China-UK Trade and Investment Ties

This article delves into the UK’s economic ties with China and Hong Kong, spotlighting the import-export sector and bilateral investments.

In the last decade, China-UK trade and investment have been steadily growing, allowing cooperation in strategic sectors, such as health, science, technology, and education. The seamless development of the relationship was also made possible by the handover of Hong Kong in 1997.

Post-Brexit, the UK is working to occupy a more independent role in the global trading system, which may create new opportunities to develop its bilateral business ties with China.

In this article, we investigate the UK’s trade and investment relations with China and the Hong Kong Special Administrative Region (SAR), outlining major export-import items and areas of investor interest.

Mainland China-UK relations

In 2022, Beijing and London celebrated 50 years of their diplomatic relations. The People’s Republic of China (PRC) was officially recognized by the UK one year after its foundation, before most other Western nations. The establishment of full diplomatic relations between China and the UK in 1972 paved the way for increased collaboration in a variety of areas, including trade, culture, and economics.

In 2021, China overtook Japan to become the UK’s largest trading partner in Asia, up from a mere US$300 million in bilateral trade in 1972, reaching nearly US$50 billion in bilateral trade. In the same year, more than 800 Chinese companies created 80,000 jobs in the UK.

London is home to the biggest offshore RMB clearance center in the world. The Shanghai-London Stock Connect and the currency swap program are two examples of successful financial exchanges between the two countries. Another growth factor for China-UK relations is cooperation in the new energy industry – developing battery capacity, offshore wind energy, electric vehicles, and other green technologies.

London is home to the biggest offshore RMB clearance center in the world. The Shanghai-London Stock Connect and the currency swap program are two examples of successful financial exchanges between the two countries. Another growth factor for China-UK relations is cooperation in the new energy industry – developing battery capacity, offshore wind energy, electric vehicles, and other green technologies.

Moreover, a cornerstone of China-UK relations is the people-to-people exchanges and educational collaboration. The UK surpassed the US in 2020 to take the top spot among countries where Chinese students study abroad. Forty-two percent of Chinese students who chose to study abroad made the UK their destination. Despite COVID-19’s negative effects on the flow of international students, 130,000 student visas for the UK were granted to Chinese students in 2021, accounting for one-third of all foreign students enrolled in universities there. As the pandemic eases, we can anticipate these trends to grow.

Hong Kong-UK relations

Hong Kong was a British colony from 1841 to 1941 and again from 1945 to 1997 when China was granted sovereignty over the SAR. In addition to supporting Hong Kong’s mini-constitution, the Basic Law, and adhering to China’s policy of observing “one country, two systems,” the UK’s policy towards Hong Kong is supported by its significant commercial interests. It also fulfills its obligation as the other signatory of the Sino-British Joint Declaration on the future of Hong Kong.

In addition, Hong Kong is home to about 2.9 million British citizens, of whom 350,000 have an active British passport, making it the third-largest jurisdiction in the world in terms of the number of British passport holders, after the United States and the Commonwealth nations of the Anglosphere. To date, institutions from Hong Kong continue to hold full and associate memberships in the Association of Commonwealth Universities and other relevant Commonwealth Foundation-affiliated bodies.

As a result of these historical and cultural factors, the UK continues to have significant business and investment ties with Hong Kong. Hundreds of British businesses have been active in Hong Kong for many years, a reflection of the long-standing historical connections.

