China-Tajikistan: Bilateral Investment and Trade Ties

We discuss the bilateral investment and trade outlook between China and the Central Asian country of Tajikistan. China is currently Tajikistan’s largest source of foreign investment and a significant trading partner. Tajikistan, on its part, is a keen BRI participant as its difficult terrain and connectivity challenges require major infrastructure and construction investment, the cumulative outcome being better economic integration and boost to trade.

China and Tajikistan have maintained regular high-level contacts and cooperation since the establishment of diplomatic ties after the settlement of their border issues. Since 2018, China and Tajikistan have been comprehensive strategic partners.

Located at the crossroads of the ancient Silk Road, Tajikistan has historically played an important part in the economic, cultural, and people-to-people cooperation between Europe and Asia.

Being among the first countries to get on board China’s modern-day Silk Road Economic Belt, Tajikistan is expected to achieve better transport connections and benefit from the greater economic integration of participating countries. Going forward, China and Tajikistan will deepen cooperation in economy and trade and promote the high-quality development of the Belt and Road Initiative (BRI).

China-Tajikistan bilateral relations

China and Tajikistan share a 477 km border in the Xinjiang Uygur Autonomous Region in western China. There is one border crossing at Karasu Port of Entry over the Kulma Pass, at an elevation of 4,362.7m above sea level. From here, the rugged AH66 route connects from China’s Karakoram Highway, on to Kashgar and Urumqi, over the Pamir mountains, and eventually to the Tajik capital, Dushanbe. It is only open for two weeks each month (16th to the 30th) from May to November as constant landslides require continual maintenance and the route requires constant repair and clearance.

China and Tajikistan established formal diplomatic relations in 1992, shortly after the fall of the Soviet Union. Since then, the two countries have maintained a mostly friendly relationship, marred only by a dispute over where to draw the border. This dispute was later settled in 2011, when Tajikistan ceded 1,158 sq.km of land to China.

Tajikistan was one of the first countries to sign a Memorandum of Understanding (MoU) with China on the Silk Road Economic Belt, and China is Tajikistan’s largest source of foreign investment. In 2017, China pledged a RMB 1.5 billion grant (over US$230 million) to build new parliamentary buildings for the Tajik government in Dushanbe.

Tajikistan was a member of “The Shanghai Five” – Russia, China, Kazakhstan, Kyrgyzstan, and Tajikistan – which would eventually develop into the Shanghai Cooperation Organization (SCO), established in 2001. Today, the SCO, a regional security and trade body, has expanded to include eight member countries, with the addition of Uzbekistan, India, and Pakistan.

In 2017, China and Tajikistan signed a strategic cooperation partnership to cover a range of industries, including finance, agriculture, water resources, energy, and mining. The strategic cooperation partnership contributed to Tajikistan’s development plan under China’s BRI program.

Why Tajikistan holds importance for China

As with other central Asian nations, Tajikistan is located in a strategic position for China, offering a much quicker route for imports of natural resources from countries like Uzbekistan and Turkmenistan in the west. However, the difficult and volatile terrain at the border also means there are easier routes to the region, such as through Tajikistan’s neighbor, Kyrgyztsan.

Despite the challenges, several China-backed projects have already been completed, such as the Vahdat – Yovon railway connecting several railway networks in the south of the country, a thermal powerplant in Dushanbe, and transmission lines for strengthening the power grid in the north of the country, to name a few.

The two countries are also united in their common goal of preventing the rise of terrorist groups in the region. On the Tajik side, mainstream Muslim politicians are wary of the damage terrorist organizations can do to the country’s stability, while China is keen to prevent terrorist organizations from harboring Uyghur separatists and stopping terrorist activity from spilling over into Xinjiang.

China and Tajikistan, along with Afghanistan and Pakistan, established the “Quadrilateral Cooperation and Coordination Mechanism in Counter Terrorism”, and China has also footed the bill for military outposts for Tajikistan to man its southern border with Afghanistan.

