China’s Economic Stimulus Explained – Understanding China’s Monetary and Fiscal Policy

China is ramping up stimulus measures to mitigate the impact of COVID-19 lockdowns and external disruption to the economy. The government is hoping that “prudent” monetary measures, such as reduced lending costs and profit transfers, and “proactive” fiscal tools, such as tax and fee relief, which saw the country through 2020 will have the same effect in 2022. We explain China’s economic stimulus measures and discuss how they are being expanded and implemented in 2022.

The COVID-19 pandemic has presented unprecedented challenges to the world economy, many of which persist until today. The sky-high cost of commodities and enduring supply chain bottlenecks caused by the disruption of 2020 has now been exacerbated by geopolitical conflict. In China, new waves of COVID-19 have led authorities to lock down parts of the country, creating new hurdles for an economy already facing a slowdown from global economic pressure and a slump in the property sector.

Despite the headwinds from external and internal factors, China succeeded in maintaining positive GDP growth in both 2020 and 2021 – at a rate of 2.3 and 8.1 percent respectively. In March of this year, set an ambitious target of “around 5.5 percent” GDP growth for 2022.

This goal now appears increasingly difficult to meet. Significant economic disruption from COVID-19 lockdowns and restrictions on movement, global economic pressure stemming from the Russia-Ukraine war and strained supply chains, and persistent issues such as high commodity prices and a slumping property sector, have compounded to create an increasingly difficult situation.

Since the outbreak of the pandemic in 2020, China has employed a series of targeted policy tools to stimulate the economy and support vulnerable businesses and people. These stimulus measures are in part to thank for keeping the economy afloat throughout the last two turbulent years.

Now, with increasing urgency to boost the economy in the lead-up to the pivotal 20th Party Congress in the latter half of the year, the government is extending, expanding, and ramping up these support measures. However, it is also moving relatively carefully, adhering to a long-held practice of cautious monetary easing and targeted fiscal policy.

Background: 2022 economic indicators

China’s economy grew at a rate of 4.8 percent year-on-year in the first quarter of 2022. This was a better-than-expected result, surpassing the 4 percent growth seen in the last quarter of 2021. However, most of this growth occurred before significant disruption to the economy stemming from COVID-19 outbreaks and the outbreak of the Russia-Ukraine war.

Other economic indicators from the past few months show that the GDP data for the second quarter may not be as rosy.

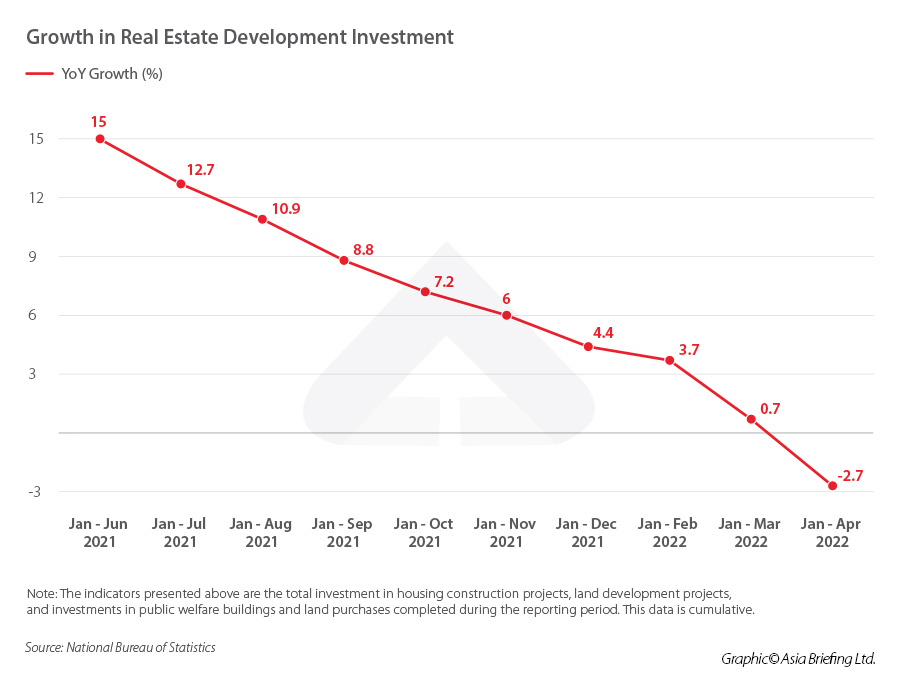

In the period between January and April 2022, for instance, real estate investment decreased by 2.7 percent year-on-year with investment in residential real estate decreasing 2.1 percent year-on-year. The year-on-year growth rate of real estate investment in 2021 was 4.4 percent, despite significant turmoil in the sector that year.