Bilateral trade trends

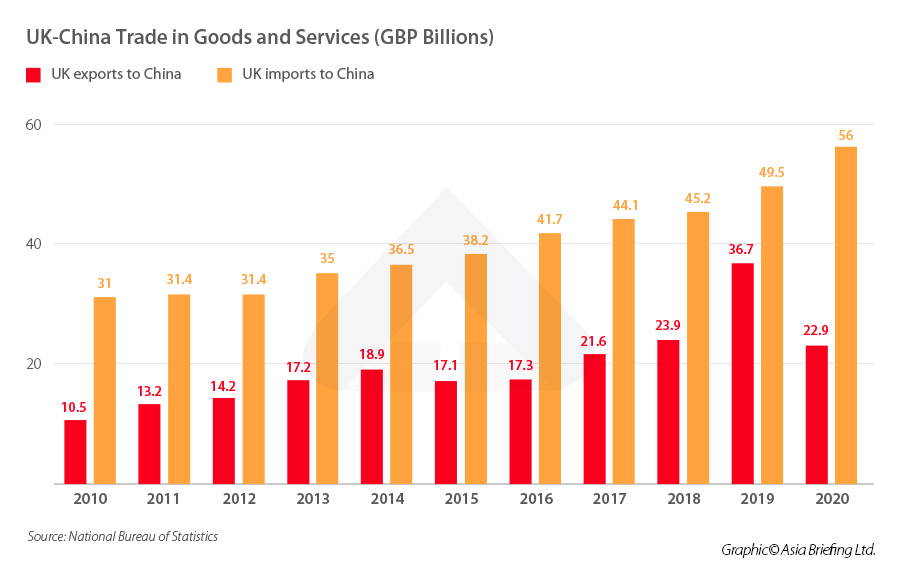

Mainland China-UK bilateral trade

China was the UK’s third largest trading partner in the four quarters to the end of Q1 2022, accounting for 6.9 percent of total UK trade. In November 2022, the UK Department of Trade and Industry reported that the total trade in goods and services (imports plus exports) between the UK and China reached £92.2 billion (US$111.24 billion) in the four quarters to the end of Q2, a decrease of 1.6 percent or £1.5 billion (US$1.8 billion) from the same period in 2021. Of this value:

- Total UK exports to China reached £27.9 billion (US$33.7 billion) in the four quarters to the end of Q2 2022, a year-on-year increase of 1.9 percent or £509 million (US$615.4 million).

- Total UK imports from China reached £65.0 billion (US$78.5 billion) in the four quarters to the end of Q2 2022, a year-on-year decrease of 3 percent or £2.0 billion (US$2.4 billion).

The bulk of the UK’s exports to China is crude oil, cars, medicinal and pharmaceutical products, non-ferrous metals, and mechanical power generators, which make up four of the top five export products. Exports of crude oil amounted to US$4.7 billion in 2021.

| Top 5 Products Exported from the UK to China in 2021 | |

| Product category | Amount (billion US$) |

| Crude oil | 4.7 |

| Cars | 4.3 |

| Medicinal and pharmaceutical products | 1.9 |

| Non-ferrous metals | 1.3 |

| Mechanical power generators | 0.8 |

| Source: Office for National Statistics, UK | |

Meanwhile, China’s top exports to the UK are machinery, telecom and sound equipment, consumer manufactures, chemicals, and clothing, which amounted to US$553.6 million in 2021.

| Top 5 Products Exported from China to the UK in 2021 | |

| Product category | Amount (billion US$) |

| Machinery | 8.2 |

| Telecom and sound equipment | 8.1 |

| Other products (consumers) | 6.6 |

| Other chemicals | 4.8 |

| Clothing | 4.2 |

| Source: Office for National Statistics, UK | |

Hong Kong-UK bilateral trade

The United Kingdom (UK and Hong Kong continue to have a close bilateral relationship.

In the four quarters to the end of Q2 2022, the total value of trade in goods and services (imports plus exports) between the UK and Hong Kong was £23.4 billion (US$27.9 billion), a slight decrease of 0.5 percent or £120 million (US$143 million) from the previous year.

In addition, Hong Kong represents a significant entrepôt for merchandise trade between the UK and Mainland China. In 2021, around eight percent of Mainland China’s exports to the UK (£5.1 billion / US$6 billion) and about 11 percent of Mainland China’s imports from the UK (£2.1 billion / US$2.5 billion) were routed through Hong Kong.

In 2021, Hong Kong-origin goods exported to the UK accounted for 6.6 percent of its total exports. Major exported products were silver and platinum, jewelry, as well as precious metal ores and concentrates.

Meanwhile, goods imported from the UK accounted for 1.2 percent (US$7.1 billion) of Hong Kong’s total merchandise imports. Major goods included non-electric engines and motors, silver and platinum, but also works of art and collectors’ pieces and antiques.

Bilateral investment trends

Mainland China’s investment in the UK

In 2021, disclosed transactions involving Chinese investment in the UK totaled £3.59 billion (US$4.29 billion), and 845 Chinese-owned businesses in the country reported audited revenue figures for the two most recent fiscal years, up from 838 in 2020.

In terms of UK inbound investment from China, Chinese businesses invested £3.4 billion (US$4 billion) into the UK in 2020, accounting for 0.2 percent of the total UK inward FDI stock.

According to the Grant Thornton Tou Ying Tracker, created in cooperation with the China Daily and China Chamber of Commerce in the UK (CCCUK), in 2021, there were around 30,000 companies that were part of a China-owned corporate group. Consumer businesses made up 28 percent of the companies, followed by manufacturing and industrial (22 percent) and business support services (17 percent).

