China’s New Stamp Tax Law: Compliance Rules, Tax Rates, Exemptions

China’s new Stamp Tax Law takes effect July 1, 2022 – there are updates to the existing system of taxation, such as the simplification of tax compliance, changes to some tax rates, and new exemptions.

UPDATE (August 31, 2023): On August 27, 2023, the Ministry of Finance released the Announcement on Halving the Stamp Duty on Securities Trading (MOF Announcement [2023] No.39), in an effort to shore up the capital market and boost investor confidence. According to the Announcement, the stamp duty on securities trading is halved from August 28, 2023, from 0.1 percent to 0.05 percent.

On June 10, 2021, the Stamp Tax Law was passed by the Standing Committee of the 13th National People’s Congress at the 29th session, which will take effect from July 1, 2022.

The current governing regulation, the Interim Regulations of the People’s Republic of China on Stamp Tax (the “Interim Regulations”) promulgated by the State Council on August 6, 1988, will be repealed simultaneously by then.

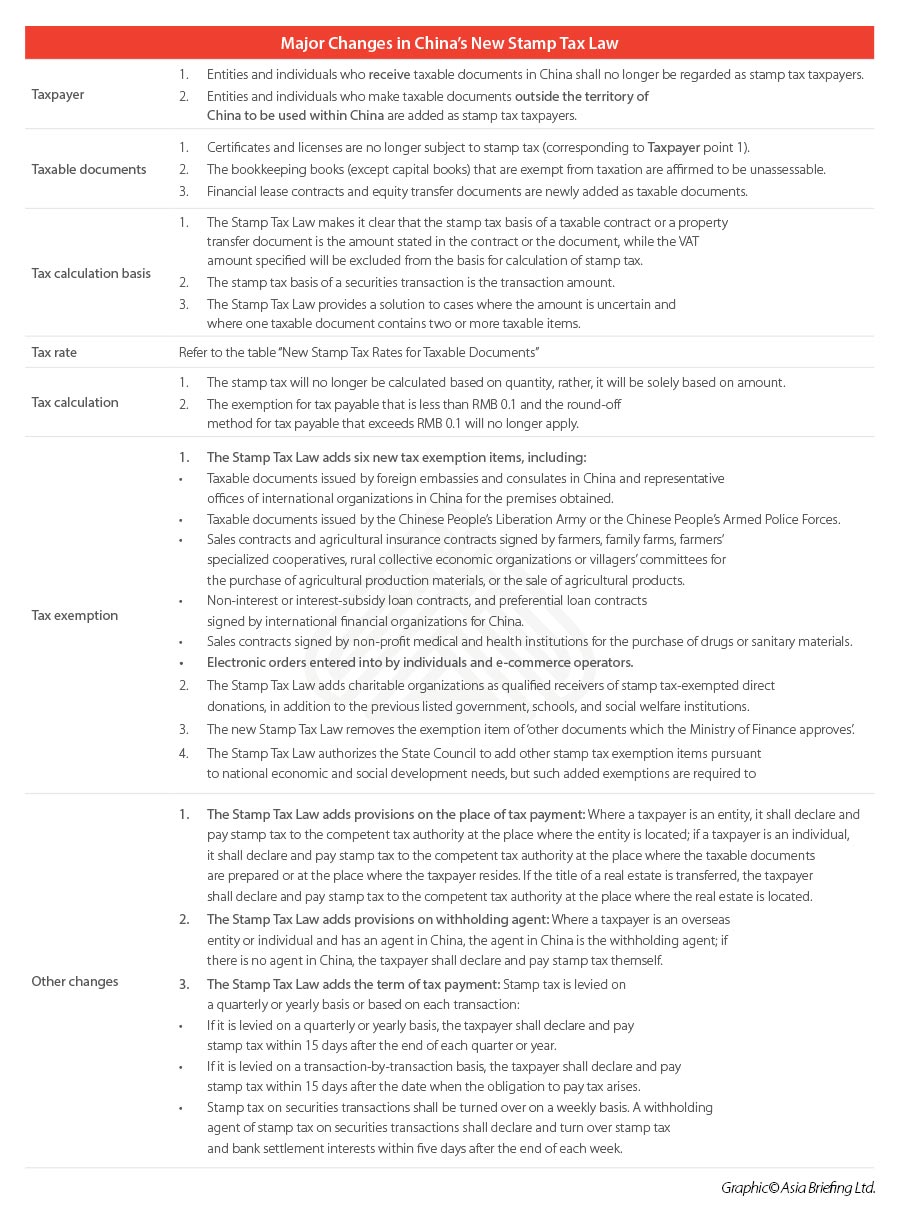

Compared to the Interim Regulations, the Stamp Tax Law maintains most of the current stamp taxation system generally, but at the same time, there are some noteworthy changes, including appropriate simplification of tax items and tax cuts.

