Closing a Business in China: What is the Simplified Deregistration Procedure?

The procedures for closing a business in China have been simplified by the government through various bureaucratic reforms for enterprises meeting stipulated criteria. We explain the criteria and the simplified deregistration mechanisms, including for tax clearance of the business.

Recent years have seen China reforming its enterprise registration and deregistration system to invigorate the market and improve the efficiency of its government services. In 2017, the government introduced a simplified deregistration procedure to facilitate certain types of enterprises to exit the market more quickly.

Compared with the normal deregistration process, the simplified deregistration procedures can reduce the time and cost of market exit.

In this article, we introduce China’s latest policies on simplified business deregistration (also known as “e-deregistration”), including the simplified State Administration for Market Regulation (SAMR) deregistration procedure and simplified tax deregistration procedure.

You can also check out another China Briefing article that explains the potential legal risks of using simplified deregistration procedures for a hurried market exit: What are the Guidelines for Simplified Enterprise Deregistration in China?

Closing a business in China through simplified deregistration

Since March 1, 2017, the State Administration of Industry and Commerce (SAIC, that is, the current SAMR) and its local branches have started implementing a simplified deregistration procedure to help investors close their companies more easily.

Simplified SAMR deregistration procedures provide one-stop government service platform (which is why it is also called “e-deregistration”) for businesses to deregister a company online, without physically visiting local bureaus (although in practice this may depend on the level of local implementation).

It requires fewer documents to be submitted and omits the steps of establishing a liquidation committee or issuing a newspaper announcement, which are required in general business deregistration procedures.

Scope of application

According to the Circular on Further Improving Simplified Deregistration to Facilitate the Withdrawal of Micro, Small and Medium-Sized Enterprises form the Market (hereafter referred to as “SAMR No.45 Circular”) issued by the SAMR on August 2, 2021, “market players that have not had any creditor’s rights or debts or have fully settled any creditor’s rights or debts (except for listed companies limited by shares) can apply for simplified SAMR deregistration procedures”.

This latest policy expands the scope of application for simplified deregistration, which is no longer limited to the original four types of companies (that is, limited liability company/LLC, non-corporate legal person, sole proprietorship, and partnership enterprise). In addition, unlisted companies limited by shares can apply for simplified deregistration not only in pilot areas, but also across the country.

When applying for the simplified e-deregistration, the enterprise should have no creditor’s rights or debts – including outstanding expenses for settlement, employee wages, social insurance premiums, statutory compensation, taxes (late fees or fines) payable, etc.

All the investors are required to make a written commitment and assume legal liability for the authenticity of the debt status of the enterprise.

