China’s FDI into the UK After the Brexit Vote

The UK voted to leave the EU in 2016, following which London’s appeal as a strategic location to freely access European markets has been put in jeopardy.

China Briefing discusses the Brexit impact on investment in the UK and why Chinese investors seem optimistic despite bleak forecasts.

Following the referendum to leave the European Union (EU) on 23 June 2016, now popularly called the Brexit vote, the United Kingdom (UK) has been preparing to exit the European bloc.

So far, the UK parliament has voted three times on a withdrawal agreement, none of which have been approved.

Nevertheless, if Brexit happens, the UK will likely be forced to leave the EU single market.

This could bring an end to all duty-free trade between the UK and other member states of the EU.

Consequently, international businesses and foreign investors have been actively reconsidering the UK as a desirable investment location, given it can no longer serve as a gateway to the EU.

This thinking is supported by the European Think-tank Network on China in its December 2017 report, which predicted the Brexit vote would reduce Chinese foreign direct investment (FDI) to the UK – when compared to the EU.

In reality, the Brexit vote has had the opposite effect; Chinese FDI flows into the UK in 2017 and 2018 were higher than to any other EU country.

This can partly be explained by the vote’s depreciating effect on the British pound against the yuan.

Why the UK is still ahead

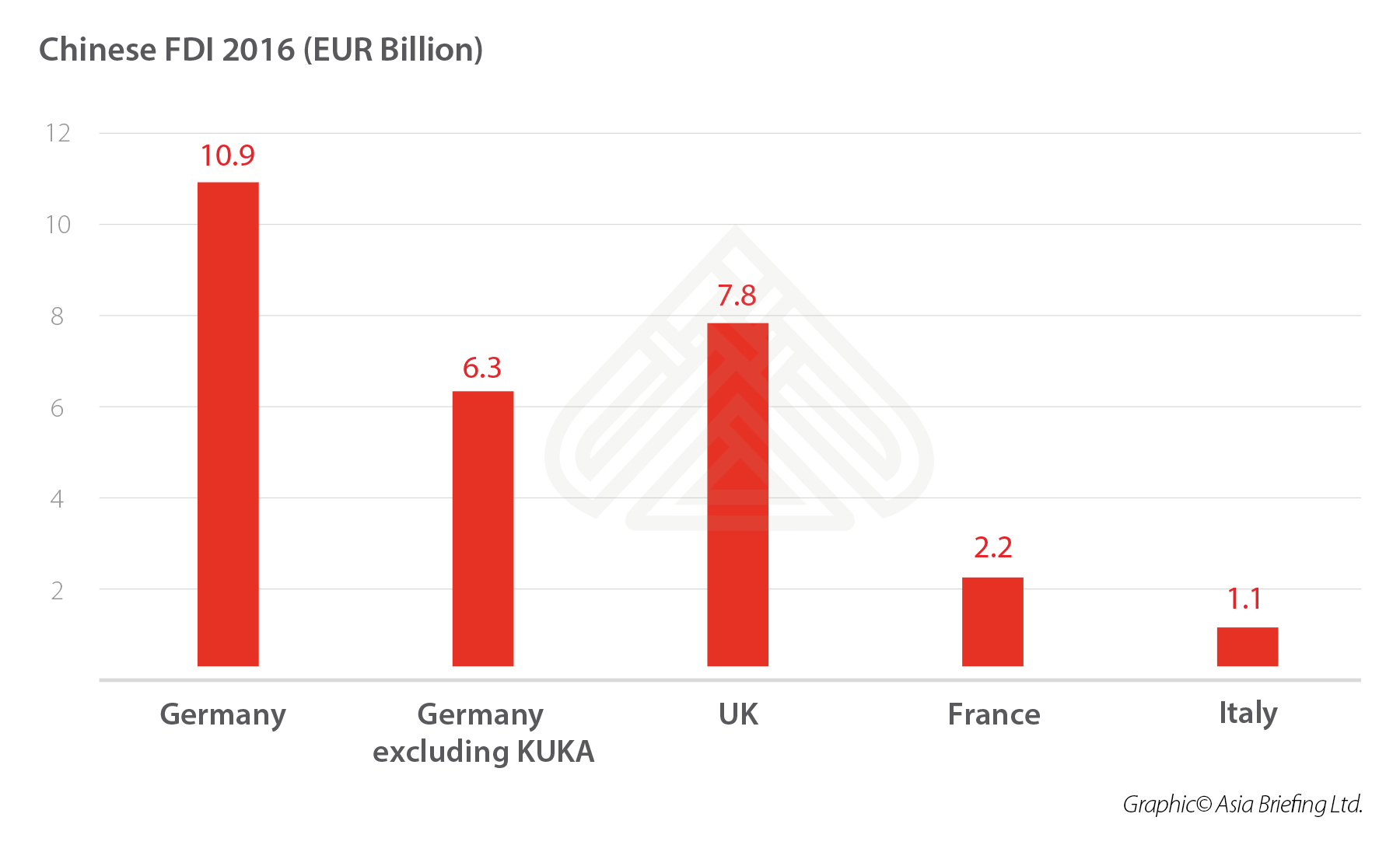

In 2016, Chinese FDI into the UK was far ahead of France and Italy.