Real estate investment is an important indicator of economic health because the property sector plays an outsized role in the country’s economy.

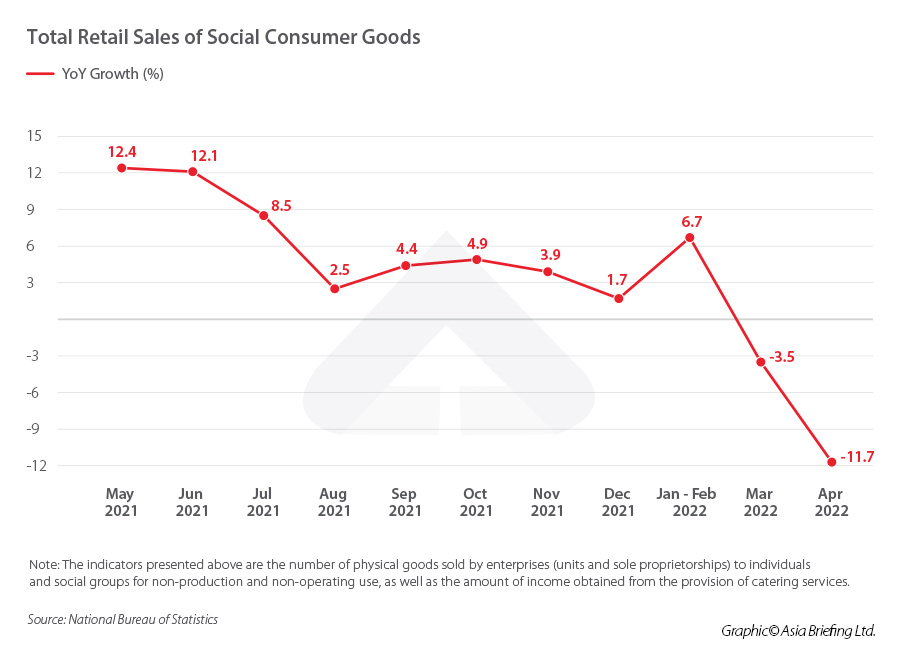

Consumption has also taken a significant hit over the past few months. In April, the total retail sales of social consumer goods dropped by 11.1 percent year-on-year, a more severe decrease than the 3.5 percent seen in March. From January to February, the indicator grew by 6.7 percent year-on-year.

