China’s 2022 Negative List for Market Access: Restrictions Cut, Financial Sector Opening

China’s 2022 Negative List for Market Access has opened more sectors of its economy to private investment. We go over key changes in the policy and discuss the further liberalization of the financial sector.

China has opened more sectors of its economy to private investment, per a new update to the Negative List for Market Access.

The negative list is a document that delineates industries that are prohibited or restricted to private investment by companies in China. Any industry not included on the list is presumed to be open to investment without requiring additional administrative approvals.

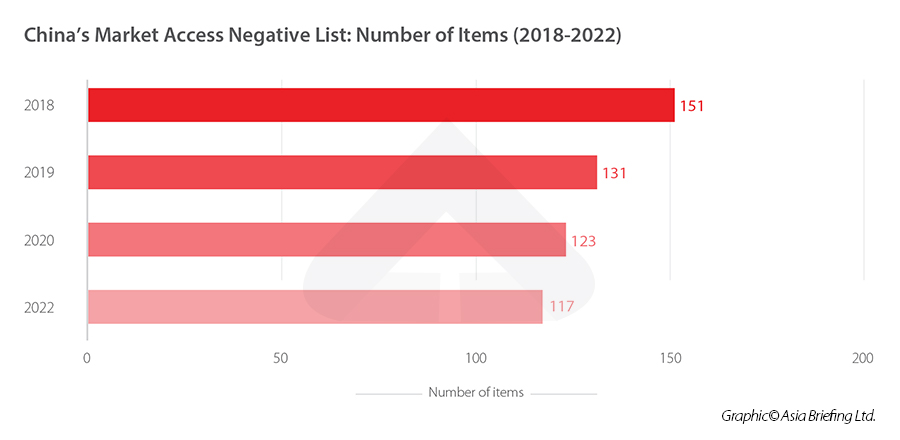

On March 25, 2022, the National Development and Reform Commission and the Ministry of Commerce jointly released an updated version of the negative list. The updated list, which came into effect immediately, covers 117 industries, down from 123 in the 2020 list.

The Negative List for Market Access applies to both foreign and domestic investors alike. It is not to be confused with the Special Administrative Measures (Negative List) for Foreign Investment Access and the Special Administrative Measures (Negative List) for Foreign Investment Access in Pilot Free Trade Zones, which are separate negative lists that apply exclusively to foreign investors.

What are the new changes?

The changes in the new negative list primarily affect the financial sector, representing a gradual opening of more industries for private investment. Here, we go over the major changes and the implications for foreign investors.

More restrictions cut

The updated negative list cuts the number of industries with restrictions from 123 in 2020 to 117. This continues the trend of gradual reductions in restrictions. The negative list had 131 in 2019 and 151 in 2018, the first year the list existed. Chinese regulators first introduced the negative list to consolidate and streamline regulatory restrictions and adopt a more open market outlook.

The new negative list removes restrictions on stock issuance, mergers and acquisitions of listed companies, and internet financial information services. Now, investors no longer need prior approval to participate in these industries.

The changes to the negative list mean that all market entities can access these industries equally, and do not require special approval to enter. However, they still must comply with relevant regulations, which vary by industry.

New restrictions on news media

Although the updated negative list lowers the total number of industry restrictions, it also introduced a handful of new ones in the news media sector.

Namely, the negative list no longer allows for private investors, without special approval, to conduct news gathering, editing, and broadcasting operations; invest, establish, or operate any form of news agency; or publish news reported by foreign entities.

The news media sector was already extremely restricted in China – especially for foreign investors – and the changes only reinforce this status.

How does the Negative List for Market Access work?

Similar to previous years, the 2022 Negative List for Market Access continues to include two categories: prohibited and restricted markets.

For the prohibited list, market players are forbidden from engaging in these industries, fields, and businesses in any way – whether it be in the form of investments, partnerships, or takeovers.

Market players wishing to enter “restricted” categories must do so by filing an application for access to the relevant administrative organs as per the laws and regulations.

So, foreign investors need to consult both the negative list for foreign investment (FI negative list) and the market access negative list to know whether they can invest in their industry, field, or business of choice.

The 2022 Negative List for Market Access has six prohibited items:

| Negative List for Market Access (2022 Edition): What Has Been Prohibited | |

| Prohibited items | Description |

| 1. Prohibited sectors clearly established by laws, regulations, and State Council directives. | 156 items specified in the Appendix of the 2022 Negative List for Market Access. |

| 2. Products, technologies, processes, equipment, and behaviors that are prohibited or restricted by state industrial policies. | Investment in obsolete items in the Catalogue for the Guidance of Industrial Restructuring is prohibited; restricted items are prohibited from new investment.

