China Lowers Corporate Income Tax Liability for Small and Low-Profit Enterprises

On April 7, 2021, the State Taxation Administration (STA) released the STA Announcement [2021] No.8 and clarified a preferential corporate income tax (CIT) policy for small and low-profit enterprises and individual businesses.

The roll-out of the Announcement follows the proposal by the 2021 Government Work Report to halve the income tax of small and micro enterprises and self-employed individuals on their annual taxable income below RMB 1 million (approx. US$154,000) on the basis of the existing preferential policy.

Current preferential CIT policy for small and low-profit enterprises

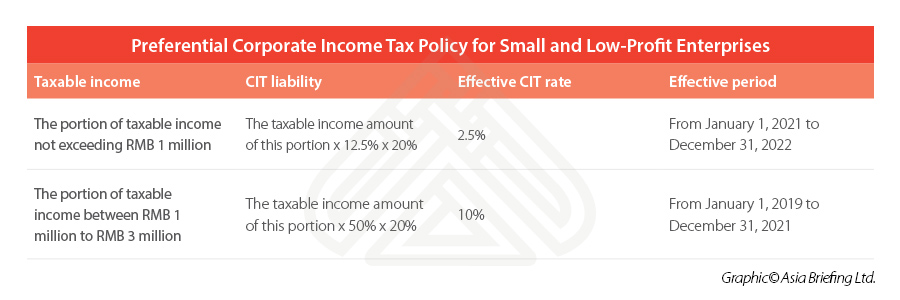

According to the STA Announcement [2019] No.13, from January 1, 2019 to December 31, 2021, small and low-profit enterprises can enjoy:

- a 20 percent CIT rate on 25 percent of their taxable income amount for the proportion of taxable income not exceeding RMB 1 million; and

- a 20 percent CIT rate on 50 percent of their taxable income amount of more than RMB 1 million but not exceeding RMB 3 million (approx. US$462,000).

Based on this existing policy, the newly announced STA Announcement [2021] No.8 further reduces the CIT burden of small and low-profit enterprises.

From January 1, 2021 to December 31, 2022, for the portion of taxable income not exceeding RMB 1 million, the amount of taxable income can be halved from 25 percent to 12.5 percent, and the CIT will be levied at 20 percent, for small and low-profit enterprises.

As a result, the effective CIT rate for the portion of taxable income not exceeding RMB 1 million will be reduced from five percent to only 2.5 percent.  Thus, this year with the two policies in effect, the CIT calculation formula for small and low-profit enterprises with annual taxable income between RMB 1 million to RMB 3 million should be:

Thus, this year with the two policies in effect, the CIT calculation formula for small and low-profit enterprises with annual taxable income between RMB 1 million to RMB 3 million should be:

CIT liability = RMB 1 million x 12.5% x 20% + (taxable income – RMB 1million) x 50% x 20%

Eligibility criteria for small and low-profit enterprises

Small and low-profit enterprises refer to enterprises engaged in industries that are not prohibited or restricted by the government, and at the same time meet the following conditions:

- The annual taxable income does not exceed RMB 3 million;

- The number of total employees does not exceed 300 persons; and

- The total assets do not exceed RMB 50 million (approx. US$7.7 million).

Staff headcount and the amount of the total assets shall be determined in accordance with the enterprise’s quarterly average figure for the year.

How to enjoy the tax relief policy?

Small and low-profit enterprises in China enjoy access to a simplified tax filing procedure as part of their preferential tax treatment; they only need to fill the relevant sections in the CIT return form when making repayment or annual settlement of CIT, without needing other filing requirements.

China Briefing will keep you updated on the most recent tax news from China. Our parent company, Dezan Shira & Associates, has an experienced team of tax accountants, lawyers, and ex-tax officials who can help your business on a wide spectrum of tax service areas across all major industries. For more information and assistance, please email us at China@dezshira.com.

About Us China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com. Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article How Can Foreigners Enter China Under the COVID-19 Travel Restrictions?

- Next Article Setting Up Your China Back Office: Cyber Security, Compliance Solutions