China’s Market for Perfumes and Fragrances

To achieve economic success in the high-opportunity Chinese perfume market, firms must first identify their own distinct advantages and build a strong brand perfume culture, while thoroughly comprehending the emotions and cultural resonance of Chinese customers.

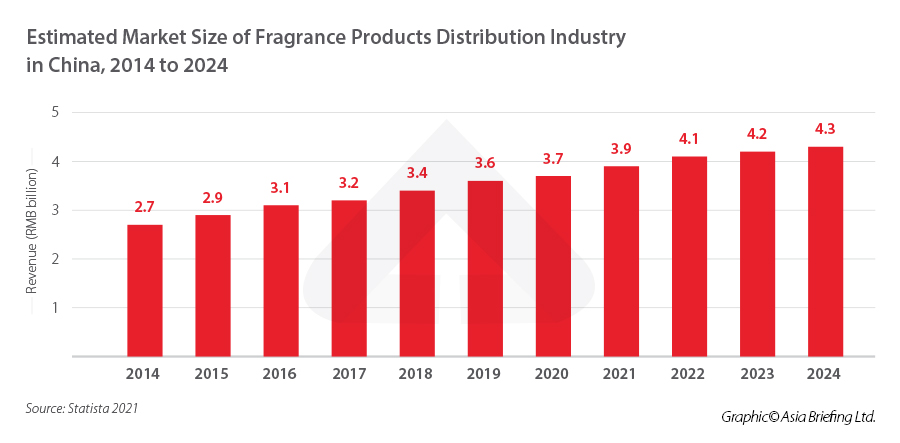

In 2020, perfume sales in China earned approximately RMB 12.53 billion (US$1.76 million) in revenue, accounting for only 2.5 percent of the worldwide market. Nonetheless, China’s perfume business had grown by more than 20 percent year-on-year between 2016 and 2020, and it is likely to rise further as Gen-Z establishes itself as the primary driver of national consumption.

Chinese perfume market overview

With Chinese consumers placing great emphasis on sensory experiences, the country’s perfume market appears ready for rapid expansion. Mintel forecasts that China’s fragrance sector will increase at a compound annual growth rate (CAGR) of 17 percent over the next five years, with market sales reaching RMB 15.44 billion (US$2.13 billion) by 2025. According to iResearch, the number can be even doubled to RMB 30 billion (US$4.15 billion).

The proportion of Chinese urban consumers purchasing perfume for personal use slightly decreased from 55 percent in 2020 to 48 percent in 2021, while the number of those buying fragrances as presents remained consistent at 41 percent to 42 percent. The shift in lifestyle caused by COVID-19 directly impacted consumer patterns, with the use of masks causing a considerable decline in demand for cosmetics, such as lipstick. The ‘lipstick effect,’ which had been linked to emotional consolation, has been supplanted by the ‘perfume effect,’ for the same reason.

In China, reviews on Xiaohongshu (a popular social media and e-commerce platform), dedicated boutiques, and friends and the primary and most trustworthy sources of information about perfumes. Floral, lemony, and woody aromas are the most popular among Chinese customers, while 50ml perfume bottles are sold the most because they are practical and can be easily carried around.

Demand for niche and high-end fragrances in China is expected to expand, resulting in a significant increase in imports. To prevent being caught off guard, TMall Global, in collaboration with the logistics business Cainiao Network, launched a ‘perfume route’ connecting European perfumers to China via dedicated daily air freight. Despite rising demand, international logistics restrictions and minimum criteria have impeded cross-border perfume trade, making it difficult for niche manufacturers to ship their products to China.

Major trends in China’s perfume market

Online and duty-free buying

For Chinese consumers, the road to beauty discovery and purchase has shifted. Online platforms have become a simple approach for fragrance manufacturers to reach a wider audience. Likewise, online channels have become the primary method for customers to acquire perfumes, whether for personal use or as a gift. Up to 70 percent of Chinese urban consumers have purchased perfumes online, followed by brand counters/speciality stores (52 percent) and stores specialized in beauty products collections (27 percent).

Another crucial aspect of the shift to online buying is the habit of checking for online reviews. Checking online product reviews (64 percent) has surpassed in-store trials (54 percent) as the most critical stage in the consumer’s shopping experience, as the focus of perfume purchases shifts online. Online platforms are indispensable channels for distributing and advertising perfumes, and social media remains the most popular and trustworthy source of information for young Chinese consumers. This is especially true for Xiaohongshu, a platform that 60.8 percent of Chinese consumers use as their primary source for learning more about perfumes and brands. In 2020, the most popular trending topics on Shanghai-based e-commerce were “masculine Guochao fragrances,” “woody,” “citrusy,” and “fancy”.

