China Plus One Series: Indonesia’s Appeal to Foreign Investors in Asia

In the face of rising costs, a slowing economy, and an extended trade dispute with the US, foreign investors have increasingly turned to “China plus one” strategies to make their operations more efficient.

Put simply, a China plus one strategy involves complementing operations in China by setting up a production base in another country. A manufacturer may shift labor-intensive operations to another low-cost jurisdiction, while concentrating high value-added operations in China, where labor is skilled and reliable.

Since the beginning of the US-China trade war, Vietnam has perhaps been the primary beneficiary of the China plus one strategy. The country is an attractive destination for foreign investors thanks to its proximity to China, rapidly growing economy, and low labor costs.

However, despite Vietnam’s advantages, Indonesia may have the highest upside for foreign investors eyeing a long-term commitment. As the largest economy in ASEAN, Indonesia offers foreign investors tremendous growth potential, although short-term challenges remain.

Indonesia’s economy has long struggled to meet its immense potential. While Vietnam recorded a robust seven percent growth rate in 2019, Indonesia sputtered to an estimated 5.1 percent growth rate.

There is, however, strong reason for optimism. The country boasts an enormous labor pool, growing middle class, and a vast wealth of natural resources. Standard Chartered Bank projected Indonesia’s economy to grow from US$4.2 trillion in 2020 to US$10.1 trillion by 2030 to become the world’s fourth largest economy in terms of purchasing power parity.

For foreign investors looking to complement operations in China, Indonesia offers an immense market with substantial room for continued growth. Accordingly, we offer an overview of Indonesia’s business landscape for foreign investors exploring a China plus one solution.

Labor market

Indonesia has favorable conditions for labor-intensive manufacturing. Indonesia is the world’s fourth most populous country – with a population of over 272 million – offering foreign investors a vast labor pool. In contrast to China, which is rapidly aging, Indonesia’s demographics skew is young: the country’s median age is 29, and 60 percent of the population is under the age of 40.

Where Indonesia’s workforce struggles, however, is in its level of skills and education. Of Indonesia’s 128 million workers, only 55 million are skilled, meaning that many workers are unqualified for their roles and productivity is low. As a result of this deficiency, the Research, Technology and Higher Education Ministry projects Indonesia to require an additional 113 million skilled workers by 2030.

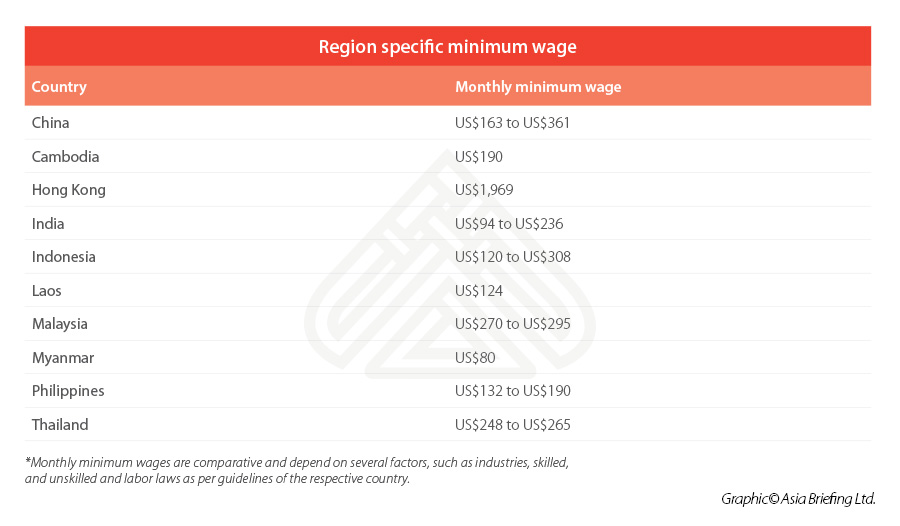

Wages in Indonesia are fairly low, though there is considerable variation across regions. Minimum wages are the highest in the Special Capital Region of Jakarta, Indonesia’s capital and largest city, at IDR 4,200,000 (US$308) per month.

