China’s Greater Bay Area in 2020: Opening up the Financial Industry, Promoting Integration

On May 14, 2020, the People’s Bank of China, along with three other central authorities, unveiled new guidelines to support the financial reform and opening-up of the Guangdong-Hong Kong-Macao Greater Bay Area (“GBA”).

The Opinions Concerning Financial Support for the Establishment of the Guangdong-Hong Kong-Macao Greater Bay Area (“the guidelines”) transcribe a series of 26 new measures aimed at liberalizing China’s controls on foreign exchange and foreign currency remittance, to boost cross-border capital flows in the GBA.

Understanding the renewed focus on the Greater Bay Area

The guidelines will encourage more cross-border business activities between Hong Kong, Macao, and mainland China to optimize the allocation of financial resources in the region, and to improve its individual efficiency and quality over time.

As a result, new opportunities now exist for businesses operating in the insurance, securities, and wealth management sectors. Additionally, businesses in fintech, blockchain, big data, and artificial intelligence (AI) will also benefit. The government is keen to promote the use of new technology and business models to facilitate the growth of emerging industries.

Already, the Greater Bay Area (GBA) is one of China’s most important financial hubs – it includes Hong Kong (a well-established international financial center) and Shenzhen (an emerging global financial powerhouse home to the Shenzhen Stock Exchange and some of the world’s leading fintech and technology companies).

However, integration has long been a sticking point as the region uses three different currencies (the Hong Kong Dollar, Macanese Pataca, and Chinese Yuan) and is governed under three distinct administrative systems.

Policymakers are now addressing this. The latest guidelines are some of the most important reforms targeting the GBA, since early 2019, and lay out a blueprint for the structural transformation of and deeper cooperation within the regional financial industry.

We discuss some of the key policies introduced by the document, and implications for businesses.

26 measures to facilitate financial cooperation

The guiding document lays out a series of 26 measures, that are guided by five policy goals and supported by the overarching objective of deepening the financial cooperation between Hong Kong, Macao, and nine cities in the Pearl River Delta region.

On a macro-level, the document introduces measures to promote the offshore use of RMB in Hong Kong and Macao, while strengthening the leading role of Hong Kong and Macao as financial hubs.

At a more micro-level, the guiding document introduces new pilot programs that will test new reform measures, such as Chinese bank account reforms to allow the pooling of multiple currencies in one account.

Most notably, the document looks at common recurring hurdles for businesses like cross-border foreign exchange, foreign currency cash pooling, internationalization of RMB, and the cross-border exchange of financial products.

We provide a more detailed breakdown some of the 26 measures in the guidelines in the tables below.

