China’s Medical Devices Industry: Key Market Entry Considerations

We provide an overview of China’s medical devices industry and deliver insights on emerging market trends, optimal market-entry paths, and investment considerations based on the Encouraged Lists from 2019 and 2020.

China’s healthcare industry was forced to do a hard reset in 2020. Just as the 2003 SARS epidemic exposed the gaps in China’s disease surveillance infrastructure, COVID-19 exposed the cracks in its delivery of healthcare services.

Now, as China is tasked with rebuilding and reorganizing its healthcare system, the government has started to signal its priorities for the next era of its healthcare transformation.

Battling the pandemic has caused a major rethink of China’s priorities within its healthcare system and making improvements to the critical health infrastructure, digital services, and public health promotion is now more urgent than if the infectious outbreak had not occurred.

To comprehensively cover these developments in China’s overall healthcare industry, China Briefing is publishing a three-part series where we take a look at the following industries:

- Telemedicine and digital healthcare

- Medical devices

- Pharmaceutical industry

In part two of the series, we provide an overview of the medical devices market and deliver insights on the emerging trends within the industry, as well as the market-entry pathways for manufacturers, importers, and distributors operating in China.

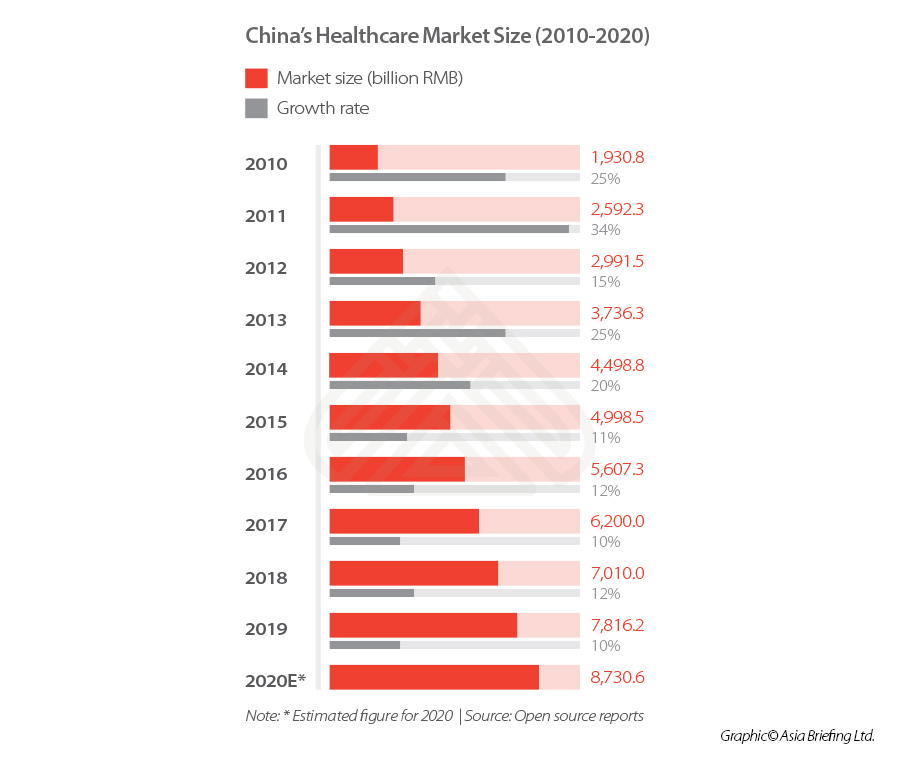

China’s healthcare industry (2010-2020)

China healthcare industry is currently ranked the second largest in the world behind the US.

The market has grown at a consistently rapid rate in the past five years, and in 2019, the market reached RMB 7.82 trillion (US$1.1 trillion), an increase of 10 percent when compared to that from the previous year.

Despite this, the market remains relatively undeveloped, with China’s health expenditure – including pharmaceuticals, medical devices, distribution, hospital, pharmacies and insurance – accounting for only 7.12 percent of the total GDP in 2020 (though this figure is an increase from 2018’s level of 6.57 percent), while the US reached 18 percent in the same year.

Given that many countries saw their GDP contract in 2020 due to COVID-19, this could have impacted the government’s total expenditure – of which a set sum is allocated to healthcare expenditure.

However, even though China’s GDP saw a slower 2.3 percent growth in 2020, its healthcare spending still rose from RMB 6584.14 billion (US$1,033.1 billion) in 2019 to RMB 7230.64 billion (US$1,134.5 billion) in 2020.

