China’s Taxpayer Credit Rating System: An Explainer

We explain China’s taxpayer credit rating system, including how it works and why it is important for foreign enterprises based in the country and doing business in China.

Taxpayer credit rating is becoming increasingly important for foreign enterprises operating in China as its government – at all levels – is working continuously to improve the country’s social credit system.

A good tax credit rating means the enterprise will access more favorable treatment when obtaining tax incentives, making bids, applying for loans, obtaining business qualifications, etc., while a poor rating can lead to more stringent scrutiny in a wide range of tax-related matters.

In this article, we will walk you through China’s tax credit management system to help you maintain a good tax credit rating.

How does China’s taxpayer credit management system work?

China established its taxpayer credit management system in 2014 with the roll-out of the Administrative Measures on Taxpayer Credit (Trial Implementation) (STA Announcement [2014] No.40). Since then, it’s been constantly perfecting this system and integrating it with the larger corporate social credit supervision mechanism.

Under the system, Chinese tax authorities collect and evaluate the taxpaying information of corporate taxpayers in each tax year (from January 1 to December 31) and confirm the taxpayer credit evaluation findings the following April.

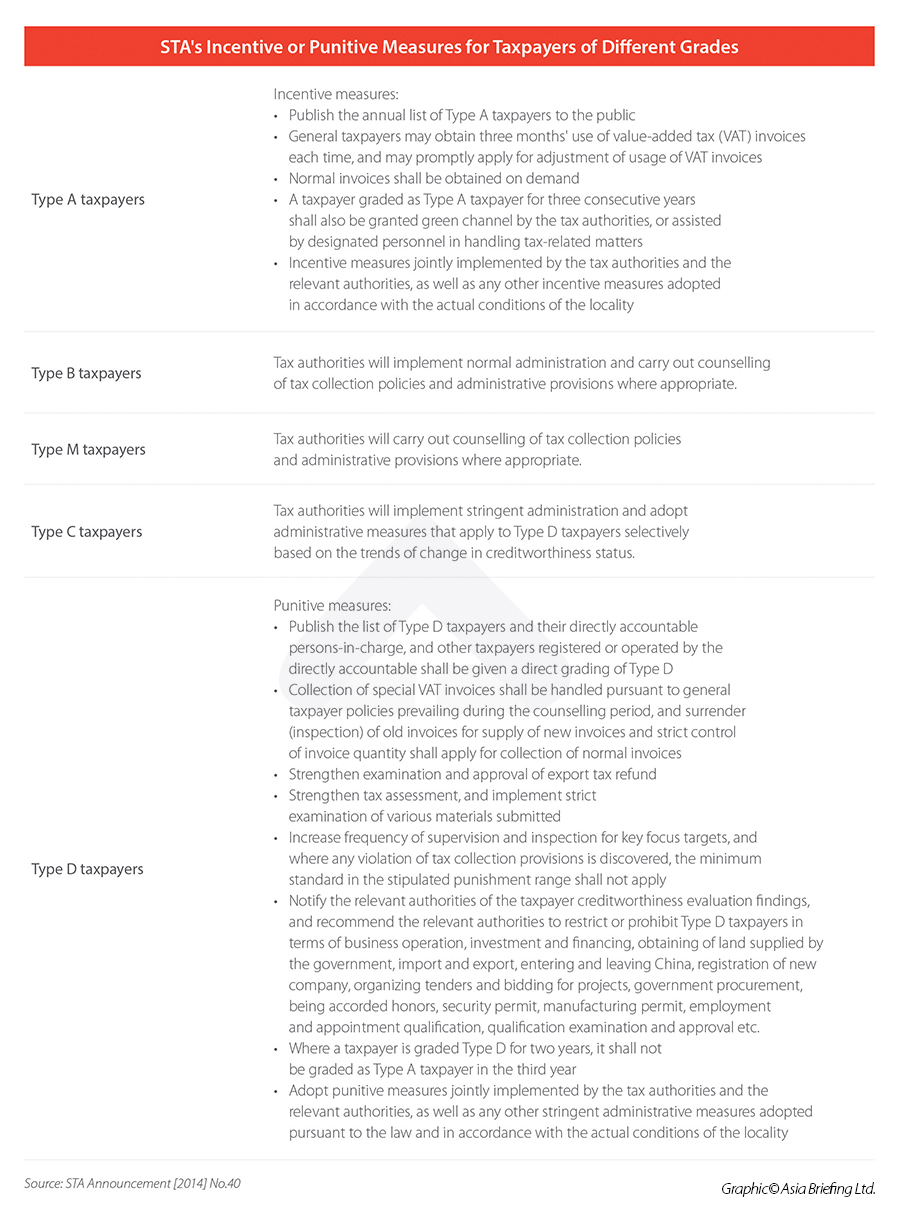

After determining the credit ratings for taxpayers by way of annual evaluation benchmark scores or direct rating, the tax authorities implement corresponding administrative measures, including incentive and punitive measures, for taxpayers of different grades.