In the course of continued efforts to build strong ties, the two countries have increasingly engaged in cultural exchange. Tajikistan now hosts Confucius Institutes in two universities where students can take Chinese language and culture classes, and several universities in China have set up centers for Tajik studies.

Foreign investment in Tajikistan

According to the 2020 World Investment Report by the United Nations Conference on Trade and Development (UNCTA), in 2019, Tajikistan received US$213 million in foreign direct investment (FDI) inflows. That’s down from US$360 billion in 2018. By the end of 2019, the country had attracted US$3.07 billion of FDI stock.

FDI mainly flows into the construction industry (including hydropower station construction, highway repair, and tunnel construction), communication network renovation, energy development, precious metal mining and processing, and food processing.

Besides China, other major countries investing in Tajikistan include Russia and Switzerland. A World Bank report from 2017 shows that about 80 percent of the foreign investment in Tajikistan originated in China (47.3 percent) and Russia (31.3 percent). The third largest investment flows came from Switzerland (6.8 percent).

Tajikistan was ranked 106th in the World Bank’s Doing Business Report for 2020. The country does relatively well on scores for starting a business (36th) and getting credit (11th) but performed worse on getting electricity (163rd), trading across borders (141st), and paying taxes (139th).

The Tajik parliament continued to grant tax exemptions for Chines firms investing in the country, although investment laws are applied inconsistently. According to the statistics from the Ministry of Commerce of China, there are more than 300 Chinese enterprises in Tajikistan. The investments are mainly related to agriculture, mining, textile, telecom, and cement, among others.

China-Tajikistan bilateral trade

In terms of imports, China was Tajikistan’s third largest trading partner, accounting for 14 percent of Tajikistan’s total imports. For exports, China was Tajikistan’s seventh largest trading partner last year, accounting for 2.6 percent of Tajikistan’s total exports.

Although China is not Tajikistan’s top trading partner and bilateral trade has fluctuated over the past few years, in 2019, China became the country’s fastest growing export market (up 10.5 percent) and import market (up 13.1 percent).

At the moment, Tajikistan has the lowest trade volume with China out of the five Central Asian countries.

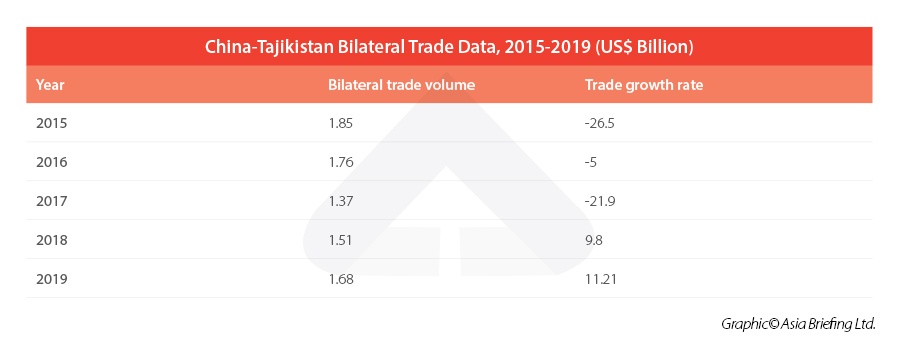

According to statistics from China Customs, China-Tajikistan trade volume reached US$1.68 billion in 2019, up 11.21 percent year-on-year. China exported US$1.59 billion to Tajikistan, up 11.27 percent year-on-year. Tajikistan exported US$85 million to China, up 10.12 percent year-on-year. While trade between the two countries plunged in 2020 due to the COVID-19 pandemic, in the first half of 2021, bilateral trade gradually recovered, registering a year-on-year growth of 44.6 percent.