At the low end, minimum wages in the Special Region of Yogyakarta are IDR 1,705,000 (US$125). As of the third quarter of 2019, average monthly wages in the manufacturing sector across Indonesia stood at about IDR 2,704,000 (US$199), according to Trading Economics.

In contrast, minimum wages in China range from RMB 1,210 (US$162) per month to RMB 2,480 (US$359). In 2018, the average wage in the manufacturing sector was RMB 6,007 (US$870) per month. In Vietnam, minimum wages range from VND 3,070,000 (US$132) to VND 4,420,000 (US$190) per month.

In addition to wages, employers in Indonesia are required to make social security (healthcare and pension) contributions for their employees. In total, employer contributions range from 10.24 to 11.74 percent of the employee’s monthly salary, depending on the industry.

Taxation

Indonesia has a standard corporate income tax (CIT) rate of 25 percent, which is slightly above the ASEAN average of 23 percent and equal to China’s CIT rate. However, the Indonesian government aims to reduce CIT to 22 percent in 2021-22 and 20 percent in 2023. This rate would move Indonesia below competitors, such as Malaysia (24 percent) and the Philippines (30 percent), and place it on par with Thailand and Vietnam.

Businesses in Indonesia can benefit from a variety of tax breaks to lower their obligations. The government also issued Regulation 45 of 2019, which provides investors up to 60 percent net income reduction of their total investments if they invested in labor-intensive industries, training programs, or research and development activities. This incentive also includes any land assets used for the business.

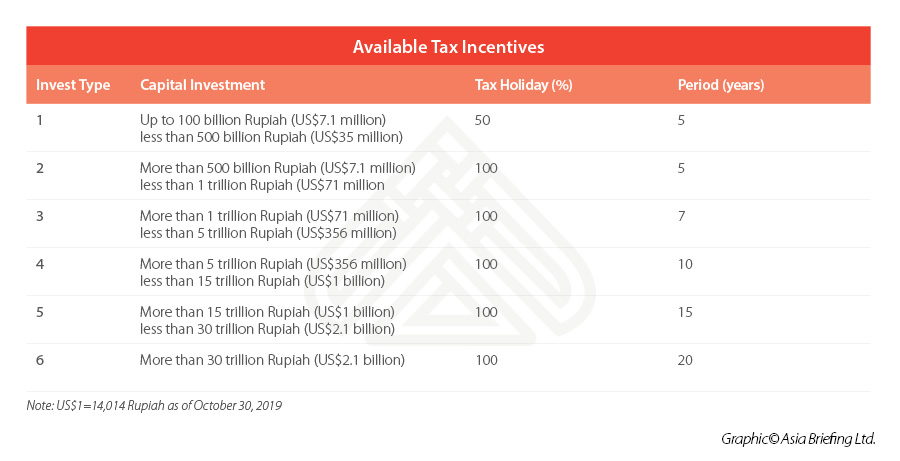

The issuance of the 16th Economic Policy Package of 2018 offers a variety of tax incentives in Indonesia. The policy offers a range of progressively higher tax exemptions depending on the size of the investment.

There is a 50 percent tax exemption for five years for investments between IDR 100 billion (US$9.7 million) and 500 billion (US$48.5 million) and a 100 percent exemption for five years for those between IDR 500 billion (US$48.5 million) and IDR 1 trillion (US$97 million).

Investors can also receive a 100 percent tax holiday for 20 years for investments of over IDR 30 trillion (US$2.9 billion). In addition to incentive schemes such as these, special economic zones (SEZs) also offer their own CIT incentives.

Indonesia levies a value-added tax (VAT) for indirect taxation. There is a 10 percent VAT rate on most manufacturers, retailers, wholesalers, and importers, and a zero percent rate for export of tangible and intangible goods, as well as services. Several goods and services are non-taxable, including education, health, and financial services, as well as basic food commodities and mining and drilling products.