What is the scope of application?

The tax credit rating system applies to all corporate taxpayers that (a) have completed tax registration, (b) are engaging in manufacturing and business activities, and (c) subject to tax collection based on their accounts, pursuant to the STA Announcement [2014] No.40.

The scope of application was expanded by the SAT Announcement on Matters Related to Evaluation of Taxpayer Credit (STA Announcement [2018] No.8) in 2018 to cover:

- Newly established enterprises, that is, enterprises that have been operating for less than a calendar year.

- Enterprises without business income in a calendar year.

- Enterprises whose corporate income tax (CIT) returns are filed on a deemed income basis.

In 2020, the STA Announcement about Issues Related to Credit Management on Tax Payment (STA Announcement [2020] No.15) added that a “non-independent accounting branch” (branches established by corporate taxpayers whose registration information has been confirmed with the tax authorities and who accounting method is non-independent accounting) can voluntarily choose to join the credit evaluation after application.

How are taxpaying credit ratings calculated?

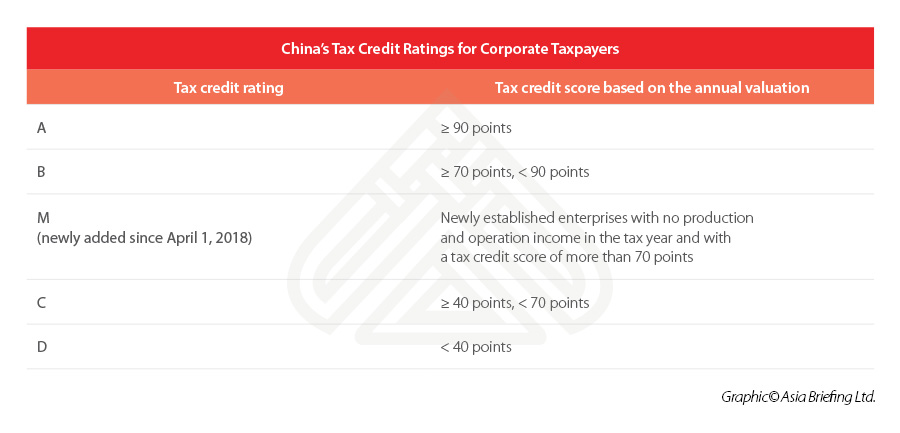

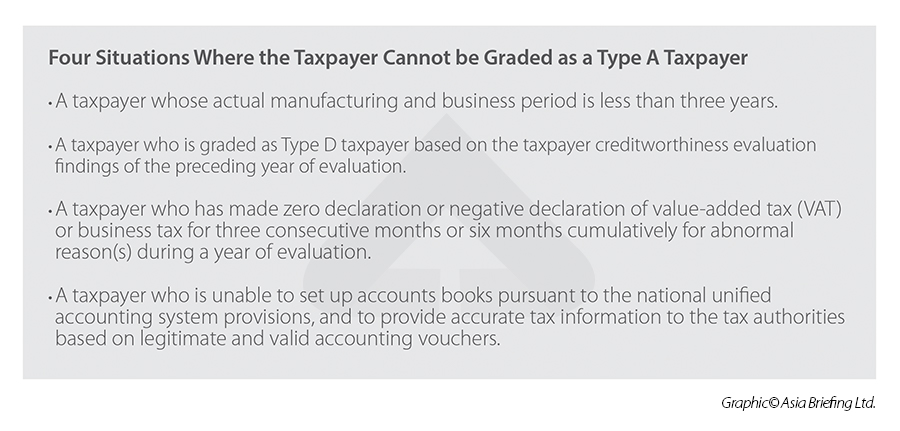

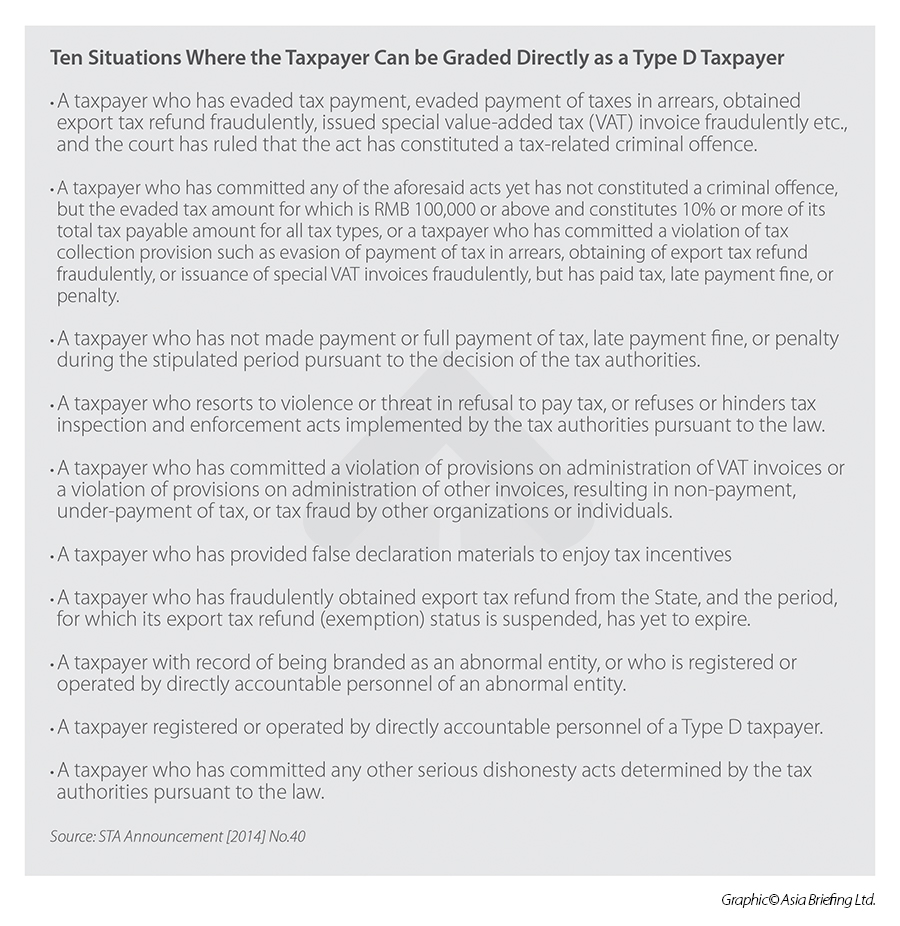

So far, there are five credit ratings for corporate taxpayers – A, B, M, C, and D, as shown in the following table. Type A taxpayers own the best tax credit rating with a score of 90 points and above, while Type D taxpayers have the poorest rating. Type D taxpayers have either scored less than 40 or were graded directly as Type D (direct grading applies to taxpayers who have committed serious dishonest acts).

Among them, the special Type M was newly added in 2018, which refers to newly established enterprises with no production and operation income in the tax year and with a tax credit score of more than 70 points.

The credit scores (usually with a starting score of 100 or 90, which we will explain in the next section) adopt the demerit method – taxpayers’ scores are deducted when they fail to meet taxpaying credit evaluation indicators.

What are the taxpaying credit evaluation indicators?