Yet, this was the first time since 2012 that Chinese FDI to Germany was higher than its investments in the UK.

This was due to a EUR 4.6 billion (US$ 5.2 billion) deal for KUKA, a German robotics company – the largest such Chinese takeover in the country.

The KUKA deal cannot be treated merely as an outlier as large deals often make up a big proportion of FDI.

However, it is telling that if the KUKA deal is excluded from the data set, the UK would have received more Chinese investment than Germany.

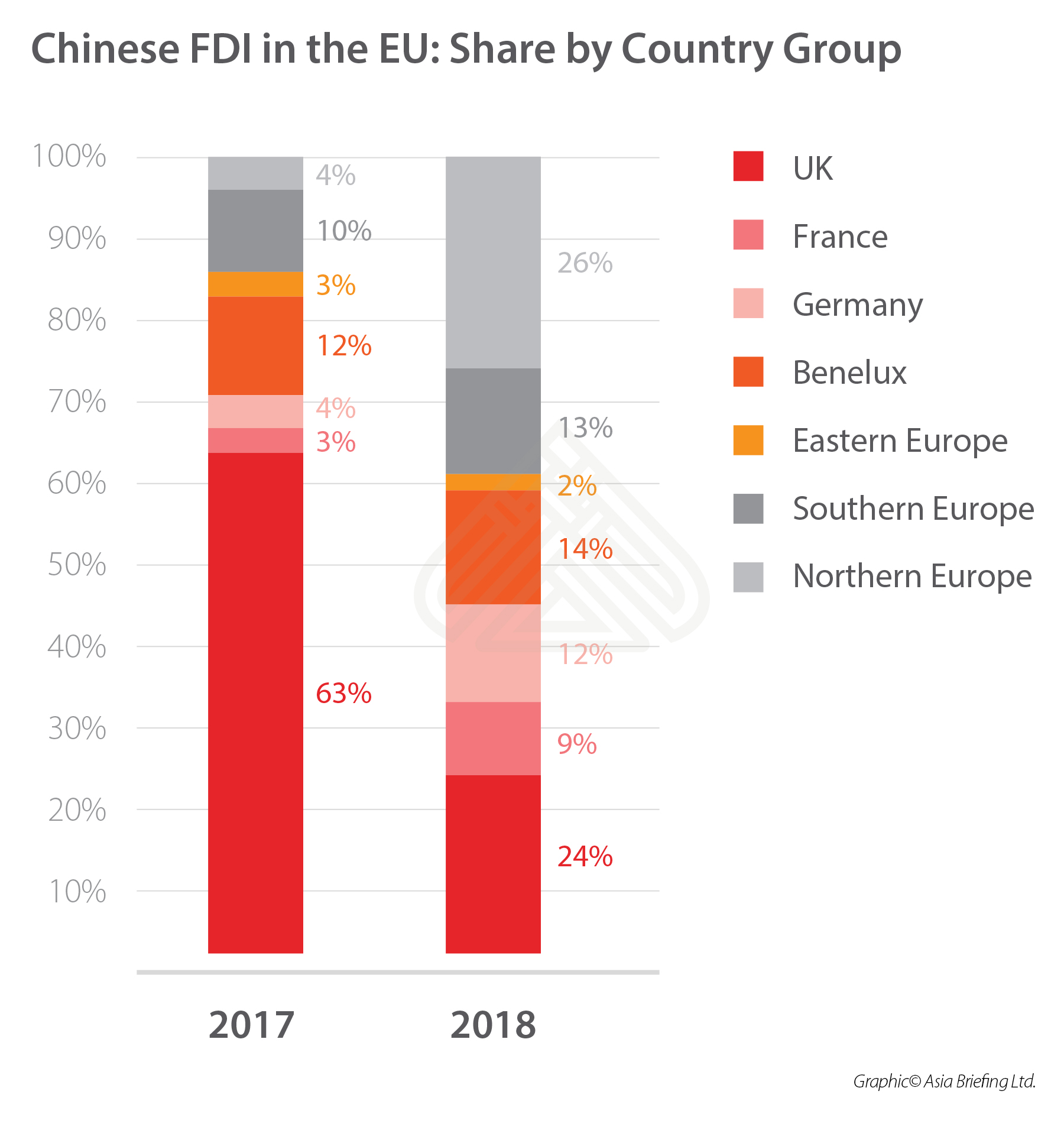

Turning to 2017 and 2018, the UK received 63 percent and 24 percent of Chinese FDI, respectively – more than any other EU country in both years.