Thus, the market presents considerable opportunities for growth, particularly as the Chinese government has more recently laid out multiple initiatives to support long-term growth and innovation in healthcare delivery, and healthcare will likely feature more heavily in the 14th Five Year Plan (covering 2021-25) than it did in the 13th Five Year Plan.

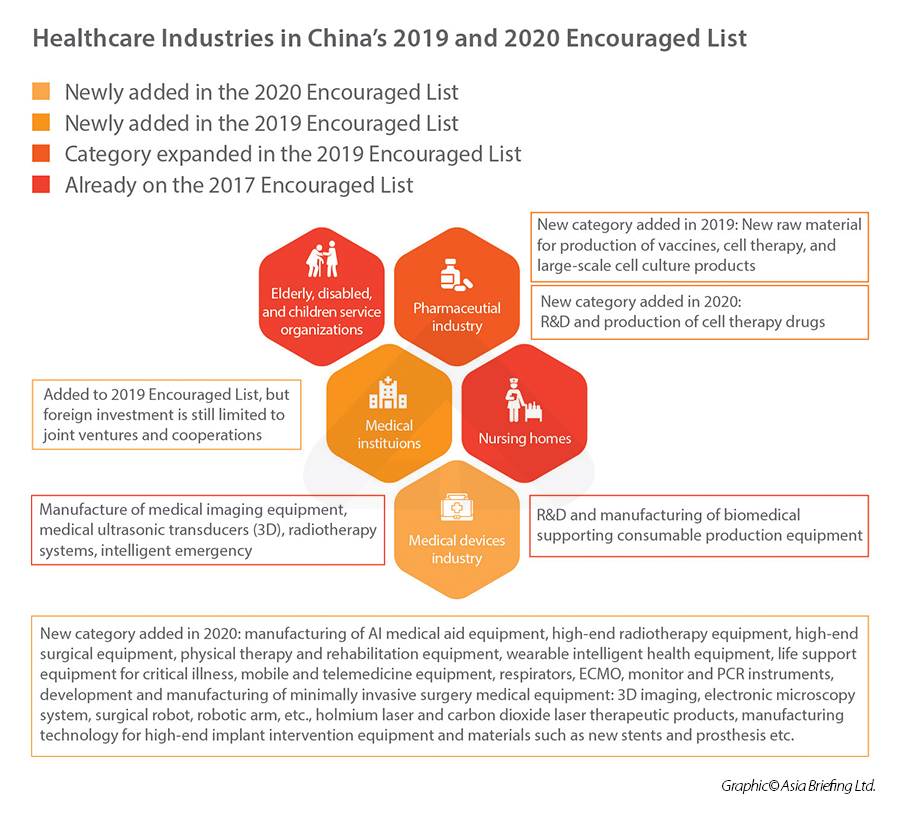

In terms of foreign investment, the healthcare industry has been steadily opening up to foreign participation – both in terms of removal of items in the National Negative List, and the addition of items on the National Encouraged List.

In 2019, “new raw material for the production of vaccines” and “medical institutions” were newly added on the 2019 National Encouraged List, which means that they are now encouraged investment sector by the central government, unlocking opportunities for foreign investors to access preferential policies and tax rate.

In 2020, under the category of “medical device industry”, China added a laundry list of new items into the- foreign investment encouraged catalogue, including manufacturing of AI medical aid equipment, high-end radiotherapy and surgical equipment, rehabilitation equipment, wearable intelligent health equipment, mobile and telemedicine equipment, etc.

Healthcare industries in China’s 2019 and 2020 Encouraged Lists

Leading trends in China’s medical devices industry

Medical devices encompass a broad range of instruments, equipment, apparatus, in-vitro diagnostic reagents, calibrators, software, and consumables intended for the purpose of detecting, measuring, restoring, correcting, or modifying the structure or function of the body for a medical purpose. The purpose of the device typically falls under one of four categories: prevention, diagnosis, treatment, and rehabilitation.

Prior to COVID-19, China’s medical devices market was growing at twice the pace of the overall market, driven by healthcare reform and overall rising demand for healthcare.

By 2030, China is expected to have more than 25 percent share of the global medical device industry at over US$200 billion, second only to the US who is expected to cross US$300 billion in sales in the same period, according to a 2018 KPMG report.

Many dominant players are now emerging, and new innovative products are high in demand – making it a hotbed for M&A activity between the medical sector and the technology sector.

Like many other sectors of the healthcare industry, however, COVID-19 has deeply disrupted the market, accelerating the pace new trends.

Preventative healthcare now taking center stage

Preventative and long-term health management has now started to take a more prominent role in the medical devices industry.

