China’s E-Fapiao System at a Glance

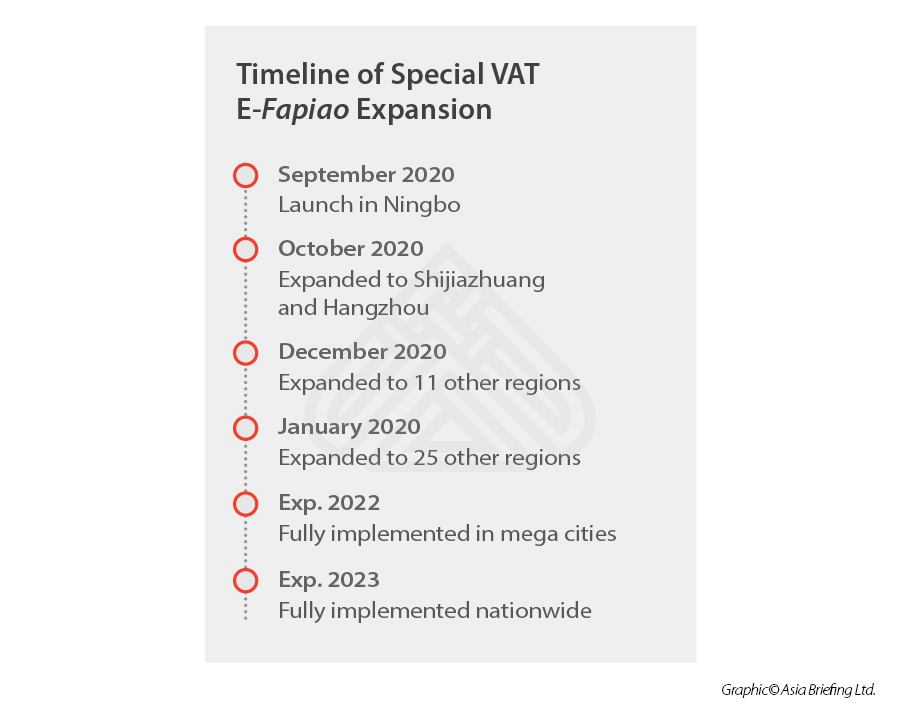

Over the last few months, China has been quickly expanding the pilot program on electronic special value-added tax (VAT) fapiao (hereafter referred to as special VAT e-fapiao). First trialed in Ningbo, Hangzhou, and Shijiazhuang, China expanded the pilot program on issuing special VAT e-fapiao to 11 regions from December 21, 2020 and then another 25 regions from January 21, 2021. China is accelerating its effort to join the booming trend throughout the world: digitalization.

In this article of China Briefing magazine, we will walk you through China’s developing e-fapiao system by introducing what it is, explaining why it matters, and exploring the potential challenges associated with the implementation.

What is e-fapiao?

To explain what is e-fapiao, one must first understand the basic concept of fapiao.

In China, fapiao refers to VAT fapiao in particular. It is a business voucher issued and received by all parties involved in the purchase and sale of goods or services.

Different from the commercial invoices or receipts used in many other countries mainly to record transactions, fapiao in China serve as both the legal receipt and the tax invoice:

- The fapiao is the original accounting document for a taxpayer to support the legitimacy of their activities; and

- The fapiao stipulates the VAT due and is used by the authorities to track transactions for tax purposes and avoid tax evasion.

