China’s FDI Inflow Surge in Q1 2021: An Explainer

China’s Ministry of Commerce (MOFCOM) has released the latest foreign direct investment (FDI) statistics, which illustrate the country’s positive economic performance in the first three months of the year. With rebounding confidence in China’s growth and opening-up, it remains the top FDI destination for foreign investors.

From January to March, China’s actual use of FDI reached RMB 302.47 billion (US$46.38 billion), representing a 39.9 percent surge year-on-year, and an increase of 24.8 percent as compared to the same period in 2019. In dollar terms, the actual use of FDI recorded a growth of 43.8 percent year-on-year; this does not include investments in the financial sector.

As to the number of foreign invested enterprises (FIEs), there were in total 10,263 new FIEs established in the first three months of 2021, up by 47.8 percent year-on-year, and up by 6.7 percent as compared to the same period in 2019.

The unusually high growth rate is because it was compared with a period in which the economy suffered a contraction under the pandemic. The data nonetheless indicates that China’s recovering FDI performance has surpassed pre-pandemic levels.

FDI statistic breakdown

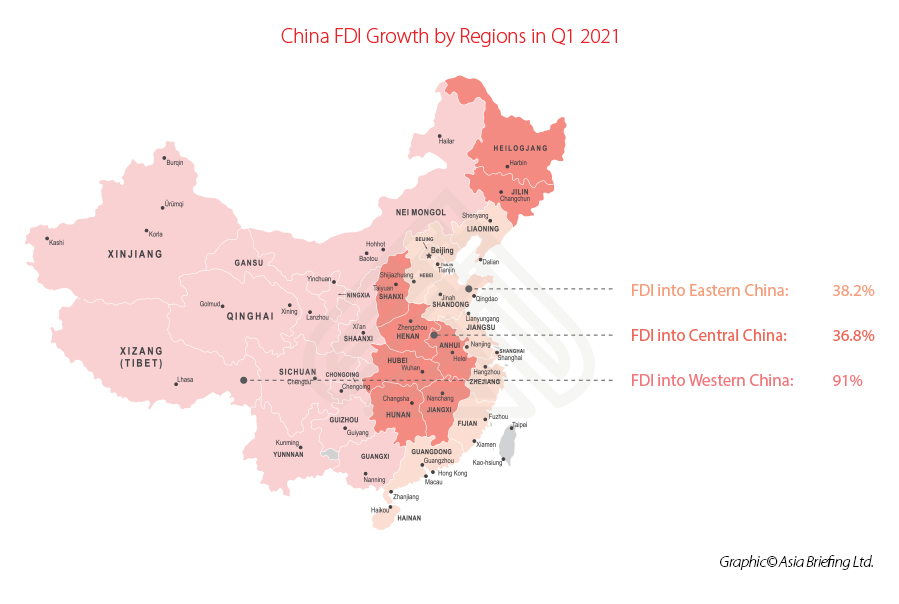

FDI into west China surging

FDI into eastern China and central China regions were reported at similar levels, growing by 38.2 percent and 36.8 percent year-on-year, respectively. In contrast, the actual use of FDI into western China surged significantly by 91 percent, indicating the huge market and development potential in inland China.

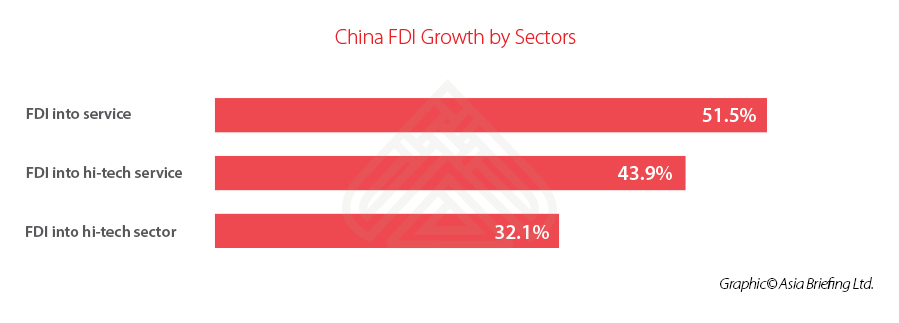

FDI into the service industry and high-tech investments increasing

Foreign investors increased their investment into service and high-tech industries in Q1 2021. Through the first three months of the year, the service industry attracted foreign investment valued at RMB 237.79 billion (US$36.6 billion), a 51.5 percent year-on-year growth from 2020.

FDI into the high-tech sector grew 32.1 percent year-on-year: FDI into high-tech services and high-tech manufacturing increased by 43.9 percent and 2.5 percent year-on-year, respectively.

The structure of China’s FDI continued to improve in 2021.

FDI from BRI and ASEAN countries growing

In the first quarter, FDI from ASEAN countries increased by 60 percent year-on-year, making it the largest contributor to China’s FDI inflow.

Countries along the Belt and Road Initiative (BRI) also contributed significant FDI inflow to China, surging by 58.2 percent. During the same period, investment from EU countries increased but at a modest rate, recorded at 7.5 percent year-on-year.

Reasons behind China’s FDI appeal

China has surpassed the United States to became the world’s largest FDI recipient, with inflows rising by four percent to US$163 billion in 2020, according to a report published by the United Nations Conference on Trade and Development (UNCTAD) in January 2021.

And in a survey released by the American Chamber of Commerce in China, investing in China is still a top choice for more than 60 percent of surveyed companies.

There are reasons for this.

China’s quick recovery from the pandemic

China’s successful containment of the coronavirus outbreak within its borders enabled the quick recovery of its economy.

This was helped by its stable social environment, integrated industrial system, efficient and advanced service and logistic networks, well-educated human resources, as well as a sizeable domestic market.