Trade agreements

Indonesia has been active in forming trade agreements in recent years.

As a member of ASEAN, it is part of the bloc’s free trade area and agreements with Australia, New Zealand, China, Indian, Japan, and South Korea. Indonesia also has a bilateral economic partnership agreement (EPA) with Japan and FTAs with Pakistan and the European Free Trade Association (which consists of Iceland, Liechtenstein, Norway, and Switzerland). Further, Indonesia and Australia ratified the Indonesia-Australia Comprehensive Economic Partnership Agreement on February 10, this year.

Besides these, Indonesia has several agreements that are signed but not yet in effect. These include an FTA with Chile, an EPA with Australia, and participation in the Trade Preferential System of the Organization of the Islamic Conference.

After concluding seven and a half years of negotiations late last year, Indonesia and South Korea are poised to formally sign an FTA in 2020. The FTA will remove tariffs on steel, automobiles, and beer, and open up 93 percent of Indonesia’s market to South Korea, compared to 80.1 percent before the deal.

Furthermore, Indonesia and the EU have completed multiple rounds of negotiations for an FTA, though a final agreement is not yet complete.

In addition to its FTAs, Indonesia has a vast network of double tax agreements (DTAs), totaling 70 jurisdictions. The country has DTAs with Australia, New Zealand, the US, Canada, China, Hong Kong, India, and many EU states, among others.

This year, Indonesia signed a DTA with Tajikistan, which came into force January 1, 2020. Indonesia also signed the updated DTA with Singapore on February 4, after negotiations to amend its contents began mid-July 2015.

Special economic zones

Like China, Indonesia has SEZs designed to attract foreign investment. Indonesia currently has 13 SEZs, but will be opening seven more throughout 2020.

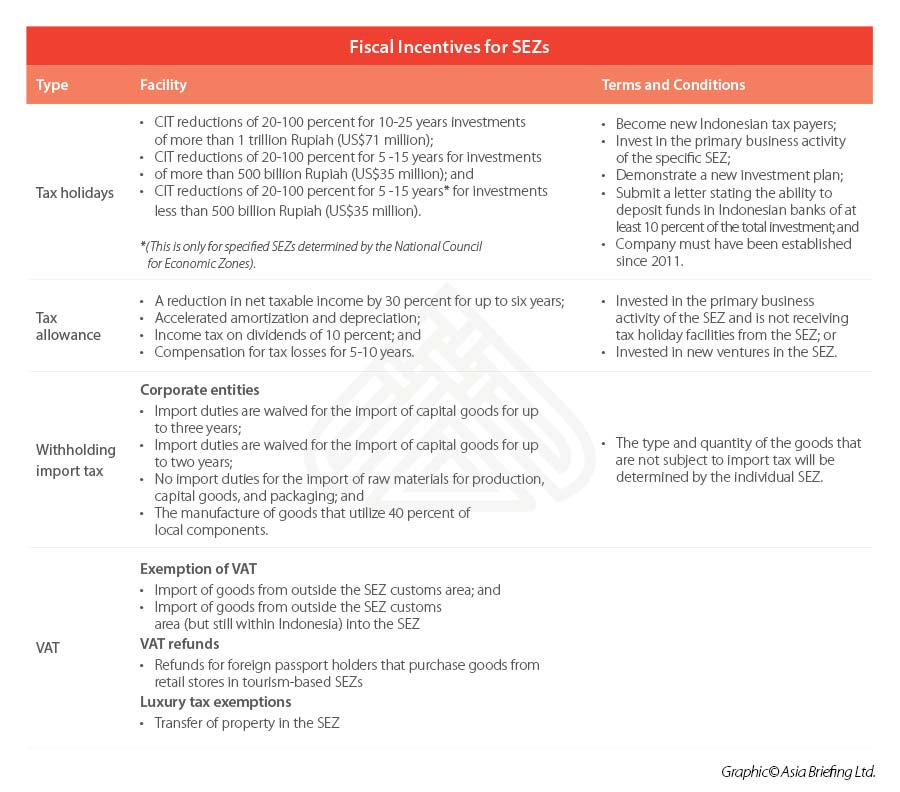

Compared to other areas in Indonesia, SEZs boast higher quality infrastructure, special tax incentives, streamlined regulations, customs exemptions, and the accelerated issuance of work visas.