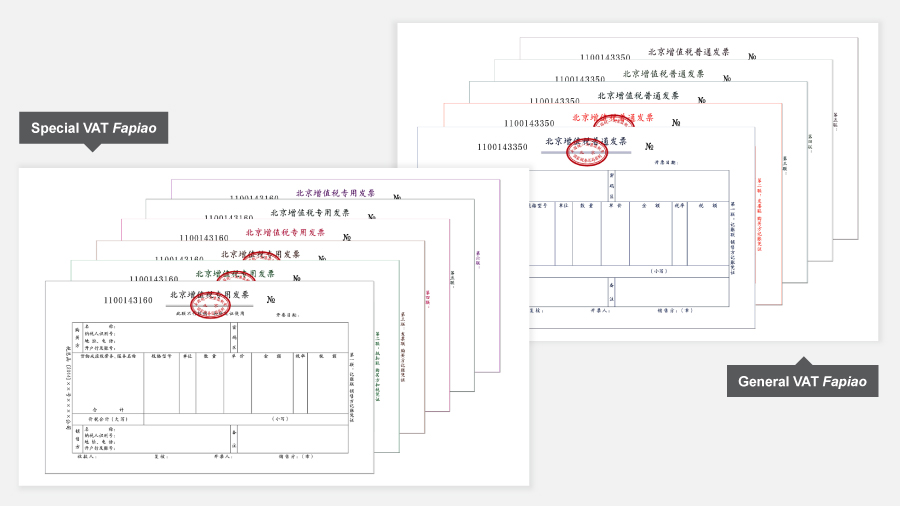

Fapiao can mainly be sorted into two categories – general VAT fapiao and special VAT fapiao. While special VAT fapiao can only be utilized by VAT general taxpayers whose annual taxable turnover is over RMB 5 million (US$ 780,000) or who have applied for such general taxpayer status voluntarily to ease their VAT obligations, general VAT fapiao can be utilized by any company registered in China but cannot be used by the recipient for VAT deduction purposes. Individuals regularly use general VAT fapiao when reimbursing their business expenses.

These two types of fapiao have been in paper form for a long time. They are printed, distributed, and administered by the State Taxation Administration (STA) and its local branches. When a company wants to issue fapiao in China, it must first obtain blank sheets of specially templated fapiao paper from the local tax bureau within its quota every month, print the transaction information on the fapiao sheets with a special printer that is linked to and controlled by the tax system, and then seal the fapiao with a dedicated fapiao seal showing the issuer’s name and tax identification code, and other necessary information.

Examples of the conventional general VAT fapiao and special VAT fapiao can be found below:

This paper fapiao system has remained in place for many years. However, in recent years, the methodology has come under increased strain from high-frequency transaction industries, such as retail, food and beverage, and travel. Especially with e-commerce booming in China, sellers find it difficult to issue and deliver fapiao in the traditional method due to the explosive number of online requests. This is why China started to explore the application of e-fapiao.

E-fapiao, as the name suggests, is a type of fapiao in electronic form. It has the same purpose and legal effect as the conventional paper fapiao.

Despite the similar appearance of an e-fapiao and the scanned copy of a paper fapiao, the two are different in nature:

- E-fapiao is a data file that is generated in the official tax system in a structured format. It is easier for financial systems to comprehend, book, and archive automatically. And it adopts technical anti- counterfeiting measures, such as electronic signature, to ensure its authenticity.

- The scanned copy of a paper fapiao just mirrors information of the corresponding paper fapiao and doesn’t contain the original anti-counterfeiting measures possessed by the paper fapiao, which are mainly physical measures, such as special printing ink, the printing font, the company fapiao chop, etc. It can’t be regarded by the tax bureau as an “original” fapiao in the way the e-fapiao can be.

