Chinese Accounting Standards for Business Enterprises: Prepare for Changes in 2021

By Zoey Zhang and Jess Feng

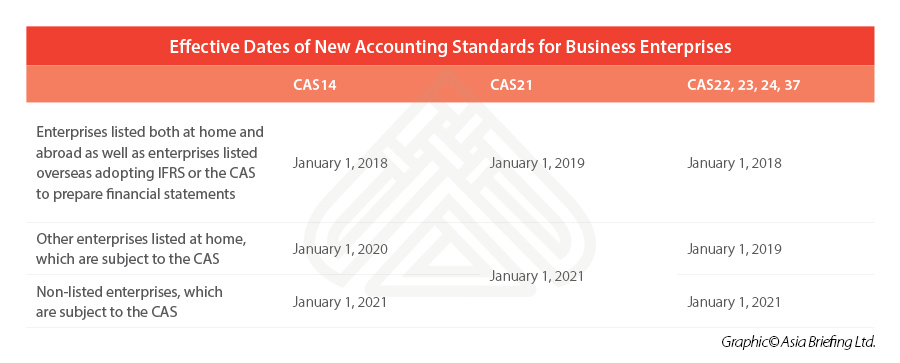

Starting January 1, 2021, several new accounting standards regarding revenue, leases, and financial instruments, will soon apply to all entities that have already adopted the Chinese Accounting Standards for Business Enterprises (CAS). These new standards include:

- Chinese Accounting Standards for Business Enterprises No.14 – Revenue (2017) (CAS14);

- Chinese Accounting Standards for Business Enterprises No.21 – Leases (2018) (CAS21);

- Chinese Accounting Standards for Business Enterprises No.22 – Recognition and Measurement of Financial Instruments (2017) (CAS22);

- Chinese Accounting Standards for Business Enterprises No.23 – Transfer of Financial Assets (2017) (CAS23);

- Chinese Accounting Standards for Business Enterprises No.24 – Hedge Accounting (2017) (CAS24); and

- Chinese Accounting Standards for Business Enterprises No.37 – Presentation of Financial Instruments (2017) (CAS37).

The issuance of new accounting standards will not only bring big challenges to the accounting work of relevant enterprises, but also make a difference to their daily business decisions, internal control, financial performance, among other aspects. It is thus advisable that enterprises make full preparations for the new CAS, in order to meet the expectations of stakeholders and the requirements of regulators.

This article will take you through the key changes and contents of the new CAS14 regarding revenue, CAS21 regarding leases, and other Chinese accounting standards regarding financial instruments, the impact brought by these new standards on businesses, and the differences among the CAS, the International Financial Reporting Standards (IFRS), and the US Generally Accepted Accounting Principles (US GAAP).

WEBINAR – Understanding China’s New Accounting Standards: Key Changes and Impacts (December 10, 2020)

We discuss the major changes in China’s new accounting standards that come in effect in 2021 and how businesses can prepare themselves to be compliant.

New Accounting Standards for Business Enterprises No.14 – Revenue

On July 5, 2017, the Ministry of Finance (MOF) released the New Accounting Standards for Business Enterprises No.14 – Revenue (CAS14), to bring the new CAS14 in line with the International Financial Reporting Standards No.15 – Revenue from Contracts with Customers (IFRS15) published by the International Accounting Standards Board (IASB) on April 28, 2014.

The new CAS14 may lead to substantial changes to revenue recognition policies of enterprises, such as changing the timing of revenue recognition and the amount being recognized.

Two new balance sheet items – “contract assets” and “contract liabilities” – will be added into the financial statement of enterprises. Besides, the introduction of the Five-Step Model and additional disclosure requirements may also complicate the accounting work of enterprises and affect the performance of their annual financial statements.

A snapshot of the major changes in the new CAS14

The new CAS14 applies to the revenue recognition of most contracts with customers. Here are the major changes, which enterprises are recommended to take note of:

- The new CAS14 consolidates the revenue recognition models in the old CAS14 and in the CAS15 – Construction Contracts into one unified model. The unified model will no longer differentiate various types of transactions, such as the sale of goods, rendering of services, the use of enterprise assets by others, and construction contracts.

- The new CAS14 emphasizes the transfer of control, instead of the transfer of significant risks and rewards, as the key criterion to recognize contract revenue. This means that revenue should be recognized only when the customer obtains the control, that is “dominate the use of the product and obtain almost all the economic benefits from it”.

- The new CAS14 introduces the concept of “performance obligations”. Enterprises are required to identify separate performance obligations in a contract and allocate transaction price among them.

- The new CAS14 offers more guidance on the determination of transaction price.

- The new CAS14 provides more guidelines on the accounting treatment of specific transactions.

- The new CAS14 adds new disclosure requirements.

