China’s New Cosmetics Regulations to Reduce Red Tape for Businesses in 2021

China’s new cosmetics industry regulation will take effect January 1, 2021 and streamlines market-entry procedures while focusing on quality and safety standards.

Late last month, the State Council released the Regulations on Supervision and Administration of Cosmetics (the New Regulations), which is a comprehensive series of rules governing the market-entry, production, sales and import of cosmetics in China.

First published in 2015, the draft has undergone several rounds of consultation before its promulgation in late July 2020.

The New Regulations will take effect January 1, 2021 – effectively replacing the previous Regulations on the Hygiene Supervision of Cosmetics, which has been the primary set of regulations governing the industry over the past decade.

In recent years, the cosmetics market in China has taken off. In 2019, the cosmetic market grew by almost 13 percent (equivalent to RMB 40 billion or approx. US$5.72 billion), to reach RMB 299 billion (US$42.8 billion), according to data published by the National Bureau of Statistics.

In reaction to the increased investment in in industry, Chinese regulators are keen to streamline market-entry procedures for new investors, while also ensuring quality and safety requirements of products are met.

We examine some of the key changes below.

Key changes in the 2021 cosmetics industry regulation

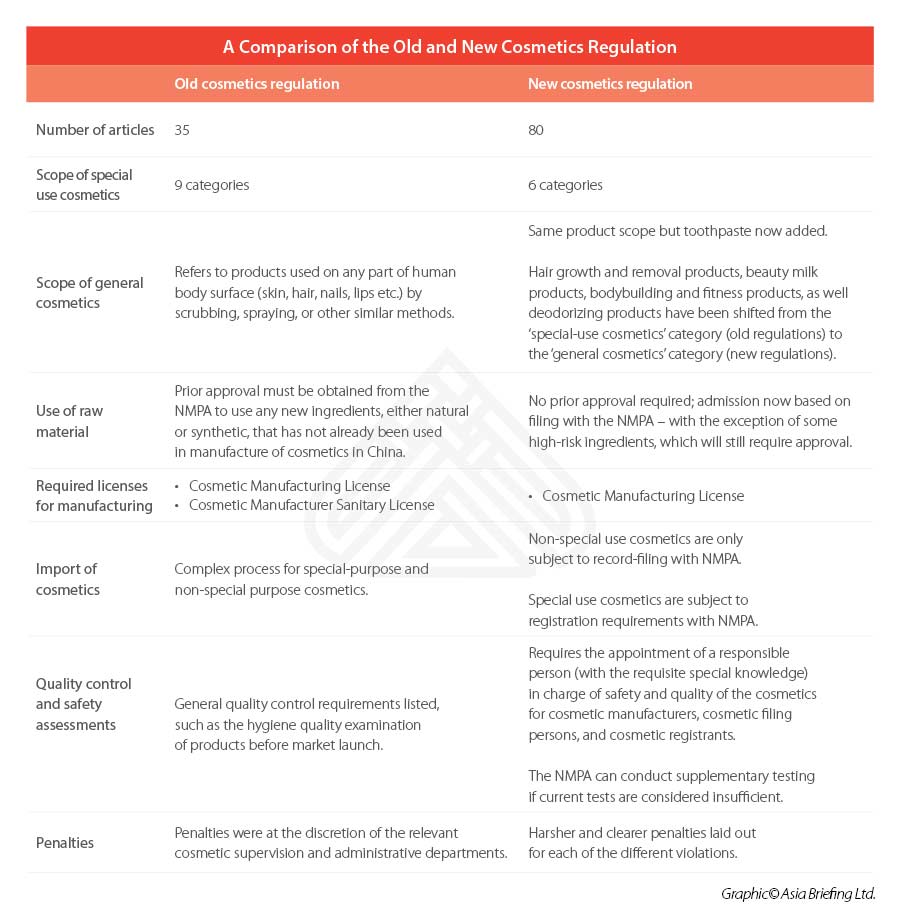

The 2021 Regulations comprise of a total 80 articles across six chapters – including separate chapters on raw materials, production and operation, supervision and administration, and legal responsibilities.

In general, the 2021 Regulations will remove much of the red tape that previously existed for businesses operating in this industry.