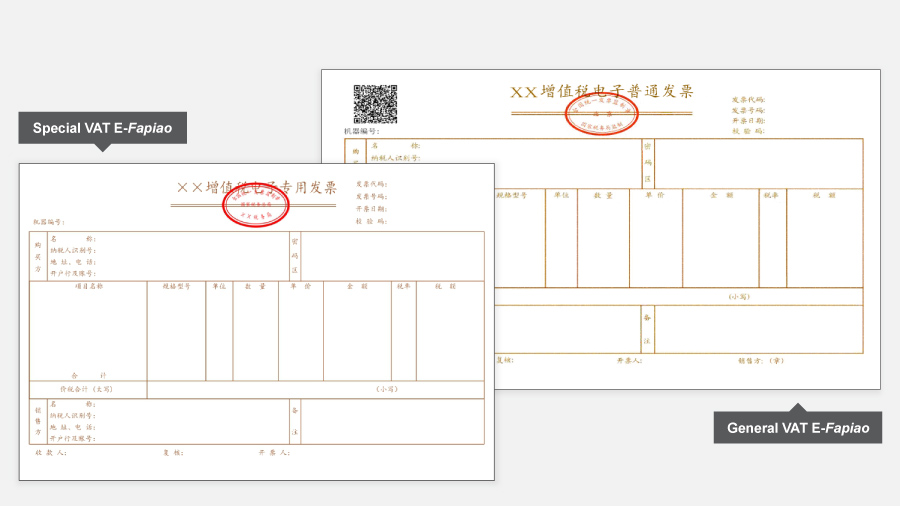

Similar to paper fapiao, e-fapiao are also divided into two types: general VAT e-fapiao and special VAT e-fapiao, but in contrast to paper fapiao for which multiple duplicate copies are issued via the special printer, e-fapiao (whether general or special versions) only exist as a single data file. Examples of e-fapiao are shown below.

E-fapiao application in China

After piloting in selected cities, China first rolled out general VAT e-fapiao nationwide in 2015, as general VAT e-fapiao are non- deductible for tax purposes by recipients and therefore much simpler to manage, compared with special VAT e-fapiao. In 2017, e-commerce, telecommunication, finance, express mail, and other high-frequency transaction industries were selected to further promote the adoption of general VAT e-fapiao. General VAT e-fapiao have already been overwhelmingly adopted in B2C transactions. Quite a few cities, such as Hangzhou, Guangzhou, Shenzhen, etc. are planning to completely replace paper general VAT fapiao with general VAT e-fapiao within their jurisdictions.

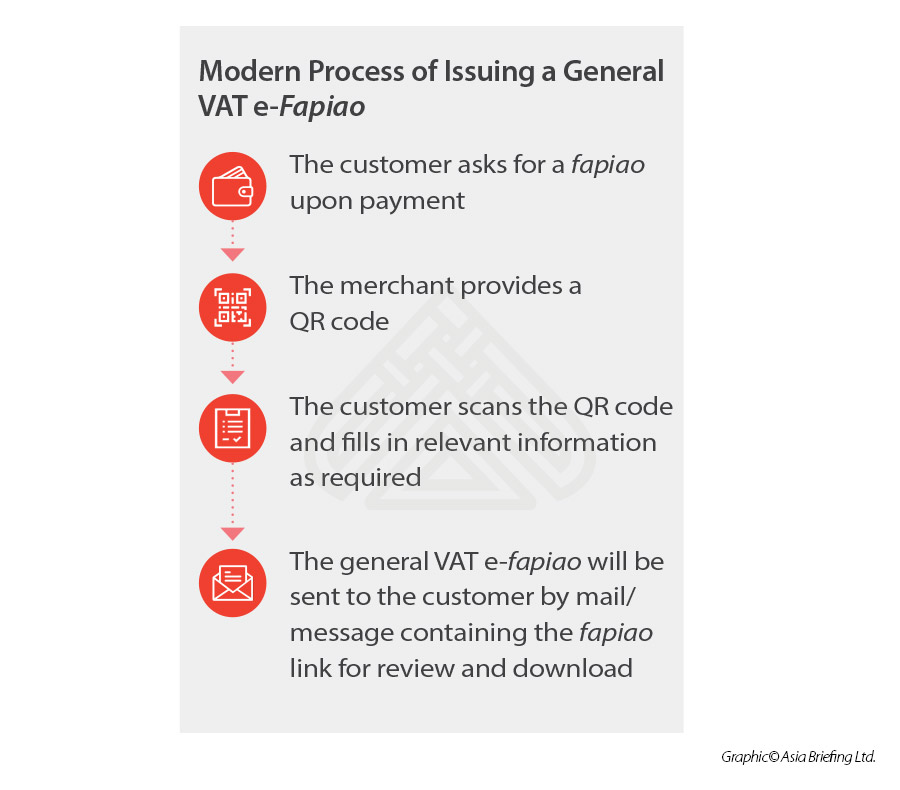

With the process growing more advanced, general VAT e-fapiao can now be issued automatically or semi-automatically when a customer makes a payment. The necessary information can be transmitted into the service portal automatically without the help of an operator.

