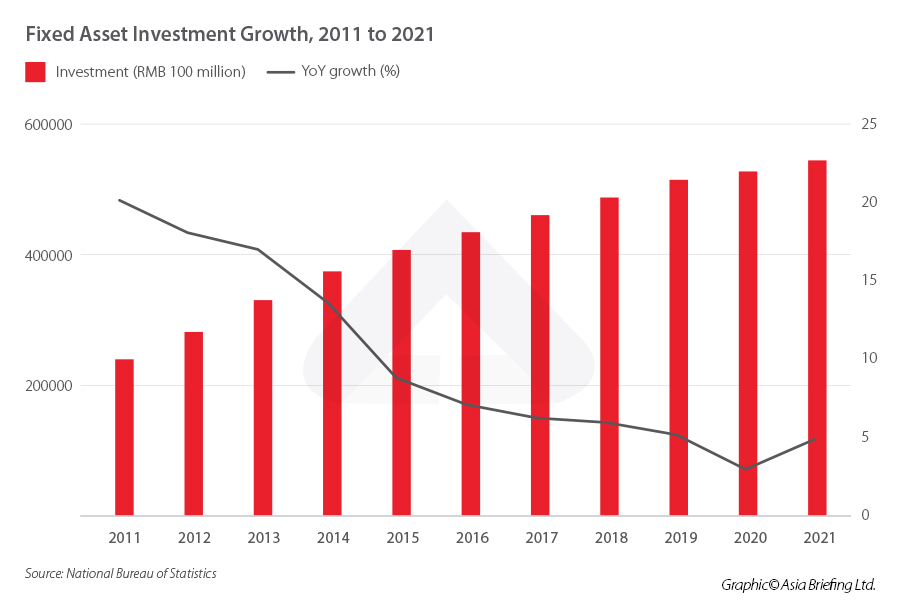

Fixed assets investment grew by 4.9 percent in 2021, up from 2.9 percent growth in 2020 but slower than the 5.1 percent growth in 2019.

Although overall investment in infrastructure has continued to rise over the past decade, growth has slowed dramatically. This is in large part due to increased restrictions on local government debt and tighter regulations on the types of projects that governments can fund (that is, requirements for projects to be commercially viable and able to pay off debts). This has led to less borrowing by local governments and fewer eligible infrastructure projects for them to invest in.

At the same time, large-scale nation-wide infrastructure projects, such as the construction of high-speed railways and shantytown renovation that were highly successful in stimulating growth and providing jobs have largely wound down, with few other large-scale projects to replace them.

Property investment dragged the overall fixed asset investment growth in 2021 as the country faced a growing housing crisis that depressed house sales and land transfers. Real estate investment grew 4.4 percent in 2021, slowing from 7 percent in 2020.

Industry, meanwhile, experienced more positive results in 2021 with investment growing 11.4 percent, a drastic acceleration from just 0.1 percent growth in 2020. Among these, manufacturing saw the largest uptick, with investment growing 13.5 percent year-over-year, up from a 2.2 percent decline in 2020. Mining grew by 10.9 percent, up from 14.1 percent decline in 2020, while investment in electricity, heat, gas, and water production and supply increased by just 1.1 percent, a significant slowdown from the 17.6 percent growth in 2020.

Stimulating infrastructure spending in 2022

Infrastructure investment in China remains a crucial driver of economic growth and a key tool for securing jobs. At the Central Economic Work Conference held in December 2021, an annual conference that sets the tone for economic policy for the following year, the government said it would “appropriately front-load infrastructure investment” for 2022. That means setting out fiscal and monetary policy before year-end to shore up investment and instigate growth at the beginning of 2022, particularly important as GDP growth slowed to just 4 percent in the fourth quarter of 2021.

However, local governments and developers likely cannot expect a drastic liberation of fiscal and monetary policy in 2022. The government has made economic stability a top priority for 2022 and repeatedly stressed the need for “a proactive fiscal policy and a prudent monetary policy.”

This means providing more targeted and sustainable fiscal incentives and support and maintaining a ‘reasonable’ level of liquidity without ‘flooding’ the market. Although the government may ease up on certain restrictions on debt and lending, it will only be for sectors that it deems important for China’s long-term goals. Restrictions on lending and spending on speculative, unsustainable, or commercially dubious projects will likely remain in place.

