China’s Most Productive Provinces and Cities as per 2021 GDP Statistics

China’s GDP in 2021 reached RMB 114.4 trillion (US$17.7 trillion), showing an increase of about RMB 13 trillion (US$3 trillion) compared to 2020, or 8.1 percent growth year-on-year, according to the National Bureau of Statistics (NBS).

Authorities have also unveiled data tracking the economic performance of 31 provinces, autonomous regions, and municipalities directly under the Central Government for 2021.

With global headwinds and COVID-linked uncertainties dampening China’s economic growth outlook in 2022, it is easy to feel pessimistic. That’s why we take a closer look at the growth rates of prominent provinces and major cities in China in this article – to gain sense of what is happening on the ground and whether the country continues to be a favored investment destination.

Guangdong’s GDP ranked first for the 33rd consecutive year

In 2021, the economic output of many provinces reached a new high. Among others, Guangdong’s GDP exceeded RMB 12 trillion for the first time – reaching RMB 12.44 trillion (approx. US$1.92 trillion) and registering eight percent growth year-on-year. This ensures that Guangdong ranked first in the country for the 33rd consecutive year. To compare, based on 2020 statistics, Guangdong’s GDP was higher than Italy (US$1.89 trillion), Canada (US$1.64 trillion), and South Korea (US$1.64 trillion).

Meanwhile, Jiangsu’s GDP breached RMB 11 trillion-mark for the first time – coming in at RMB 11.64 trillion (approx. US$1.80 trillion), showing an increase of about RMB 1.37 trillion (US$0.21 trillion) compared to 2020.

Shandong’s GDP reached a new high, ranking third in China with RMB 8.31 trillion (approx. US$1.29 trillion). Zhejiang’s GDP exceeded RMB 7 trillion (approx. US$1.09 trillion) for the first time, ranking fourth in China, and Henan’s GDP approached RMB 6 trillion (approx. US$0.93 trillion), ranking fifth in the country.

On the other end, Sichuan and Hubei’s GDP exceeded RMB 5 trillion (approx. US$0.78 trillion) for the first time.

Shanghai, Anhui, Hebei, and Beijing’s GDP exceeded RMB 4 trillion (approx. US$0.62 trillion), Shanxi and Inner Mongolia’s GDP exceeded RMB 2 trillion (approx. US$0.31 trillion), and Gansu exceeded RMB 1 trillion (approx. US$0.16 trillion), respectively.

In total, the GDP of 27 provinces in China surpassed RMB 1 trillion (approx. US$0.16 trillion).

Hubei’s GDP grew the fastest while Hainan’s two-year average GDP growth rate ranked first

In terms of the economic growth recorded by all provinces in 2021, Hubei led China’s recovery, pulling in a 12.9 percent GDP growth rate as compared to 2020. This shows Hubei’s economy has navigated itself out of the haze of the pandemic disruption, returning to normalcy. Hainan and Shanxi ranked second and third, with GDP growth rates of 11.2 percent and 9.1 percent, respectively.

In terms of two-year average growth, however, Hainan, Shanxi, and Guizhou topped the list – registering an average growth of 7.3 percent, 6.3 percent, and 6.3 percent, respectively. Hainan has thus led the regional economic growth rate in the past two years. With China’s ongoing efforts to develop Hainan Island into a globally influential free trade port, it is foreseeable that in the next few years Hainan may usher in the fastest development stage in history.

In addition, the GDP growth of the following regions beat the national GDP growth rate of 8.1 percent: Jiangxi (8.8%), Jiangsu (8.6%), Beijing (8.5%), Zhejiang (8.5%), Shandong (8.3%), Anhui (8.3%), Chongqing (8.3%), Sichuan (8.2%). Both Shanghai and Guizhou’s GDP increased by 8.1 percent, in line with the national level.

South China provinces record better economic performance than their northern neighbors

By region, among the top 10 provinces by GDP, only Shandong and Henan were northern provinces while the remaining eight provinces were all located in South China.

