China’s Economy in 2022: A Tumultuous Year Ending with an Optimistic Outlook

China’s economy has experienced ups and downs in 2022 as the country grappled with multiple COVID-19 outbreaks and continued turmoil in the property sector. Against these odds, sectors such as foreign trade and investment continued to see double-digit growth and the year has ended on a positive note as the country lifts COVID restrictions and forges a way toward economic growth. We discuss the impact that various domestic and international issues have had on China’s economy through the lens of various economic indicators.

2022 has been a challenging yet pivotal year for China’s economy. Two years after the start of the pandemic, China appeared to be on a path toward steady recovery only to be hit by a series of COVID-19 outbreaks, turmoil in international markets, and continued crisis in the property sector that led to volatility and uneven growth across various sectors.

At the same time, as the country emerges from a strict zero-COVID environment and begins to learn to live with the virus, 2022 has proven to be a decisive year for the future development of business, society, and the economy.

As we head into a new year and unchartered territory, we take a look back at the growth trends of various areas of China’s economy and discuss the drivers behind the ups and downs that the country has experienced over the course of the last 11 months.

GDP growth in 2022

China’s economic outlook at the beginning of 2022 was cautiously optimistic. In 2021, China experienced rapid post-COVID recovery, achieving an annual GDP growth rate of 8.1 percent. It was, however, clear that China would not be able to replicate this rate in 2022. Despite the high overall rate, growth had slowed to just 4 percent in the fourth quarter of 2021, down from 18.3 percent in the first quarter.

This slowdown at the end of 2021 can be attributed to a number of factors, including a series of natural disasters over the summer, a crisis-hit property market, a power crunch in the latter half of the year, and a rising prevalence of COVID-19 outbreaks. In addition, exports, a major contributor to China’s GDP, gradually fell over the course of the year as overseas markets lifted COVID restrictions, decreasing demand for Chinese goods.

Some of these issues were still plaguing the Chinese economy at the beginning of 2022. The economy was nonetheless relatively stable, and at the Two Sessions in March, the government set an ambitious GDP growth target of “around 5.5 percent”.

GDP growth in the first quarter of 2022 also beat the previous quarter, increasing to 4.8 percent year-on-year from 4 percent in the fourth quarter of 2021. However, other economic indicators, including net exports and consumption, continued to slow down.

By March 2022, multiple cities in China had begun to struggle in earnest with the worst outbreak of COVID-19 since early 2020, which led to the beginning of a series of lockdowns in major cities. This was the turning point for the economy in 2022, as stringent COVID-19 measures began to take a toll on the country’s economic outlook.

The Shanghai lockdown, which saw China’s largest city and major economic center effectively shut down for two months from April to June, had a particularly severe impact. However, shorter lockdowns in cities such as Shenzhen, as well as ramped-up COVID restrictions in places such as Beijing, also contributed to the economic hit. As a result of the COVID lockdowns, GDP growth slowed to just 0.4 percent in the second quarter.

Despite the high number of cases, the outbreaks were eventually brought under control, and most lockdowns and restrictions were lifted over the summer months. This enabled economic activity to restart, and GDP growth rebounded to 3.9 percent year-on-year in the third quarter.

The fall of 2022 saw a resurge in COVID-19 cases that spread to every province and region, leading to an increase in lockdowns and restrictions. Major outbreaks at factories led to supply chain issues, and lockdowns in major cities such as Chengdu and Guangdong have further impacted the economy.

In November and December, China took decisive steps to end its long-standing zero-COVID policy. The pivot removed a wide range of restrictions and greatly reduced the scope of people and businesses that are affected by lockdowns. These moves have rekindled hope for an economic rebound late in the year as, in principle, normal economic activity and spending can recommence.

The IMF has forecast China’s annual GDP growth in 2022 to reach 3.2 percent. This prediction was published on November 23, after the government had begun to loosen its zero-COVID policy but before certain major changes had been announced. The body cited the impact of COVID-19 restrictions, low consumption, private investment, and tightening regulatory control over the property sector among the reasons for its evaluation.

However, despite the lifting of most COVID restrictions, it is unlikely that we will see a significant upturn in GDP growth in the last quarter of 2022. In addition to the relatively poor performance of various economic indicators in October and November – which we discuss below – the transition period from zero-COVID to living with COVID will come with its own challenges. This includes an expected surge in COVID-19 cases, which may lead to trepidation among consumers and labor shortages in the short term.