On the consumer side, this is due to the rise in public health awareness, which was amplified since the outbreak of COVID-19. On the business side, COVID-19 merely accelerated a shift from treatment to prevent that was already happening in the fast-maturing industry due to the nation’s rapidly aging population and rising prevalence of chronic disease.

This heightened awareness of disease control and prevention caused a rise in both the R&D and sale of wearables, such as fitness trackers, health watches, electrocardiogram watches, blood pressure monitors, and biosensors.

For example, Withings, a French consumer electronics company with an e-commerce presence in China, recently released an analog watch that is able to record the electrical signals of a heartbeat to detect atrial fibrillation or an arrhythmic heartbeat in the user – potential signs of a more serious health conditions that can then be sent directly to the physician for further medical advice.

Similarly, Medtronics has partnered with Fitbit to integrate health and activity tracking for patients living with diabetes. The mobile app monitors and collects information on the patient’s glucose levels to enable patients to manage their glucose level and inform decisions made by their physicians.

Intelligence received by these medical devices are transforming the overall quality of medical treatment received by patients as they empower clinicians with real-time data when making decisions, while enabling patients to avoid unnecessary and expensive trips to the hospital.

Leveraging data to improve the quality of healthcare services

Complementing this, medical device companies are increasingly leveraging data to build intelligence in their products to offer new ways to measure performance and outcomes more accurately, ultimately improvement the prevention, diagnosis, and treatment of medical conditions.

This trend has been propelled by the sheer scale of data now available due to the advent of new monitoring apps during the COVID-19 period, such as the health code and digital work attendance tools that have collected wide breadths of information and formed new consumer habits.

Medical device companies have started to make full use of the data available to shift from a purely product-driven business model to a data-driven service model. This shift enables them to play a larger role in the value chain and get closer to customers, patients, and consumers.

To gain competitive edge, companies are now in a race to find innovative ways to leverage data in a way that best serves consumer needs. To quickly enhance their technology capabilities and effectively introduce smart offerings to their portfolio, many medical device companies have entered into partnerships with other players.

One example of this is Huma – a London-based healthcare startup, who with the support of strategic partners, such as Tencent and Bayer, has a growing presence in China. Huma has released products known as Medopad and Biobeats, remote patient monitoring systems, that compiles and analyzes health data collected from various devices to predict and ultimately prevent the advent of chronic diseases, or mental health illnesses. Biobeats monitors your heart rate variability, sleep patterns, activity, and mood in real-time and measures it according to your baseline physical and mental score, to provide you personalized support when needed.

Another example is the Shenzhen-based healthcare startup called iCarbonX (碳云智能), which uses AI to collect and combine medical history, behavioral, and biological data from patients all over the world to create a map of human health, to gain a more comprehensive understanding about diseases, conditions, make more accurate diagnoses, and ultimately provide better quality treatments.

In both these cases, data and analytics empower patients and healthcare providers with information to make better decisions, and in the case of corporates, offers new ways for them to interact with the user.

Market entry considerations

China’s National Medical Product Administration (NMPA) is the main regulatory and administrative body that creates, implements, and governs the standards of all medical devices, cosmetics, and drugs in China. NMPA are responsible for most of the pre-market approval and post-marketing activities, thus, businesses operating within this industry will likely be required to encounter the NMPA in some way or form.

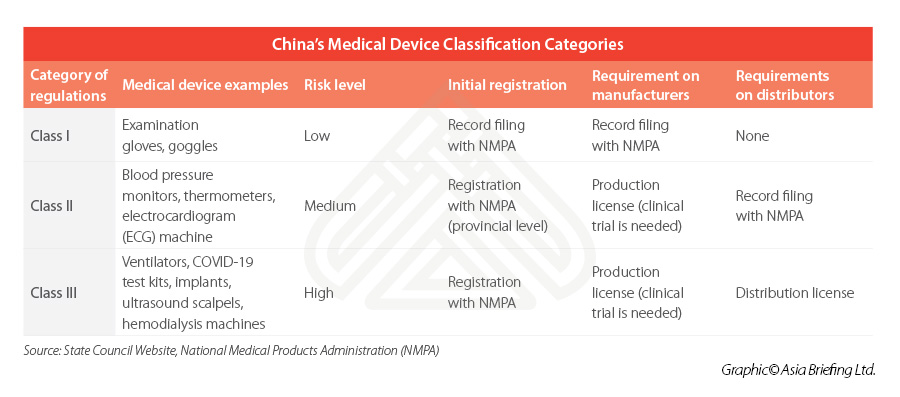

Medical device classification

The Regulations on Supervision and Administration of Medical Devices (State Council Order No. 680) is the highest level of governing rules for the registration and record keeping of medical devices.