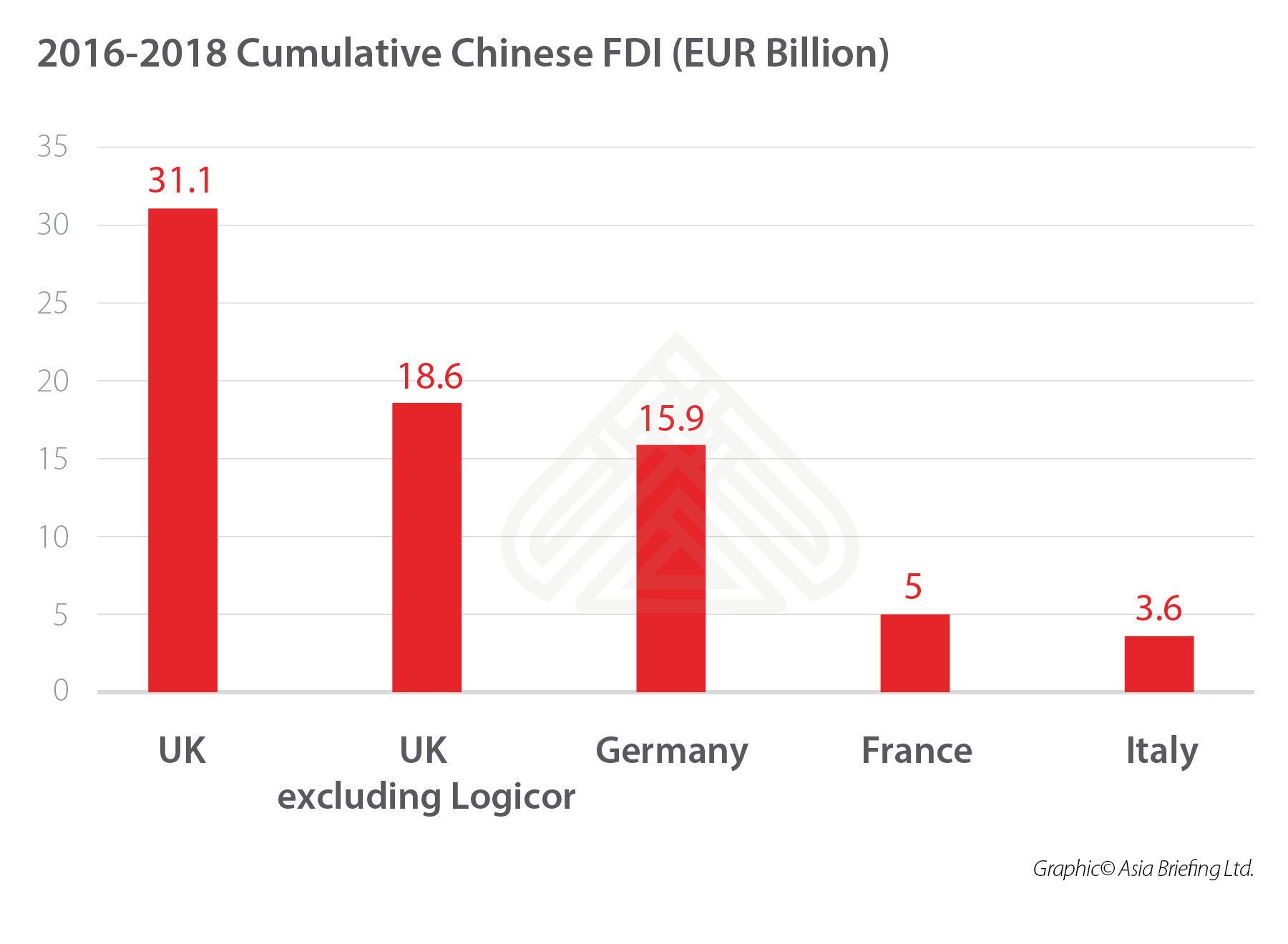

In 2017, the Chinese takeover of the UK warehouse company Logicor accounted for a huge component of its FDI inflow into the UK. Logicor was bought for EUR 12.5 billion (US$14.4 billion).

Again, even if this deal is excluded from the data set, the UK still received the highest amount of Chinese FDI in 2017 by EUR 2.7 billion (US$3.1 billion).

Looking at the cumulative investment from 2016-2018, the UK received a larger amount of Chinese FDI than any other EU country.

Brexit vote spurs Chinese investments

A contributing reason for the UK’s high performance as a destination for Chinese FDI is the depreciating pound sterling.

Between 22 June and 27 June, just before and after the Brexit vote, the pound’s real effective exchange rate – a weighted average of the pound against a range of other currencies – fell 8.8 percent.

Against the Chinese yuan, the pound has remained at a relatively depreciated value when compared to pre-Brexit vote levels.

Buoyed by their stronger buying power, Chinese investors have looked at UK investments favorably.

Looking into the future, a joint report by the TMF Group and China-Britain Business Council states that cutting ties with the EU will force the UK to forge closer links with other strategically important bilateral partners like China.

Their prediction is that although the continued uncertainty surrounding Brexit may temporarily slow FDI, closer links will boost business and economic relationships even as the pound starts to gain its strength again.

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Dalian, Beijing, Shanghai, Guangzhou, Shenzhen, and Hong Kong. Readers may write to china@dezshira.com for more support on doing business in China.

- Previous Article China’s Belt and Road Forum: Good News for SMEs Selling Products and Services to China

- Next Article China’s Lowers CIT for Pollution Prevention and Control Enterprises