Funding infrastructure investment through SPBs

One of the main ways local governments can raise funds for infrastructure projects is by issuing special-purpose bonds (SPBs).

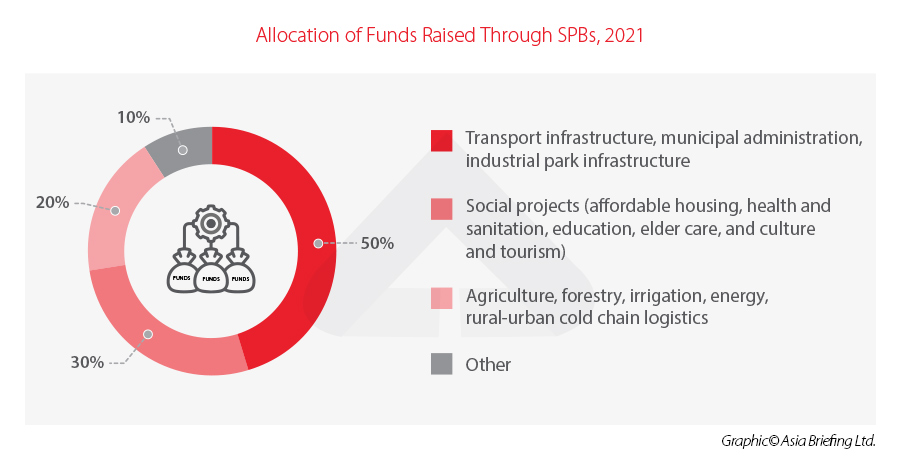

China allocated a quota of RMB 3.65 trillion (US$573 billion) in SPBs for local governments in 2021, of which 97 percent had been issued by December 15, 2021. All of the funds raised through the issuance of SPBs were used in “key areas determined by the Party Central Committee and the State Council”, according to a newsletter (link in Chinese) posted on the central government website.

Among the funds raised, about 50 percent was used for transport infrastructure, municipal administration, and industrial park infrastructure sectors. Another 30 percent was spent on social projects, such as affordable housing, health and sanitation, education, elder care, and culture and tourism, while another 20 percent was spent on agriculture, forestry, irrigation, energy, and rural-urban cold chain logistics, among other sectors.

At the end of 2021, China’s Ministry of Finance (MOF) pre-allocated RMB 1.46 trillion (US$229.6 billion) of the 2022 quota to be used in the first quarter, in the hopes that the extra liquidity would spur investment at the beginning of the year, with higher quotas allocated to provinces and regions with higher capital needs.

According to data from financial services firm Zhongtai Securities, local governments issued a total of RMB 698.9 billion (US$109.9 billion) of bonds in January 2022, of which RMB 448.4 billion (US$70.5 billion) were new SPBs. This is a 93 percent increase from the same period in 2021 and puts local governments on track to hit bond targets for the first quarter of 2022.

The government has urged local governments to spend the funds raised through SPBs on projects that are “underway or that can be started as soon as possible, in order to create more physical workload as soon as possible.”

Will SPBs be enough to ensure economic growth?

Ensuring enough liquidity for local governments to effectively spur spending and economic growth is still not a certainty. As discussed by Reuters, finances raised through SPBs may not be able to make up for the drastic fall in land transfers, another major source of funding for local governments. According to conservative estimates by Reuters, local governments’ revenue from land transfers may drop by RMB 2 to 3 trillion (US$314.5 billion to US$471.8 billion) in 2022, meaning that SPBs alone are unlikely to fill the funding gap.

At the same time, some of the local government bonds have been issued to refinance the so-called “hidden debt” accumulated using local government financing vehicles (LGFVs) – debt that is not included on official balance sheets. We discussed the rise of LGFVs and local governments’ reliance on land transfers in more detail in our article on the housing market.

