China’s Economic Recovery – July 2021 Economic Roundup

China’s National Bureau of Statistics recently released economic data for the month of July, revealing sharp deceleration across key areas of the economy. The lower-than-expected figures, which were blamed in part on resurgent COVID-19 cases, severe flooding, and rising commodity prices, are a continuation of a longer economic trend that could signal trouble for China’s economic recovery post-COVID. However, strong foreign direct investment statistics indicate reasons to be optimistic about the future.

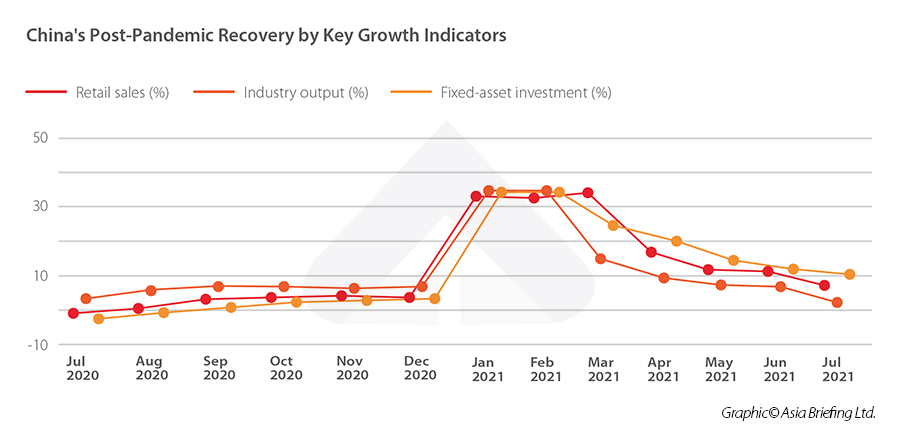

On August 16, the National Bureau of Statistics (NBS) released China’s key economic indicators for the month of July. Several of the indicators, namely industry value-added output, retail sales, and fixed-asset investments, showed some of the lowest growth gains since China’s meteoric recovery at the beginning of 2021, raising concerns over the country’s economic outlook in the second half of 2021 and beyond.

Below, we provide a brief overview of the key indicators, discuss the reasons behind the slowdown in China’s economic growth, and look ahead to see what this slump may mean for the country’s post-pandemic recovery and opportunities for foreign investors.

China’s economic growth slows down, but FDI remains strong

Retail sales, often considered a bellwether for China’s economy and a key indicator for post-pandemic recovery, grew 8.5 percent year-on-year, 3.6 percentage points lower than in June. Retail sales growth slowed among almost every single category, with the biggest slumps seen in cosmetics, which dropped to just 2.8 percent year-on-year growth from 13.5 percent in June, and telecom, which plummeted to 0.1 percent from 15.9 percent the month before.

Automobiles were the only sector to see negative growth, dropping to -1.8 percent from 4.5 percent in June, whereas pharmaceuticals was the only category that accelerated slightly, rising to 8.6 percent from 8.5 percent in June.

Other key indicators were similarly hit by headwinds. Industry value-added output grew 6.4 percent year-on-year in July, 1.9 percentage points below June’s figure. This was below the market forecast of 7.8 percent and marked the weakest growth increase in almost a year.

Growth in fixed asset investments also slowed. July recorded a 10.3 percent year-on-year increase, reaching RMB 30.25 trillion (US$4.66 trillion). This is 2.3 percentage points below June’s growth of 12.6 percent and misses the 11.3 percent market forecast. Of this, infrastructure investment from January to July 2021 grew 4.6 percent year-on-year, 1.5 percentage points lower than the 6.1 percent growth seen from January to June 2021. Meanwhile, real estate development investment growth also slowed slightly, decreasing 0.2 percentage points from the period from January to June to 12.7 percent in July.

Finally, another indicator of interest to both market analysts and government officials, the surveyed unemployment rate, rose slightly in June to 5.1 percent, from 5 percent in June. Among those aged 16 to 25, unemployment rose to 16.2 percent from 15.4 percent in June. However, government announcements attributed this increase to a seasonal trend, as university students graduate in the summer months and start job hunting. Meanwhile, the unemployment rate among the population aged 25 to 59 was 4.2 percent, remaining unchanged from the previous month.

It is important to note that China’s unemployment rate may be inaccurate, as it does not account for migrant workers or self-employed people.

On the same day that the NBS released the July economic statistics, China’s Ministry of Commerce reported significantly rosier results for foreign direct investment (FDI). The latest figures show FDI rose considerably throughout the first half of 2021, with the actual use of foreign capital in the period from January to July 2021 reaching US$100.74 billion.

At 25.5 percent growth from the same period a year prior, this figure still marked a slight slowdown from June, which reported a 28.7 percent year-on-year increase in the period since January. However, July’s figure remained well above the pre-pandemic period, marking a 26.1 percent increase from 2019.

A breakdown of the July FDI figures shows the main recipient was the services sector, of which wholesale and retail surged with 69.3 percent year-on-year growth, while scientific research and technology services rose 49.2 percent year-on-year.

What is causing the slowdown?

Analysts have attributed the drop in some retail sectors in July partly to an increase in sales during the annual 618 shopping festival the prior month, which sees a barrage of online sales and promotions on e-commerce platforms in the weeks leading up to June 18th.