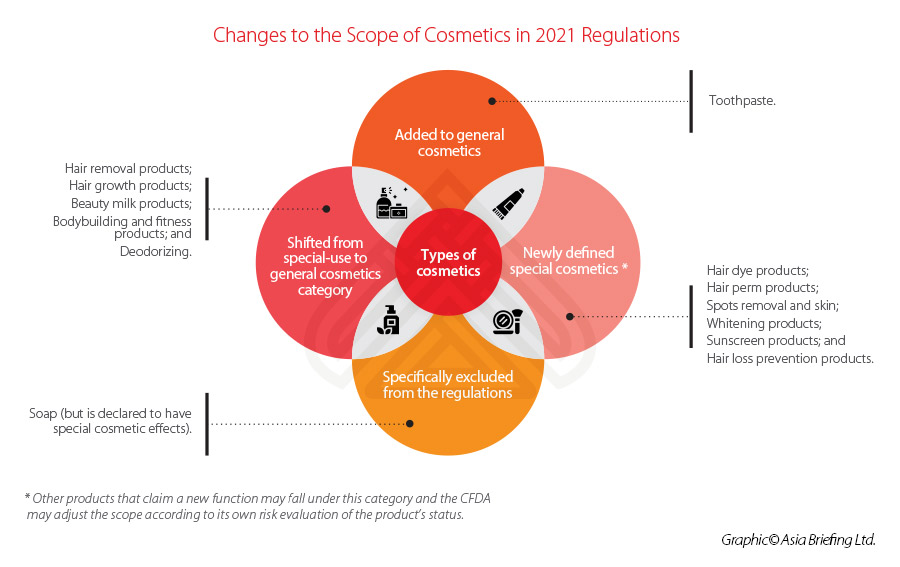

Similar to previous regulation, a clear distinction is made between ‘special’ and ‘general’ cosmetics – with the former list decreasing its focus from nine categories to six under the 2021 Regulations. Toothpaste will be included under the scope of the cosmetics regulations for the first time.

See below for a summary of the changes made to the categories and scope of the new regulations.

Use of raw materials

According to the 2021 Regulations, prior approval will no longer be needed for the use of new ingredients in general cosmetics. Instead, products falling within this category can be simply be registered on a filing basis with the National Medical Products Administration (NMPA).

The applicant is required to submit the following documents and materials during the filing process:

- A new ingredient research report;

- Research materials related to the preparation process;

- Stability and quality control standards; and,

- Material for safety assessment.

This new filing-admission process is applicable for all new ingredients, except for those deemed as ‘special cosmetics’, such as antiseptic, sunscreen, colorant, hair dye, and freckle whitening among others, which will continue to be subject to the pre-use registration process.

Once the NMPA receives the material, the review process will be initiated, and businesses will be notified of the decision from NMPA within an approximate 120-day time frame.

After the applicable process have been completed, and the product has entered the market, the applicant is required to report annually to NMPA, for a period of three consecutive years. If no safety concerns arise within this three-year period, then the new ingredients will be included in the catalog of accepted use in cosmetic production in China.

Manufacturing and import of cosmetics

Under the 2021 Regulations, the licensing system has also been simplified from two licenses to one license. Previously, the regulations required that cosmetics manufacturers obtain a Cosmetic Manufacturing License and a Cosmetic Manufacturer Sanitary License.

Now, under the 2021 regulations, cosmetic manufacturers will only need to apply for a Cosmetic Manufacturing License with the NMPA.

The distinction between special and general cosmetics is also mirrored in the import provision within the regulations.

General cosmetics, either manufactured domestically or imported, will be required to file with the NMPA, while special cosmetics will still be required to register with the drug regulatory authority under the State Council.

The streamlining of the regulatory process is also expected to quicken the import cycle – reducing the costs typically associated with logistics and warehousing.

Quality control and safety assessments

This time around, the new regulations also includes a series of specific requirements for the quality control and safety assessment of cosmetics.

A responsible person should be appointed by cosmetic manufacturers, cosmetic filing persons, and registrants.

The designated person is to have professional knowledge of the industry and have more than five years of relevant professional experience, and must ensure that the safety and quality of the cosmetics are met.

This is a significant revision upon the old regulations, which only listed general requirements to be met – such as requiring the hygiene quality examination of products to be conducted before market launch.

Sale

In addition, cosmetic advertising and labeling will also be subject to more stringent oversight.

Cosmetics labels are now prohibited from explicitly or implicitly suggesting that products have medical functions and must not contain false or misleading information that could reasonably deceive a consumer.

In addition, all imported cosmetics are required to have a Chinese label.

As stipulated by the 2021 Regulations, cosmetics labels shall be marked with the following contents:

- Product name and special cosmetics registration certificate number;

- The name and address of the registrant, the filing party, and the entrusted production enterprise;

- The serial number of the cosmetics production license;

- Standard number for product implementation;

- Full ingredients;

- Net content;

- Duration of use, method of use, and necessary safety warnings; and

- Other contents that should be marked in accordance with laws, administrative regulations, and mandatory national standards.

E-commerce platform operators also received due attention under regulations.

Operators are now specifically required to use their real-name registration for cosmetic merchants and assume management responsibilities. Failing to do so will mean being subject to fines of up to RMB 100,000 (US$13,310).

Beauty salons, hairdressers, and hotels that use or provide cosmetics in their service must also adhere to the rules required of operators as prescribed in the 2021 Regulations.

A summary of the major regulatory changes affecting the cosmetics industry can be seen below.

Implications for businesses

The 2021 Regulations provide better market access for overseas cosmetics businesses. For an increasing number of products, a simplified filing system will replace the burdensome approval system.

However, from 2021, quality control and safety supervision will be the focus within the industry. Businesses working in this space must familiarize themselves with the new regulatory provisions because starting January 1, 2021, the penalties for non-compliance are much clearer and greater.

Though the quality control will be more stringent, the new regulations as a whole are a positive development for foreign businesses as they offer more clarity and certainty in the Chinese market than ever before.

To prepare for the necessary changes before the New Cosmetics Regulations take effect on January 1, 2021, please contact china@dezshira.com for more information.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article How to Close a Representative Office in China: Step-by-Step Process

- Next Article Company Chops in China: What Are They and How to Use Them