Duty-free is also growing in popularity as a preferred channel for perfume purchases. Approximately one-third of the respondents to a recent poll declared to have previously purchased perfumes both in physical duty-free establishments (19 percent) and online duty-free shopping platforms (19 percent). While women are more likely than males to shop in duty-free channels in general, it is worth mentioning that men who travel for work and are married are also likely to be familiar with such distribution channels.

Gen-Z: the new generation of Chinese consumers

As novelty-loving Gen-Z consumers begin to use fragrances in their daily lives, their taste for more individualized and unusual aromas may call international businesses’ dominant position into doubt. Chinese young consumers see perfumes as a way to showcase their individuality. Therefore, they may choose fragrances with personality, that are neither too sweet nor too powerful, and they prefer gender-neutral smells. That is why perfumes like Byredo’s ‘Rose of No Man’s Land’ and Juliette Has a Gun’s ‘Not A Perfume’ are among TMall’s 2020 Top 10 Young People’s Favorite Imported Niche Perfumes.

Differences in consumer behavior in China’s higher-tier and lower-tier cities

Consumers in first-tier and new-first-tier cities place a premium on experience, so perfumers must create an immersive experience to stand out.

On the other hand, fragrance customers in second-tier and third-tier cities prioritize cost-effectiveness and choose dependable outlets. Indeed, regardless of age, customers in lower-tier cities are eager to buy cheaper items that they believe are of the same quality as costlier ones. Furthermore, when it comes to purchasing perfume, this group wants to interact with real people and demands certifications of authenticity.

Home fragrances

The COVID-19 prolonged home isolation/lockdowns encouraged the interest and purchase rate of the home fragrance category. Several companies have taken notice of this sector, including Loewe, which announced the debut of a home fragrance and scented candle collection in November 2020, and Byredo, which introduced 13 scented candles in its co-branding with IKEA in the same month.

Scented personal care and laundry items are the most popular items in this category, followed by room scents, such as scented candles and scented oils with diffuser stones.

Consumers are also more likely to recognize professional lifestyle companies entering this niche.

Competition from local players

Perfumes in China have not been immune to young customers’ preference for brands that take inspiration from China’s cultural past, and thus far, Chinese brands have demonstrated a competitive advantage in harnessing local narratives. Aside from incorporating Guochao features (that is, elements of traditional Chinese culture and style) into their packaging, Made-in-China manufacturers also began calling their scents after literary and artistic inspirations, such as Wegoo’s Sweet Osmanthus Rain, which has borrowed its name from a popular theme in ancient Chinese poetry. Perfumers are using China’s cultural heritage to forge deeper connections with the home audience.

Another example is Scent Library (气味图书馆), a brand that has been very creative in leveraging this ‘nostalgia aspect’ of smell. Its scent L.B.K Water(凉白开) is well-known for reminding consumers of a Chinese past where families used to boil water in aluminium pots.

To Summer (or Guanxia, 观夏) is another popular Chinese brand that offers unique eastern botanic smells. With a slow-marketing strategy, the inspiration behind each product of the brand is centred on the Asian imaginary. For instance, its Four Seasons Mood Aroma interprets the scent and scene of the four seasons through traditional floral design, with both the packaging and the name incorporating a different picture of this, such as ‘Spring Magnolia,’ ‘Autumn Osmanthus,’ and so on.

All in all, Chinese competitors have expanded substantially as well in the fragrance market. Growing localism provides domestic brands with a distinct edge in leveraging Chinese culture and history to engage with consumers.

Product and market strategies adopted by foreign players

For a long time, the Chinese scent market has been dominated by large businesses like Chanel, LVMH, Coty, and Procter & Gamble.

L’Oréal, Estée Lauder, Mary Kay, Burberry, Salvatore Ferragamo, and Avon account for 48.8 percent of the total perfume market in China. These major businesses have a significant online and physical presence.

Indeed, according to the 2021 China Perfume Industry Research White Paper, the top 10 performing fragrance brands in the Chinese market are all foreign names. Among these, there are a few notable examples from luxury brands.

In 2015, Armani released the scent Prive Pivoine Suzhou, inspired by Suzhou’s traditional gardens. Giorgio Armani chose the peony as the flower that represents prosperity, dignity, and completion to depict China’s ‘Venice of the East.’ The fragrance’s global debut occurred at Suzhou’s iconic Humble Administrator’s Garden, in the presence of Zhang Zilin, actress and winner of Miss World. Despite its early popularity, Armani has reduced the number of designs for its fragrance lines from seven to three in 2017, since the brand reported a five percent drop in group sales in 2016.

In 2015, Atelier Cologne’s sales rose to US$40 million, and the brand was acquired by L’Oréal the following year. L’Oréal’s cosmetic sales were up 10.5 percent in early 2017, with Atelier Cologne being one of the key drivers of this growth. In June 2017, the brand opened its first flagship shop in Shanghai, and in October of that year, its second franchised location was inaugurated in Chengdu. Oolang Infini is an example of a Cologne product that incorporates Chinese elements by featuring the famous Chinese oolong tea as one of its ingredients.