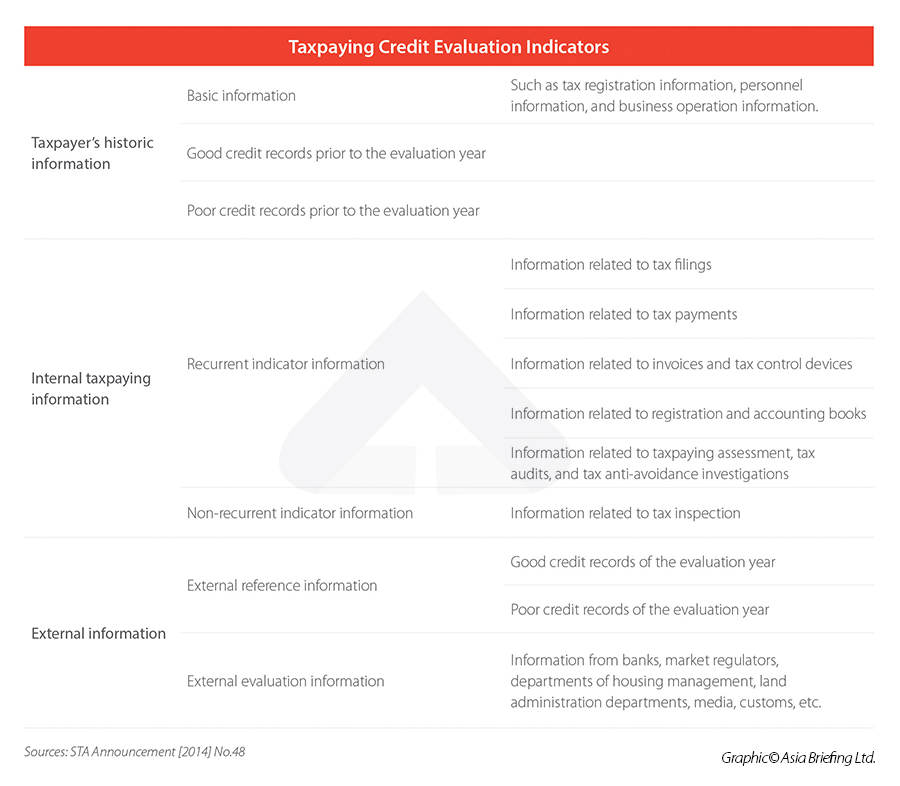

The taxpaying credit evaluation indicators consist of the taxpayer’s historic information, internal taxpaying information, and external taxpaying information, according to the STA Announcement on the Promulgation of Taxpaying Credit Evaluation Indicators and Methods (for Trial Implementation) (STA Announcement [2014] No.48). You may refer to the following table to have a rough idea about the respective evaluation indicators.

The internal taxpaying information contains “recurrent indicators” and “non-recurrent indicators”.

The recurrent indicator refers to indicator information frequently generated by taxpayers during the year of evaluation, such as tax-related declaration information, tax payment information, invoices and tax control equipment information, registration, and accounts books information. The non-recurrent indicator refers to indicator information not frequently generated by taxpayers, such as the tax bureau’s record of tax assessment, tax audit, anti-tax avoidance investigation, or tax inspection information.

According to the STA Announcement [2020] No.15, if there is non-recurring indicator information in the past three evaluation years, the starting score of the taxpayer can be 100. In the absence of non-recurring indicator information in the past three evaluation years, the starting score is 90.

What are the incentive and punitive measures for taxpayers in China?

After determining the taxpayer credit rating, the tax authorities will implement administrative measures, including incentive and punitive measures, accordingly.

As we can see from the table below, contrary to Type A taxpayers who will be entitled to favorable treatment like streamlined administrative procedures and fast-tracked approvals, Type D taxpayers could face increased frequency of supervision and inspection and stricter scrutiny on a wide range of tax-related matters, such as application for invoice issuance and value-added tax (VAT) refunds on exported goods and monitoring business compliance.

Furthermore, the State Taxation Administration (STA) has actively been participating in the construction of China’s social credit system and the exploration of cooperation on credit sharing.

In 2015, the STA and the China Banking and Insurance Regulatory Commission (CBIRC) set up the “Bank-Tax Cooperation” mechanism. Tax authorities committed to forwarding part of the taxpayer’s tax credit information to banks under the premise of legal compliance and enterprise authorization. Banks will be able to use this information to optimize their credit model and provide credit loans for trustworthy small and micro firms. Since November 2019, the scope of beneficiaries has been expanded from Type A and Type B taxpayers to include Type M taxpayers (newly established ones).

Inter-agency collaborative agreements are an increasingly prominent feature of the Chinese regulatory landscape.

In July 2016, 29 Chinese regulatory authorities, including SAT, NDRC, People’s Bank of China (PBOC), etc., jointly signed a cooperation memorandum to grant 41 incentives to taxpayers with Class-A tax credit rating. In October 2016, 40 Chinese regulatory authorities jointly signed a Cooperation Memorandum to Grant Joint Incentives for Customs’ Advanced Certified Enterprises.