Key economic indicators in 2022

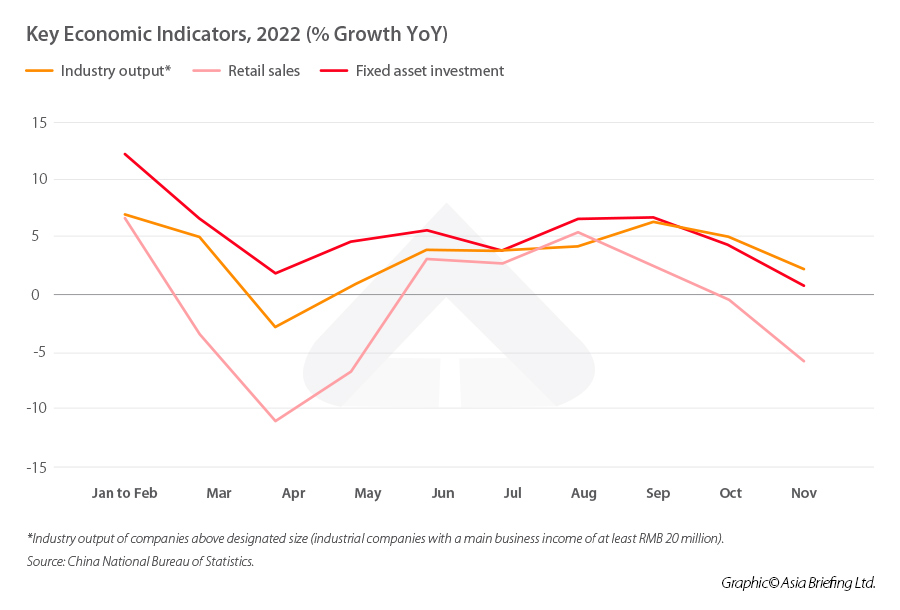

Looking at China’s economy at a more granular level, we can see that several indicators follow a similar trajectory to that of the GDP – slowing yet stable growth in the first quarter followed by a sudden drop in the second quarter, and modest recovery in the third quarter. Data on consumption, retail sales, and investment in October and November also show us how the COVID-19 outbreaks in the latter half of the year have impacted growth.

Consumption

Consumption took a significant hit in 2022 and has been a major cause for concern among policymakers. Consumption had already cooled significantly at the end of 2021 but continued to slow over the course of 2022. Consumption per capita slowed to 5.7 percent year-on-year growth in the first quarter, down from 12.6 percent in the fourth quarter of 2021.

This dropped further to just 0.8 percent in the second quarter of 2022 and had only recovered slightly to 1.5 percent in the third quarter.

Retail was one of the hardest-hit sectors in 2022. Year-on-year growth of retail sales fell by 11.1 percent year-on-year in April, the worst-performing month. Following reopening after the spring lockdowns, they recovered to 5.4 percent year-on-year growth in August. However, the lockdowns later in the year took their toll, and by November, retail sales were once again seeing negative growth, falling by 5.9 percent year-on-year.

Stimulating consumption was one of the government’s major goals for 2022. Although no specific measures were introduced, increasing consumption was on the agenda of the 2022 Two Sessions. The Government Work Report (GWR) released during the meetings called for roundabout mechanisms for boosting consumption in the longer term, including increasing and improving income distribution, providing better social infrastructure, and improving the quality of products and services.

As the country continued to fight several COVID-19 outbreaks over the course of the year, a concrete plan for stimulating consumption was put on the back burner. Some local governments did attempt to get people shopping through tactics such as handing out consumption vouchers to residents over the summer, a move that has been repeated in recent months.

It is uncertain whether the lifting of COVID-19 restrictions will significantly restore retail sales in December 2022 as initial anxiousness among consumers during the transition to living with the virus may continue to keep consumption subdued.

Industrial activity

Industry activity in 2022 saw a similar trend in 2022 as consumption, although indicators show that it fared slightly better overall. The value-added output of industrial enterprises above a designated size (those with an annual main business income of at least RMB 20 million (US$2.9 million)) grew at a rate of 7 percent year-on-year in the period from January to February 2022. However, this quickly fell in the subsequent months as COVID-19 lockdowns took their toll, and industrial output fell by 2.9 percent year-on-year in April.

Industry activity recovered better than retail, as certain factories were permitted to restart operations earlier on during the lockdowns by implementing closed-loop COVID-19 prevention management (where workers are kept in a COVID-free bubble by living in the place of work and minimizing contact with the outside world). By May, industrial output was back to positive growth and had reached 6.3 percent year-on-year growth in September.

Outbreaks at major factories, as well as lockdowns of large manufacturing cities such as Guangzhou and Chengdu in the latter half of the year, once again negatively impacted industrial output, and growth once again slowed to 2.2 percent year-on-year in November.

Fixed asset investment

Overall fixed asset investment maintained positive growth throughout the year but nonetheless showed similar ups and downs to the economic indicators. Growth was relatively strong at the beginning of 2022, up 12.2 percent in January and February, but slowed to just 1.8 percent year-on-year growth in April before recovering to a high of 6.7 percent year-on-year in September. COVID-19 disruption once again dragged on growth, and in November, slowed abruptly to just 0.7 percent year-on-year.