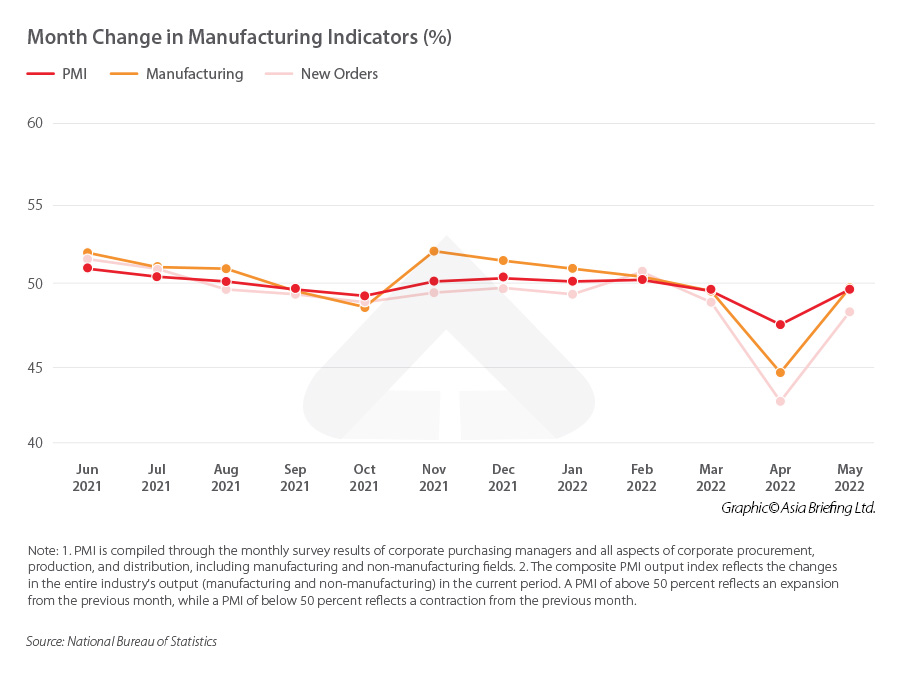

Manufacturing PMI, which gives an indicator of manufacturing activity in a given month, has also dropped since March 2022, reaching a low of 47.4 in April (a PMI of above 50 indicates an economic expansion compared with the previous month, while a PMI of below 50 indicates a contraction).

However, the figures from May indicate a slight recovery. The PMI of large enterprises reached 51, up 2.9 percentage points from the previous month. Small and medium-sized companies still experience a contraction, but at a smaller rate, with PMI reaching 49.4 in May, up from the low of 46.7 in April.

The production index also saw significant improvement, reaching 48.2, up from 44.4 in April, while new orders increased by 5.6 points to reach 48.2 This indicates that the decline in manufacturing market demand narrowed in May.

What stimulus measures has China implemented so far?

China has consistently refrained from using universal cash-in-hand measures to stimulate the economy, such as those seen in countries such as the US, leaning instead on the country’s financial system to support the private sector, implementing preferential tax policies and fee cuts, and increasing government spending and investment to indirectly support the real economy.

Since the initial outbreak of COVID-19 in early 2020, the government has been utilizing a series of fiscal and monetary tools to provide support for companies struggling under growing economic pressure, which we discuss below.

Fiscal policies

Tax rebates and fee cuts

The government has deployed a host of preferential tax policies and fee cuts to support both businesses and individuals throughout the pandemic. These include refunds, waivers, and reductions to corporate income tax (CIT), value-added tax (VAT), and individual income tax (IIT). Many of these applied to small businesses and companies in industries that were particularly hard-hit by the pandemic, and individuals working in essential roles, such as healthcare workers.

Starting in late 2021, China rolled out a raft of tax relief measures for small businesses to provide financial relief in the face of economic pressure from continued COVID-19 disruption and rising operational costs. Industries covered include manufacturing, services, and technology, as well as low-profit enterprises in other industries.

In March 2022, the tax bureau revealed that China had issued US$39 billion in tax deferrals to small businesses that month alone, as a result of the tax policies implemented in 2021 and extended in the first half of 2022.

In the 2022 Government Work Report released in early March, the government further ramped up its tax policy, pledging a total of RMB 2.5 trillion (US$374 billion) in tax refunds and reductions in 2022, of which RMB 1.5 trillion (US$224.5 billion) would be earmarked for VAT rebates. All of this amount of money is to go directly to companies.

In addition to tax relief, the government has also extended fee cuts for small businesses and companies in certain industries. This includes deferral of social security premiums, housing provident fund payments, loan interest, as well as reduction of education surcharges.

Special purpose bonds

Local government special-purpose bonds (SPBs) are one of the key ways in which local governments fund infrastructure and other public projects within their jurisdiction. Importantly, investment in infrastructure is also one of the government’s main strategies for boosting economic growth.

There are certain limits and criteria for the types of projects that can be financed via SPBs – for instance, they are limited to nine major areas, including transport, energy, and affordable housing.

In 2021, the Chinese government set the SPB quota at RMB 3.65 trillion (US$547.5 billion). According to data from the State Council, funds raised from around 50 percent of the bonds were used to invest in transportation and municipal and industrial park infrastructure projects, and around 30 percent went to affordable housing projects and social undertakings such as healthcare, education, pensions, and tourism.

Following the economic slowdown in the second half of 2021, the government decided to front-load the 2022 quota of SPBs, releasing RMB 1.46 trillion (US$218.5 billion) of the 2022 quota in late December 2021, in order to boost spending at the beginning of the year.