Hebei, Beijing, and Shaanxi ranked third to fifth among the northern regions and ranked 12th to 14th in the country, respectively. The three northeastern provinces dropped out of the top 15, such as Liaoning, which ranked 17th nationwide. The fastest growing of the northern provinces was Shanxi, which saw its economy soar in 2021 due to rising energy-related prices.

Among the six central provinces, Henan, located in central China, tops the list, followed by Hubei, Hunan, Anhui, Jiangxi, and Shanxi. With an economic output of nearly RMB 6 trillion (approx. US$0.93 trillion), Henan is firmly at the top of the list of six central provinces, while Hubei, the fastest growing province, registered more than RMB 800 billion (approx. US$124 billion), coming behind Henan. Shanxi ranked first in the central region in terms of economic growth rate, but its economic output just exceeded RMB 2 trillion (approx. US$0.31 trillion) in 2021, which means it will take longer time for Shanxi to catch up with Jiangxi.

China GDP ranking of 31 provinces in 2021

Per capita GDP of 17 provinces exceeded US$10,000

In terms of GDP per capita by province, Beijing’s per capita GDP remained the highest in China, rising from RMB 164,200 (approx.US$25,457) in 2020 to RMB 183,900 (approx.US$28,512) in 2021. Shanghai’s per capita GDP ranked second among all regions with RMB 173,800 (approx. US$26,946) in 2021. After that, Jiangsu, Fujian, Zhejiang, and Tianjin’s per capita GDP exceeded RMB 100,000 (approx.US$15,504), reaching RMB 137,300 (approx. US$21,287), RMB 117,500 (approx.US$18,217), RMB 113,900 (approx.US$17,659), and RMB 113,200 (approx. US$17,550), respectively.

In US dollar terms, the per capita GDP of 17 provinces exceeded US$10,000, among which Beijing, Shanghai, and Jiangsu’s per capita GDP surpassed US$20,000, while Anhui, Hunan, Jiangxi, Liaoning, and Shanxi’s per capita GDP reached US$10,000 for the first time.

China GDP per capita ranking for 31 provinces

GDP breakdown of China’s provinces by industry-type

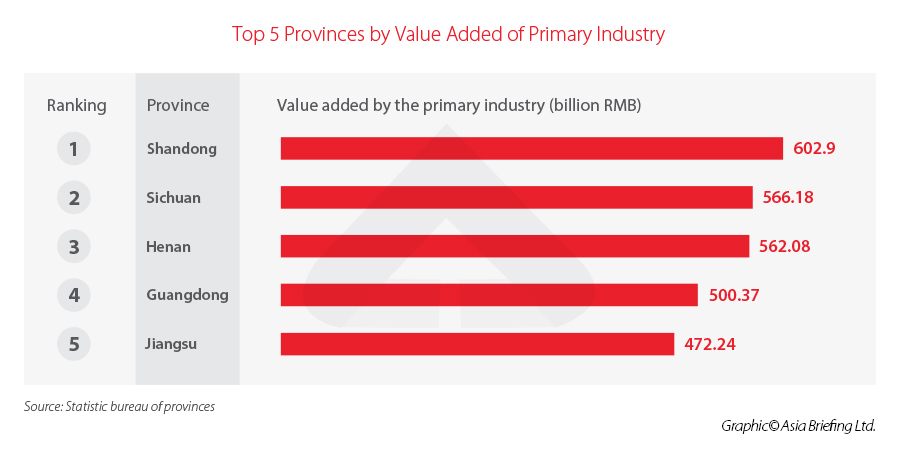

Primary industry

In terms of the share of the primary industry, Shandong ranked first in the country with an added value of RMB 602.9 billion (approx. US$93.5 billion) in 2021, continuing to consolidate Shandong’s position as a strong agricultural province. Sichuan and Henan rounded up the top three agricultural provinces in the country.

The added value of Guangdong’s primary industry exceeded RMB 500 billion (approx. US$77.5 billion) for the first time, rising to fourth place in China. The added value of the primary industry in Hebei and Guangxi surpassed RMB 400 billion (approx. US$62.0 billion) for the first time, ranking eighth and ninth in China, respectively.