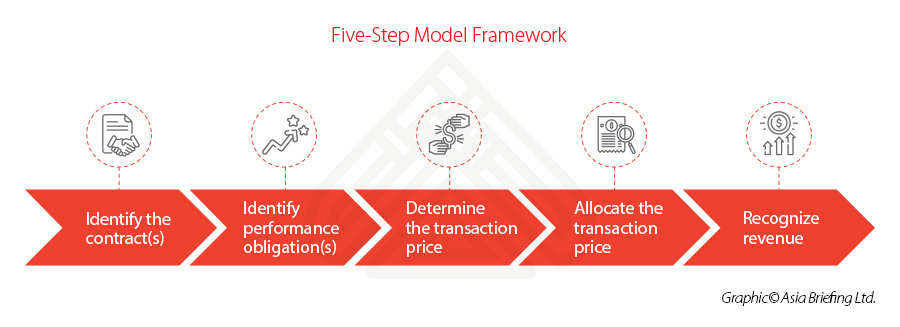

The Five-Step Model framework for revenue recognition

In July 2018, the MOF issued applicable guidelines for the CAS14, introducing a Five-Step Model framework to guide enterprises to recognize revenue step by step. The Five-Step Model reflects the core principle of revenue recognition under the CAS14 – “an entity shall recognize revenue when (or as) it satisfies a performance obligation, which is when the customer obtains control of the product”. To comply with the new principle, enterprises will need to review and modify their revenue recognition process, which is expected to involve more legal and risk assessment work in the accounting process.

Here are the key contents of the Five-Step Model framework:

Here are the key contents of the Five-Step Model framework:

- Identify the contract(s): It provides key criteria for identifying a contract, which would require entities to evaluate terms of their contracts in details and develop credit risk assessment policies to ensure that the contracts meet the new standard.

- Identify performance obligation(s): It asks entities to identify multiple separate performance obligations in one contract, which would require entities to identify their promises to transfer distinct products to the customer and assess the interrelation between the promises under the new standard. This step could be challenging as it requires entities’ accounting judgement.

- Determine the transaction price: It provides guidelines for entities to determine the transaction price, which is the consideration (payment for a product or service) an entity expects to be entitled to receive. It also clarifies accounting treatments with specific arrangement regarding variable consideration, significant financing component in the contract, non-cash consideration, and consideration payable to a customer.

- Allocate the transaction price: It provides clear provisions that when a contract contains two or more performance obligations, at the inception of the contract, the entity should determine the “standalone selling price” of the distinct product underlying each performance obligation and allocate the transaction price in proportion to the standalone selling price. This step would require accounting estimate particularly when the standalone price is not readily available.

- Recognize revenue: It needs entities to determine whether a performance obligation is satisfied over time or at a point of time. For a performance obligation satisfied over time, the entity should recognize revenue based on performance progress over time. This step could completely change the timing of revenue recognition.

Transitional accounting treatment

An entity that first applies these standards shall, based on the cumulative effect of initially applying these standards, adjust the opening balance of retained earnings and the amount of other relevant items in financial statements of the annual reporting period, and shall not adjust the information of the comparative period.

Impact of the new CAS14

Overall, the new CAS14 will potentially affect the timing of revenue recognition and the transaction amount being recognized in different business contracts as well as pose challenges to entities’ accounting practices. Here, we summarize some of the major challenges and impact:

- Identifying separate performance obligations would require a high degree of judgement in terms of product integration, product modification and customization, and interrelationship among products, to determine which promises are separately identifiable and which are not. Wrong classification could affect the timing and accuracy of revenue recognition.

- Under the old accounting standard, revenue can be recognized only when the amount of revenue can be measured reliably. With the new accounting standard becoming effective, revenue from contracts with variable consideration can be recognized based on the expected amount or the most likely amount with certain constraints. This change could potentially bring the timing of revenue recognition earlier than it used to be.

- For construction contracts lasting for more than one year, entities need to consider whether there is any significant financing component in receipt in advance from customer and retention payable. It involves accounting judgements as to whether such arrangements are of financing in nature.

- The change in revenue recognition policy may affect your bank covenants, compensation, and bonus plan, and the ability to pay dividends.

- The new CAS14 will probably have a significant impact on the following specific types of transactions from both accounting and tax perspectives:

i) Sales contract with a right of return;

ii) Sales contract with warranties;

iii) Distinguishing between the principal and the agent;

iv) Sales contract with customer’s additional purchase options;

v) Licenses of intellectual property;

vi) Buyback;

vii) Advanced payments;

viii) Non-refundable initial payments;

ix) Copyright distribution; and

x) Advertising production and launch via online and new media.