For example, when a customer pays the bill in a retail store, the merchant will typically give him a receipt with a QR code attached. If the customer wants to apply for a fapiao, they can simply scan the QR code to display the relevant information required for issuance of the fapiao (e.g., company name, tax registration number, company address, company bank account, etc., in the case of company type fapiao) in digital form on their mobile phone. The required information is typically pre-registered within their WeChat or Alipay app and can be “pulled across” to instantly populate the relevant fields. Once submitted, the e-fapiao will be issued immediately and sent to their mobile phone and / or email address. The whole process takes a matter of seconds. It removes the burden from the business of manually issuing the paper fapiao and is much more convenient for both parties.

Encouraged by the success of general VAT e-fapiao in B2C transactions, in 2020, Chinese tax authorities mulled over expanding the e-fapiao programs to the B2B field, where special VAT fapiao dominate. This is because businesses generally require special VAT fapiao to deduct their input VAT, and in doing so reducing their overall VAT burden.

In July 2020, the State Council released the Implementing Opinions on Further Optimizing the Business Environment to Better Serve Market Players (Guo Ban Fa [2020] No.24), stating that China would realize the electronic operation of special VAT invoices by the end of 2020.

In August 2020, the Ningbo branch of STA announced that the special VAT e-fapiao would be piloted in Haishu District and Cixi City of Ningbo starting from September 1, 2020, which was later expanded to the whole of Ningbo in mid-September, to Shijiazhuang in October, and to Hangzhou in November.

Next, the Announcement of State Taxation Administration on Matters Relating to Implementation of Special VAT e-fapiao for Newly Established Taxpayer (STA Announcement [2020] No.22) released by the STA in December 2020, indicated that the special VAT e-fapiao would be implemented for newly established taxpayers in 11 regions, namely, Tianjin, Hebei, Shanghai, Jiangsu, Zhejiang, Anhui, Guangdong, Chongqing, Sichuan, Ningbo, and Shenzhen starting from December 21, 2020, and another 25 regions, including Beijing, Shanxi, Inner Mongolia, Liaoning, Jilin, Heilongjiang, Fujian, Jiangxi, Shandong, Henan, Hubei, Hunan, Guangxi, Hainan, Guizhou, Yunnan, Tibet, Shaanxi, Gansu, Qinghai, Ningxia, Xinjiang, Dalian, Xiamen, and Qingdao starting from January 21, 2021. The scope of recipients of these special VAT e-fapiao shall be nationwide.

So far, the issuance of special VAT fapiao is still on a voluntary basis. Enterprises falling into the pilot scope in the pilot areas can choose to issue special VAT e-fapiao or hard-copy special VAT fapiao when issuing, and where the recipient requests for a hard-copy fapiao, the enterprise should issue a hard-copy special VAT fapiao as it is requested.

However, considering the tax authorities’ determination to apply big data and information technology intelligence to enhance tax administration and combat tax evasion, as stated in the Opinions on Further Deepening the Reform of Tax Collection and Administration (Shui Zong Fa [2021] No.21) in March 2021, the rolling out of special VAT e-fapiao can be expected to be much faster than that of the general VAT e-fapiao.

According to industry forecasts, special VAT e-fapiao is expected to be fully implemented in mega cities as early as 2022, with all taxpayers having the ability to issue special VAT e-fapiao. Nationwide adoption of special VAT e-fapiao is expected to happen in 2023 or so.