Private healthcare was the best-performing sector in terms of revenue and employee growth, which experienced a 40 percent and 14 percent increase, respectively.

The UK’s investment in China

The most recent figures for outbound investment from the UK into China show investments worth £12.9 billion (US$15.4 billion), accounting for 0.8 percent of the total UK outward FDI stock in 2020.

These figures are backed up by what Dezan Shira & Associates UK has been saying about UK investment into China – the underlying trends remain strong. The firm handles British investment into the PRC and has done since 1992. Grant Williams in the firm’s Shanghai office says, “Contrary to media reports, British investors remain welcome in China and there are plenty of sectoral elements for them to be involved with, especially given China’s huge consumer market. We are able to provide market research facilities, establishment, and tax structuring assistance to UK exporters that require a new look in rethinking a China strategy.”

Bilateral Hong Kong-UK investment ties

In 2020, the outward stock of FDI from the UK in Hong Kong was £76 billion (US$90.8 billion), accounting for 4.6 percent of the total UK outward FDI stock.

In 2021, Hong Kong recorded 9,049 businesses with parent companies overseas, and the UK figured as the fourth largest investor, after the Mainland, Japan, and the United States.

On the other hand, FDI from Hong Kong in the UK reached £7.5 billion (US$8.9 billion), accounting for 1.4 percent of the total UK inward FDI stock.

Under the British National (Overseas) visa program, London and the surrounding boroughs of the capital of the UK continue to be the top destination for immigrants from Hong Kong, accounting for the majority of home sales in the area. According to the UK Office of National Statistics, Hong Kong investors, along with Chinese ones, purchased London real estate worth £7.69 billion (US$9.3 billion) in 2019. This made the British capital one of the most sought-after locations worldwide for Chinese property investments.

Other engagements between China and the UK

UK-China strategic plan for financial services

There is unmatched cooperation in financial services between China and the UK – the top offshore RMB center in the world. Through the UK-China Strategic Plan for Financial Services, both parties unveiled their vision for bilateral cooperation in the years to come in order to support the continued internationalization of China’s financial markets and currency as well as the UK’s position as the top financial center in the world. This will be accomplished through increased knowledge exchange, expanded market access, and the promotion of competitiveness for both domestic and foreign firms in China and the UK.

The plan includes the creation of a new UK-China Financial Services Summit led by senior leaders from both countries’ financial services sectors. The summit informs the annual UK-China Economic and Financial Dialogue to:

- Increase opportunities to diversify Chinese investment by allowing greater market access for UK asset managers in China and expand opportunities for Chinese asset managers to establish in the UK and invest in global

- Establish closer ties between the capital markets of the UK and China, which will improve the efficiency and liquidity of the Chinese capital markets.

- Promote reciprocal market access to the banking sectors of both nations to aid in boosting diversity, market effectiveness, and financial inclusion. Increase cooperation to assist infrastructure co-financing in the UK, China, and other markets, especially those along the Belt and Road Initiative (BRI).

- Support the growth of the private pensions sector in China, including the creation of national savings vehicles, and expand the opportunity for UK companies to offer private pensions services.

- Boost Fintech cooperation to support the entry and growth of Chinese and UK businesses in each other’s markets, as well as to help improve financial infrastructures, expand company access to capital, and advance financial inclusion.

- Further develop the UK-China Strategic Green Finance Partnership.

Energy and environment

In 2015, the UK government announced a deal with China to position British companies as partners of choice for low-carbon energy. The timing of the deal coincided with President Xi Jinping’s official visit to the UK in October of the same year.

The agreement promotes collaboration in low-carbon energy research and business, and it is anticipated that it will spur more investment in green technologies in both nations.

According to a statement from the Department of Energy and Climate Change (DECC), the deal would “strengthen the UK’s position as the partner of choice for China in low carbon energy and help to pave the path for effective energy relations between the two nations,”

and “UK businesses in the low-carbon industry will have better access to the world’s largest energy market, allowing them to share their technological and innovative know-how and win new business.”

By 2015, China had already made investments in the UK’s offshore wind and electric vehicle markets as well as industry and research partnerships in marine energy and green buildings as part of the partnership.

Some investments include the participation of state-owned China Three Gorges (CTG) power company in the Moray offshore wind project in Scotland and the Chinese production of 2,000 electric buses for the UK market.

The most relevant part of the DECC remains the involvement of China’s state-owned China General Nuclear Power Group in the Hinkley Point nuclear power station, in which the company holds a 33.5 percent interest.