Although the proportion of bonds issued for the purpose of refinancing hidden debt has dropped significantly from the previous year (about 16.5 percent (RMB 115.2 billion (US$18.1 billion)) of the bonds issued in January 2022 were for refinancing, versus almost 100 percent in January 2021), it is still not clear whether bonds issued throughout the rest of 2022 will primarily be new bonds or refinancing bonds. As the Chinese government strives to meet the dual targets of stimulating infrastructure spending and reducing local government debt, some regions may find themselves stuck between a rock and a hard place and unable to make significant progress on infrastructure development.

Target industries for infrastructure spending

“New infrastructure”

A key buzzword that many may have heard coming from the Chinese state in 2020 and 2021 is “new infrastructure” (although the term was first coined in 2018).

New infrastructure is broadly divided into three categories:

- Innovative infrastructure: Infrastructure with public benefits, which support science and technology, science and education, and industrial technology innovation, including R&D institutions, research infrastructure, and innovation-focused industrial parks.

- Information infrastructure: Technology that increases productivity, speed, accuracy, and breadth of information collected, stored, disseminated, and analyzed, including 5G, Internet of Things (IoT), industrial internet, artificial intelligence (AI), cloud computing, blockchain, data centers, and internet communication network infrastructure.

- Integrated infrastructure: Infrastructure that supports the upgrade and transformation of traditional industries through the application of the internet, big data, AI, and other technologies. This includes constructing inter-city high-speed rail and inner-city rail systems, charging stations for electric vehicles (EVs), and ultra-high voltage (UHV) power transmission.

The development of new infrastructure is a core component of China’s 14th Five Year Plan (FYP), the country’s primary economic roadmap for the period between 2021 and 2025. The plan urges China to accelerate the building of new infrastructure in the years leading up to 2025, covering a wide range of industries, from gigabit fiber optics to space-based infrastructure.

Key tasks include:

- Building high-speed and efficient information infrastructure to enhance data perception, transmission, storage, and computing capabilities.

- Large-scale deployment of 5G networks, increasing 5G uptake to 56 percent, and laying the technological groundwork for the development of 6G.

- Promoting the upgrade of gigabit fiber-optic networks.

- Promoting the commercial deployment of Internet Protocol Version 6 (IPv6).

- Building a national integrated big data center system and several national hub nodes and big data center clusters, including E-level and 10E-level supercomputing centers.

- Comprehensive development of the Internet of Things (IoT) and building IoT access capability that supports the integration of fixed-mobile and broadband.

- Building a space-based infrastructure system with global coverage to improve communication, navigation, and remote sensing.

The government has also elaborated on the development of new infrastructure in numerous meetings and official documents since the release of the 14th FYP in March 2021. A State Council meeting chaired by Premier Li Keqiang in September 2021 discussed the implementation of the 14th FYP for new infrastructure industries. The meeting further mentioned the need for:

- Improving digitalization of agriculture.

- Building welfare-oriented infrastructure such as telemedicine and online education capabilities.

The government has also specifically mentioned the role of both private and foreign capital in the development of new infrastructure, stating that it “encourages diversified investment, promotes open cooperation, and supports private and foreign capital to participate in the investment and operation of new infrastructure.”

Expanding transport infrastructure

China’s high-speed rail network has previously been a key driver of economic growth and a major target of local government spending.

The extensive plan includes details for expanding China’s railway networks, including intercity rail and high-speed rail, highways, and passenger airports.

The 2025 transport infrastructure targets include:

- Expanding the railway operating mileage by 19,000 kilometers, of which 12,000 kilometers will be high-speed rail.

- Expanding mileage of public roads by 302,000 kilometers, of which 29,000 kilometers will be expressways.

- Building at least 29 new passenger airports.

- Expanding urban transit rail operating mileage by 3,400 kilometers.

In addition, the plan calls for increasing the coverage of access rail links to key transport and logistics hubs, as well as rural villages (those under government jurisdiction). This includes expanding the coverage of access rail links to coastal ports to at least 70 percent and airport hubs to at least 80 percent and increasing the access rate of express delivery to rural villages to at least 90 percent.

The plan also outlines goals for the expansion of smart and green energy transport. Concrete targets include expanding the application rate of China’s Beidou satellite system in “key areas” (key operating vehicles, postal express transport vehicles, passenger ships, and dangerous goods ships that should be equipped with onboard equipment with satellite positioning functions) to over 95 percent and for new energy vehicles to make up 72 percent of public transport vehicles in urban areas.