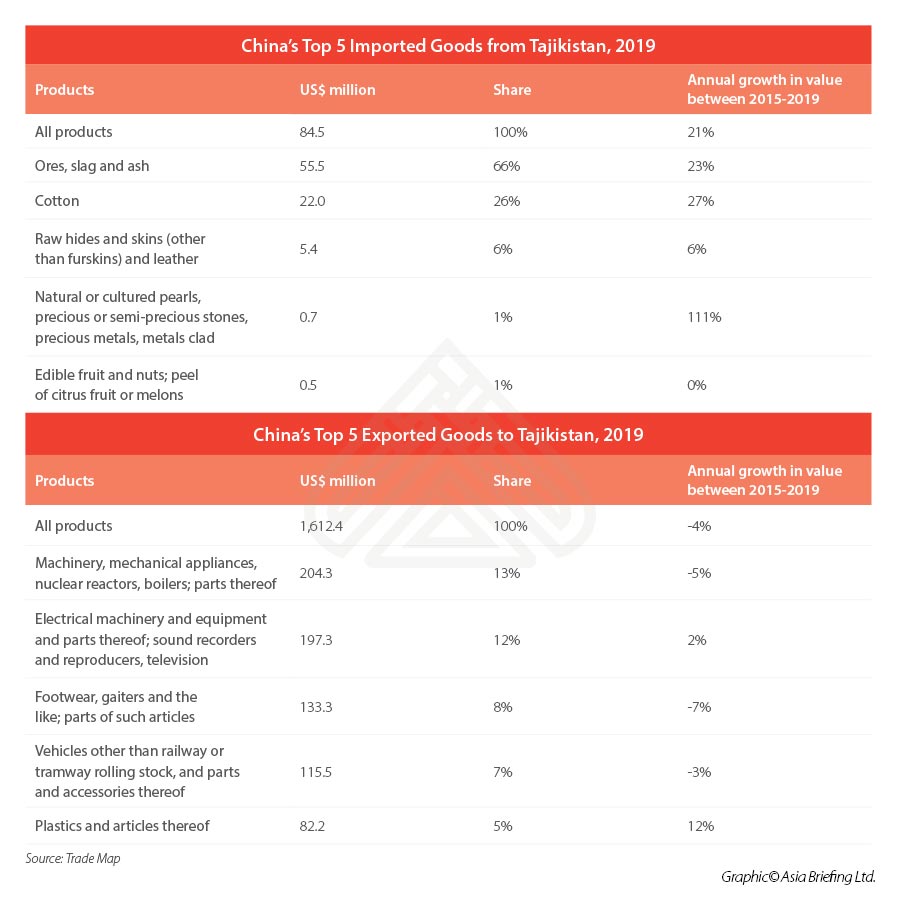

China’s main exports to Tajikistan are boilers, machines, electrical equipment and its parts, recorders, rubber footwear, vehicles and their accessories, plastics, light pure woven cotton, and coated flat-rolled iron. In turn, Tajikistan’s main exports to China are ore, slag, and ash, cotton, raw hides and leather, silver, fruits and nuts, marble, travertine, and other stones, silk, and organic chemicals.

China-Tajikistan investment and trade agreements

China-Tajikistan Bilateral Investment Treaty (BIT)

On March 9, 1993, China and Tajikistan signed the Agreement on the Encouragement and Mutual Protection of Investment, which took into force from January 20, 1994.

As BITs set out terms and regulations for private investors in the partner country, an important function of the agreement is providing protection and guarantees for both individuals and companies in the host country. These are provisioned in addition to protections already guaranteed under a host country’s domestic laws and include mechanisms for foreign investors to raise and settle disputes in a neutral court should the host country fail on its obligations to protect their rights.

The existence of the China-Tajikistan BIT guarantees that investors and companies from both countries receive the same treatment by the host country as that awarded to domestic investors or investors from a third country.

China-Tajikistan Double Taxation Avoidance Agreement (DTA)

On August 27, 2008, China and Tajikistan signed the Agreement for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income and Capital. The agreement had become effective from March 28, 2009.

From an investor’s perspective, confusion about international taxation can arise when investors are subject to two different and potentially conflicting tax systems.

The existence of China-Tajikistan DTA not only provides certainty to investors regarding their potential tax liabilities but also acts as a tool to create tax-efficient bilateral investments where applicable.

