China 2022 Economic Growth – A Breakdown of Provincial GDP Statistics

China’s 31 mainland provinces, municipalities, and autonomous regions have released their local GDP and economic indicators for 2022. The data reflects the nationwide slowdown in economic growth in 2022, but also shows significant variations from region to region. We analyze the drivers behind the 2022 China provincial GDP figures and discuss the prospects for growth in 2023.

Over the course of January, the local statistics bureaus of China’s 31 mainland provinces, municipalities, and autonomous regions (hereinafter collectively referred to as “provinces”) have released local economic data for 2022. The data, which includes nominal GDP, GDP growth rates, and in most cases, data on social and industrial development, reveals an overall slowdown in economic growth and social development from 2021 as the country battled several COVID-19 outbreaks.

At the same time, the provinces have also announced their GDP growth targets for 2023, which suggest widespread optimism for the year ahead following the lifting of COVID-19 restrictions in the fourth quarter of 2022.

Below, we analyze the local economic data for 2022 and how the fortunes of China’s mainland provinces may change in the year ahead.

China provincial GDP growth in 2022

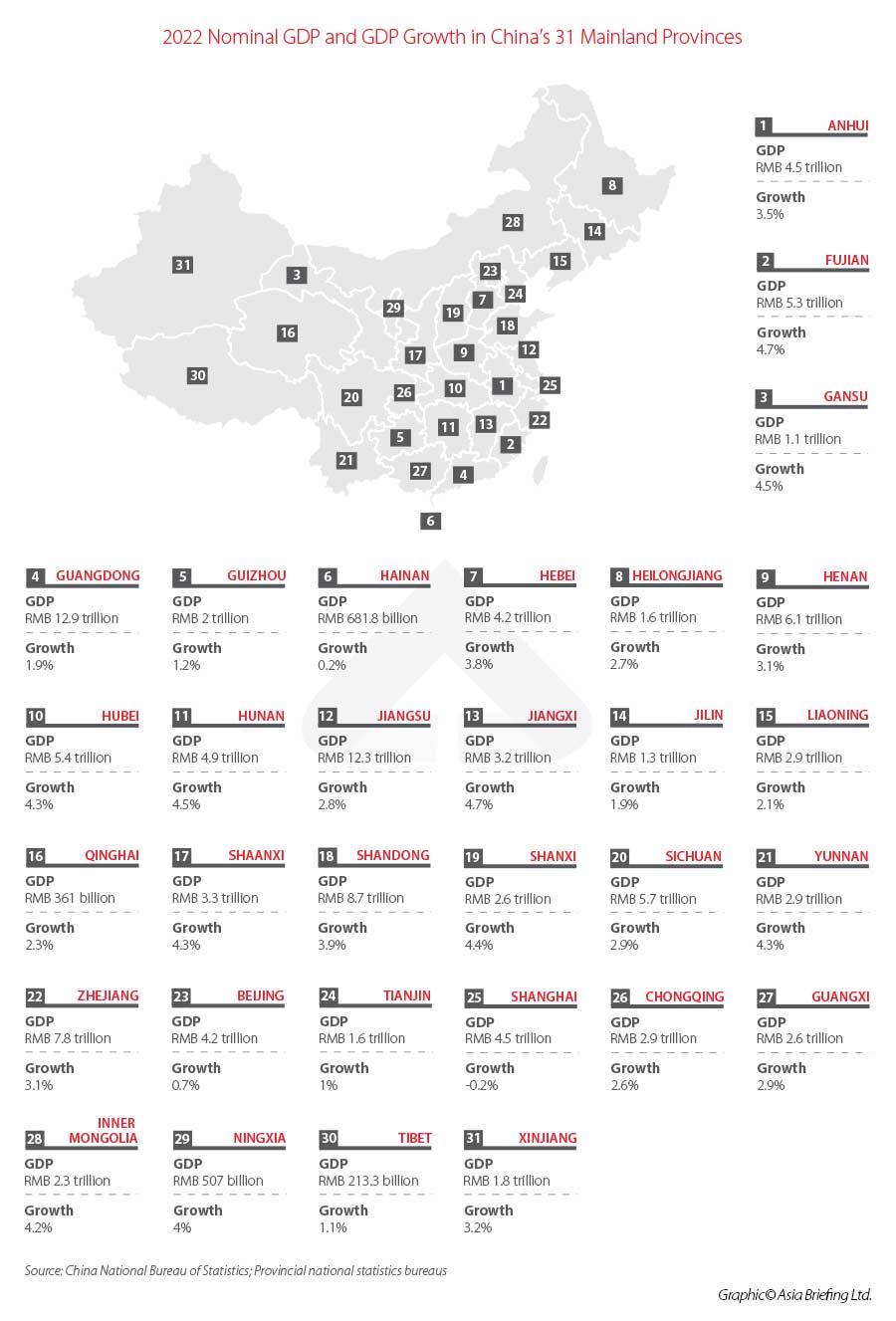

Local GDP growth in 2022 varied greatly from province to province. The provinces with the highest annual growth rates were Fujian and Jiangxi, which grew 4.7 percent from 2021 to reach RMB 5.3 trillion (approx. US$778.1 billion) and RMB 3.2 trillion (approx. US$475.8 billion), respectively. For context, China’s total GDP in 2022 reached RMB 121 trillion (approx. US$1.8 trillion) in 2022, a year-on-year increase of 3 percent.