However, looking at the different sectors, we can see that not all investment was equally impacted. Both infrastructure and manufacturing investment maintained relatively high rates of growth in 2022. In the period from January to February, manufacturing investment grew 20.9 percent year-on-year but slowed to 9.3 percent year-on-year in the period from January to November.

Infrastructure investment, on the other hand, bucked the volatile trend experienced by other sectors and remained stable over the course of the year. Growth was at 8.1 percent year-on-year in the period from January to February and slowed to 6.5 percent year-on-year in the period from January to April. However, in the period from January to November, growth was back up to a high of 8.9 percent year-on-year.

Infrastructure investment in China is greatly buoyed by the issuance of special purpose bonds (SPBs), a key vehicle through which local governments fund infrastructure projects. In 2022, the central government set an SPB quota of RMB 3.65 trillion (US$547.5 billion).

This goes some way to explain why infrastructure investment did not see the same extreme drops as a result of COVID-19 lockdowns in 2022 as other sectors.

The main drag on overall fixed asset investment in 2022 was the property sector. Crisis hit the housing market in mid-2021 after measures to reign in the high levels of sector debt and cool house prices began to take effect.

Despite efforts to ease regulatory control over the sector, such as easing requirements for debt refinancing, many of these issues have not been resolved in 2022. Furthermore, additional turmoil hit the sector in 2022 when thousands of would-be homeowners threatened a mortgage boycott in July over property developers’ failure to finish pre-paid homes.

All these issues have compounded to completely tank real estate development investment in 2022. Investment began at a relatively modest 3.7 percent growth year-on-year in the period from January to February 2022. However, in the period from January to November, investment dropped by an average of 9.8 percent year-on-year.

Foreign trade and investment remain strong

Foreign trade in 2022 has maintained relatively stable, although growth has slowed gradually over the course of the year. Imports and exports reached a total of RMB 6.2 trillion (US$890.6 billion) at the end of February, a year-on-year growth rate of 13.3 percent. Of this, exports grew 13.6 year-on-year while imports grew 12.9 percent year-on-year.

By April, this had slowed greatly as manufacturing and logistics were hit by COVID-19 lockdowns. In the period from January to April, growth of foreign trade slowed to 7.9 year-on-year, with exports growing 10.3 percent and imports growing to 5 percent.

The sector recovered somewhat in the third quarter, and in the period from January to November, the growth of imports and exports settled at 8.6 percent, of which exports grew 11.9 percent and imports grew 4.6 percent.

The slowdown in exports is not only attributable to domestic COVID-19 policy. Policymakers had previously warned Chinese exporters that the rapid growth in foreign trade seen in 2021 – especially in exports – could likely not be replicated in 2022. The strong exports seen in 2021 were largely attributable to the fact that many overseas markets were in lockdown, and were therefore spending more on domestic goods from China. In 2022, as these markets implemented COVID exit strategies, consumption shifted to services, decreasing the demand for Chinese goods.

Meanwhile, the low growth of imports signals weakening domestic demand throughout the year, another effect of the low levels of consumption in the China market.

Actual use of foreign capital saw very high growth at the beginning of the year, growing 37.9 year-on-year in the period from January to February. Broken down by sector, services saw a 24 percent year-on-year increase in the actual use of foreign capital high-tech industries increased by 73.8 percent year-on-year.

This growth rate slowed over the course of the year but continued to maintain double digits. In the period from January to October, the latest data available, actual use of foreign capital increased by 14.4 percent year-on-year, with services growing 4.8 percent and high-tech growing 31.7 percent.

A tumultuous year-end but outlook is optimistic

It is clear that for much of 2022, the government’s main priority has been curbing the spread of COVID-19 to prevent an excess of illness and death in its population. This focus has come at the expense of the economy, as the measures needed to prevent the spread of the virus have meant locking down key cities and businesses for long periods of time.

This focus changed abruptly in the last two months of the year, and the priority now and for 2023 will be stimulating economic growth. Economic policymakers have already signaled this shift in gears. The monthly Politburo meeting held at the beginning of December and chaired by Xi Jinping focused on various measures for boosting the economy in 2023 – expanding domestic demand and consumption, improving the resilience of supply chains, attracting more foreign investment, and reducing unemployment, to name a few.

The 2022 Central Government Work Conference, which took place in mid-December and sets the economic policy agenda for the following year, set a similar tone and reiterated many of the same measures for boosting growth in 2023.

The upshot is that the economy is likely to experience a rebound in 2023 as the major barriers to growth have been removed. Whether or not this rebound will be as quick as Chinese policymakers would like will depend on a range of domestic and external factors, which we will discuss in our upcoming article on China’s 2023 economic outlook.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Managing Your China Manufacturing & Supply Chains During COVID Outbreaks

- Next Article Mainland China and Hong Kong to Expand their Stock Connect Scheme