As the economy met further headwinds from stringent COVID-19 lockdowns and containment measures in cities such as Shenzhen, Shanghai, and Beijing, as well as increasing instability in the global economy as a result of the Russia-Ukraine war, the government has strived to further speed up the issuance of SPBs.

A set of 33 policy measures released by the State Council at the end of May urged local governments to complete the issuance of all of the RMB 3.45 trillion (US$517.5 billion) of the SPBs that have already been released by the end of June and have mostly used them up by the end of August. The total quota for SPBs in 2022 has been set at RMB 3.65 trillion (US$547.5 billion).

Monetary policies

PBOC profit transfer

In March 2022, the PBOC announced (link in Chinese) an RMB 1 trillion (US$149.6 billion) profit transfer to the government. According to the statement, the funds would primarily be used for tax refunds and transfers to local governments to help them provide support to local businesses and people.

RRR cuts

Another of the government’s monetary policy tools is cutting banks’ reserve requirement ratio (RRR). The RRR is the amount of liquidity that banks must withhold against the amount they invest. A lower RRR means that banks have more cash to spend.

In December 2021, the PBOC cut the RRR by 0.5 percent, freeing up RMB 1.2 trillion (US$179.6 billion) for banks. The central bank had previously cut the RRR by the same amount in July 2021, releasing about RMB 1 trillion (US$179.6 billion) in funds. This will allow banks to provide more loans to businesses struggling in the economic slump at the end of the year, according to analysts.

The first RRR cut in 2022 occurred on April 25, however, it was significantly smaller than previous cuts at 0.25 percent, freeing up RMB 530 billion (US$79.3 billion).

LPR cuts

Another key tool for stimulating the economy is cutting the loan prime rate (LPR). The LPR is the benchmark corporate loan and mortgage rate for commercial banks set by the PBOC. The LPR benchmark is set on the 20th of every month and is based on the proposed rate of 18 commercial banks, including two foreign banks. The LPR is also underpinned by the medium-term lending facility (MLF) rate, which is set by the PBOC. We discuss the MLF in more detail below.

Lowering the LPR, therefore, reduces the costs of new loans for borrowers, helping to inject more liquidity in the economy. It can therefore also help boost housing sales as new mortgages become cheaper.

In May 2022, the PBOC cut the five-year LPR by a record amount, from 4.6 percent to 4.45 percent, in part to help boost the property sector.

Relending programs

Since the outbreak of the pandemic, the PBOC has increasingly been leaning on its relending program to extend support to small businesses and hard-hit sectors. Re-loans, also known as central bank loans, are loans that the central bank provides to commercial banks. The PBOC also sets the relending rate, meaning it can control the price of loans and enable banks to issue cheaper loans by lowering the relending rate.

Recent examples of these programs include an RMB 100 billion (US$15 billion) relending program to support the transport industry launched in May 2022 and an RMB 40 billion (US$6 billion) relending program for elderly care.

In December 2021, the PBOC also cut the relending rate for small businesses and rural industries.

Medium-term lending facility

The MLF is a key channel through which the PBOC can inject liquidity into the banking system. Through the MLF, the PBOC provides medium-term loans (about three months to one year) to large commercial banks to provide them with more cashflow

The MLF rate is the interest rate at which the PBOC provides the loans to the banks. A lower MLF rate, therefore, makes borrowing cheaper for the banks. Because the MLF rate also influences the LPR, cuts to the MLF will also reduce the cost of loans for companies and individuals.

The last time the PBOC cut the MLF rate was in January 2022, when it reduced the rate from 2.95 percent to 2.85 percent on one-year MLF loans worth RMB 700 billion (US$104.8 billion). In March 2022, the PBOC injected RMB 100 billion (US$15 billion) worth of one-year MLF funds (link in Chinese) into the banking system but did not cut the MLF rate as expected.

How has China’s “prudent” monetary policy helped the economy?

China has been steadfast in its use of a “prudent” monetary policy throughout the pandemic, constantly reiterating that it would refrain from using measures that risk “flooding” the market with liquidity.

This “prudent” monetary policy means using highly targeted monetary tools, such as relending and policy loans to provide support for specific industries and groups of people, as well as broader tools, such as RRR and LPR cuts to increase liquidity through the banking system.