Major trade and investment agreements

Mainland China-UK

Bilateral investment treaty

China and the UK signed a bilateral investment treaty (BIT) in 1986 to ensure that investors from both contractual nations will have their investments in the other contracting country protected.

Investors covered by the BIT include:

- Citizens of the PRC and the UK; and

- Companies legally established within the territories of the PRC and the UK.

Under the China-UK BIT, “investments” that are protected include (but are not limited to):

- Movable, immovable property and other property rights such as mortgages and pledges;

- Shares, stock, and any other kind of participation in companies;

- Claims to money or to any other performance having an economic value;

- Copyrights, industrial property rights, know-how, and technological process; and

- Concessions conferred by law, including concessions to search for or exploit natural resources.

The BIT also guarantees investors from both countries the right to transfer profits derived in the other contracting party’s territory back to their home country. This includes the transfer of profits, dividends, interests, and other income, money from partial liquidation of investment, payables pursuant to loan agreements related to investments, and royalties.

The BIT includes articles on dispute mechanisms, including litigation in a neutral international tribunal or a tribunal established under a special agreement between both parties. The treaty also ensures that investors from both nations have the right to transfer their investments back to their home countries. Aside from that, it forbids both contracting countries from seizing or expropriating a foreign company’s assets that are under their control, unless there are extreme domestic needs for it, and it is done against fair compensation.

For more information on how investors can benefit from China’s BITs, see our article here.

Agreement on Cooperation and Mutual Administrative Assistance in Customs Matters

The UK-China Agreement on Cooperation and Mutual Administrative Assistance in Customs Matters (CMAA) entered into force on January 1, 2021. The document represents both parties’ commitment to the facilitation of goods exchange and the exchange of information and expertise on measures to improve customs techniques and procedures and on computerized systems that may be beneficial to it.

The CMAA agreement outlines that technical cooperation may be provided when mutually beneficial to customs matters, in the form of:

- Exchange of personnel and experts, for the purposes of promoting the mutual understanding of each other’s customs law, procedures, and techniques;

- Training, particularly developing specialized skills of their customs officials;

- Exchange of professional, scientific, and technical data relating to customs law and procedures;

- Techniques and improved methods of processing passengers and cargo; and

- Any other general administrative matters that may from time to time require joint actions by their customs administrations.

The scope of the agreement between the two countries includes:

- Establishing and maintaining channels of communication between their customs authorities to facilitate and secure the rapid exchange of information;

- Facilitating effective coordination between their customs authorities;

- Promoting facilitation of bilateral and global trade; and

- Any other administrative matters related to the CMMA that may from time to time require their joint action.

The CMAA agreement also covers the type of assistance exchanged between the UK and China on the matter of customs administration, whether that is spontaneous or requested – in which case, it should follow specific clauses.

Lastly, the CMAA agreement specifies the form in which information should be communicated, confidentiality measures, assistance expenses, and exceptions to the obligation to provide assistance.

Hong Kong-UK engagements

Investment Promotion and Protection Agreement

Hong Kong and the UK signed an Investment Promotion and Protection Agreement (IPPA) in 1998 to promote favorable conditions for greater investment from both sides.

Investors covered by the IPPA include:

- Citizens of the SAR and the UK; and

- Companies legally established within the territories of the SAR and the UK.

Under the Agreement, “investments” that are protected include (but are not limited to):

- Movable and immovable property and any other property rights such as mortgages, liens or pledges;

- Shares in and stock and debentures of a company and any other form of participation in a company;

- Claims to money or to any performance under contract having a financial value;

- Intellectual property rights, goodwill, technical processes, and know-how; and

- Business concessions conferred by law or under contract, including concessions to search for, cultivate, extract or exploit natural resources.

The IPPA guarantees investors from both countries the right to transfer profits derived in the other contracting party’s territory back to their home country. This includes the transfer of profits, dividends, interests, and other income, money from partial liquidation of investment, payables pursuant to loan agreements related to investments, and royalties.

Under the Agreement, investment disputes which have not been resolved amicably should be settled through specific procedures agreed upon within a period of three months.

Comprehensive Avoidance of Double Taxation Agreement

In 2010, the UK and Hong Kong signed a Comprehensive Avoidance of Double Taxation Agreement (CDTA). The CDTA outlines in detail the division of taxing authority between the two jurisdictions as well as the reduction in tax rates for various forms of passive income. It promotes closer economic and trade ties between the two nations, assists investors in better estimating their potential tax liabilities from cross-border economic activities, and offers additional incentives for UK-based businesses to conduct business or make investments in Hong Kong and vice versa.

