China Optimizes Prepayment of Individual Income Tax by Some Taxpayers

On December 4, 2020, China’s State Taxation Administration (STA) released the Announcement about Further Simplifying and Optimizing Individual Income Tax Prepayments by Some Taxpayers (STA Announcement [2020] No.19), in a move to reduce the tax return burden of some taxpayers and withholding agents.

From January 1, 2021, eligible taxpayers whose annual wage and salary income does not exceed RMB 60,000 (approx. US$9,000) on which individual income tax (IIT) is withheld and repaid by the same employer on a monthly basis within the preceding complete tax year – will not have to prepay IIT on months when their accumulative income of the current tax year is not higher than RMB 60,000. Instead, they are allowed to start paying the IIT from the month when their accumulative income exceeds RMB 60,000 to the end of the current tax year.

Who will be eligible for this new announcement?

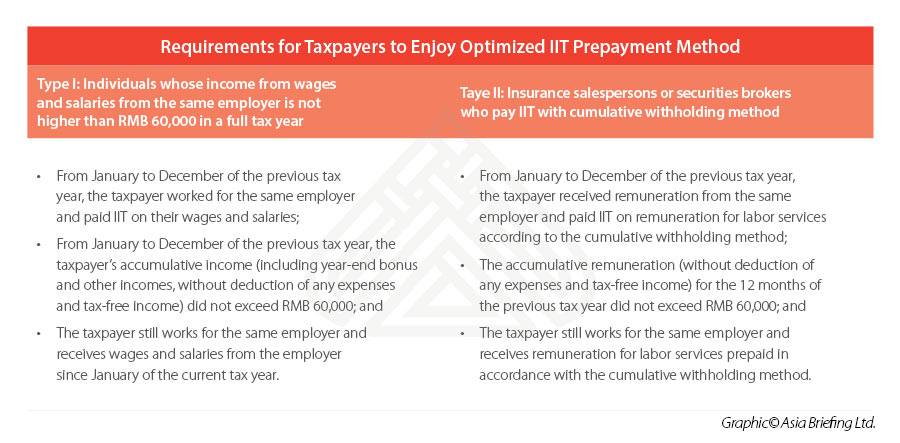

The STA Announcement [2020] No.19 will apply to two types of taxpayers:

- Individuals whose income from wages and salaries from the same employer is not higher than RMB 60,000 in a full tax year; and

- Insurance salespersons or securities brokers who pay IIT with cumulative withholding method.

Specifically, there are conditions that must be met at the same time for the two types of taxpayers to be eligible – see table below.

What is the new optimized IIT prepayment method?

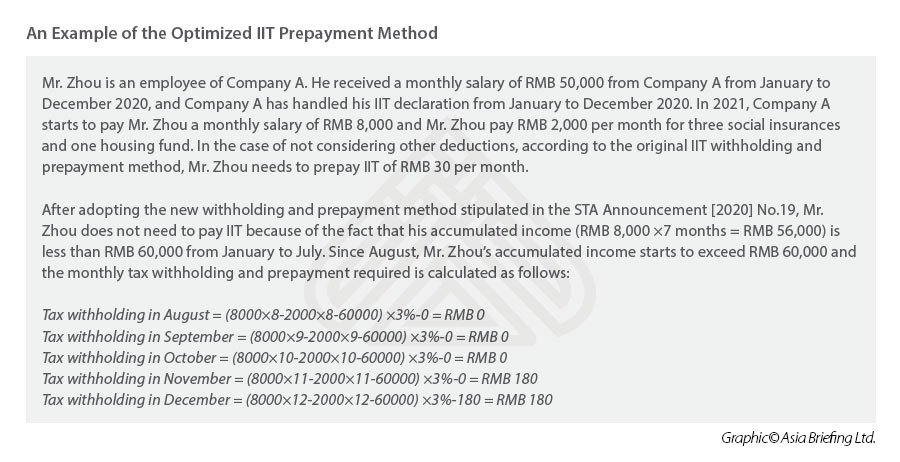

According to the announcement, from 2021, when the withholding agent calculates and withholds IIT of their eligible employees, the accumulative deduction of expenses shall be calculated and deducted directly from January on the basis of the annual amount of RMB 60,000.

That is, when the taxpayer’s accumulative income from January of the current tax year does not exceed RMB 60,000, they do not need to withhold or prepay IIT. In the month when their accumulative income exceeds RMB 60,000, the taxpayer can start to withhold and prepay IIT in that month and the following months within the year.

To be noted, under either situation, the withholding agent should still handle the withholding declaration of all employees in full amount, according to the provisions of the tax law.

How should a withholding agent handle IIT withholding declaration?

For the withholding agent using the Natural Person Electronic Taxation Bureau system (app or website) to declare IIT, when the withholding agent calculates and withholds employees’ IIT in January of the current tax year, the system will, based on the withholding declaration of the previous tax year, automatically summarize and suggest a list of possibly qualified employees.

The withholding agent can then, according to the actual condition, check and confirm the list, and withhold and prepay the IIT according to the optimized IIT repayment method.

For the withholding agent who chooses to physically declare IIT for their employees, they will need to judge and confirm the list of eligible taxpayers on their own, based on the withholding declaration of the previous tax year and the situation of the current tax year.

Then the withholding agent can state the wordings “declared for each month in the preceding year and the employee’s annual income does not exceed RMB 60,000” in the remark column of the corresponding taxpay in the “Declaration and Withholding Form for IIT” when they declare employees’ IIT.

DSA observation

As the STA Announcement [2020] No.19 is about to come into effect from the beginning of next year, it is advisable that the withhold agent should complete the verification of the withholding declaration in 2020 for the employees of the company and the individuals providing labor services to the company, and consider the possible situation in 2021, to confirm a list of the personnel who can be eligible for the optimized IIT repayment method in the STA Announcement [2020] No.19.

Dezan Shira & Associates’ experienced team of tax accountants, lawyers, and ex-tax officials can provide assistance on a wide spectrum of tax service areas, including ongoing tax compliance and reporting. For more information, please email us at Tax@dezshira.com or visit our website www.dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Shanghai Pudong New Area Pilots “One Integrated License”

- Next Article Suzhou City Profile: Investment Stronghold and Innovation Trailblazer