COVID-19 flare-ups in several parts of the country and destructive flooding in Jiangxi, Hubei, and Henan provinces have ground parts of major cities to a standstill, further hindering consumption and productivity.

Blame for the slowdown in industrial output has also been placed on the resurgence of the COVID-19 virus, which triggered lockdowns in some areas of the country. At the same time, surging prices of raw materials and supply chain bottlenecks have stifled production in industries ranging from textiles to food to automobiles.

Meanwhile, tightened policies may also be having an effect on areas such as infrastructure investment. Local infrastructure investment is highly dependent upon local government bonds, in particular special-purpose bonds (SPDs). However, issuance of SPDs has slowed in 2021, and was lower in July than in the period from April to June, according to data from China’s Ministry of Finance.

The drop in the issuing of SDPs is a result of heightened supervision from the central government, which earlier this year demanded stricter control over local governments’ new hidden debt and measures to resolve existing hidden debt. This in turn has made supervision of government investment and financing platforms stricter and subjected urban investment bonds to tighter restrictions, making it harder for these companies to find projects to invest in.

However, the slowdown across these key indicators in July, although more severe than in previous months, is part of a longer downward trend that began earlier in 2021. Retail sales growth has been slowing since peaking in March 2021 and fell short of market forecasts in both April and May. June’s 12.1 percent growth beat the 11 percent forecast, but at the time was still the smallest increase since December 2020.

Similar trends are seen in industry output and fixed-asset investments, which have both slowed considerably since peaking in the January to March period of 2021.

It is therefore also worth noting that year-on-year growth figures in the first half of 2021 are an imperfect gauge of the health of the economy, as they are a comparison to the extremely low numbers seen at the beginning of 2020. The acceleration of growth in the early months of 2021 can be partly attributed to the tanking of these same indicators as the first wave of COVID-19 swept across China a year earlier.

China’s economic recovery in H2 2021

The latest indicators may at first glance appear to paint a dire picture for China’s economy going into the second half of 2021 and 2022. However, GDP growth for 2021 is still set to reach its target of 6 percent. International organizations and foreign banks, many of which lowered their 2021 GDP forecasts earlier in August in response to tightened COVID-19 travel restrictions and lockdowns, still predict a year-end growth rate above the 6 percent target, with the International Monetary Fund’s (IMF) prediction standing at 8.1 percent.

The NBS and other government bodies have also sought to assuage fears by pointing out that, despite slowdowns, key macro indicators still fall within a “reasonable range”, and other indicators, such as production, investment, unemployment, and commodity prices, remain relatively stable.

Of course, a certain degree of uncertainty and concern will persist throughout the second half of 2021 and beyond. At the time of writing this article, COVID-19 cases have been declining, indicating that the latest resurgence has been largely contained. This may provide some short-term relief for some industries and boost consumption, in particular as we head toward the busy holiday period in the fall.

However, as the highly contagious and vaccine-resistant Delta variant continues to sweep across other parts of the world, it is highly unlikely that China can continue to stave off the virus indefinitely, and future waves remain a strong possibility.

Some observers – as well as government insiders – have also raised concerns that China’s zero-COVID policy will leave the country increasingly isolated from the rest of the world, with the continued imposition of travel restrictions hampering economic recovery. Despite calls for a review of the zero-tolerance policy, officials have doubled down on the government’s commitment to stamping out any sign of infection, making the possibility that China will reopen borders in the near future seem rather dim.

On the industrial production front, disruptions to global logistics and rising shipping prices brought about by the pandemic do not appear to be easing. The shutdown of a terminal at the Ningbo-Zhoushan port in Zhejiang Province, one of the world’s busiest, in response to a case of COVID-19 quickly intensified congestion at other east coast shipping terminals, including Shanghai. The result is likely to aggravate issues in global supply chains, and by extension, further raise commodity prices for key industries.

Tone from the top

As the summer months come to a close, it is possible we will continue to see the effects of adverse weather events, not least as cities reeling from the severe flooding in July continue to carry out the immense task of rebuilding infrastructure and rehousing displaced people.

The Chinese government is highly aware of these issues. At a State Council executive meeting held on August 16, Premier Li Keqiang addressed the issues hindering China’s economic recovery. In response to the impact of the floods, he stressed the importance of strengthening disaster prevention and relief measures, resettling people affected by recent calamities, and rebuilding infrastructure damaged by the floods.

The premier also raised the need to maintain supply and stabilize prices by improving and implementing measures to deal with rising prices of key raw materials, increasing domestic production, and organizing the reserve and release of important commodities. The government has in recent months released reserves of core materials in attempts to control soaring commodity prices.

Finally, the premier urged local governments to boost consumption using special-purpose bonds to drive investment and promote foreign trade and investment with more effective measures for reopening.

Amid continued uncertainty in both domestic and global markets, China’s recovery appears to be trundling on a slowing but nonetheless steady path. Meanwhile, a sustained, high level of FDI growth also suggests that investors are still confident in China’s ability to produce returns. As growth slows, the Chinese government is likely to seek new ways to stimulate the economy, potentially opening up new channels for investment. It is therefore important for investors not only to watch economic trends but also the potential opportunities that may arise as a result.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Investing in Dongguan, Guangdong Province: China City Spotlight

- Next Article China and Kyrgyzstan: Bilateral Trade and Future Outlook