Hong Kong “residents” covered by the CDTA include:

- Any individual who ordinarily resides in the Hong Kong Special Administrative Region;

- Any individual who stays in the Hong Kong SAR for more than 180 days during a year of assessment or for more than 300 days in two consecutive years of assessment one of which is the relevant year of assessment;

- A company incorporated in Hong Kong or, if incorporated outside, being centrally managed and controlled in the SAR;

- Any other person constituted under the laws of the Hong Kong SAR of, if constituted outside, being centrally managed and controlled in the SAR.

UK “residents” covered by the CDTA include any person who, under the laws of the UK, is liable to tax therein by reason of his domicile, residence, place of management, place of incorporation or any other criterion of a similar nature. This term, however, does not include any person who is liable to tax in the UK in respect only of income from sources in the country.

Moreover, the Agreement covers taxation of the governments, political subdivisions, and local authorities of both countries.

The document also illustrates the case of an individual being a “resident” entity in both countries, in which case:

- They will be deemed to be a resident only of the Party in which they have a permanent home available;

- If they have a home in both countries, then they will be considered “residents” of the country where they have closer personal and economic relations (that is, “centre of vital interests”);

- In case the centre of vital interests cannot be determined, they will be deemed to be resident where they have a habitual abode. If this condition cannot be satisfied, then the competent authorities of the Contracting Parties shall settle the question by mutual agreement.

In the case of Hong Kong, taxes covered by the CDTA include:

- Profits tax;

- Salaries tax; and

- Property tax;

While, in the case of the United Kingdom, they include:

- Income tax;

- Corporation tax; and

- Capital gains tax.

See our China country portal for an overview of Chinese taxes and regulations on residence and incorporation.

Multilateral treaties

China, Hong Kong, and the UK are all WTO members, which by extension means they are parties to a range of multilateral agreements on trade and investment. These treaties include:

- The Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS) requires WTO members to extend intellectual property (IP) rights to the IP owners in any member state or region. It includes a most-favored-nation (MFN) clause, guaranteeing equal treatment for IP rights protection for all member countries and regions, and offers dispute resolution and compensation mechanisms.

- Agreement on Trade-Related Investment Measures (TRIMs), which prohibits members from implementing investment measures that have the effect of restricting trade with other members, such as local content requirements (requirements for a company to use locally-produced goods or local services in order to operate in the market).

- General Agreement on Trade in Services (GATS), which guarantees MFN status to service providers of any WTO member (except governmental services such as social security schemes, public health, education, and services related to air transport).

Outlook

The recent resumption of direct flights between China and the UK starting August 2022 should enable face-to-face interactions between people on an individual, business, and diplomatic levels. The British Chamber of Commerce in China anticipates those formal economic interactions, such as through the Joint Economic and Trade Commission (JETCO) and the Economic and Financial Dialogue, will resume in the near future as travel between the two nations becomes more convenient.

Increased exchanges and communication will facilitate Chinese businesses to participate more confidently in the UK economy on the one hand, while also assisting British enterprises in overcoming obstacles in the Chinese market and regulatory environment on the other.

Concerning Hong Kong, in addition to being its second-largest trading partner in Europe, the UK also serves as the SAR’s primary source and recipient of FDI. The future economic growth and prosperity of the UK will also depend on how successfully the country will reshape its connections, investment, and trade with Hong Kong in the Brexit era. British companies have already started to seek non-EU nations for export and investment opportunities. A recent report revealed that 35 percent of UK companies intend to increase their investments in Asia’s growing economies as their top priority. The benefits of large-scale development initiatives like the Belt and Road Initiative (BRI) and the Guangdong, Hong Kong, and Macau Greater Bay Area, will surely attract this category.

While China’s COVID-zero policy, which has led to lockdowns and suspended operations for factories and businesses, remains a challenge for foreign investors, Beijing has also shown signals of relaxing measures and gradual opening. One concrete step in this direction is the reopening of several flight routes between China and the UK, as well as fewer requirements on arrival – such as a reduced quarantine period.

To be up to date with China’s travel updates, refer to our article here.

All in all, in 2022, both the Chinese and the British economies will experience a slowdown, amid a global recession and post-pandemic recovery. It remains to be seen how the governments will respond to such economic headwinds, and how these might reshape their mutual trade and investment relations.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China’s Lithium-Ion Battery Industry – Overcoming Supply Chain Challenges

- Next Article China-Mongolia: Bilateral Trade, Investment, and Future Prospects