Two provinces experienced a contraction in GDP: Jilin and Shanghai. Jilin’s GDP shrank by 1.9 percent year-on-year, while Shanghai’s shrank by 0.2 percent year-on-year.

Both Shanghai and Jilin were some of the hardest-hit regions by the coronavirus pandemic. Jilin Province was under a strict weeks-long lockdown in March 2022, which significantly impacted the province’s manufacturing output, one of its key industries. Shanghai, meanwhile, was under a two-month lockdown in April and May, which put the city at a virtual standstill.

However, both areas experienced a recovery in the latter half of the year. Shanghai’s GDP contracted at a rate of 5.7 percent in the first half of 2022 but narrowed to -1.4 percent in the first three quarters. Jilin, meanwhile, experienced a contraction of 7.9 percent in the first quarter, which had narrowed to -1.6 percent by the end of the third quarter.

Guangdong Province remained the largest province in China by nominal GDP, reaching RMB 12.9 trillion (approx. US$1.9 trillion), up 1.9 percent year-on-year. This was followed by Jiangsu, which reached RMB 12.3 trillion, up 2.8 percent year-on-year.

The provinces with the lowest nominal GDP were Tibet (RMB 213.3 billion; approx. US$31.7 billion) followed by Qinghai (RMB 361 billion; approx. US$53.7 billion).

No province exceeded the 2022 national GDP growth target of “around 5.5 percent”.

Despite its contraction, Shanghai remained the single largest city in China by GDP in 2022. This was followed by Beijing, with a local GDP of RMB 4.2 trillion (US$624.5 billion), and Shenzhen, which reached RMB 3.2 trillion (approx. US$475.8 billion).

Meanwhile, Chongqing overtook Guangzhou to become the fourth-largest city in China by GDP. Chongqing’s total GDP in 2022 was RMB 2.91 trillion (approx. US$432.7 billion), while Guangzhou’s fell just short of that at RMB 2.88 trillion (approx. US$428.3 billion).

