China’s Pilot Bonded Zone VAT Program

China recently expanded the scope of its pilot VAT program for comprehensive bonded zones, adding an additional 24 locations to the program.

Since 2016, China has allowed qualified enterprises to apply for general value-added tax (VAT) taxpayer status in Special Customs Supervision Zones (SCSZs), which include Comprehensive Bonded Zones (CBZs).

Enterprises that are registered as general VAT taxpayers enjoy a variety of benefits, including the ability to issues special VAT invoices (or fapiao).

SCSZs are important drivers for trade in China.

From January to November 2018, imports and exports in China’s SCSZs reached RMB 4.7 trillion (US$700 billion), up by 12.3 percent year-on-year and accounting for 16.8 percent of the country’s total foreign trade in the same period. That means 1/20,000th of the nation’s land is responsible for around one sixth of its total foreign trade.

The announcement to expand to new CBZs was issued by the State Administration of Taxation (SAT), the Ministry of Finance (MOF), and the General Administration of Customs (GAC) and came into force from February 1, 2019.

The expansion of the pilot program follows recent pledges by the Chinese government to further develop and upgrade the country’s SCSZs. The pilot VAT policy is one step in the government’s efforts to utilize its SCSZs to promote foreign trade, expand domestic consumption, and sustain stable employment amid trade tensions with the US.

What does general VAT taxpayer status mean?

For enterprises registered in SCSZs, qualifying for general VAT taxpayer status allows them, in certain cases, to expand access to the domestic market and lower tax obligations for domestic sales and procurement.

China has two VAT taxpayer categories: small-scale taxpayers and general taxpayers.

Only general taxpayers can issue special VAT invoices, which are used to credit input VAT from output VAT and to claim VAT export exemptions and refunds.

Small-scale taxpayers cannot issue special VAT invoices, but benefit from a lower three percent VAT rate.

Previously, in-zone non-pilot enterprises with small-scale taxpayer status were often subject to double taxation when purchasing raw materials from out-zone domestic resources and then selling the processed goods back to domestic market.

Meanwhile, out-zone buyers could not receive any special VAT invoices to offset their own taxes, since small-scale taxpayers cannot issue such invoices.

The pilot program, however, allows enterprises registered in participating SCSZs to apply for general taxpayer status on a voluntary basis even when they would normally be considered small-scale taxpayers.

When doing business with the domestic market, in-zone pilot enterprises registered as general taxpayers can issue or receive special VAT invoices, which are needed for tax reliefs on either side of trade.

To specify, when selling goods or services to the domestic market, in-zone pilot enterprises can now issue special VAT invoices to out-zone buyers, so the buyers can then use the invoices to credit their own input VAT.

Likewise, when buying goods and services from domestic sources, in-zone pilot enterprises can receive special VAT invoices from out-zone sellers. This means that in-zone pilot enterprises can use the invoices either as an input tax credit voucher for domestic sales, or as an export exemption or refund voucher.

The pilot general VAT taxpayer policy affects the various activities of qualified enterprises as follows:

For domestic procurement:

- Pilot enterprises that purchase goods from domestic out-zone sellers can request special VAT invoices.

- The special VAT invoice can be used by pilot enterprises as an input tax deduction voucher for domestic sales or an export tax refund voucher.

- The current bonded policy shall apply to goods purchased in processing trade.

For domestic sales:

- Enterprises in pilot zones selling goods to the domestic market (including selling to other enterprises in pilot zones) may be issued special VAT invoices. Such enterprises need to declare and pay VAT and consumption tax in accordance with the provisions.

- If domestic sales contain bonded goods, or the non-processed bonded goods are sold directly outside the pilot zone, the bonded goods shall be declared and paid import duties, VAT, and consumption taxes according to the state of the bonded goods when they enter the zone, and the deferred tax interest shall be paid according to the provisions.

- If pilot enterprises purchase goods from in-zone non-pilot enterprises, the goods shall be subject to the tax policy on import goods.

- The current bonded policy shall apply to non-processed bonded goods purchased or sold between pilot enterprises.

For export:

- Pilot enterprises can apply for tax refunds after the export goods depart from the territory of China.

- Sales to non-pilot enterprises in pilot SCSZs (except for non-processed bonded goods) shall be regarded as export and tax refund may be allowed.

For imported goods/self-use equipment:

- The current bonded policy shall continue to apply to goods imported from overseas.

- Imported equipment, including machine equipment, construction materials, and office supplies for self-use, will be temporarily exempted from import tariffs, import VAT, and consumption tax (hereinafter referred to as “import taxes”).

- The interim exempted import taxes will be divided on a pro-rata basis per annum, according to the length of Customs supervision of the imported self-use equipment. At the end of each year, the import taxes exempted for the year will be divided based on the ratio of domestic and overseas sales. The taxes based on overseas sales percentage will be subject to the tax policy of the pilot zone where the pilot enterprise is located, and the taxes based on domestic sales percentage will be levied in accordance with the out-zone tax policy.

The full policy can be found here (in Chinese).