It is prohibited to invest in the prohibited items listed in the Provisions on the Administration of Investment in the v 6t7 6t7Automobile Industry. |

| 3. Development activities that do not meet the requirements of the main functional area. | The relevant items listed in the negative list (or prohibited list) of industry access for local national key ecological function zones and the negative list (or prohibited list) of industry access for major agricultural production areas. |

| 4. Financial related businesses in violation of regulations

|

Non-financial institutions and enterprises not engaged in financial activities shall not use the words “bank”, “insurance” (insurance company, insurance asset management company, insurance group company, self-insured company, mutual insurance organization), “securities company”, “fund management company (refers to fund management companies engaged in public fund management business), “trust company”, “financial holding company”, “financial group”, “financial company”, “wealth management”, “equity crowdfunding”, “finance”, “financial leasing”, “Auto finance”, “money brokerage”, “consumer finance”, “financing guarantee”, “pawn”, “credit investigation”, “trading center”, “exchange” and other words related to finance in their registered names and business scope, except as otherwise stipulated by laws, administrative regulations, and the State documents.

Non-financial institutions and enterprises not engaged in financial activities shall, in principle, not use the terms “financial leasing”, “commercial factoring”, “small loan”, “asset management”, “online lending”, “P2P”, “Internet insurance”, “payment”, “foreign exchange (exchange, settlement, and sale of foreign exchange, currency exchange)”, and “fund management (refers to the fund management companies or partnerships engaged in private fund management business. The venture capital industry access shall be implemented in accordance with the relevant provisions of several Opinions of The State Council on Promoting the Sustainable and Healthy Development of Venture Capital (Guofa [2016] No. 53))” and other words related to finance in their registered names and business scope. Where enterprises (including stock enterprises) choose to use the above words in the name and business scope, the market supervision department shall timely inform the financial supervision department of the registration information, and the financial supervision department and the market supervision department shall pay continuous attention to it and list it into the key supervision object. |

| 5. Prohibited internet-related business activities

|

Prohibited measures in the Catalogue of Prohibited and Permitted Access to the Internet Market:

|

| 6. Prohibited news media business activities | Non-public capital shall not engage in the business of news gathering, editing, and broadcasting.

Non-public capital shall not invest in the establishment and operation of news organizations, including but not limited to news agencies, newspapers and periodicals, radio, and television broadcasting organizations, radio and television stations, and Internet news and information collection, compilation, and release service organizations. Non-public capital shall not operate the layout, frequency, channels, columns, and public accounts of news organizations. Non-public capital shall not be engaged in live broadcasting of political, economic, military, diplomatic, major social, cultural, scientific and technological, health, education, sports, and other activities and events related to political direction, public opinion orientation, and value orientation. Non-public capital shall not introduce news released by foreign subjects. Non-public capital shall not hold forum summits and award selection activities in the field of news and public opinion. |

The 2022 Negative List for Market Access has 111 restricted items:

| Negative List of Market Access (2022 Edition): Restricted Items

(Subject to approval, qualification, licensing measures, or requisite legal procedures) |

|

| Sector | No. of items |

| 1. Agricultural, forestry, animal husbandry, and fishery | 10 items |

| 2. Mining | 1 item |

| 3. Manufacturing | 20 items |

| 4. Production and supply of electric power, heat, gas, and water | 1 item |

| 5. Construction | 1 item |

| 6. Wholesale and retail | 7 items |

| 7. Transportation, warehousing, and postal services | 7 items |

| 8. Accommodation and catering | 1 item |

| 9. Information transmission, software, and information technology services | 4 items |

| 10. Finance | 9 items |

| 11. Real estate | 1 item |

| 12. Leasing and business services | 5 items |

| 13. Scientific research and technical services | 8 items |

| 14. Water, environmental, and public utility management | 5 items |

| 15. Residential services, repairs, and other services | 2 items |

| 16. Education | 1 item |

| 17. Health and social work | 3 items |

| 18. Cultural, sports, and entertainment | 7 items |

| 19. List of Investment Projects approved by the Government that are subject to approval | 10 items |

| 20. Licensing items in the Internet Market Access Prohibited Licensing Director | 6 items |

| 21. Other | 2 items |

Gradual opening of the financial sector

In terms of regulatory liberalization, this year’s changes to the negative list primarily affect the financial sector. China has an enormous financial sector – including over RMB 7.3 trillion (US$1.15 trillion) in market capitalization in its banking market – but remains heavily regulated, particularly for foreign investors.

While participating in China’s financial sector requires navigating a complicated regulatory environment, there are increasing opportunities for foreign investors in targeted areas. This includes in fintech, green finance, and a wider array of services in the Shanghai Free Trade Zone.

The revised negative list is not the only major change that Chinese regulators have made in recent weeks. On April 2, 2022, the China Securities Regulatory Commission, along with other agencies, announced new draft rules that will allow for greater cross-border regulatory cooperation.

The change removes the requirement for Chinese offshore-listed firms to have their on-site financial data inspections be primarily conducted by Chinese regulatory agencies. Chinese regulators are now working on a framework to allow US regulators to gain full access to audit reports for most Chinese companies listed in the US. If successful, the change will allow for Chinese companies to continue to be listed in the US.

The Chinese government has long committed to opening up the financial sector, but progress toward this end has been relatively slow. Together, reforms to the negative list and offshore auditing requirements reflect new momentum in liberalizing China’s financial sector as the government seeks to further stimulate economic growth.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Belt and Road Weekly Investor Intelligence #76

- Next Article Russia’s Pivot to China – Geopolitics, Trade, and Development in the Wake of the Ukraine Conflict