Many SEZs also promote industry clustering, such as Batam island’s new digital park and central Java’s export-oriented automotive SEZ. Each SEZ was selected for their accessibility to local resources, and thus serve specialized industries.

Specific incentives vary depending on the SEZ, industry, and size of investment. For example, investments in a primary industry worth over IDR 1 trillion (US$97 million) can receive CIT holidays of up to 100 percent for 10 to 25 years, while investments between IDR 500 billion (US$48.5 million) and 1 trillion (US$97 million) can receive five to 15 years. Investments below IDR 500 billion (US$48.5 million) can also receive tax holidays for five to 15 years at a rate dependent on the nature of the investment.

Despite these advantages, it is not always beneficial to invest in Indonesia’s SEZs. Most of the SEZs are relatively new or are yet to open, while many are not fully functional or particularly active. Moreover, not all SEZs are able to offer the skilled labor that a particular industry requires, making them unable to cater for all investment types.

Business environment

The ease of doing business in Indonesia is roughly in line with its level of development, though it has fallen behind regional competitors. According to the World Bank’s ease of doing business rankings, Indonesia ranks 73rd, trailing Southeast Asian counterparts, such as Malaysia (12), Thailand (21), and Vietnam (70), though ahead of the Philippines (95) and Cambodia (144). Indonesia also lags behind China (31) and India (63), two countries that have rocketed up the rankings in recent years due to numerous reforms cutting red tape.

Where Indonesia particularly struggles is in starting a business, ranking a woeful 140th, in large part because of the many steps involved in the establishment process. Indonesia’s rankings are also held down by its rigid employment regulations as well as complicated tax compliance requirements.

Despite the country’s rankings, the Indonesian government has taken steps to improve areas in which it is lagging. It has begun to streamline the business establishment by creating online platforms to manage various administrative processes, such as business registration, tax filing, and customs documentation. While reforms in Indonesia’s business environments are perhaps not progressing as quickly as foreign investors would like, they are trending in the right direction.

How Indonesia compares to its ASEAN peers

Foreign investors adopting China plus one strategies have numerous variables to consider when determining which country can best complement their existing operations, from industry requirements to the composition of their end markets.

The Indonesian market presents a huge opportunity for foreign investors looking to complement their China operations but poses substantial challenges as well.

Indonesia projects to become one of the world’s largest economies on the back of a young workforce and rapidly expanding middle class.

At the same time, however, Indonesia suffers from a relatively restrictive investment environment, complicated regulations, skills shortages, insufficient infrastructure, and uneven growth. While the government has made improving the business environment a priority, political challenges limit the pace of reform.

For those prioritizing low costs, proximity to China, and growth potential, Vietnam may be the ideal destination for structuring China plus one operations. Meanwhile, those seeking reliable production and an approachable business environment at a moderate cost, more mature markets like Thailand or Malaysia appear to be the best options.

However, for investors making long-term commitments and eyeing new growth opportunities, Indonesia may be the most attractive option to complement operations in China. Compared to its ASEAN peers, Indonesia stands out from the rest due to its size and resource wealth. Outside of India, there is no other emerging economy in Asia that offers as much growth potential as Indonesia.

Related Reading

Setting Up in Indonesia

Setting Up in Indonesia

In this issue of the ASEAN Briefing magazine, we introduce Indonesia’s business environment – its major industries, tax, and visa regulations. We analyze the tax incentives offered to foreign investors and incentives provided in special economic zones (SEZ). Finally, we focus on the set-up process investors need to follow if they are looking to establish a legal presence in the country.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, and Thailand in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article China Extends March Tax Filing Deadline to March 23

- Next Article Foreign Permanent Residency in China: New Draft Regulations Released