New Accounting Standards for Business Enterprises No.21 – Leases

On December 7, 2018, the MOF released the New Accounting Standards for Business Enterprises No.21– Leases (CAS21), to bring the new CAS21 in line with the IFRS16 published by the IASB on January 13, 2016.

The new CAS21 would bring significant changes to financial statements, especially for lessees with substantial operating leases.

Since the operating leases and finance leases will no longer be differentiated – both will be recognized in the balance sheets, relevant lessees may see notable increases in total assets and total liabilities in their balance sheet. These changes may affect the lease negotiation, therefore also influencing the lessor’s operation.

A snapshot of the major changes in the new CAS21

- The new CAS21 optimized the principles to distinguish leases from services. It introduces the concepts of the “identified assets” and the “right to control”, and uses the “right to control” to determine the scope of application of lease accounting.

- Under the new CAS21, the lessee is no longer required to differentiate operating lease and finance lease. The lessee should recognize right-of-use assets and lease liabilities on all leases (except for short-term leases and low-value asset leases that are subject to simplified accounting treatment) in the balance sheet as well as interest expense, accrued depreciation and any impairment loss in the income statement.

- The new CAS21 provides more guidance on lessor accounting. It emphasizes on the substance of the transaction other than the form of contract, gives more indicative signs for a lease to be classified as a finance lease, offers more guidance on the accounting treatment for a finance lease with the manufacturer or dealer as the lessor, and adds more disclosure requirements for lessors.

- The new CAS21 provides more guidance on arrangements such as sales and leaseback, sub-lease, lease changes, etc.

Explanation of the key contents in CAS21

Here are the key contents of CAS21 entities should pay attention to:

- Definition of leases: The new CAS21 provides clear provisions to distinguish the “leases” from “services”, where it emphasized two concepts – “identified assets” and the “right to control the use of the identified assets”. They are the two key points when assessing whether the contract is a lease or includes a lease.

- Splitting of leases: The new CAS21 regulates that where a contract concurrently contains multiple separate leases, the lessee and lessor shall split the contract and conduct accounting treatment respectively for each separate lease. Where a contract concurrently contains leased and non-leased parts, the lessee and lessor shall split the leased and non-leased parts, unless the simplified treatment has been adopted.

- Lease term: The lease term will have to include the period covered by the lessee’s option to renew leases, and exclude the period covered by the lessee’s option to terminate leases, when the lessee has reasonably determined that the options will be exercised.

- Accounting treatment for lessees: On the lease inception date, the lessee will start recognizing the right-of-use assets as well as the lease liabilities for all leases (expect for short-term leases and low-value asset leases that are subject to simplified treatment) – on their balance sheets. The new standard also explains how to measure “right-of-use assets” and “lease liabilities” using the appropriate discount rate.

- Simplified accounting treatment: Simplified accounting treatment is applicable to short-term lease (a lease with a lease term of not more than 12 months on the lease inception date) and low-value asset lease (a lease of a single new leased asset with relatively low value when the single leased asset is a new asset).

Transitional accounting treatment

Since the potential effect of the new lease standard is significant and pervasive, the standard provides a lessee with multiple choices for transitional accounting treatment.

On the first day of implementation (that is, January 1, 2020), a company may opt not to re-assess whether a contract that already exists is a lease or includes a lease. However, contracts commencing on or after the first day of implementation have to apply the new standard.

If an entity decides to re-assess existing leases, it may choose to adjust the retained earnings at the beginning of the year when implementing the new standard for the first time but shall not adjust information in the comparative period. For entities adopting this method, any lease that will be completed within 12 months after the first day of implementation (that is, January 1, 2020) may be treated as a short-term lease, thereby subject to simplified treatment.

Alternatively, an entity may choose to adopt the retrospective adjustment method in accordance with CAS28 – Changes in Accounting Policies and Estimates and Correction of Errors.

Impact of the new CAS21

For a lessee under operating lease, both total assets and total liabilities will increase due to the right-of-use assets and lease liabilities recognized in the balance sheet. This will have a significant impact on various financial indicators (that is, return on assets, gearing ratio). The impact will be particularly significant for industries that heavily adopt the current operating lease model, such as manufacturing, transportation, airlines, etc.

Besides, for lessees, the new standard will affect the income statement by recognizing interest expense in the finance expense category, thereby influencing Earnings Before Interest and Taxes (EBIT) and Earnings Before Interest Taxes and Amortization (EBITA).

Also, total expense recognized in the income statement will be front-loaded, meaning that the total expense for the first few periods after the inception of the lease will be larger than the amount that would have been reported under the old standard. In addition, the difference between lease expense and lease payment will give rise to deferred taxation.

For lessees, not all of the lease payment will be presented under cash outflows from operating activities. Instead, repayment of the principal and interest of lease liability will be included in cash outflows from financing activities.