After businesses and factories reopened and internal movement relaxed following the successful implementation of COVID-19 control measures, China proved itself to be a reliable investment destination.

In 2020, China’s GDP grew by 2.3 percent and reached RMB 10,159.86 trillion (US$1571.73 trillion), making China the only major economy that experienced positive growth that year.

These factors and outcomes increased the confidence of foreign investors in China and helped the country avoid large-scale relocation of foreign and local companies.

China’s trade agreement network

China has been extremely active in putting into place a variety of trade agreements. This includes bilateral investment treaties (BITs), free trade agreements (FTAs), and double taxation agreements (DTAs), etc.

BITs

China has been entering into BITs with other countries since the early 1980s, when the nation began its path to reforms under then-President Deng Xiaoping.

Although many have now been superseded by more complicated and sophisticated trade agreements, such as double tax treaties (DTAs) and other bilateral mechanisms, BITs remain important, especially for investors from emerging nations with relatively immature tax laws and regulatory environments. Such treaties also help to underpin the bilateral investment conditions between China and other developed nations.

By far, China has ratified 145 BITs with other countries and regions, among which 107 are in force. Hong Kong has another 20 BITs in force.

DTAs

DTAs are mostly of a bilateral nature and, while DTA-signing countries are not all members of the Organization for Economic Cooperation and Development (OECD), DTAs are generally based on model conventions developed by the OECD or (less commonly) the United Nations. And while about 75 percent of the actual words of any given DTA are identical with the words of any other DTA, the applicability and specific provisions of each treaty can vary substantially.

From an investor’s perspective, confusion about international taxation can arise when investors are subject to two different and potentially conflicting tax systems. For example, Hong Kong and Singapore adopt a “territorial source” principle of taxation, which means that only profits sourced locally are taxable. Meanwhile, other countries, such as China and the United States, are on the worldwide tax system, and resident enterprises can be required to pay tax on income sourced both inside and outside of the country.

DTAs not only provide certainty to investors regarding their potential tax liabilities but also act as a tool to create tax-efficient international investments.

By far, China has signed DTAs with 110 countries or regions.

FTAs

China has developed a strategic position when it comes to entering into FTAs – the policy of allowing dutiable and tax reduction on certain products and services being one of the cornerstones that have projected the nation to be the world’s manufacturing hub over more recent years.

Without a doubt, the signing of the China-ASEAN FTA, followed by the recent RCEP agreement, will continue to have a huge impact on China, its development in global sourcing, and the foreign investment related to this.

China also has an FTA with Switzerland, which as a result, has become one of the few European nations not to have a China trade surplus.

In total, China has signed off FTAs with 26 countries or regions countries (including the 10 ASEAN nations). There are 13 other countries (independently or jointly) negotiating FTAs with China, and a further eight are under consideration.

China’s market reforms and opening-up

China has endeavored to attract greater foreign investment by relaxing more market access restrictions and continuously introducing improvements to the business and regulatory environment.

Key among its reform actions are changes to the negative lists. These lists indicate which industries are subject to special administrative measures for foreign investors, or in other words, supervised by authorities when determining market entry, the scope of operation, and access to the local market. The negative lists were shortened again in 2020.

The 2020 National Negative List cut the number of restrictive measures by 17.5 percent, from 40 to 33, and the 2020 FTZ Negative List cut the restrictive measures by 18.9 percent, from 37 to 30. Taking auto manufacturing as an example, the restrictions on the share ratio of foreign investment in commercial vehicle manufacturing has been liberalized. Before, the Chinese party shareholding percentage in commercial automobile manufacturing was to be no less than 50 percent.

Besides, with the Foreign Investment Law and supporting regulations coming into effect in 2020, together with other reforms in the areas of company establishment, tax, finance, reporting, and compliance management – foreign investors in China are playing on a more even ground with domestic competitors.

China has also publicly stated its intentions to accelerate market-opening reforms.

More free trade zones (FTZs) were announced to diversify scope and access to preferential incentives as well as a pilot sector- and region-based relaxation of entry norms. Most recently, on September 21, 2020, China announced it would establish pilot FTZs in Beijing, Tianjin, and Anhui, raising the country’s FTZ tally to 21. This also constitutes part of China’s efforts to transform into a more innovative, service, and consumption-driven economy and the creation of sustainable and high-end manufacturing capacity to attract international businesses.

The dual circulation strategy

China’s dual circulation strategy (DCS) was adopted as a State development policy in mid-2020. It seeks to spur China’s domestic demand, on one hand, and simultaneously develop conditions to facilitate foreign investment and boost production for exports, on the other.

This two-pronged strategy refers to the parallel emphasis on an ‘internal circulation’ and an ‘international circulation’ and a shift towards becoming a demand and innovation-driven economy.

While on its own merit, the DCS is not an inwards-looking strategy, the focus on tapping into China’s internal consumption patterns and domestic markets aims to buffer the impact of global economic headwinds and unpredictable external events on China’s economy and financial stability.

The strategy is also, in simpler terms, a culmination of China’s intentions to become more self-reliant as well as increase its export market exposure.

Looking forward

Given China’s positive economic outlook, the accelerated opening up of its services sector, and the ongoing upgrading of the country’s industrial structure, foreign investment is expected to further flow into China, especially the financial sector, high-tech services, and high-end manufacturing sector.

With the COVID-19 vaccination rolling out nationwide, China’s FDI performance can be expected to be further benefitted from the recovering global mobility and enhanced communications among countries.

As of April 20, 2020, 195.022 million vaccine doses had been administered in China, with Beijing and Shanghai inoculating 60 percent and 42 percent of their population, respectively.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Belt and Road Weekly Investor Intelligence, #25

- Next Article Investieren in Hangzhou, Provinz Zhejiang: China City Spotlight