China-Tajikistan Comprehensive Strategic Partnership

On August 31, 2017, China and Tajikistan signed a joint announcement on establishing a comprehensive strategic partnership.

The two sides agreed to bolster efforts to combat the threats of terrorism, separatism, and religious extremism, as well as international criminal groups and drug trafficking by launching professional intelligence exchanges. Both sides also agreed to strengthen communications between defense, security, and law enforcement departments.

So far, China has not signed a free trade agreement (FTA) with Tajikistan.

China-Tajikistan trade opportunities and outlook

The Tajik President Emomali Rahmon is shaping the national development strategy of Tajikistan to attract more investment. Its National Development Strategy 2016-2030 seeks to attract as much as US$55 billion in FDI by 2030.

Tajikistan remains highly isolated, largely due to its challenging terrain – completely landlocked and with an average elevation of 3186 m above sea level, and as a result, is one of the poorest countries in Central Asia. This is also why it does poorly in terms of providing electricity and good transport infrastructure. Its economy is highly reliant upon foreign remittances and thus vulnerable to economic downturns in the countries it exports labor to, most significantly Russia.

According to a report from the World Bank, Tajikistan’s borders are some of the most inefficient in the region, and infrastructure needs to see significant improvements if the country is to develop trade with neighboring countries and diversify its economy. It is in this area that foreign investment can have a considerable impact upon the country, and China is likely to remain one of the biggest players in this area. Tajikistan has an open economic policy and political stability, which is conducive to Chinese firms’ participation in its infrastructure construction.

Tajikistan is rich in mineral resources, with more than 50 known minerals and more than 600 deposit areas to be developed. Among metal mineral resources, silver, antimony, lead, zinc, and gold are the country’s dominant mineral resources, and Tajikistan leads the Central Asian region’s reserves of silver, lead, zinc, and uranium. Chinese companies have developed gold and lead and zinc deposits there. Tajikistan used to be considered poor in oil and gas resources but recently discovered significant oil and gas resources in the south. Major oil companies, including Chinese companies, have started exploration, which may provide investment opportunities for some related areas.

BRI transport projects in the region are expected to have a favorable impact on Tajikistan’s trade, FDI, and GDP. In fact, the benefits of the reduced shipment times due to BRI infra investments to-date are already visible. Tajik trade flows increased prior to the COVID-19 pandemic, especially its exports of metals and agriculture. FDI inflows jumped to more than US$300 million a year in 2014 to 2018 from only around US$80 million a year in 2005 to 2013, the bulk of it coming from China. Chinese firms have invested substantially in the two Free Economic Zones in Istiklol near Khujand and in Danghara near Dushanbe. Nevertheless, given Tajikistan’s economic structure and isolated topography, it likely means more limited opportunities compared to its regional peers.

Although there are also obstacles existing in China-Tajikistan cooperation, such as the underdeveloped business environment in Tajikistan, the complicated regional situation, the competition with other big nations, and worries over China dominating investments, China and Tajikistan’s cooperation is a logical result of their complementary advantages and mutual needs.

From China’s perspective, Tajikistan is a key hub connecting China with Central Asia, West Asia, South Asia, and Europe, and an important object of China’s overseas investment and production capacity cooperation. China and Tajikistan cooperation is expected to strengthen in almost all areas, including economy and trade, energy, transportation, agriculture, production capacity, finance, science and technology, education, and tourism.

On the other hand, foreign investors and enterprises should carry out risk assessment regularly to avoid investment losses. Tajikistan has a unique national condition, and its risks include policy stability, investment transparency, and business environment. Investment cooperation should be assessed in detail. At the same time, Tajikistan’s domestic market capacity is limited, so when selecting investment projects, market capacity and competition should be considered to avoid over-production and investment losses caused by large-scale investment with diminishing scope of returns.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Investment Prospects in China’s Biotech Industries

- Next Article Hong Kong Plans To Join RCEP, Jointly Invest In Belt & Road Initiative Economic and Trade Co-operation Zones