For both lessees and lessors, when assessing the lease term, significant judgement is involved in determining whether the option to renew or terminate lease will be exercised.

New Accounting Standards for Business Enterprises No.22 – Recognition and Measurement of Financial Instruments

On March 31, 2017, the MOF released the new CAS22 – Recognition and Measurement of Financial Instruments, CAS23 – Transfer of Financial Assets, and CAS24 – Hedge Accounting. These new CAS regarding financial instruments are consistent with the IFRS9 published by the IASB on July 24, 2014 in material aspects.

The major changes in these accounting standards regarding financial instruments include:

- The classification of financial assets is changed from the current four categories to three categories. Financial assets are now classified according to the business model of the management of financial assets and the characteristics of the contractual cash flows, rather than the definitions provided in the old standard.

- Impairment of financial assets is assessed based on the expected credit loss, instead of the actually occurred loss.

- Rules on hedge accounting are amended to better reflect the risk management activities of an entity. The threshold and complexity of entities applying hedge accounting have been lowered.

The CAS regarding financial instruments requires financial assets to be measured at amortized cost or fair value. Depending on the business model of an entity’s management of financial assets, accounts receivable and bills receivable might be reclassified as financial assets at fair value through other comprehensive income or fair value through profit and loss. Bank’s structured deposits, wealth investment products, or other financial instruments that do not satisfy the test of “solely payments of principal and interest on the principal amount outstanding” might be reclassified as financial assets at fair value through profit and loss. Also, under the new standard, all the non-trading equity instruments shall be measured at fair value.

In addition, moving to an expected credit loss model can be a major challenge, particularly for banks and other lenders. Since reasonable and well-grounded forward-looking information needs to be obtained when evaluating impairment, more accounting judgement will be involved in assessing the credit risks of the financial instruments, potentially resulting in fluctuated provision recognized in income statement. The expected credit loss method in impairment assessment of financial instruments may result in more impairment being recognized earlier in income statements than it used to be. Besides, the expected credit loss model is also applicable to lease receivables and contract assets.

CAS vs. IFRS vs. US GAAP

Revenue – CAS14 vs. IFRS15 vs. ASC606

There is no material difference between the CAS14, IFRS15, and ASC606 (Accounting Standard Committee 606 – Revenue from Contracts with Customers).

However, entities should be aware of the subtle differences when preparing for GAAP adjustments. For example, both CAS14 and ASC606 specifically state that shipping and handling activities before the customer obtains control of the product are fulfilment activities, which should not be identified as separate performance obligations. However, no similar requirement is noted under IFRS15.

Leases – CAS21 vs. IFRS16 vs. ASC842

There are several notable differences to keep in mind when preparing for GAAP adjustments.

Due to the specific circumstances of Mainland China, the land use rights are classified as intangible assets, thus not subject to CAS21. Under IFRS, however, the land use rights are regarded as property, plant, and equipment and are subject to IFRS16.

One of the notable differences between CAS21 and ASC842 is that for lessee accounting, US GAAP differentiates operating lease from finance lease. For operating lease, the lessee recognizes right-of-use assets and lease liabilities in the balance sheet. However, under ASC842, the overall impact on income statement remain constant for each period. On the contrary, the impact of CAS21 on the income statement is frontloaded.

Financial instruments – CAS22 vs. IFRS9

There is no material difference between CAS22 and IFRS9, but only subtle differences. For example, while CAS22 specifies the treatment regarding the change in principal during the existence of the financial assets, IFRS 9 uses the term the expected life of the financial instruments.

How to prepare for the new Chinese accounting standards?

All enterprises are required to adopt the new accounting standards starting January 1, 2021. Thus, relevant enterprises are recommended to:

- Fully understand the changes specified in the new accounting standards.

- Conduct a comprehensive review and analysis on the impact of the new accounting standards on corporate financial statements, key financial performance indicators, and capital regulation and communicate with shareholders, banks, and authority-in-charge for potential influence.

- Learn from the practice and experience of those who already implemented the new standards.

- Prepare for the transitional accounting treatments and set up a timeframe for the adoption of the new standards as well as a plan to move forward on specific projects.

- Identify the gaps between the current practice and the implementation under the new standards, and update the accounting system, information system, internal control process, and accounting policies.

- Foreign-invested enterprises should communicate with the headquarters in a timely manner, study whether there are any differences between CAS and the accounting standards adopted by the corporate group, adjust the daily management reports and consolidated reports, and assess whether it is necessary to update the mapping with group management accounts.

Dezan Shira & Associates (DSA) has a strong China presence and offers deep, blended service expertise in accounting, tax, and technology solution services. For more information, you are welcome to contact us at accounting@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Terminating an Employee in China Upon Expiration of Fixed Contract

- Next Article China’s 2021 Holiday Schedule