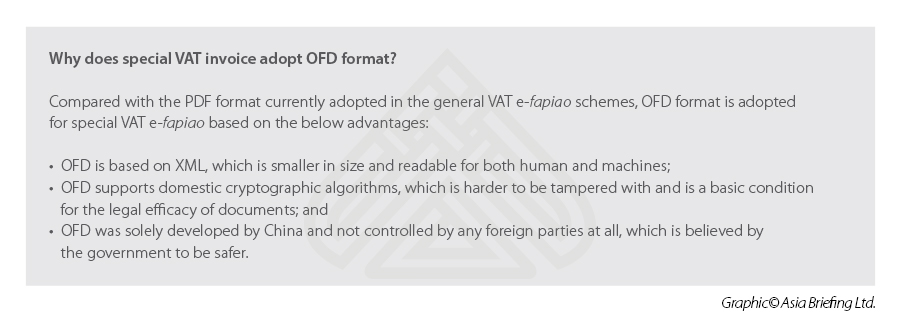

To issue a special VAT e-fapiao, the enterprise shall receive a free USB “key” from the local tax bureau, which allows it to connect to a dedicated portal developed by the STA for invoicing. The special VAT e-fapiao is in OFD format and requires a special reader to read and verify. The special VAT e-fapiao can also be verified through the national VAT invoice verification platform (https://inv-veri. chinatax.gov.cn).

Advantages of e-fapiao

Because of the digital nature of e-fapiao, it comes with added benefits for both taxpayers and tax administration.

Being easier to obtain, issue, deliver, and store, the new invoicing process will lead to more cost-effective and environmentally friendly business practices. Besides, considering e-fapiao is easier to search for at a later date, to retrieve when needed, and more suitable for automation, the whole financial and accounting process can be expected to be more streamlined, efficient, and accurate with improved data quality. The business environment and general market vitality can be expected to be improved as a consequence.

To be more specific, advantages of e-fapiao are summarized below.

Less bureaucratic

The new e-fapiao system will cut some red tape that currently take place in obtaining paper fapiao. For example, businesses will no longer need to obtain hard-copy fapiao by visiting the tax bureau physically or applying for express delivery. They can simply apply for the electronic version of fapiao or additional volumes through multiple electronic channels. Besides, businesses will no longer need to acquire special printing hardware for producing paper fapiao.

Easier to issue, deliver, preserve, and retrieve

Different from paper fapiao that have multiple copies, both general VAT e-fapiao and special VAT e-fapiao have only one copy. Moreover, for special VAT e-fapiao, the column “goods or taxable services, service name” on paper fapiao was simplified to “project name” and the “seller (chop)” column was canceled. These all simplified the fapiao issuance process.

Compared to paper fapiao that need to be delivered by on-site collection or express delivery, e-fapiao can be delivered through email, links, QR code and other remote- delivery ways, which are much faster and convenient. This instant delivery also allows companies to speed up their payment collection process, which can help ease the pressure on the finance team.

Paper fapiao can be easily damaged, worn, or lost due to improper storage, while e-fapiao can be safely preserved in a digital format, which can be re-downloaded from free channels provided by the STA even if the original e-fapiao was lost or damaged.

E-fapiao are easy to search at a later date due to their digital nature, and there is no need to rely on manual entry or OCR scanning to extract information from them, as is necessary for paper fapiao.

Cost efficient

As e-fapiao has no paper carrier, relevant costs for printing, storing, and delivering fapiao can be saved for businesses. Besides, when artificial intelligence and automation technologies are applied by businesses, manpower and time costs can be reduced dramatically in the whole financial management process. Employees will be freed to focus on other more creative and value-added areas.

Simplified verification

Traditionally, taxpayers must manually input the fapiao code, fapiao number, issuing date, transaction amount, as well as the verification code to the National VAT Fapiao Verification Platform developed by the STA to verify each paper fapiao received.

In contrast, in addition to the traditional verification channel, a special VAT e-fapiao can be verified directly by the “Fapiao reader” developed by the STA when opening the OFD document, which is much more convenient and faster. With the integrated fapiao service platform growing more sophisticated, businesses can even achieve fapiao verification by batch processing, so they won’t need to even open each file manually.