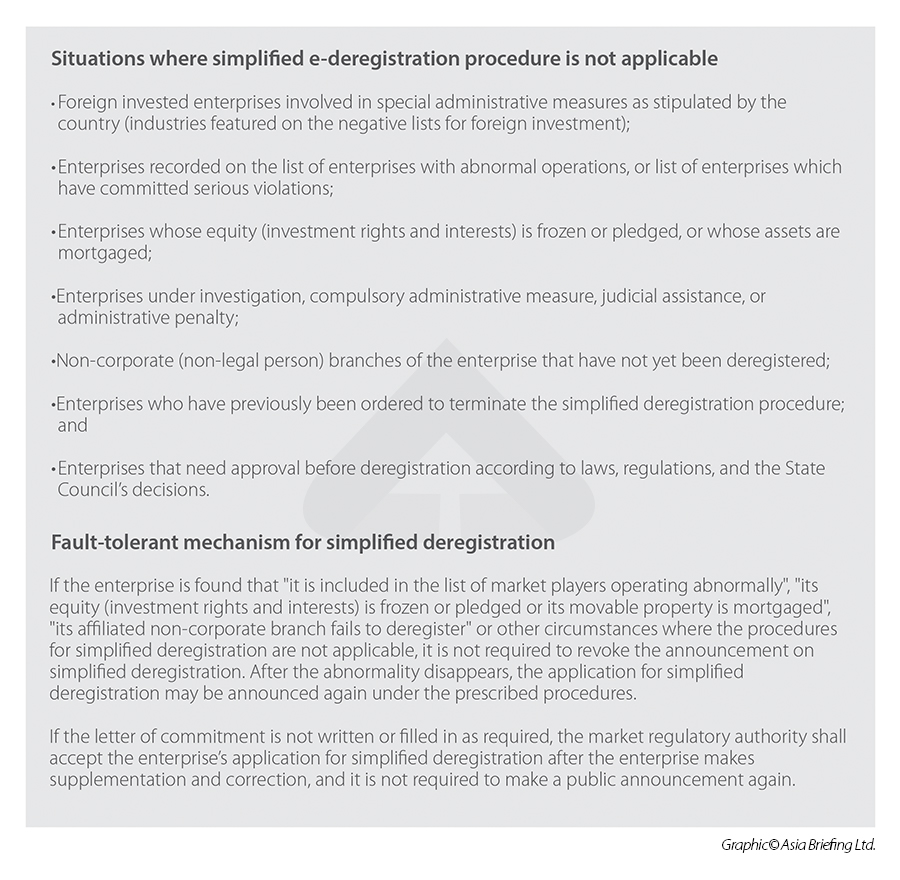

Moreover, there are several situations where the simplified e-deregistration procedure is not applicable (as shown in the table below). However, under the “fault-tolerant mechanism” required by the SMAR No.45 Circular, enterprises can carry on applying for simplified deregistration after the abnormalities disappear.

When is the e-deregistration procedure not applicable?

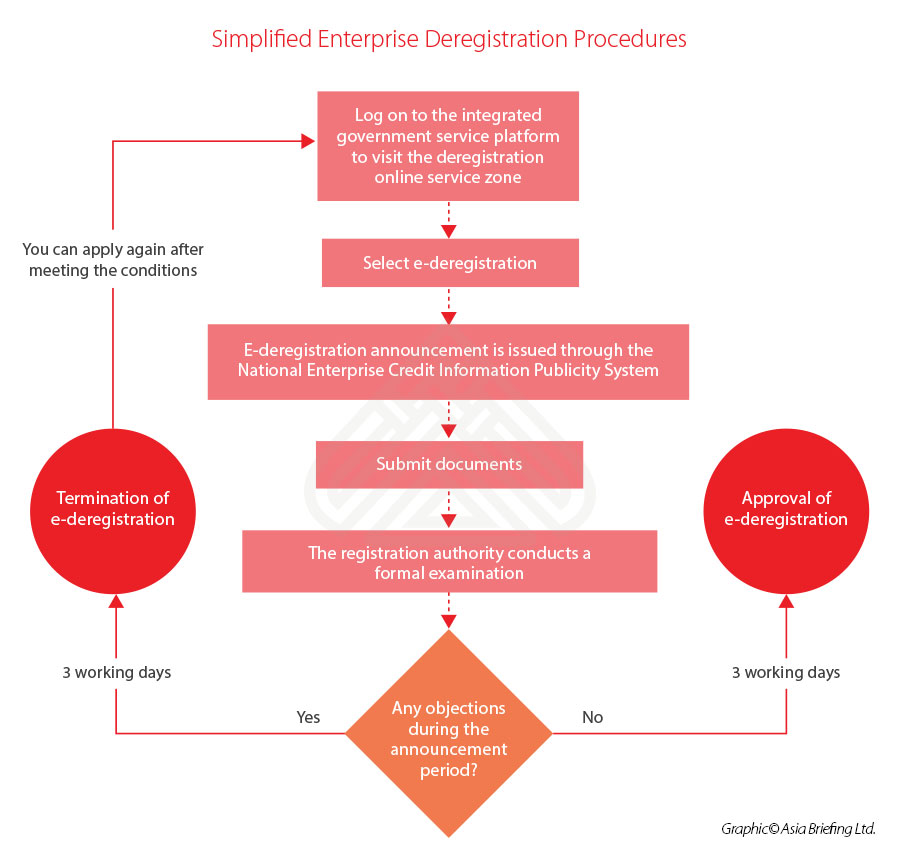

Simplified Enterprise Deregistration Procedures: Key steps

I. Pre-application announcement for simplified deregistration

To apply for the simplified SAMR deregistration, the enterprise applicant must first log on to the integrated government service platform, visit the deregistration online service zone, upload the Letter of Commitment of All Investors, and make a public announcement for its intended simplified deregistration application through the National Enterprise Credit Information Publicity System.

Once the announcement is posted online, the system will automatically allow for any objections for 20 days (the original 45-day period has been shortened to 20 days, based on the SAMR No.45 Circular).

During the publicity period, the SAMR will pass the related deregistration information of the enterprise to the relevant tax, HR, and social security authorities. For FIEs, the information will also be forwarded to the relevant commerce department for review. These government departments and other interested parties can raise an objection and state the reasons through the system.

However, according to the SAMR No.45 Circular, tax authorities shall not raise any objections, if the taxpayer:

a) has never handled tax-related matters;

b) has handled tax-related matters but never received or used invoices (including invoices issued on a commission basis) and has no tax in arrears or other pending matters; and

c) has completed tax clearance formalities.