Industry output and retail sales in 2022

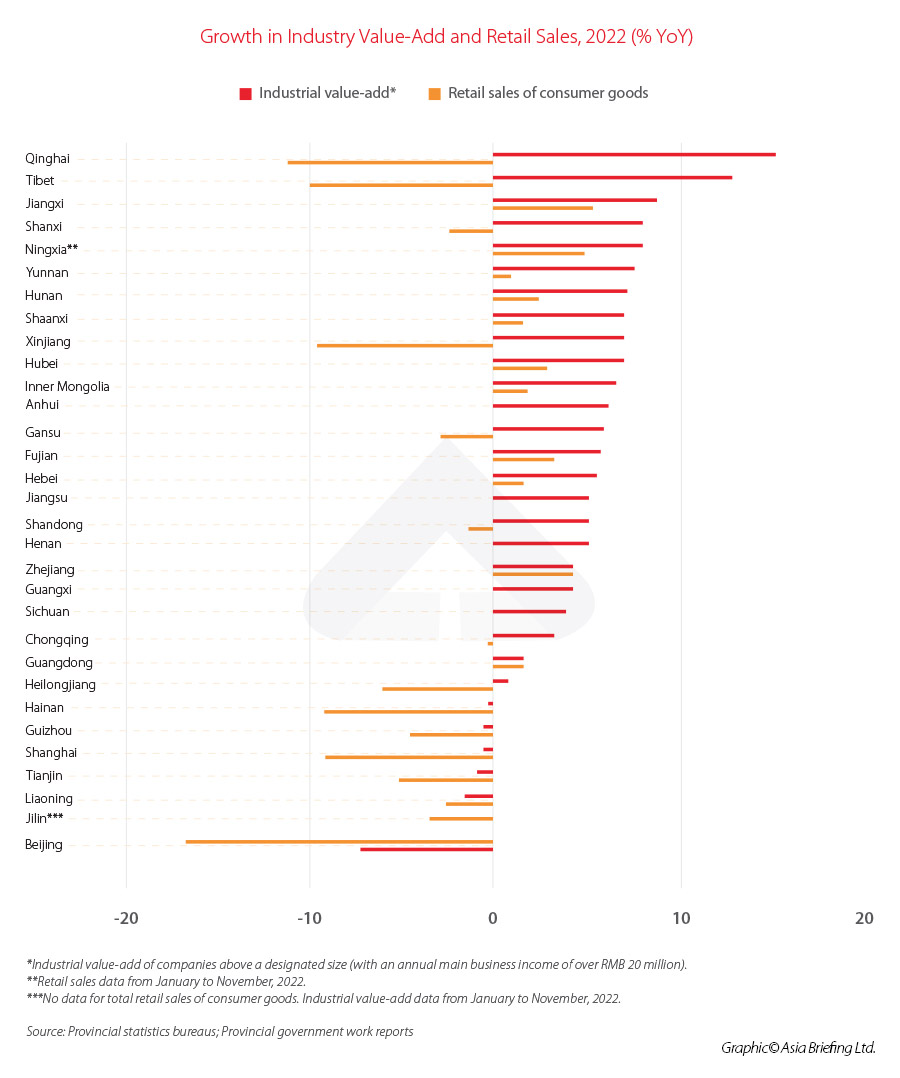

Industrial value-add to the economy varied greatly from province to province in 2022, suggesting the varying degrees to which the COVID-19 pandemic impacted different regions.

The western province of Qinghai punched above its weight with the highest growth in industrial value-add of companies above the designated size (those with a main business income of above RMB 20 million or approximately US$3 million), accelerating 15.5 percent year-on-year. Meanwhile, the worst-performing region was Beijing, whose industrial value-add dipped by 16.7 percent year-on-year.

The national average growth rate of industrial value-add in 2022 was 3.6 percent year-on-year.

Qinghai’s industrial activity was buoyed by strong growth in sectors such as its salt lake chemicals industry (up 31.3 percent year-on-year), including lithium carbonate (24.5 percent), potash fertilizer (13.3 percent), and raw salt (24.3 percent), according to data from the Qinghai Provincial Bureau of Statistics.

In Beijing, the steep contraction reversed when accounting for the impact of the production of the coronavirus vaccine. Beijing is home to major vaccine manufacturing facilities – such as that of the pharmaceutical giant Sinovac – and demand for vaccines in 2022 dropped significantly as most people had already completed their two rounds of inoculation in 2021.

In addition, high base effects from 2021 dragged significantly on the 2022 figure. In 2021, thanks to major vaccine drives in both China and overseas, the value-add of Beijing’s pharmaceutical manufacturing industry grew by a staggering 252.1 percent year-on-year, accounting for around 30 percent of the total industry value-add of companies above a designated size that year.

Broken down by industry, we can see that the pharmaceutical manufacturing industry dragged on overall growth in 2022 with a contraction of 58.3 percent. However, when removing factors associated with the production of coronavirus vaccines, the industrial value-add of the pharmaceutical manufacturing industry grew by 6.4 percent, and overall industrial value-add grew by 2.5 percent.

Several other industries saw positive growth in 2022, including equipment manufacturing (10.2 percent), railway, ship, aerospace, and other transportation equipment manufacturing (3.7 percent), and manufacturing of instruments and apparatus (2.5 percent).

Retail sales of consumer goods on average fell by 0.2 percent year-on-year in 2022 across the country, with almost half of provinces experiencing a contraction.

The provinces with the steepest year-on-year fall were Qinghai (-11.2 percent) and Tibet (-10 percent). Major cities, such as Beijing and Shanghai, also saw steep declines (-7.2 and -9 percent respectively) as COVID-19 restrictions slowed economic activity and consumption.

Nonetheless, provinces such as Jiangxi and Ningxia fared relatively well, with retail sales growing 5.3 percent and 5 percent, respectively. These provinces experienced fewer disruptions from COVID-19 outbreaks compared to other regions and generally performed well across all main economic indicators.