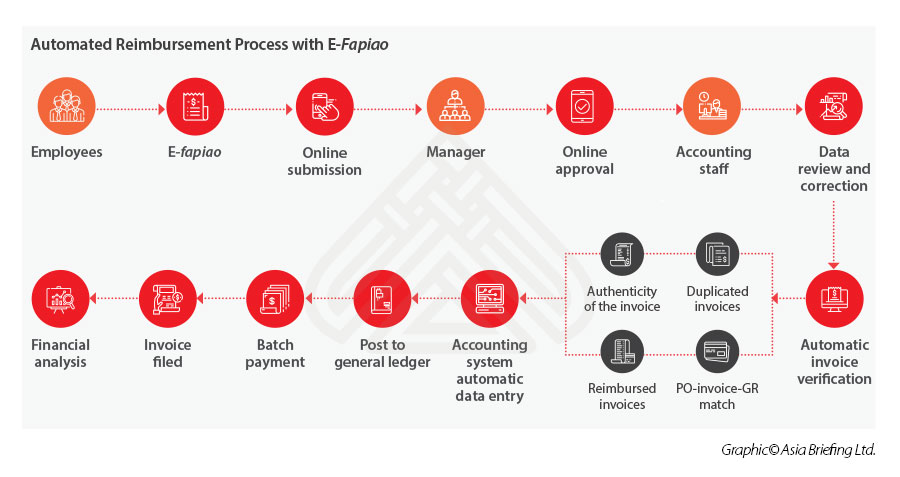

Automation and work processes optimization

Unlike paper fapiao that need to utilize OCR or other technology to transfer to a machine- readable format when achieving digitalization, e-fapiao is machine-readable by nature. It can easily be integrated into the company’s existing management systems (such as ERP) and connect the transaction data, the payment data, and the financial accounting data in a real-time manner, which enables enterprises to further optimize financial and accounting processes and achieve higher levels of automation. For example, with different modules of the automation system further developed and integrated, automatic reconciliation, transaction posting, tax calculation, and tax filing can be realized, which will reduce error, save manpower, and improve transparency and productivity.

Why does it matter?

The implementation of e-fapiao will not only initiate a revolution within the traditional financial and accounting processes of a business, but also will significantly affect the whole business operation and supply chain management. Below we explain why.

E-fapiao is related to all businesses

Businesses, especially those not included in the pilot special VAT e-fapiao programs, may think that e-fapiao will not have much influence on them. This is a misunderstanding. Although e-fapiao can only be issued by newly established enterprises in the pilot regions, they may still receive special VAT e-fapiao as the scope of receipt is nationwide. Despite the law indicating that paper fapiao have to be provided where the recipient requests for a hard-copy, it is not always achievable if the business does not have much leverage in the supply chain. Therefore, all businesses must quickly prepare to handle e-fapiao in an efficient and legally compliant way.

E-fapiao will affect businesses sooner than expected

E-fapiao is rolling out in China at a surprising speed. The general VAT e-fapiao has already been become the default method of issuance in the B2C area and is close to fully replacing the paper fapiao, while special VAT e-fapiao is expected to be fully implemented in mega cities as early as 2022, with all taxpayers having the ability to issue special VAT e-fapiao. E-fapiao may affect businesses sooner than thought.

E-fapiao has imposed new compliance requirements on the financial and accounting processes

With China hastening the expansion of e-fapiao, it has also been developing relevant laws and regulations to facilitate the implementation of e-fapiao management and has put forward specific compliance requirements to businesses.

For example, on December 20, 2020, the STA released the Notice on Regulating Reimbursement, Bookkeeping, and Archiving of Electronic Accounting Vouchers (Cai Kuai [2020] No.6), according to which taxpayers can solely use electronic accounting vouchers (including e-fapiao) for bookkeeping and accounting only if they satisfy the criteria set out in the Notice.

If a taxpayer cannot meet all the conditions, they must properly preserve the printed copies of electronic accounting vouchers as well as the original electronic accounting voucher (the original digital file produce by the invoicing system, rather than the scanned copy of the printed copy). Meanwhile, taxpayers should also establish a retrieval system between the archived location of each electronic accounting voucher and the corresponding hard-copy bookkeeping voucher to enable quick access to the original accounting documents.