If there is no objection, within 20 days upon the expiry of the publicity period, the enterprise can apply to the local SAMR for the simplified deregistration procedure. Given the actual situation, the enterprise is also allowed to apply for an appropriate extension of up to 30 days within 20 days upon the expiry of the announcement period.

II. Submission of simplified deregistration application documents

Within 20 days upon the expiry of the publicity period, the enterprise can submit the application and the following documents to the local market regulatory authority for the simplified deregistration:

- The application letter for deregistration;

- The Commitment Letter of All Investors;

- The power of attorney to agent; and

- The original and duplicate business licenses.

After submitting the application, enterprises can choose to submit the paper documents to local market regulatory authority. Eligible market players may go through simplified deregistration formalities online throughout the whole process by submitting electronic documents.

After receiving the submitted documents, the local market regulatory authority will issue a decision on the simplified deregistration of the enterprise within three working days. If agreed, this means the business has been officially written off.

To be noted, the submission of false statements, or fraudulent concealment, during the simplified SAMR deregistration procedure may result in rejection and may be listed as violation of the law. This can result in a blacklisting of the entity through the National Enterprises Credit Information Public System. Parties affected by such conduct may claim damages from the investors in the enterprise, and depending on specific circumstances, investors may also face administrative and criminal punishment.

What is the simplified tax deregistration procedure?

To expedite the tax deregistration process, the State Tax Administration (SAT) has introduced the tax clearance certificate exemption service, optimized the on-site tax deregistration service, and simplified document submission requirements and application procedures.

We break down key aspects of the procedure below.

Tax clearance certificate exemption service

Pursuant to Shui Zong Fa [2018] No.149, taxpayers who apply for the simplified SAMR deregistration process, and meet one of the following circumstances, are exempted from getting a tax clearance certificate from the tax bureau prior to the deregistration with the SAMR:

- Those who have never handled tax-related matters with the tax bureau; or

- Those who have handled tax-related matters, but have never applied to issue invoices, and have no outstanding tax (including overdue fine) and penalties.

Despite the exemption, if these taxpayers need a tax clearance certificate and applied to the tax bureau, they can still immediately obtain one.

Optimized on-site tax deregistration service

Taxpayers may get tax clearance and obtain a tax clearance certificate on site even when there is information missing by ‘making a commitment’ (a commitment of a resubmission within a specified period), if they have satisfied the following conditions:

- They do not have outstanding tax payments (including overdue fines) or other penalties; and

- They have handed in the special value-added tax (VAT) invoices and VAT invoices machine to the tax bureau for cancellation.

And at the same time:

- They are taxpayers with class-A or class-B tax credit rating;

- They are taxpayers with class-M tax credit rating whose parent company has a class-A tax credit rating;

- They are enterprises whose founders are talents introduced by a provincial government or recognized by industrial associations above the provincial level;

- They are individual businesses that are not included in the evaluation of tax credit rating and make regular tax payments of fixed amounts; or

- They are taxpayers who have not reached the VAT payment threshold – individual taxpayers (excluding individually-owned businesses registered as general taxpayers) whose sales amount do not reach the VAT threshold and can be exempted from paying VAT.

However, if the commitment is not fulfilled in the stipulated time period, the tax authorities will categorize the applicant’s legal representatives and financial managers with a class-D tax credit rating.

Simplification of documentation and procedures

The tax bureaus will facilitate and optimize the tax deregistration process through the following measures:

- Simplify the information required: Taxpayers who have conducted real name authentication are exempted from providing tax registration certificates and personal identification documents.

- Open a special window: A special service window for tax deregistration will be set up with the tax authorities and the number of these windows will be adjusted according to the situation.

- Offer a ‘combo’ service: Integrate the pre-approval items for tax deregistration, plus the service of acceptance at one window, internal circulation, and completion of handling tax-related affairs within a prescribed time limit.

- Strengthen the ‘first asking duty system’ and ‘one-off notification’: When the taxpayer goes to the tax authorities to handle tax deregistration, the tax collector approached first is responsible for asking the situation, distinguishing the matters and complexity, classifying the relevant notice that needs to be handled, communication, and counseling.

- Optimize internal work and duties: It is necessary to innovate working methods, simplify the process, have division of labor, achieve interconnectedness, and handle within a time limit.

Although these policies have been implemented to different degrees in various regions, eligible foreign companies may seek advice and expertise from local experts or local authorities to take advantage of simplified deregistration procedures.

If you wish to deregister an enterprise in China, or have further questions about the company deregistration process, please feel free to contact us at china@dezshira.com.

Note: This article was originally published July 2020, and was last updated on August 24, 2021.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article The PRC Personal Information Protection Law (Final): A Full Translation

- Next Article China’s Personal Information Protection Law: A Comparison of the First Draft, the Second Draft, and the Final Document