The major changes are summarized below.

| Stamp Tax Rates for Taxable Documents | ||||

| Category | Taxable document | Scope | Tax rate | Note* |

| Contract | Loan contracts | Contract entered by banks and other financial organizations and borrowers except interbank loan agreements. | 0.005% of the loan amount | Same |

| Financial lease contract | 0.005% of the lease contract | Newly added | ||

| Purchases and sales contracts | Contracts for purchasing and selling movables except those made by individuals. | 0.03% of the value purchases | Scope updated | |

| Work contract | 0.03% of contracted amount | Tax rate reduced from 0.05% of contracted amount | ||

| Construction project contract | 0.03% of contracted amount | Same | ||

| Transportation contract | 0.03% of the transportation fee | Tax rate reduced from 0.05% of the transportation fee | ||

| Technology contracts | Not including contracts for transferring the right of use of patent and know-how. | 0.03% of the price, remuneration, or royalty | Scope updated | |

| Leasing contracts | 0.1% of the lease contract | “Any amount less than RMB 1 to be stamped as RMB 1” removed | ||

| Safekeeping contract | 0.1% of the safekeeping fees | Separated from the previous “Warehousing and safekeeping contract” | ||

| Warehousing contract | 0.1% of the warehousing fees | |||

| Property insurance contracts | Not including reinsurance contract | 0.1% of the insurance expenses | Scope updated | |

| Property transfer documents (Transfer refers to transaction, succession, bestowal, exchange, and division) | Land usage right granting document | 0.05% of the amount indicated | Changed from “land usage right granting contract” | |

| Land usage right, ownership of buildings and structures, such as houses transfer documents | Not including the transfer of land contracting and management right or land management right. | 0.05% of the amount indicated | Scope further clarified and defined | |

| Equity transfer document | Not including those security transactions subject to stamp tax. | 0.05% of the amount indicated | Newly added | |

| Exclusive right to use trademark, copyright, patent, the right to use know-how transfer document | 0.03% of the amount indicated | Tax rates reduced from 0.05% of the amount indicated | ||

| Business accounting contracts | 0.025% ** of the total amount of the paid-up capital (stock) and the capital reserve fund | Tax calculation basis updated | ||

| Security transactions | 0.05% of the volume of transactions*** | Newly added | ||

*As compared to the Interim Measures and the relevant amendments to the Interim Measures.

** This was first provided in Cai Shui [2018] No.50, which reduced the stamp tax rates for this item from 0.05%.

***The stamp tax rate on security transactions was halved from 0.1 percent to 0.05 percent starting from August 28, 2023.

Some highlights for stamp tax management

Bearing the changes of the Stamp Tax Law in mind, we would also like to bring some points to your attention in dealing with stamp tax in your daily operations:

- Previously, the stamp tax on security transactions was regulated by documents released by the Ministry of Finance and the State Taxation Administration. Now, with the release of the Stamp Tax Law, this matter will be regulated by law, which has higher legal force. The stamp tax on securities transactions will continue to be levied on the transferor of securities transactions rather than the transferee and the applicable tax rate remains at 0.1 percent of the turnover.

- The Stamp Tax Law stipulates that the basis for calculation of stamp tax excludes the VAT amount specified in the taxable contract or property transfer document. Nevertheless, in the case where the VAT amount is not specified in the taxable documents, the entire amount could be subject to stamp tax without deducting any VAT amounts. So, it is suggested that the taxpayers list the VAT amount separately from the contract price in the taxable documents.

- Direct donation can be exempted from stamp tax, according to the Stamp Tax Law, which is different from that in the Corporate Income Tax Law, where donation has to be done through charitable organizations or People’s Governments of county level and above and their departments to be tax exemptible. Businesses are advised to pay attention to this difference and not dismiss or overlook this stamp tax saving treatment when making direct donations.

- It should be noted that the loan contract signed by enterprises and non-financial organizations are not subject to stamp tax. Besides, according to Cai Shui [2017] No.77, the loan contracts signed by financial institutions and micro and small-sized enterprises can be exempt from stamp tax, and the duration of the policy was extended to December 31, 2023, by the Ministry of Finance and the State Taxation Administration Announcement [2021] No.6. Businesses should be aware of this policy and use it to save tax for loan contracts if they are one of eligible enterprises.

Bigger background: Law-based tax administration

In 2015, the State Taxation Administration released the Guiding Opinions on Comprehensively Promoting the Governing of Taxes according to Law (Shui Zong Fa [2015] No.32), stipulating that China will accelerate the process of upgrading relevant tax regulations into law, to improve the certainty of tax policies, enhance the authority of the tax documents, and ensure the efficiency of tax administrations. This is an important part of China’s broader efforts to achieve rule of law, that is, law-based governance of the country.

With the promulgation of the Stamp Tax Law, China has made laws for 12 of the 18 existing taxes. Businesses are well advised to keep a close eye on the future developments of China’s tax laws as it is related to how they will pay tax in China.

(This article was first published on July 5, 2021, and was last updated on August 31, 2023.)

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China’s IIT Special Additional Deductions: An Explainer

- Next Article China’s IIT Preferential Policy for Expatriates Extended to End of 2027: Key Points