China provincial GDP prospects for 2023

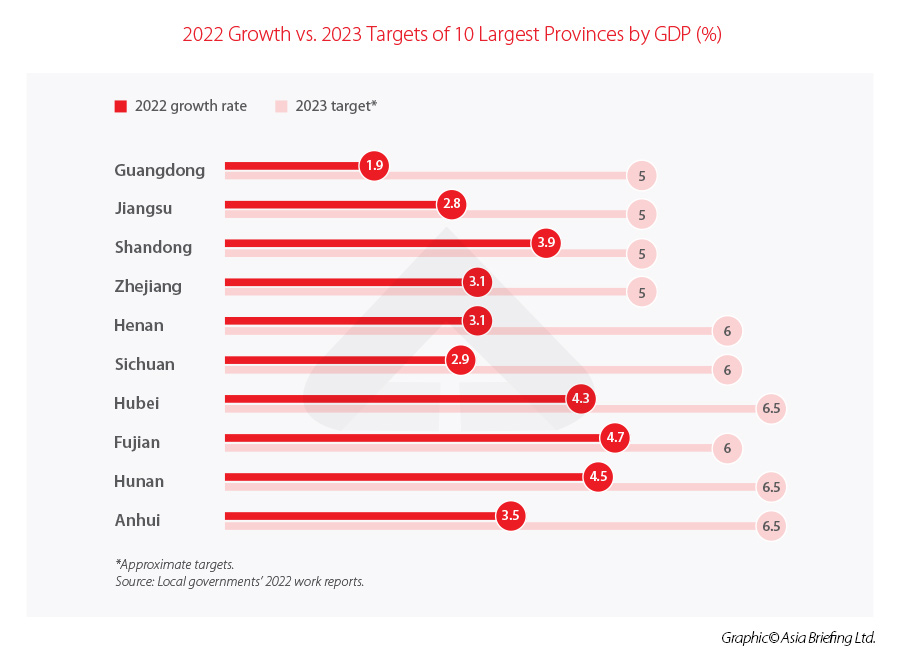

China’s mainland provinces have also released their GDP growth targets for 2023. These targets are almost all very ambitious, suggesting widespread optimism about the economy in the coming year.

This optimism is in large part spurred by the central government’s decision to abolish its zero-COVID policy in late 2022, which saw the lifting of the majority of the restrictions that had hampered growth in recent years. Moreover, the central government also set a bold new pro-growth economic agenda for 2023.

Presently the central government has not yet set an official national GDP growth target for 2023. Traditionally, it is announced during the Two Sessions meetings held annually at the beginning of March. However, the central government is not required to set a concrete GDP growth target, and it is not certain whether it will do so this year. Meanwhile, the International Monetary Fund (IMF) has upwardly revised its forecast for China’s GDP growth in 2023 to 5.2 percent from its previous projection of 4.4 percent.

The majority of provinces have set their local GDP targets for 2023 at above 5 percent year-on-year. The notable exceptions are Beijing and Tianjin, which have set their growth targets at “above 4.5 percent” and “around 4 percent”, respectively.

The highest growth target of any province was set by Hainan, which is aiming to achieve “around 9.5 percent” year-on-year growth in 2023. This is particularly ambitious given Hainan’s annual GDP growth rate in 2022 was just 0.2 percent year-on-year.

The island province was hit hard by the pandemic not because of local outbreaks but rather due to its heavy reliance on tourism, which took a sharp dive as a result of the COVID-19 travel restrictions. However, its economic activity recovered in the second half of the year, going from a 2.5 percent contraction in the second quarter and recovering to 1.9 percent year-on-year growth in the fourth quarter.

With the removal of COVID restrictions, travel and tourism are expected to rebound, which will help to spur economic growth. The creation of a free trade port on the island, as well as the introduction of various preferential policies, is also hoped to boost business activity.

Hainan is one of the provinces with significant growth potential as it is still underdeveloped compared to its counterparts in eastern and southern China. Its GDP per capita, at RMB 66,845 (approx. US$9,940), is still below the national average of RMB 85,698 (approx. US$12,743).

In general, the provinces with the most ambitious growth targets – Tibet (around 8 percent), Xinjiang (around 7 percent), and Jiangxi (around 7 percent) – are all historically underdeveloped areas, and therefore have high growth potential. The government has also been heavily promoting investors and industries to move to underdeveloped areas in central and western China, in an effort to balance economic development.

Meanwhile, large developed cities such as Beijing (above 4.5 percent), Tianjin (around 4 percent), and Shanghai (above 5.5 percent), have set slightly more modest targets.

It is also worth pointing out that, due to the low growth rates recorded in 2022, base effects will help to boost the 2023 economic indicators. This means that many provinces have a very good chance of recording strong GDP, industry, and consumption growth rates, especially in the second and third quarters when most of the country experienced a significant slowdown in economic activity.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Mainland China to Fully Resume Travel with Hong Kong and Macao

- Next Article Belt and Road Weekly Investor Intelligence #119