Medical devices are listed in a Medical Device Classification Catalogue, which places the devices into three district categories – depending on the level of the risk they pose to patients and users and this classification will in turn determine the rules that apply (see table below).

Class I is the lowest risk class, meaning that registration is comparatively easier, while Class II and III usually involves a longer and more rigorous process – typically requiring local testing and clinical trials prior to its registration.

Some imported devices may need to be registered with a higher-level government authority than domestic devices. In addition, some further special regulatory provisions exist for customized medical devices, while fast-track approval processes apply for certain types of medical devices (innovative or emergency approval) operating within certain regions (for example, in Hainan Boao Lecheng International Medical Tourism Zone).

For businesses intending to manufacture or distribute medical devices not listed in the catalogue, they can refer to the Rules for Medical Device Classification or apply for an official classification at NMPA.

Expedited pathways to China market entry

Businesses handling certain types of medical devices or operating with certain locations – may be granted access to an expedited process. We explore a few of these pathways below.

Innovative device pathway

In order to spur on innovation in the area, the Chinese government has established a fast-track approval pathway for ‘innovative medical devices’ – which enables devices in this category to have priority in various stages of application and easier consultation with governmental authorities.

Pursuant to the Special Evaluation of Innovative Medical Devices, to qualify for this fast-track process, medical devices must first belong to either Class II or Class III, and satisfy three main criteria:

- Domestic invention patent of core technologies granted within five years;

- Novelty of such product in the PRC, is in a leading position worldwide, and demonstrates significant clinical practical value; and

- The applicant has prototype of the products after completion of early stage research and has complete and traceable research data to back it up.

According to public reports, from 2014 to September 2020, a total of 279 products have applied for access to this entry pathway, and 89 products have been approved for listing. Nearly 50 percent of the innovative and approved products are high-value medical consumables, such as cardiovascular, orthopedic, ophthalmic, and dental products.

Hainan Medical Tourism Pilot Zone

The Hainan Medical Tourism Zone also offers importers of eligible medical devices a fast-tracked entry pathway into China’s medical devices industry.

Officially known as the Hainan Boao Lecheng International Medical Tourism Pilot Zone, the zone is an initiative spurred on by the government that aims to transform Hainan into a world-class medical tourism destination and technology innovation center by 2030.

Just as its name implies, the Hainan medical tourism pilot zone was designed to provide various medical services and a green medical convalescence environment to attract domestic and foreign tourists.

According to regulations released in 2018 and 2020, medical devices are subject to the following preferential policies:

- Expanded scope of overseas imported medical devices allowed to enter the Pilot Zone;

- Greater access for urgently needed medical devices entering Hainan via the emergency review pathways, and devices can be stored in bonded warehouses in Pilot Zones before approval is obtained; and

- More leeway given to enterprises to collect and apply real-world clinical data for the trial of medical devices, to expedite approval processes and shorten time of marketing.

In addition, a traceability management platform exists for drugs and medical devices within the zone, making way for a streamlined process of import, approval, use, and regulation of medical devices within the pilot zone.

China’s medical devices industry outlook

COVID-19 has accelerated technological transformation already happening within the medical device industry.

The outbreak has resulted in an unprecedented emphasis on public health, which at a consumer level, has translated into a surge in preventative and long-term patient management aids and devices. In addition, due to the vast amounts of information collected and new digital habits formed during the COVID-19 control and prevention period, there is now more data available to optimize the quality of diagnosis, treatment, and prevention of poor health conditions.

As a result, the sector is now rife with new opportunities to shift traditional product offerings to a more service-driven business model, also made possible through the new applications of emerging technology such as 5G, artificial intelligence, Internet of Things, or data analytics software.

Consequently, foreign multinationals need to consider how to contend or work with local technology firms holding distinct competitive advantages and better access to data intelligence.

Foreign companies looking to enter or expand their presence in China’s medical device industry should consider key success factors, including regional or industry-specific preferential policies, and be conscious of adapting to country-specific distribution models and sales channels, investing in local technology infrastructure, and collaborating with domestic value chain stakeholders.

China’s medical device industry continues to demonstrate huge growth potential – however, companies operating in this area need to continue making long-term investments and forging partnerships to carve out their share in this massive market, in order to remain relevant in 2030.

This article was originally published on August 27, 2020. It was last updated November 16, 2021.

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China’s Tax Incentives: An Overview of Key Schemes

- Next Article Annual Audit in China – New Issue of China Briefing Magazine