The STA has signed a Cooperation Framework on Credit Sharing and Application with the State Development and Reform Commission (NDRC) in 2017 and dozens of Memoranda of Joint Actions on Rewarding Honesty and Punishing Dishonesty with related government departments to further develop mechanisms in credit sharing, mutual rating recognition, and cooperation in reward and punishment with respect to credit rating results.

Does China provide taxpaying credit restoration measures?

To encourage corporate taxpayers to proactively fix their tax incompliance record, China also incorporates tax credit restoration measures into the taxpayer credit management system. This grants taxpayers a chance to repair their credit rating.

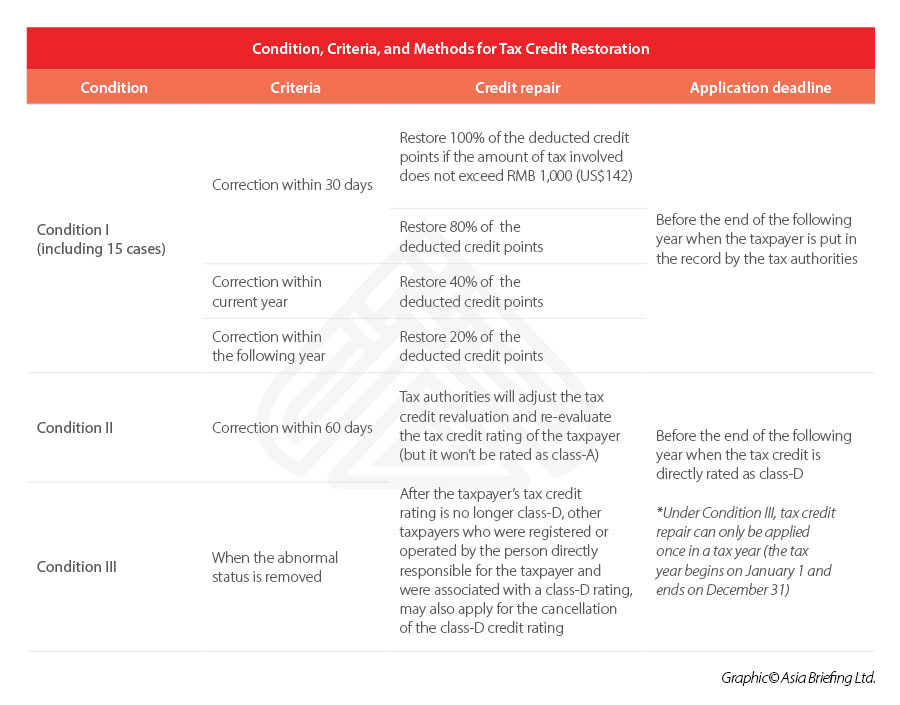

Pursuant to the Announcement on Matters Related to Tax Credit Restoration (SAT Announcement [2019] No.37), beginning January 1, 2020, corporate taxpayers included in China’s tax credit management system can apply for tax credit restoration by correcting tax irregularities and making credit commitments.

Eligible corporate taxpayers applying for tax credit restoration must satisfy one of the following three conditions:

- Condition I: The enterprise has now completed all tax declarations, tax payments, and data filing, after previously failing to do so, within the statutory time limit;

- Condition II: The enterprise that previously failed to pay or pay in full the taxes owed, late fees, and fines and was categorized as a Type D taxpayer (not due to a crime), has now paid or made up the payment within 60 days upon the statutory payment deadline; or

- Condition III: The enterprise has fulfilled all corresponding legal obligations, and thereby the tax authority has lifted its ‘abnormal’ status.

The taxpayer can apply to the relevant tax bureau and make a commitment that the irregularities have been corrected and the tax bureau will then, within 15 workdays, complete the audit and inform the applicant of the result. After the completion of the tax credit repair, the taxpayer will be subject to the corresponding tax policies and administrative measures based on the recovered tax credit rating.

China has been putting great effort into optimizing its corporate credit system to improve the efficiency of tax and credit governance. Corporates are highly advised to keep track of their tax credit ratings and the reasons for their poor rating (if any), refer to the respective announcements from tax and regulatory bodies and seek professional advice to make up for the credit loss.

For further information or assistance in your tax credit management, you are welcome to contact us at china@dezshira.com or tax@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Chongqing’s Growing Focus on the Electronics Industry and Digital Economy

- Next Article Guangdong’s Pilot Program on Chief Data Officer: Accelerating Digitalization and Achieving Better Data Protection