If companies fail to comply with such compliance requirements, monetary penalties might be triggered, in addition to potential restrictions to participate in certain businesses. What’s worse, the enterprise’s tax credit or its capability of applying for VAT rebates may also be negatively affected where the violations are serious. This would cause even bigger losses to the business.

Consequently, companies are suggested to establish proper financial and accounting protocols and provide due training to their financial staff as early as possible to ensure 100 percent compliance, before the full implementation of special VAT e-fapiao, and before they have too many non-compliant legacy records to fix.

E-fapiao requires software installment and system upgrade

To be able to open and read the OFD format of the special VAT e-fapiao, enterprises are required to install a special software developed by the STA. However, foreign invested enterprises are usually subject to strict restrictions in installing such software. For larger organizations, may take months for the headquarter to assess the security of the software before approving the installment. If the enterprise doesn’t think about this issue until they start receiving e-fapiao, the corresponding accounting, tax calculation and filing, and archiving process will be unavoidably delayed.

The company may also need to upgrade its existing system to be compatible with the new special VAT e-fapiao format.

E-fapiao offer a great opportunity for enterprises to further automate and optimize their operations

As mentioned earlier, the high automatable nature of e-fapiao enables enterprises to further streamline their businesses, which will help them to achieve higher productivity, more accuracy, and enhanced internal control in risk management.

Please note that not only the financial and accounting processes will be affected. The implementation of e-fapiao and associated improved automation will also help to optimize other key operations, such as supply chain management, client relationship management, reporting, etc.

For example, for the reimbursement process, e-fapiao are easier to be obtained and preserved and the applicant can directly use the digital file for reimbursement via an automated expense management app without manually filling in an application form and sticking paper fapiao to a piece of A4 paper (provided that the e-fapiao management of the company can satisfy relevant requirements). This digital method is not only more accurate but also more convenient and efficient for both finance team and employees. Expense management apps can verify the fapiao automatically and by batch, which solves a main pain point in reimbursement management. For the time being, at least for most organizations, e-fapiao will still need to be printed out and stored by the internal administration team in paper format, however, this inconvenience is likely to be eliminated as well within a few years.

Another example can be observed in the procurement process. Under the traditional procurement process, after the buyer receives the purchased goods and issues a receipt upon goods examination, warehousing, and accounting checking, the supplier will issue a fapiao and deliver to the buyer by mail, which usually takes two days or longer. When the fapiao arrives, the financial staff of the buyer needs to manually verify the fapiao and compare it with the order and the receipt, before making payment to the supplier and archiving the fapiao. The whole process involves manual work from multiple departments, which is not only time consuming but also is prone to error.

If businesses can take the chance of the implementation of special VAT e-fapiao to fully digitalize its procurement process, the fapiao can be received and booked as soon as it is issued, and the accounting checking and the order-invoice-receipt matching can be done automatically, which will substantially shorten the turnaround time and make the payment period more predictable. This will help businesses maintain a good reputation among their suppliers.

Summary

In the context of the tax bureau’s determination to achieve advanced tax administration through information technology, the implementation of e-fapiao is imperative. The digital nature of e-fapiao will bring multiple benefits to businesses in achieving higher accuracy, higher efficiency, and higher levels of automation. However, on the other hand, the e-fapiao implementation also impose challenges on businesses in the short-term to understand the laws and regulations, develop relevant internal protocols, revise standard business processes, and upgrade relevant software and equipment to comply with the new reimbursement, bookkeeping, and archiving requirements. It’s important that companies get prepared and develop a thorough strategy for e-fapiao to alleviate operational risks and get the most out of the e-invoicing trend.

A version of this article was originally published in our June 2021 China Briefing Magazine, Preparing for the Coming E-Fapiao Era.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Cybersecurity für Unternehmen in China: Wie Sie Ihr Unternehmen schützen können

- Next Article Guangzhou’s Next Round of GBA IIT Subsidy Applications: July 1 to August 31, 2021