Top five Chinese provinces by value added by the primary industry

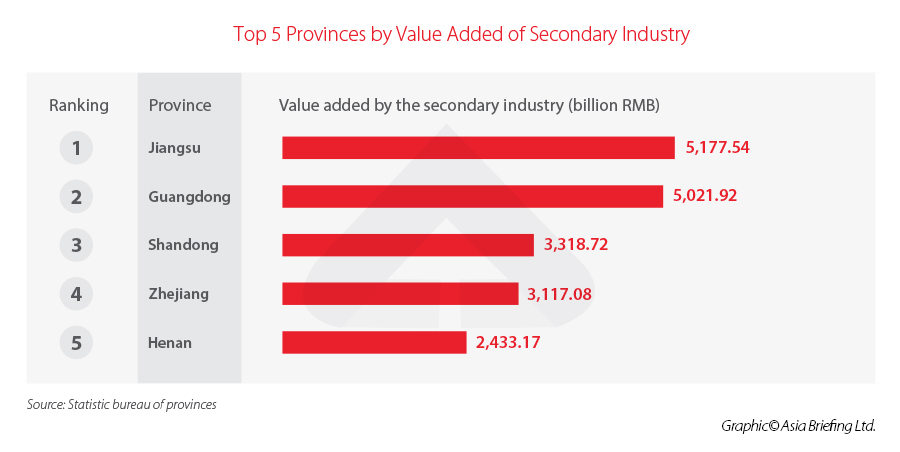

Secondary industry

In terms of the added value of the secondary industry, both Jiangsu and Guangdong reached a new level of RMB 5 trillion (approx. US$0.78 trillion). Jiangsu ranked first in the country with the added value of the secondary industry at RMB 5.18 trillion (approx. US$0.80 trillion), followed by Guangdong with added value worth RMB 5.02 trillion (approx. US$0.78 trillion), further consolidating the status of Jiangsu and Guangdong as two strong manufacturing provinces.

The added value of the secondary industry in Shandong and Zhejiang, both, reached a new level at RMB 3 trillion (approx. US$0.47 trillion), ranking among the top four in China. In addition, the added value of the secondary industry in Shanxi, Chongqing, and Liaoning exceeded RMB 1 trillion (approx. US$0.16 trillion) for the first time.

It is worth noting that in the secondary industry, Beijing’s growth rate is the brightest, reaching 23.2 percent. After that, Hubei, Zhejiang, Shanxi, and Jiangsu all grew by more than 10 percent.

Top five Chinese provinces by value added by the secondary industry

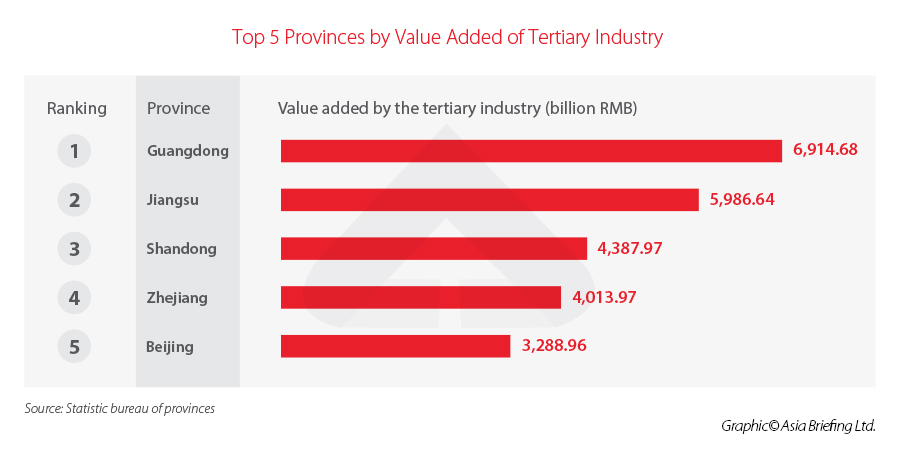

Tertiary industry

In terms of the tertiary industry, the added value of Guangdong’s tertiary industry is the most outstanding, having reached RMB 6.91 trillion (approx. US$1.07 trillion) in 2021 and continuing to lead the country. After that, Jiangsu ranked second – with its tertiary industry adding value worth RMB 5.99 trillion (approx. US$0.93 trillion).