Coco Chanel created her world-renowned Chanel N°5 in 1921, and the brand has maintained an unshakeable position in the perfume market ever since. Chanel Gabrielle is a flowery, fruity fragrance with notes of jasmine, ylang-ylang, orange blossom, and tuberose, which debuted in 2017 and is named after Coco Chanel’s true name. The fragrance was released at a special ceremony in Beijing, attended by Chinese movie stars Hugo Hu, Zhou Xun, and Liu Shishi, as well as Chanel’s Chinese ambassador, Liu Wen. The brand remains one of the top three fragrance choices among Chinese consumers, with a 6.42 percent market share as of the end of that same year. With multiple pop-up stores and live-streamed events, Chanel is also very popular on Chinese social media Weibo and Xiaohongshu. However, in 2021 the brand launched an inaugural advent calendar which drew harsh criticism from the Chinese public owing to the perceived low value for money of the gift box’s content. The criticism received in this case shows that foreign brands need to be more conscious of the impact of their sales strategies on their brand value, particularly as China’s perfume market is becoming highly competitive with the rise of local and niche players.

Entering China’s perfume market

According to Transparency Market Research, four big groups control about half of the global market for fragrances, oils, and perfumes. The four companies are Givaudan and Firmenich from Switzerland, International Flavors & Fragrances from the United States, and Symrise from Germany. Moreover, European-listed firms dominate over 80 percent of the Chinese fragrance market.

Large companies are attempting to expand their Chinese markets by designing items that cater directly to this audience. Along this line, in 2019 Firmenich completed the Shanghai Perfume Creative Center, aiming at building the world’s first one-stop high-end perfume center. Givaudan, on its end, opened its own manufacturing facility in Changzhou in 2020.

Another way for foreign businesses to approach the Chinese market is to create close collaboration with Chinese brands. Documents, a Chinese high-end fragrance brand that launched its first Shanghai flagship shop in early July 2021, collaborated with Givaudan on six scents with fragrance concentrations ranging from 15 percent to 25 percent. In 2021, Givaudan also partnered up with the Tmall Innovation Center to develop fragrances for Chinese consumers. The brand has established a digital team in China to capitalize on the digital market potential.

Challenges for foreign players in China’s fragrance and perfume market

Perfume consumption is fundamentally different when compared between China and Western markets, with tastes being on opposing ends of the spectrum. For example, in the Chinese market, the notion of attractiveness is far from that in Western nations, and the same is true for commercials that cater to this market. For instance, a traditional masculine perfume/scent is typically made of spicy or woodsy fragrances and is designed to portray passion, sensuality, and strength in Western markets. On the other hand, in China, the same picture is conveyed through a smell that is fresher, with citrus undertones.

For smaller players – both foreign and domestic – market penetration is more complicated. Perfumes are perceived as a non-essential commodity and, as such, consumer awareness is still in its infancy. Moreover, it takes time to build customer trust, and it is difficult for niche scents to reconcile supply and demand. On the other hand, enterprises are in a stronger position when there are on social media which helps in community development; with the ability to make sales directly on WeChat mini-programs, opportunities are vast. Such direct distribution strategies also allow the company to devote more time to refining the actual product.

Another challenge is the retail point. Unlike European countries, retail locations are not well established to encourage in-depth product knowledge in China. As a result, integrating into the scent market might become more difficult.

Overall, the Chinese cosmetics business is expanding and changing. Foreign-funded firms continue to lead the way, accounting for an estimated 86 percent of total retail sales, but Chinese companies are swiftly catching up, currently accounting for 14 percent. As a result, businesses entering the market should be wary of Chinese competitors who are often able to propose cheaper alternatives and are knowledgeable of all the trends in China as well as how to approach their audience.

Conclusion

Asia – mainly Japan, Korea, and China – represented 13 percent of the global premium perfume market in 2020, with China being the most promising market of the three, with a 15 percent growth. As studies reveal, by 2030 China is expected to become the 2nd largest perfumes market worldwide.

The current and future development trends of the Chinese perfume market are positive. It is anticipated that high-end fragrances, particularly high-end gender-neutral scents, will continue to dominate the mainstream market over the next three to five years.

The perfume market still has plenty of room for new companies, and the arrival of foreign and local capital and brands, as well as the maturation of all distribution channels, will provide a more favorable environment for the growth and diversification of this industry.

This article was published on September 29, 2022, and has been updated on October 4, 2022.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China’s First Ever Private Pension Scheme – What You Need to Know

- Next Article China Resumes License Approval: What’s Next for its Gaming Industry? (updated)