Shortly before the 2022 Two Sessions held at the beginning of March 2022, the People’s Bank of China (PBOC), China’s central bank, posted an article on its official WeChat account. The article highlighted the benefits of this policy on China’s economy, stating that it has ensured stability in the years leading up to and throughout the pandemic in several ways.

One of these is maintaining a stable price of goods. According to the PBOC, China has been a considerable stabilizing factor for the price of goods as the cost of commodities and inflation in developed countries rose considerably during the pandemic. In January 2022, the global commodity price index (CPI) rose 46 percent year-on-year, with the US and Euro area seeing a 7.5 percent and 5.1 percent rise respectively. According to the National Bureau of Statistics (NBS), China’s CPI rose just 0.9 percent year-on-year that same month, maintaining an average CPI growth of 2.1 percent since 2018.

Moreover, the policy has enabled China to maintain the exchange rate of the renminbi stable, despite turbulence in international financial markets. During the 973 trading days in China’s foreign exchange market from 2018 to 2021, the central parity rate – the rate at which the currency trades against other currencies – of the renminbi against the US dollar appreciated on 485 trading days, depreciated on 487 trading days, and remained flat on one trading day. According to the PBOC, these changes reflect the normal two-way fluctuation.

In addition, these achievements have also helped prevent severe inflation from interfering with economic growth and enabled China to take appropriate measures in the event of downward pressure on the economy.

The prudent monetary policy has also enabled the PBOC to be more flexible and precise in its approach to economic stimulus, allowing more room to inject liquidity into the areas that need it the most when required. This is most commonly achieved through means such as RRR cuts, cuts to the LPR, cuts to relending rates, increasing the proportion of inclusive loans for small businesses, and other monetary measures to stimulate the real economy.

Can we expect more stimulus measures in 2022?

According to estimates by Bloomberg, China’s total pledged stimulus for 2022 currently amounts to RMB 35.5 trillion (US$5.3 trillion) – significantly higher than in 2021 but still below RMB 37.5 trillion (US$5.6 trillion) seen in 2020. Excluding general budget expenditure, the fiscal and monetary stimulus amounts to RMB 8.8 trillion (US$1.3 trillion) thus far in 2022 and RMB 12.8 trillion (US$1.9 trillion) in 2020.

The PBOC deployed its main stimulus tools more frequently in 2020 than it has done so far in 2022. For example, in 2020, it cut the RRR rate three times between January and May 2020. This indicates that the government may still have room to further ease monetary policy and expand upon fiscal measures to boost the economy in 2022.

Although the smaller-than-expected RRR cut in April and lack of an MLF cut in March prompted some analysts to believe that further RRR and lending rate cuts were unlikely, the government has since hinted that it may yet turn to these tools. The 33 stimulus measures released on May 31 call for “promoting the steady and moderate reduction of real loan interest rates” and to “continue releasing the efficacy of the mechanism reform for setting the LPR”.

The measures also encourage financial institutions to establish a “green channel” for financial bonds for agriculture, rural areas, and farmers, SMEs, green industries, and entrepreneurship and innovation.

Expansion of fiscal stimulus is also possible. The State Tax Administration recently expanded its VAT credit refund program to even more companies, increasing the number of covered industries from six to 13. A program deferring social security premiums for hard-hit industries was also recently expanded to cover another 17 industries, in addition to the five that were previously eligible for the program.

To encourage more infrastructure investment by local governments, the measures also propose expanding the scope of projects that can be financed through SPBs, with priority given to new infrastructure (projects in digital and emerging fields, such as 5G and artificial intelligence) and new energy projects.

Whether the stimulus measures rolled out thus far will be enough to turn the economy around in the latter half of 2022 remains to be seen. China is still facing considerable challenges, with parts of the country still not fully back to normal and restrictions on movement between different areas of the country still in place.

Although the measures are expansive, they may still not be enough to achieve the 5.5 percent growth target. More direct stimulus to businesses and consumers may be required in order to get the country back to full swing by the end of the year, but current indications are that the government is hesitant to do this. The direction that the government will take over the summer and fall may become clearer after the economic data for the second quarter is released next month.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article An Introduction to Doing Business in Hong Kong 2022

- Next Article Shanghai Lifts Lockdown from June 1, 50 New Support Measures for Businesses