Gradual expansion of the pilot program

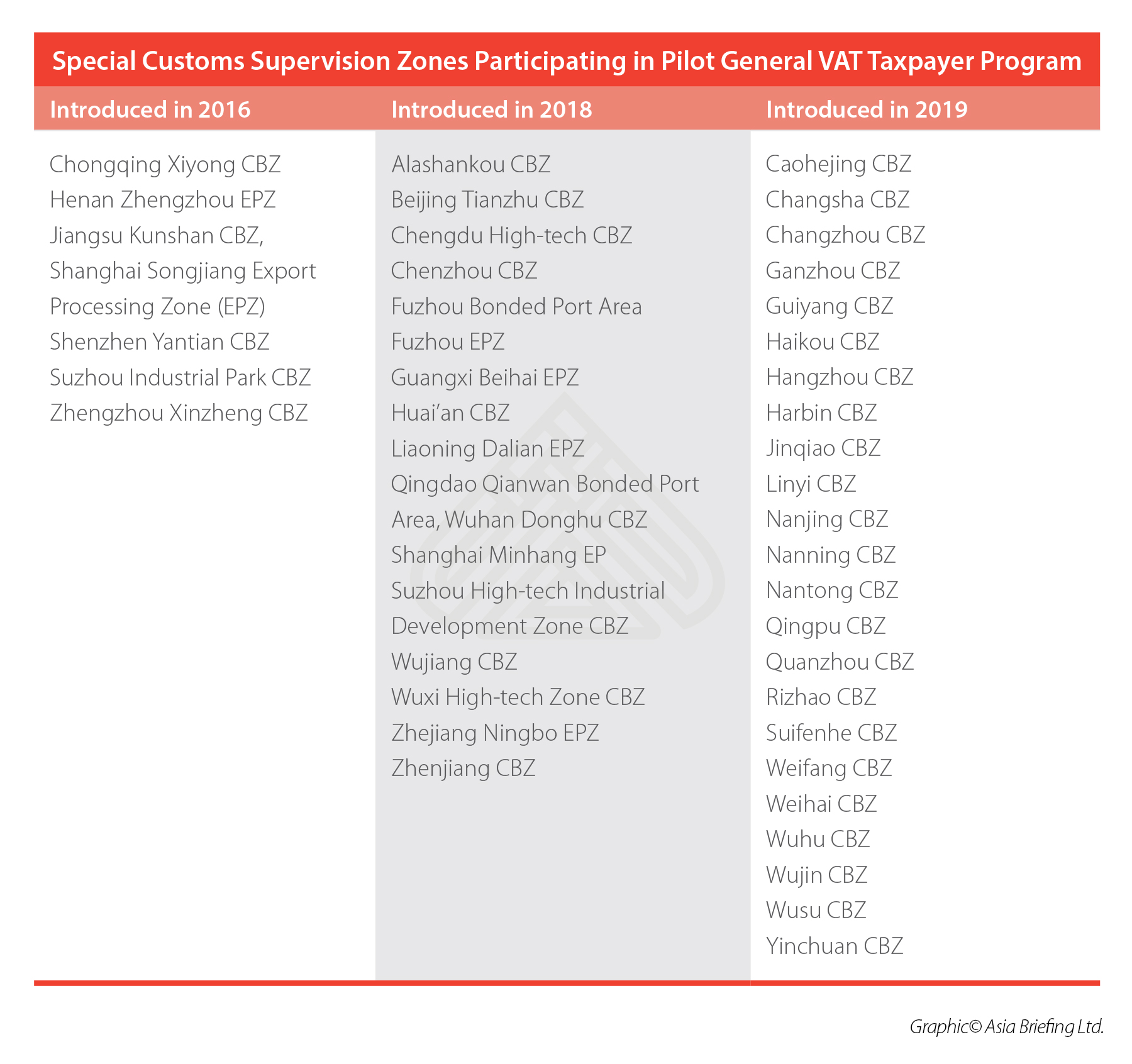

China first adopted the pilot VAT program in November 2016, initially in just seven SCSZs. The policy was later expanded to another 17 SCSZs in January 2018, at which point a withdrawal mechanism was introduced. In February 2019, the program was further expanded to another 24 CBZs.

The withdrawal mechanism introduced in 2018 stipulates that pilot enterprises have the option of exiting the program 36 months after joining. If an enterprise decides to withdraw from the pilot program, the standard tax policy for in-zone non-pilot enterprises shall be resumed, but the enterprise is unable to make another application for the pilot program for 36 months.

The SCSZs currently participating in the pilot program are shown in the table below.

Consider the costs and benefits

The pilot VAT program offers several advantages, but not all enterprises are suitable to participate.

Depending on the size and nature of the business, some enterprises may determine that it is more beneficial to continue to be considered a small-scale taxpayer.

Those focusing on the international market for procurement and sales, for example, may not need to change their existing bonded zone status.

For those determining which SCSZ to choose, the pilot VAT program is just one of many factors to consider.

While the pilot program is now available in 48 SCSZs, China has 140 SCSZs in total.

New entrants may find that a non-pilot zone’s location, industry cluster, and other incentives on offer outweigh the benefits offered by one participating in the pilot VAT policy.

When considering whether to make use of the pilot VAT policy, interested enterprises are recommended to conduct detailed analyses to clearly identify the incremental benefits – such as increased access to the domestic market and ability to use VAT credits – as well as the potential costs, such as additional VAT obligations.

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Dalian, Beijing, Shanghai, Guangzhou, Shenzhen, and Hong Kong. Readers may write china@dezshira.com for more support on doing business in China.

- Previous Article China Releases New Draft List of Encouraged Industries for Foreign Investment

- Next Article What is the Greater Bay Area Plan?