Next, a couple of firsts:

- The added value of the tertiary industry in Shandong and Zhejiang exceeded RMB 4 trillion (approx. US$0.62 trillion) for the first time.

- The added value of Shanghai’s tertiary industry exceeded RMB 3 trillion (approx. US$0.47 trillion) for the first time.

- The added value of Anhui’s tertiary industry reached RMB 2 trillion (approx. US$0.31 trillion) for the first time. The added value of Shanxi’s tertiary industry exceeded RMB 1 trillion (approx. US$0.16 trillion) for the first time.

In terms of the growth rate of the tertiary industry, Hainan saw the best growth rate of 15.3 percent in 2021. Hubei followed with a growth rate of 12.6 percent. The tertiary industry in Jiangxi, Shandong, and Chongqing all grew by over nine percent in 2021.

Top five Chinese provinces by value added by the tertiary industry

24 cities with GDP over RMB 1 trillion

In 2021, China’s city GDP “trillion club” expanded again as 24 cities ended up with a GDP over RMB 1 trillion (approx. US$0.16 trillion).

Shanghai and Beijing’s GDP exceeded RMB 4 trillion (approx. US$0.62 trillion). The rapid recovery of Shanghai’s economic growth owes much to strategic emerging industries, especially new energy vehicles. Beijing’s rapid growth is partly due to the fast growth of its industries above the designated size. On the other hand, Beijing has begun to deploy advantageous production capacity after relocating the non-capital functions to neighboring provinces.

Dongguan’s GDP reached RMB 1.09 trillion (approx. US$0.17 trillion) in 2021, becoming the 24th member of the trillion-club cities. According to analysts, this is mostly due to the rapid growth of China foreign trade in 2021.

In terms of the geographic area of the 24 trillion club cities, 18 of them were located in South China while six of them belonged to North China. In terms of their constituent provinces, the number of trillion-club cities in Guangdong reached four, including Shenzhen, Guangzhou, Foshan, and Dongguan. Thus, Guangdong has caught up with Jiangsu in the number of trillion-club cities. Jiangsu has the following four trillion-club cities: Suzhou, Nanjing, Wuxi, and Nantong.

List of China’s trillion-club cities – GDP over RMB 1 trillion

Looking ahead

China’s economic performance lived to expectation in 2021. On the other hand, there were unmistakable signs that the country is facing mounting downward pressures. These include a property downturn, shrinking demand, and diminished support from exports. China’s economic outlook for 2022 will depend on exports performance, the pace of recovery of the property industry, and whether domestic consumption can rebound.

Given this, the growth targets of China’s provincial governments have become more realistic. While Hainan has set an ambitious GDP target at around nice percent for 2022, Hubei, Jiangxi, Anhui, Ningxia, and Henan have all set growth targets of around seven percent. Most other provinces have only set their growth target at between five percent and 6.5 percent.

Though GDP numbers only tell part of the story of a region’s economic situation, it is an important indicator for managing growth expectations and predicting local economic policies. Enterprises doing business in China should keep a close eye on the economic development patterns of specific provinces and cities.

Dezan Shira and Associates professionals have a deep understanding of China’s business and regulatory environment, and provide comprehensive market entry and operational advisory services. Our advisors use their exceptional expertise in legal, accounting, technology, and market entry intelligence to offer you a one-stop solution. If your business requires assistance in China, you can reach out to our team by sending an email to China@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article German Chamber’s Business Confidence Survey 2021/22: Long-Term Outlook is Positive

- Next Article Belt and Road Weekly Investor Intelligence #67