Further integration will increase opportunities in the GBA

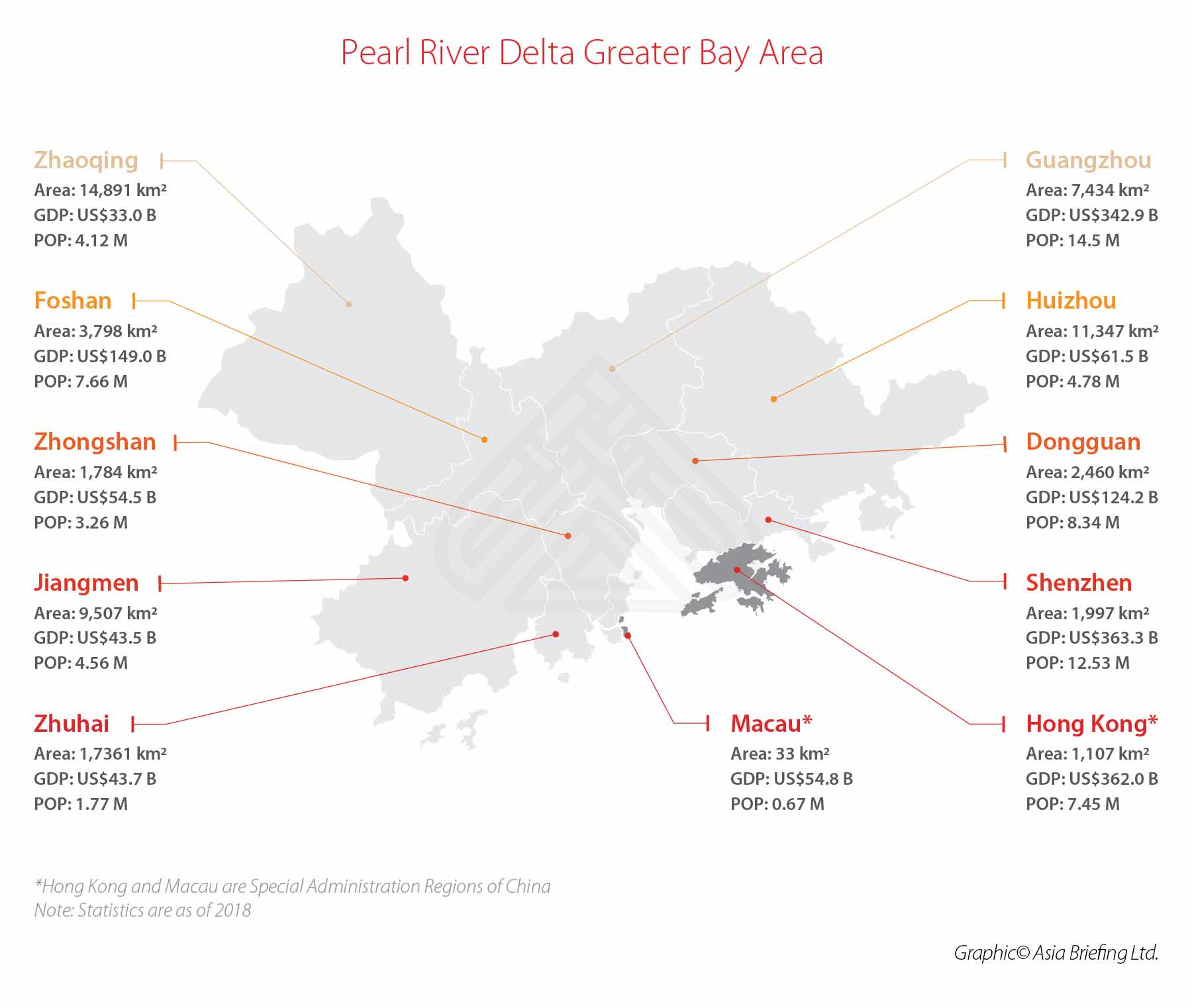

The Greater Bay Area is an ambitious national plan aimed at integrating the two Special Administrative Regions of Hong Kong and Macao, together with the nine cities across the Pearl River Delta, namely Guangzhou, Huizhou, Dongguan, Shenzhen, Jiangmen, Zhuhai, Zhongshan, Foshan, and Zhaoqing.

The GBA region encompasses a total population of 71 million people and has an economy worth an estimated US$1.6 trillion – making it the world’s 13th-largest if it were a stand-alone economic entity.

The principal goal of the region is to ease the flow of goods, people, and capital within the region.

Under the newly released guidelines, the financial industry, which already plays a prominent role here, will receive more support for its cross-border financial services, transactions, and investments through relaxation of restrictions, piloting cross-border processes, and upgrading financial infrastructure.

This boost in intraregional connectivity and more cross-border transactions will spur on other dominant industries in the region as well, including advanced manufacturing, technology and trade.

Together, the new measures are well-placed to allow the GBA to rival other well-known city clusters, such as the San Francisco Bay Area and the Tokyo Bay area.

Foreign businesses should act now to leverage the growing opportunities within the GBA as the plans in the blueprint start to come into fruition. Businesses that tailor their strategy to the plan’s priorities will be best placed to benefit from its ambitious agenda.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article ¿Por qué los estímulos económicos en China por el Covid serán distintos a los del pasado?

- Next Article Warum China die globale wirtschaftliche Erholung nach COVID-19 anführen könnte