Social welfare infrastructure

China’s infrastructure spending goals for 2022 will inevitably tie into another core policy to come out of 2021 – common prosperity.

One such area is the construction of affordable rental housing. In February 2022, the government removed caps on loans to finance affordable rental housing. The move hits multiple targets with one policy: it eases restrictions on the struggling property sector, stimulates local infrastructure spending, and offers a housing solution for low-income households at a time when property prices remain exorbitantly high.

The measure appears to have already garnered positive results, with the city of Chengdu, Sichuan province announcing in February 2022 that, with the help of banks, it would invest RMB 150 billion (US$23.6 billion) to “build, reconstruct, renovate, and revitalize” 300,000 affordable rental homes by 2025, with around 60,000 to be completed by the end of 2022.

Environmental infrastructure

On February 9, 2022, China’s State Council released a Circular urging local governments and industries to accelerate the construction of urban environmental infrastructure (link in Chinese).

Environmental infrastructure refers to infrastructure that contributes to building a system integrating sewage, garbage, solid waste, hazardous waste, medical waste treatment and disposal facilities, and the requisite monitoring and supervision capabilities.

The circular specifically calls for accelerating construction in areas that lack such infrastructure, such as smaller towns and villages.

The circular sets tangible 2025 targets for the construction of environmental infrastructure. 2025 targets include:

- Increasing the sewage treatment capacity and expanding sewage collection pipelines, especially in smaller counties.

- Increasing domestic waste sorting and transport capacity, daily incineration capacity, and solid waste disposal capacity and utilization rate.

- Making up for shortcomings in hazardous and medical waste collection and treatment.

To support the construction of the infrastructure required to achieve these targets, the circular proposes a number of mechanisms and incentive measures. These include:

- Improving the pricing system of waste disposal, sewage treatment, and reclaimed water distribution by adopting market-oriented pricing where appropriate, establishing a dynamic pricing system, or enabling stakeholders to negotiate prices with the government.

- Increasing supportive fiscal, tax, and financial policies, including central budget allocation for eligible projects and inclusion of environment infrastructure in the eligible projects for financing through SPBs, encouraging financial institutes to use various financial tools to finance projects, and encouraging qualified projects to carry out pilot projects in real estate investment trusts (REITs).

Will infrastructure spending lead to economic growth?

We have already seen some promising signs of increased infrastructure spending at the beginning of 2022. The fact that local governments have issued RMB 448.4 billion (US$70.5 billion) in new debt – exactly RMB 448.4 billion more than one year ago – is the surest sign that more money will be spent on local infrastructure in the coming months than last year.

Central government support and stimulus for spending on public infrastructure projects, such as railways, logistic chains, and social housing, also has a good chance of boosting local economies and further raising the standard of living for many people.

It is also possible that the government will continue to ease debt caps for local governments and property developers, which would further help increase investment in infrastructure projects.

However, it is yet uncertain whether the reversal of previous restrictive policies will be enough to drastically change the course of China’s slowing economy. The International Monetary Fund (IMF) has set China’s GDP forecast at 4.4 percent, considerably lower than the 8.1 percent growth seen in 2021 and just a little above the 4 percent growth in the fourth quarter.

Looking beyond 2022, one of the main long-term trends we are likely to see in infrastructure investment is the continued transition to investment in high-tech and advanced infrastructure.

The motive behind this is not just to build China into a technological powerhouse, it is also a long-term strategic consideration. As has been well documented, China is in the midst of a drastic demographic change as birth rates plummet and the population gets older and older. This means the country will not be able to continue to rely on traditional growth drivers – such as a large and efficient workforce – and will need to pivot to new areas for continued economic success.

This means moving the country’s industries higher up the value chain and increasingly relying on machines and advanced technology for labor. Achieving this will require a huge amount of investment and offers a host of new opportunities for growth.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Understanding China’s New Rules on Import and Export Food Safety

- Next Article Come convincere un fornitore a minimizzare i difetti e a fare il primo passo?